Buying a house to live in is the number one Kiwi strategy for getting ahead. Not only do you get a place to call your own, you have a stake in the New Zealand property market. Many people firmly believe that property values double every 10 years and data reveals it’s a reality for much of the country.

This guide will help you with the financial aspects of your first encounter with the New Zealand property market. The experience of buying your first home is more likely to be positive if you’re well educated before you start.

Getting a deposit together

In general, your deposit will need to be at least 20% of the purchase price. So in theory, a $100,000 deposit means you could pay up to $500,000 for a home. But you and your lender would have to be confident that you can make the ongoing repayments on a $400,000 mortgage. It’s sometimes possible to buy with a deposit that’s less than 20%. Just remember, a smaller deposit means a bigger mortgage for the same house price.

Where can the deposit money come from?

A deposit can be made up from more than one source of money. Most first home buyers these days get a deposit together using money from their savings, KiwiSaver and parents or family. You don’t have to have personal savings, but a good savings record helps to show the lender you’ll be able to make regular mortgage repayments.

How to save for a deposit

Saving for a deposit is a great way to practice making regular mortgage repayments. You may already be paying rent of course, but your mortgage repayments will probably be more. Saving the difference between rent and paying a mortgage every month will give you the confidence to take on a home loan in the future.

Having a savings goal is important, so use some of the readily available online mortgage calculators to get an idea of:

- How much you can afford to borrow, based on your current income and expenses

- What your regular mortgage repayments are likely to be

The next step is to set up a savings account and start paying into it, as though it was a mortgage. Some savings accounts offer bonus interest if you don’t make any withdrawals each month. This can provide a good incentive to leave your savings alone.

Here are some basic savings tips to get you started:

- Organise an automatic payment, so some money goes into your savings account as soon as your pay arrives in your everyday account

- Keep track of where your money goes, so you can recognise opportunities to save

- Only buy what you really need

- Look for cheaper deals and ways to do things

- Talk to other people about how they manage to save

- Consider asking for a pay rise or applying for a higher paying job

Some online savings calculators will show when you’re likely to reach your savings goal for a house deposit. If that looks too far away and your income is below certain limits, you could be eligible for a special first home mortgage with a deposit that’s less than 20%. Talk to a lender or mortgage specialist.

Other ways to boost your deposit

Using KiwiSaver to buy a house

First home withdrawal – if you’ve been a KiwiSaver member for at least three years, you may be able to make a first home withdrawal from your fund. The property you buy must be in New Zealand and you must be intending to live in it. If that’s the case, you should be able to withdraw all but $1,000 of the money in your fund. Just remember that withdrawing money now will affect your retirement savings. To find out more, talk to your KiwiSaver fund provider. If you don’t know who that is, call Inland Revenue.

First home grant – if your income is less than certain levels, and you’ve been regularly contributing at least the minimum to KiwiSaver for three years, you may also be eligible for a KiwiSaver First Home Grant. These can provide a lump sum for each buyer of up to $5,000 for existing homes and up to $10,000 for new builds. If more than one eligible person is buying the property, each person can receive the grant. Other criteria apply, including house price caps for different areas of New Zealand. To find out more, visit kaingaora.govt.nz. In some circumstances, people who have already owned a home or property may still be eligible for the KiwiSaver First Home Grant.

Getting help from parents to buy a home

Not all first home buyers can get financial help from their parents, but it’s believed that up to 50% do. This may be due to the many ways that parents can help, from a cash gift to guaranteeing the mortgage and a range of options in between. Here’s a brief summary of the most common ways parents act as the ‘bank of mum and dad’

Gifting cash – this is perhaps the most obvious option, where a parent makes a gift of cash to help the first home buyer get their deposit together. It’s simple, clean and has no ongoing commitment.

Guaranteeing a mortgage – if a first home buyer can’t get a 20% deposit together, a lender might accept a lower deposit if someone is willing to be a guarantor for the loan. However, this is a risky long-term option for parents, as they’ll be liable for the loan if the first home buyer doesn’t meet their repayments. The lender will also want to be sure the parents are in a financial position to cover that risk.

Borrowing against their own home – a third option for parents is to increase their own mortgage, or get a new one, to contribute towards a first home buyer’s deposit. Either the parents or the home buyer can agree to repay it. The advantage is the parents are only liable for a much smaller mortgage.

If you do decide to get financial help from your parents, be sure to get independent legal advice, so everyone knows what they’re getting into. You don’t want to put a strain on relationships because things turn bad over something no-one saw coming.

Types of mortgages

Interest rate options

Fixed interest rate

The main features of a fixed interest rate are:

- Choice – different fixed interest rates are offered for different lengths of time (terms).

- Certainty – the main advantage of a fixed interest rate is knowing exactly what your repayments will be during the loan term.

- Early repayment penalty – if you repay your loan, or a chunk of it, while it’s on a fixed interest rate, the lender may charge you a penalty. A penalty is more likely if interest rates have dropped and the lender will lose money relending the money you paid back early.

- Limited flexibility – most lenders will only let you increase your repayments by a percentage (say up to 20%) of the minimum payment without paying a penalty. Any more and it is considered an early repayment, which may come with a penalty.

- Float or re-fix at the end of the term – when you reach the end of your agreed interest rate term, it will change to the variable (floating) interest rate, unless you choose one of the fixed interest rate terms available at the time. At this point, some people repay a lump sum (without penalty) while their mortgage is on the variable rate, then re-fix for a lower, more predictable rate.

Variable interest rate

The main features of a variable (floating) interest rate are:

- Uncertainty – as the name suggests, a variable interest rate can rise or fall, which means your minimum regular repayments can also change. When interest rates fall you can usually choose between reducing your repayments to match or keeping them the same and repaying more principal (the amount you owe) each time.

- Payment flexibility – you can increase your regular payments or make a lump sum repayment without penalty whenever you choose. The only restriction is paying at least the minimum payment each time.

- The freedom to fix at any time – you can change all or part of your variable rate loan to a fixed interest rate at any time. People sometimes choose a variable rate when they think interest rates will fall, and then lock in a favourable fixed rate when they do.

- More loan types – offset mortgages and revolving credit mortgages have variable interest rates and might offer significant advantages, depending on your circumstances. See below.

Combinations of fixed and variable

Many people split their total borrowing across different types of interest rates. You might put some on a variable rate to allow extra repayments, or to take advantage of an offset or revolving credit mortgage. You could then put the rest of your borrowing on a fixed rate term for more certainty and often a lower rate.

You can even split your fixed rate borrowing across more than one term; say a one-year rate and a three-year rate, to potentially reduce the risk of having to re-fix the full amount when rates are high.

Types of variable mortgages

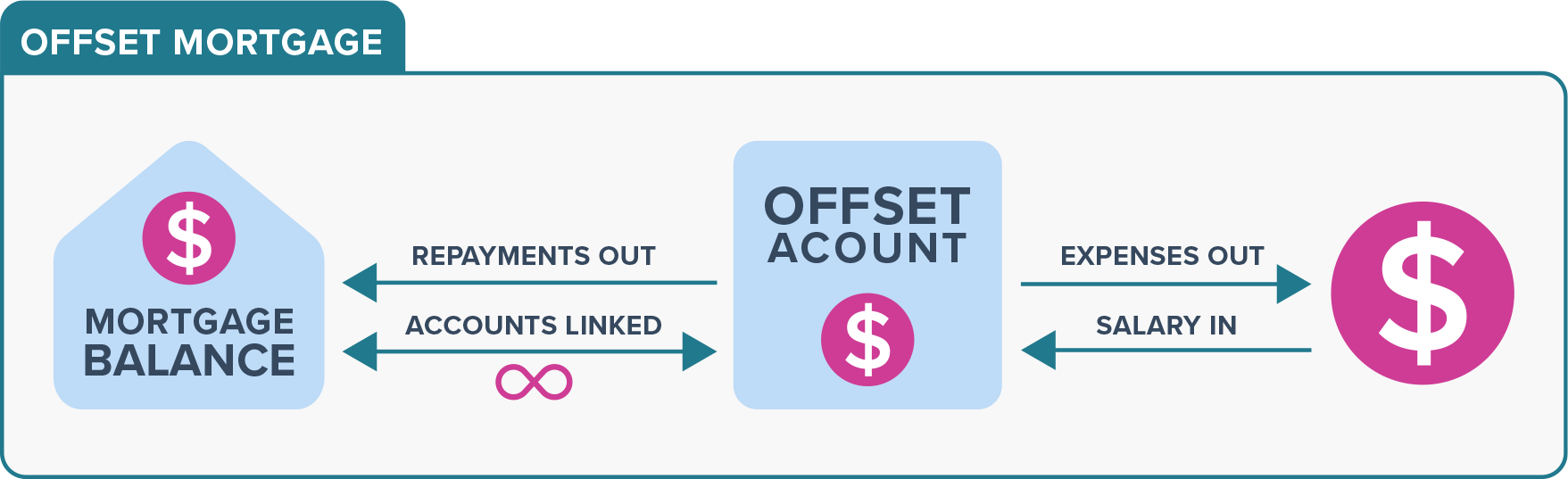

Offset mortgage

Revolving credit mortgage

This type of variable rate mortgage only suits people who are really disciplined when it comes to managing money. It offers tremendous flexibility, but there’s always the risk of overspending instead of repaying your loan as you planned to. Well managed, a revolving credit mortgage can significantly reduce the interest you pay over the life of your loan and help get you mortgage-free sooner. Here’s how it works:

- You agree to a maximum borrowing limit, and then you’re free to withdraw (draw down) money and put money in (such as your salary) whenever you choose. You just can’t exceed your borrowing limit.

- It operates like a regular bank account with easy access and a large overdraft facility. Interest is based on the daily balance and paid from the same mortgage account each month.

- Because the interest is the only regular payment required, a revolving credit mortgage can suit people with irregular income, such as contractors and seasonal workers.

- Some revolving credit mortgages have a reducing limit on the amount you can borrow. This removes some flexibility, but makes it easier to stay on track to repay your mortgage as planned.

Payment options

Mortgage payments usually include the interest you owe and a contribution towards repaying what you owe (the principal). There are different ways of working out how much principal you repay each time. Here are the main examples:

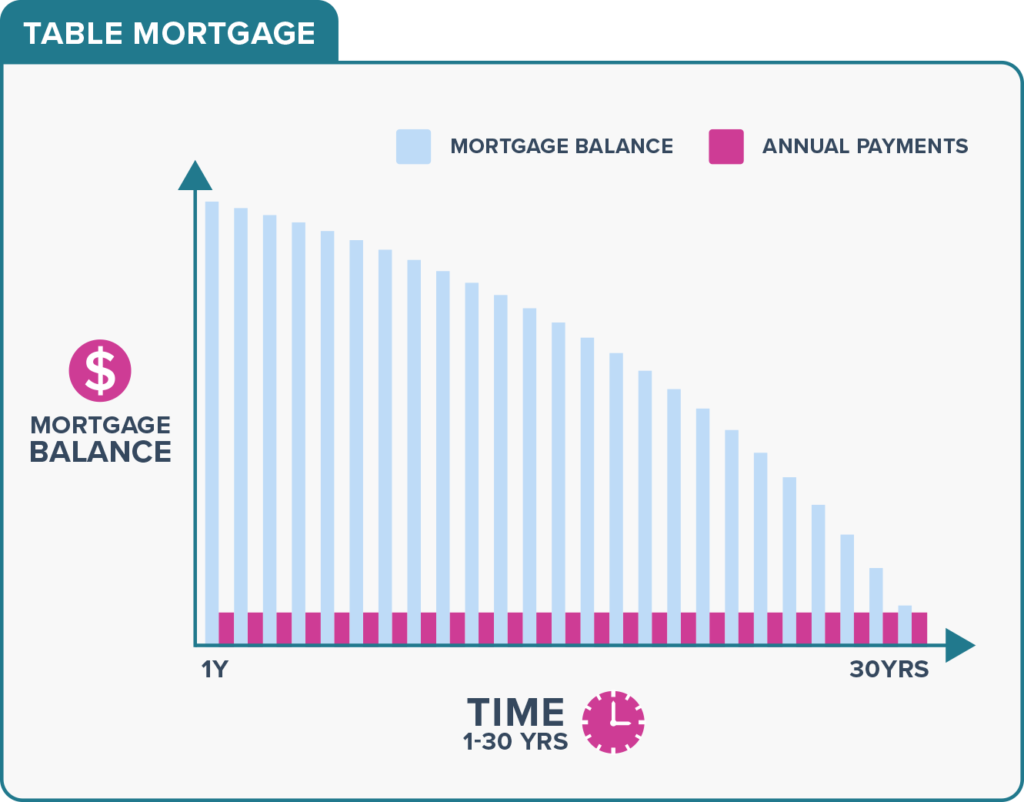

Table mortgage – this is the most common payment option for standard mortgages. Your regular payments stay the same, unless the interest rate changes. So as you repay the amount owing, the interest charged gradually reduces and the principal repaid gradually increases each time. A table mortgage offers some consistency and helps you repay your loan sooner, by accelerating the principal repayments and reducing the total interest charged.

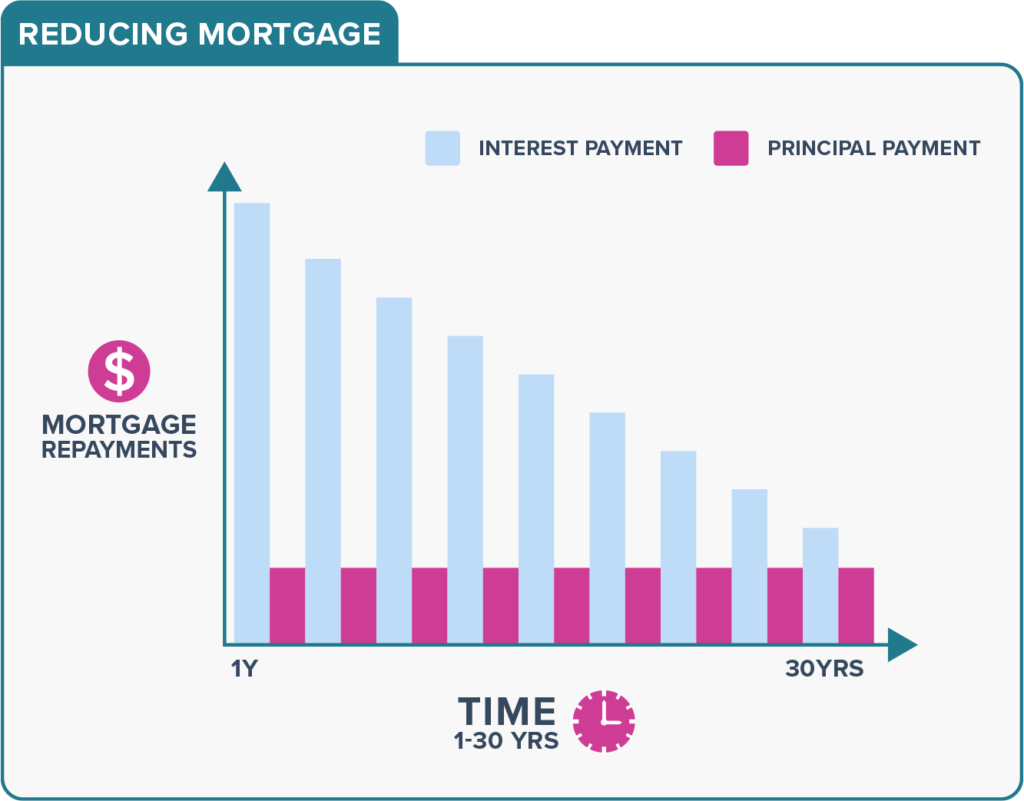

Reducing mortgage – with this payment option, you repay the same amount of principal each time plus the interest owing. Your payments are high to begin with, but as you gradually repay your loan, the interest owing reduces, so your regular payments steadily decrease.

Interest only mortgage – as the name suggests, your regular payments include no principal, just the interest owing each time. Although this keeps your payments to a minimum at first, you keep paying interest on the full amount and never reduce the amount you owe. At the end of the agreed mortgage term, you’ll have to pay it all back, which could be done by getting another mortgage.

Revolving credit mortgage – as mentioned above, the payment amounts and when you make them are up to you, provided you pay the interest owing each time and don’t exceed your maximum borrowing limit.

Choosing a mortgage term

The term of a mortgage is how long you have to repay the amount borrowed. This can usually be up to 30 years. A longer term means lower regular payments, but you’ll pay more interest over the life of the loan. First home buyers often start with a longer term, to keep things affordable, but take steps to reduce the term as their income increases or expenses, such as student loan repayments, reduce. Even a small reduction in the term can save you a lot of interest, leaving you much better off financially later in life.

Putting it all together

Here are some examples of how different people might set up their mortgages to suit their circumstances.

Twins team up, but split their borrowing

Interior designers Kora and Alex get together

Loved-up couple secure their nest

Zac and Tracey have been living together since they met at uni. After saving hard, and with some help from their banks of mum and dad, they were finally in a position to look for a place of their own. It took a while to find one and they had to adjust their expectations down a bit, but eventually they had an offer accepted on a place with good potential. With their loans pre-approved, everything went smoothly and they were soon setting up home with the help of a few hand-me-downs from family and friends. They borrowed $575,000, which they split between a two-year fixed rate mortgage of $500,000 and an offsetting mortgage of $75,000. Here’s why:

Tracey is a civil engineer in a fairly senior role with the local council. Zac is an established freelance photographer and social media specialist. He collects GST on his invoices, which he pays to Inland Revenue every two months. He also pays provisional income tax four times a year. Zac carefully puts this money aside each month in a separate account, so there’s no chance of spending it. The balance can get up to around $7,000 between tax payments. They use this account, Tracey’s savings account and their day-to-day joint account to offset the balance of their mortgage and reduce the interest they pay.

Deciding the size of your mortgage

The size of your loan will impact your day-to-day life. If you borrow barely enough, you might be able to afford your home, but not the necessary fix-ups you want to do. And you might not have enough to cover the cost of essential whiteware and furniture.

At the other end of the scale, if your loan is too big it will require more of your income. Servicing your loan could leave you strapped for cash, making it tricky to afford things like car repairs and doctor visits. What’s needed is balance. A loan that covers the cost of the essentials, while still allowing for unexpected costs that may crop up.

How to make yourself an attractive proposition for a lender

Before making your mortgage application, there things you can do to make yourself more attractive to lenders:

- Pay off your high interest debts. Perhaps you have a hire purchase agreement, car payments or you’ve maxed out your credit card? These loans are typically high interest. Paying these off sooner will save you money, because they typically involve high interest rates. Not having these debts owing when the bank reviews you for a loan will be in your favour.

- Focus on ‘bad’ debt first. ‘Good’ debt is generally an investment of some kind. For example, buying an asset like a house or investing in education. This kind of debt is not seen to be as undesirable as a ‘bad’ debt, which is funding consumer items like whiteware and electronics which depreciate with age. While any debt is going to be considered negative, paying off your ‘bad’ debt first makes your application more attractive.

- Review your outgoings. There are always some non-negotiable outgoings, like electricity, water, travel and food. But perhaps, if you look closely, you can identify ways to streamline these costs even more. Have shorter showers, turn off lights and fans/heating when not in use. Eat and drink ‘in’ rather than going for coffee or lunch out. Make meal schedules and a shopping list to minimise your visits to the supermarket and convenience stores. Carpool, cycle and take public transport. Then take a look at the negotiables, the ‘nice to haves’. Do you need subscriptions to Netflix, Neon, Spotify, a newspaper, magazines? Are you using that expensive gym, golf, squash membership? Could you go from being a platinum member to a mere bronze card holder without losing too much in the process? Take a look through your bank account, to find where your money is going and question whether this is something you could cut back on.

- Have a good financial history. Be able to show you can make regular repayments if you do have outstanding debts, or that you can make routine saving deposits. Owing money to the Inland Revenue could prevent you from securing a loan, so make sure any amounts are paid off if possible.

- Review your credit cards. Having credit cards is a risk to your lender. You could spend money you don’t have, across many cards, with a high interest loan rate that could impact your ability to make mortgage repayments. The fewer credit cards you have, and the lower the credit limits, the less risk to them. You could also consider trading your credit card for a debit card to reduce this risk even further.

- Check your credit rating. Perhaps there’s a very old debt that you didn’t know about that needs settling. Or a payment you made that was never processed properly by the vendor, that may cause you a bad credit rating, so you can fix them before your lender sees them. You can check your credit rating via ClearScore for free credit reports that update monthly.

Finding out how much you could borrow

Generally, your loan value will be the total cost of the home, less the deposit. Your deposit may be made up of your savings as well as Kiwisaver, but could include money gifted from family too. Determining factors on your loan value will focus on your income, minus your day-to-day outgoings, but may also include existing loans or payments, renovations and the purchase of furnishings.

You can use our Borrowing Power Calculator to help work out what you may be able to borrow.

Going in with others, so you can borrow more and buy better

Buying on your own could be too much of a stretch. There’s the hard graft of saving enough for a deposit, only to be followed by ongoing loan repayments for years ahead. However, if there were two, three or more people involved, you could pool your resources to achieve the deposit sooner and share the burden of repayments.

Typically people getting a joint mortgage are couples, families or siblings, but this arrangement could work for friends too. At the very least, write an agreement documenting amounts contributed and debts liable per person, so there is no uncertainty moving forward. Also add a section regarding exit strategies, to allow for a change of circumstances in the future. While you’re happy and excited to be embarking on this adventure together today, it’s always best to consider ‘what ifs’ that may crop up over the long life of your mortgage. To be extra safe, consult a lawyer about document contributions and exit strategies.

An alternative to sharing your mortgage with others might be to recruit some flatmates to help with your monthly repayments. Not only will it make your mortgage more manageable, it will also divide and reduce other costs like water, electricity and internet. You could also consider hosting boarders or travellers. These shared living arrangements will help to stretch your day-to-day budget and possibly make some lump sum early repayments. The extra income could also assist with getting a loan in the first place.

Getting conditional approval before you go house hunting

Understanding your repayments

Most mortgages are made of two parts – the principal and the interest. The principal is the amount of money you have borrowed, while the interest is the cost of borrowing the money. In the beginning, with a typical table mortgage, a large percentage of your repayments will be covering interest. As you chip away at the principal amount, the interest will decrease until finally you’re paying your principal down almost entirely, with only a small amount of interest to cover. This process is called amortisation.

As a rule, you’ll end up paying more interest on a longer term loan. While the monthly repayments may be lower, the interest rates are typically higher, giving you a higher total cost. A shorter term loan will have a lower total cost, due to lower interest rates but higher monthly repayments.

First-time buyer’s FAQs

- Have contributed at least the minimum amount to KiwiSaver for three or more years in total, and the minimum amount is 3% of your total income or at least $1,000 a year (whichever is lower)

- Have earned no more than a certain amount in the 12 months before you apply, which is $95,000 before tax for an individual buyer, $150,000 for an individual buyer with one or more dependants, or $150,000 combined for two or more buyers

- Not currently own any property

- Have a deposit of at least 5% of the purchase price of the house or one you want to build

- Agree to live in the home for at least six months

With the government’s First Home Grant:

- If you buy a qualifying existing home, you can get $1,000 for each of the three or more years you’ve paid into KiwiSaver, up to a maximum of $5,000

- If you buy a qualifying new home or land to build on, you can get $2,000 for each of the three or more years you’ve paid into KiwiSaver, up to a maximum of $10,000

This grant can be put towards the deposit, which must be at least 5% of the property’s purchase price. For more information, including regional price limits and other property qualifying criteria, visit kaingaroa.govt.nz

To get a First Home Grant you must show that you will have a deposit of at least 5% of the purchase price of a property you want to buy or build.

Once approved or pre-approved, your First Home Grant from the government can count towards this deposit. It can also include a KiwiSaver first-home withdrawal, savings in the bank, money you’ve already paid towards the property and money gifted by a close family member. Family making a gift must complete a formal declaration that the money is indeed a gift and not a loan to be repaid.

In general, lenders will only provide a mortgage of up to 80% of the property’s value, so a 20% deposit is usually required. Smaller deposits are possible in some circumstances and can be as low as 5% if you qualify for a government-backed First Home Loan.

However, a deposit doesn’t have to include your own savings. It can be made up from a variety of sources, such as a First Home Grant, cash gifts from family and a KiwiSaver first-home withdrawal. You and the lender will just need to be sure you can afford the regular ongoing mortgage payments.

First home buyers usually go on to be second and third home buyers, so most banks are keen to pick up reliable new customers from the beginning. Finding the best bank for you will depend on your circumstances and the interest rates, fees and charges each bank requires at the time. It pays to shop around or consult an independent adviser, such as a mortgage broker.

Not all banks offer the government-backed 5% deposit First Home Loan for people who qualify. To find the banks that do, visit kaingaroa.govt.nz

If you’ve contributed the minimum amount to a KiwiSaver fund for at least three years, there are two ways it could help you get a deposit together:

- KiwiSaver first-home withdrawal – if it’s the first time you’re buying a property or land, it’s in New Zealand and you intend to live in it, you can withdraw all but $1,000 of your fund and put it towards the deposit. In some circumstances this may also be available to people who previously owned a home.

First Home Grant – if you and the home you want to buy qualify for this government grant, it can provide between $3,000 and $5,000 towards the deposit on an existing home, or between $6,000 and $10,000 towards the deposit on a new home or land to build on.

This varies a lot, depending on your situation and demand on lender processing resources. During a real estate boom time, turnaround times can be negatively impacted. Although conditional approval can sometimes be given in a few days, it pays to allow a few weeks for full approval and another period of time before the mortgage can be drawn down for settlement.

If you have a deposit that’s at least 5% of the purchase price and your total household income before tax is no more than $130,000, you may be eligible for First Home Partner from Kāinga Ora. There are other criteria you’ll have to meet but basically Kāinga Ora buys the home with you and contributes up to 25% of the purchase price or $200,000, whichever is lower. You’re expected to buy back Kāinga Ora’s share within 15 years and have to do so within 25 years.

To learn more, visit kaingaroa.govt.nz

→ NOTE: This guide was published 1st March 2021 and updated on 26th July 2022.

IMPORTANT: 29/09/2023 – Due to recent unprecedented demand, the Kāinga Ora First Home Partner scheme is now fully subscribed and therefore they will not be accepting any new applications while they work through their commitments to those already in the scheme. Find out more here.