When you have a mortgage ticking away with regular repayments happening automatically, it can be easy to simply let things continue as they are. But finding little ways to repay your mortgage faster will have an ever-accelerating effect.

Every little extra you pay off will immediately reduce the interest you have to pay each time. This will increase the rate at which you can pay back what you owe, further reducing the interest charged each time and saving you thousands of dollars over the life of your mortgage.

One powerful way to repay your mortgage faster is to negotiate a lower interest rate. Another way is to switch to a loan structure that better suits your circumstances. A good mortgage adviser can use their skills and knowledge to ensure you have the best possible deal. Our adviser panel makes it easy to connect with one of New Zealand’s mortgage advisers. It’s a free service and your adviser is paid by the lender whose deal you ultimately choose.

Understand the benefits

The first step to repaying your mortgage sooner is to keep in mind the short and long term benefits. This helps you stay motivated and on track for your goals, rather than being tempted to spend up on what seem to be more appealing short-term rewards.

Here are some of the main reasons to start early and stay focussed on reducing your mortgage as quickly as possible:

The compounding effect

Most people understand the idea of compounding interest on savings. The interest received increases your savings balance, which increases the interest you earn next time. In other words, you earn interest on your interest. It’s like a snowball rolling down a hill; the bigger it gets the more snow it gathers.

With mortgages, if you can repay a little extra a little sooner, it starts a wonderful chain reaction. Every bit you repay now reduces the interest you’ll be charged each time for the remainder of your mortgage, which could be up to 30 years. As you pay less and less interest each time, your regular fortnightly or monthly repayments will pay back more and more of what you owe, which reduces the interest charged each time even further.

More flexibility and less stress

Getting ahead in your mortgage repayments may give you the chance to slow things down for a while in the future. This can let you take advantage of opportunities that might temporarily reduce your income, or require extra money to get underway.

It also means you don’t have to worry so much about life’s what-ifs. What if the car needs some major work done? What if the house needs unexpected repairs? What if I lose my job? What if I’m injured in an accident? What if we start a family? There’s way less stress if the answer to these questions can simply be, “we’ll just reduce our mortgage repayments for a while because we’re already well ahead of the minimum required”.

A larger deposit for your next home

Equity for buying an investment property

Achieving more bucket-list experiences

Repaying your mortgage faster means you can turn your attention to saving for life’s goals much sooner. Your experience in managing money well, through your mortgage, will also help to ensure your savings grow as quickly as possible. By parking your bucket-list for now and going hard on your mortgage, you’ll have the money to enjoy more of your goals overall.

An earlier or more comfortable retirement

When you’re buying your first home, retirement can seem so far off it just doesn’t come into your plans. You’ve got KiwiSaver, so retirement’s already covered, right? But the reality of retirement means you could be earning little or no income for a third of your life. Even some quite wealthy retirees find no longer earning an income to be pretty scary, at least for the first few months or so.

Repaying your mortgage faster means you could sell up and downsize for retirement with a larger nest-egg to support your living costs. It can give you the option to retire earlier, or to keep earning and let your savings grow into a sum that will provide a more comfortable retirement lifestyle.

Making it happen

Now that you understand the benefits of repaying your mortgage faster, let’s look at how you might go about it.

Increase your regular mortgage repayments

Increasing your mortgage repayments is the most obvious way to pay off your mortgage faster. What’s less obvious is the importance of doing this as soon as you can. Someone who increases their regular repayments by $20 for 20 years will do far better than someone who waits 10 years then increases them by $40 for the next decade. They both contribute the same extra amount overall, but by starting earlier you pay much less interest over the life of your mortgage, so you’ll pay the loan off faster.

Here are some straightforward ways to bump up your regular mortgage repayments.

Choose fortnightly over monthly repayments

Many people choose to time their mortgage repayments to match payday. It makes budgeting easier, which is always a good idea. However, if you can afford to, switching from monthly to fortnightly repayments means you will repay your loan faster and pay less interest overall. The way to do this is divide your monthly repayment by two, then opt to pay this amount every two weeks. Over a year, you’ll make 26 fortnightly repayments – the equivalent of paying an extra month’s repayment every year.

Rounding up

One of the easiest ways to increase your regular mortgage repayments from day one is to simply round up the required repayment. For example, if your minimum fortnightly repayment is $974.56, see if you could afford to make that an even $1,000.

Pretending you’re on a shorter term

If you’ve chosen to pay off your mortgage over a longish term, to ensure the regular repayments are affordable, you could still choose to increase your repayments to those of a shorter term. It gives you a more challenging target, but if it works out you’ll be in a much better position financially. If the higher regular repayments become too hard to handle, you can simply revert to the original minimum without restructuring your home loan. You’ll still be ahead and on track to repay your mortgage faster.

Matching your income increases

If you get a pay rise or a higher paying job, rather than splashing the cash to celebrate your new wealth, see if you can increase your mortgage repayments to match. You’ll probably end up being much wealthier in the long run, with more ability to pursue your major goals in life. Using a pay increase to up your regular mortgage repayments will also get you ahead of your minimum repayment schedule, so you’ll have the freedom to reduce your repayments for a while if something unexpected happens down the line.

Make a lump sum repayment

If you sell a significant asset, receive an inheritance or find yourself with sizeable savings, it nearly always pays to make a lump sum mortgage repayment, rather than setting it aside in something like a term deposit. That’s because mortgage interest rates are nearly always higher than the rates for savings or term deposits. By using the lump sum to repay part of your mortgage, you’ll save (avoid paying) more interest. You also don’t have to pay tax on the interest saved, but interest earned from savings or investments is treated as income when it comes to the tax you pay.

Structure your mortgage carefully

More than one fixed rate term

Fixed interest rates are available for a range of terms, typically from one to five years. The rates offered are almost always lower than the variable (floating) rate at the time. A fixed interest rate also gives you more certainty. However, you can only increase your regular repayments by a limited amount or not at all during the fixed rate term. If you repay faster than agreed, you’ll normally be charged an early repayment penalty.

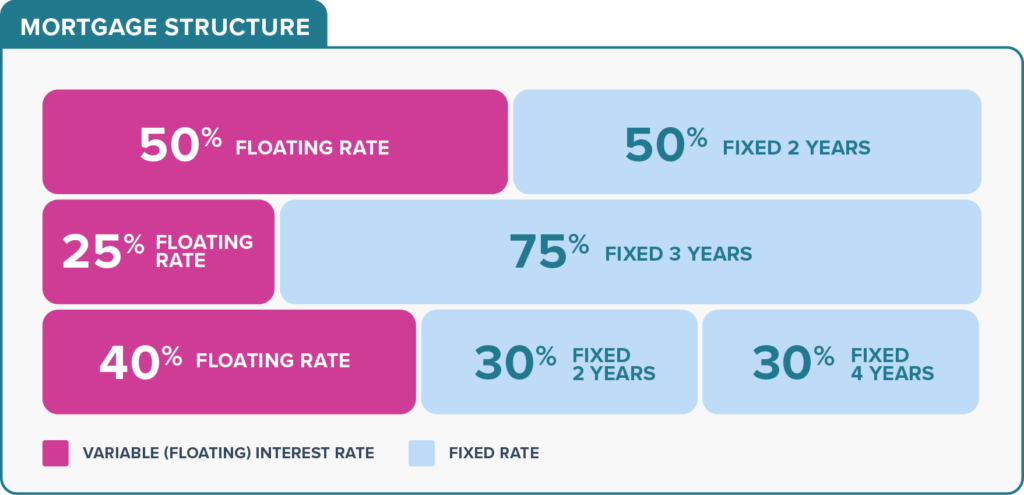

Choosing to split your mortgage between two or more fixed rate terms can give you more options. For example, splitting a $400,000 mortgage into $200,000 on a one-year fixed rate and $200,000 on a three-year fixed rate would allow you to make a lump sum repayment from savings after the first year. You’d still have the certainty of the three-year rate on the other $200,000 mortgage. You can always re-fix the one-year mortgage after making the lump sum repayment.

Splitting across different terms also helps reduce the risk of having to re-fix your entire amount at a time when interest rates might be high.

Some on a variable interest rate

While variable (floating) interest rates are almost always higher than fixed rates, they do allow you to increase your regular repayments or make lump sum repayments at any time, without an early repayment penalty.

To take advantage of the flexibility variable rate mortgages provide, many people put some of their total home loan into a variable rate mortgage. The size of the variable mortgage will depend on how much extra they might be able to repay, while the rest of their borrowing is on fixed rate terms. If they end up repaying the entire variable mortgage, they can always set up another one by reducing one of the fixed mortgages at the end of its fixed rate term.

Offsetting mortgages

Some variable mortgages let you use money in everyday and savings accounts to effectively reduce (offset) the balance of your mortgage when it comes to calculating interest. The interest is usually calculated daily and paid monthly, so the longer you can leave money in the offsetting accounts the less interest you’ll pay each month. That means more of your regular monthly repayment will go towards repaying what you owe, so you’ll pay even less interest next time and much less over the life of your loan.

By having your income paid into an offsetting account, the full amount goes to work for you from day one. If you also make most of your purchases using a credit card and repay it in full at the end of the interest-free period, your offsetting balance will stay higher for longer and save you more interest every day.

Splitting your total home loan between a variable offsetting mortgage and fixed rate mortgages can give you the best of both worlds. Keeping the offsetting mortgage small, so you offset most of what’s owed when your income goes in each month, will minimise the downside of variable interest rates being higher than fixed.

Keep your eye on the prize

Nobody wants to let their mortgage dominate their life, and nor should they. But keeping an eye on things and asking yourself a few questions every few months or so can make a big financial difference in the long run. Here are a few ideas to get you started:

Regularly review your budget

As your income gradually increases, it’s easy to start spending more freely simply because you feel you deserve it. Keeping a living budget, which you revisit from time to time, makes it easy to spot where well-deserved treats or hasty purchases may have gone a bit further than you realised.

It’s also a good idea to check whether your regular bills for things like power, internet and mobile phone service are still the best deals available. Special deals offered to attract new customers are seldom advertised to existing ones, so you could be paying more than you need to. Don’t be afraid to challenge an existing provider to get a better deal.

Set short and long-term goals

Setting realistic, achievable goals can provide all the reward and encouragement you need to keep repaying your mortgage as fast as you can. But if you simply have a goal to be mortgage-free in 20 years’ time, it’s a long way off and unlikely to keep you motivated.

Setting smaller, shorter-term goals gives you more opportunities to celebrate and creates a much greater sense of achievement. You might set a goal to get $100 ahead of your minimum repayments each month or to add $100 a month to an emergency fund in a savings account that’s offsetting part of your total mortgage. When achieved consistently, these are goals worth celebrating (just don’t spend too much!).

Keep it real

Like most things in life, succeeding at faster mortgage repayment requires a balanced approach. You’ll probably be repaying your mortgage for decades. If you go at it too hard for too long, you may feel it’s stifling your life or causing unnecessary stress. Either way, the fun can quickly disappear as you lose your initial motivation.

It’s important to be realistic and not get locked into repayments that turn out to be completely unaffordable. Using an offsetting mortgage is one way to safely test whether you can sustain higher repayments. You simply pay the extra into an offsetting savings account and it works as though you’ve used it to repay more than your minimum amount. If it turns out you’re overdoing things, you can stop or pause the extra repayments whenever you need to. And the extra money you put in will still be readily available if you need it to put things right. You just have to avoid the temptation to spend up, just because the money’s there and it feels like you’re pretty well off.