Property investment has been big news over recent years. Low interest rates and soaring demand for property increased FOMO to record levels, so properties suitable for investment were being snapped up as quickly as they appeared.

In response, the government moved the bright line for capital gains tax and is gradually phasing out property investors’ ability to claim interest paid on loans for existing homes. Some property investors reacted by selling up their portfolio and putting everything into an expensive family home, because the house you live in doesn’t attract capital gains tax. However, the lure of long-term gains hasn’t really dampened the glow of property investment. When the equations are done correctly, it’s still a proven way to grow your wealth. Keep reading for a ‘how to’ that will help you get started in New Zealand property investment.

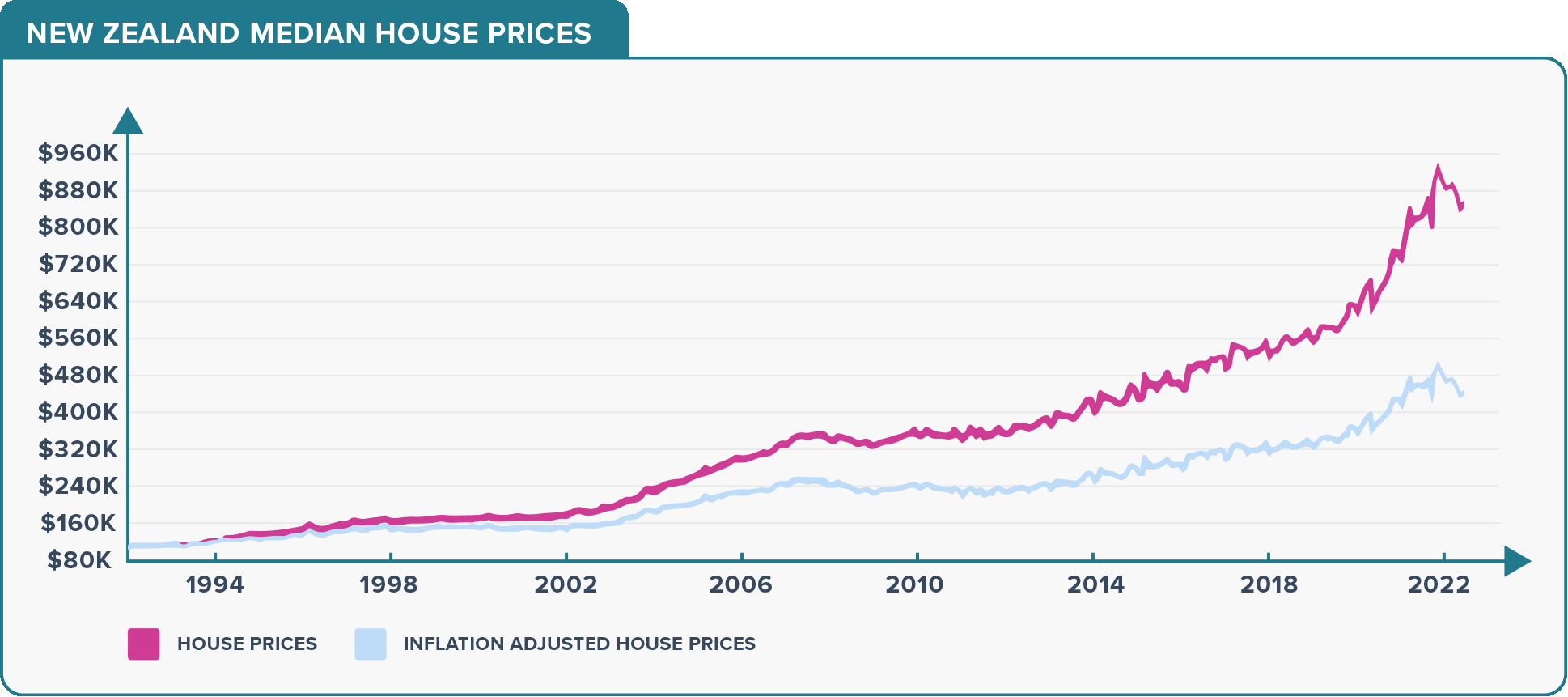

Source: globalpropertyguide.com

A quick glossary of terms

Property investment has a language all of its own. Here are some of the terms you need to understand:

Equity – the difference between the market value of a property and the amount you owe on the mortgage.

LVR – loan to value ratio is the amount you’re borrowing versus the value of the property. If your LVR is 65%, it means you’re borrowing 65% of the value of the property.

Negative gearing – the expenses related to your investment property are more than the rental income.

Positive gearing – the rental income you get from your investment property is more than the expenses.

Yield – how much cash your property investment generates each year, usually expressed as a percentage of the property’s value. Gross yield is before expenses; net yield is after expenses (except for home loan interest).

Deciding on commercial or residential

When there’s chat about becoming a property investor around the barbecue, it’s usually referring to buying residential rental properties. There’s always the option of investing in commercial real estate, but we’re saving that topic for another guide. The information and tips that follow are squarely focused on residential property investment in New Zealand. See this for more on commercial property investment.

The benefits of residential property investment

Ministry of Business, Innovation and Employment (MBIE) data from 2021 tells us there were more than 120,000 residential landlords in New Zealand. Of these, around 78% owned just one rental property. It’s interesting to note that Stats NZ said there were about 440,000 privately owned rental properties in total, so a relatively small number of landlords have significant property portfolios. 1

The attraction of residential property investment can be summed up like this:

- Rental properties are a necessity in New Zealand. The number of households renting their home is increasing.2

- Over time property values have increased steadily in New Zealand. In some areas, statistics show they have been doubling (or more) every 10 years.3

- Rental income (after tax) helps to pay off your mortgage. Depending on the property you buy, the amount of your deposit and the rental yield, it could cover all the payments.

- Rental property is a tangible asset – bricks and mortar. Unlike shares, you get something solid for your money.

How a property investment grows in value

Financing your investment

Using family home equity to buy a renter

Choosing an optimum location

When you’re hunting for a rental property, don’t limit yourself to the suburb, town, city or region you live in. By using a property manager to look after the renter, you could own an investment property anywhere in New Zealand. The important thing is to identify a location that has potential for capital gain and/or a decent rental yield. Let logic rule your decision, not emotions. Here are some tips to help:

- Look for population growth trends. When a population is growing, there is more demand for houses. Demand drives prices up.

- See if you can identify locations that are trending for capital gain. You can use Trade Me’s property insights to see recent and past property selling prices all over the country.

- People like to live close to their work, so identify locations that are handy to employment opportunities.

- On a more micro level, look at availability of public transport, schools, shops and amenities. A location that is convenient and pleasant to live in could be more valuable in the long run.

Property investment strategies

When you’re launching into your first property investment, it’s good to have a strategy that guides your decisions. Here are some popular strategies:

- Buy, renovate and sell. This is a classic speculator strategy for making a buck with property investment. Its success hinges on finding a property that needs work, spending money and time improving the property, and then selling it quickly for a profit. These days, the bright line test means that if you sell a rental property within 10 years of buying it, you will have to pay income tax on any profit you make.5

- Buy and hold. With this popular strategy, you buy a property, rent it out and wait at least 10 years before you sell it. This way you get 10 years of capital gain and avoid the bright line test, so you don’t have to pay income tax on the profit.

- Optimum yield. If you’re getting into an investment property to create an income stream, you’ll want to get maximum rent for minimum investment. That will mean doing some research around New Zealand to identify locations where rental properties are quite cheap, but also in high demand.

- Max capital gain. If capital gain matters more to you than rental yield, you need to think carefully about what and where you buy. For example, you could look for the most humble house on an elite street. The real estate game is all about location, location, location. Another capital gain strategy would be to look for a four-bedroom/two-bathroom home that’s close to an excellent high school. There’s always a market for family-size homes that are in zone for a popular school.

Crunching the numbers, to make sure it’s working

Before you commit to buying a rental property, you need to look hard at the numbers. It’s smart to sit down with an accountant or mortgage broker to see the reality of what you’re getting into. If your expenses will exceed income, you’re into what’s known as a ‘negative gearing’ situation. Unless you get capital gain, you’re losing money rather than making it. When the income exceeds the expenses, you have a ‘positive gearing’ situation. Profit can either be used as income or you can pay back the mortgage faster.

| Income | Expenses |

|---|---|

| Rental payments | Mortgage payments |

| Council rates | |

| Repairs and maintenance | |

| Fixed water charges | |

| Insurance | |

| Property management fees (if you’re not managing the property yourself) |

Frequently asked questions about buying a renter

In general, the following people are eligible to buy investment property in New Zealand:

- New Zealand citizens living here or overseas

- Permanent residents living here

- Citizens of Australia or Singapore, because New Zealand has free trade agreements with these countries

People not in these groups may be able to invest in a property development where the developer has successfully applied for an exemption, but the rules are complex.

For an investment property that’s an existing home, not a new-build, a deposit of at least 35% is required by lending banks in New Zealand. If you live overseas, proof of income is generally only accepted from employers with a strong international reputation.

Negative gearing is where the income from an investment property (rent) is less than the total cost of owning it. In simple terms, it typically means the rent doesn’t cover the mortgage interest plus other expenses. That means the owner has to keep paying money into the investment, as well as repaying the money they borrowed to make the purchase.

Negative gearing relies on the property increasing in value, creating capital gain. In addition, some expenses that create the negative gearing may offset part of the income earned for tax purposes.

Some investors choose negative gearing to buy a higher value property, with the expectation that it will provide greater capital gain in the long run than a lower value property. However, recent tax law changes that have removed the ability to claim mortgage and loan interest on an existing property as an expense have made negative gearing less and less attractive. However, for a new-build property you can claim interest as an expense for the first 20 years from the date it receives a code of compliance certificate. This continues, but does not reset, if the property is sold to another investor during the first 20 years.

Everyone’s situation is different, so it pays to get independent financial advice before deciding whether negative gearing is a good idea for your investment goals and circumstances.

If your home is worth more than the amount still owing on your mortgage, you have equity in your home. If this is more than 20% of the home’s value, then you may be able to put the extra amount towards a deposit for an investment property. You would do this by increasing the mortgage on your home, up to 80% of its current value, and using the additional amount borrowed for the investment property deposit.

When you buy and sell a rental property in New Zealand, you may have to pay tax on the difference between the purchase price and the sale price. Known as a capital gains tax, it applies if:

- You bought the property with the firm intention to resell it

- You have a pattern of buying and selling property and are considered to be a property dealer

- You sell the property within a bright-line period

The bright-line period for a rental property depends on when the sale and purchase agreement you signed to buy it became binding. If it became binding:

- Between 1 October 2015 and 28 March 2018 (inclusive), the bright-line period is two years

- Between 29 March 2018 and 26 March 2021 (inclusive), the bright-line period is five years

- From 27 March 2021 onwards, the bright-line period is 10 years for existing homes and five years for new-builds

However, if you made an offer on a property on or before 23 March 2021 that couldn’t be withdrawn before 27 March 2021, and the resulting agreement became binding on or after 27 March, the earlier date’s bright-line period of five years applies.

Recent tax law changes for residential property income have steadily removed the ability to claim the interest paid on a mortgage or a loan for repairs and maintenance as an expense. For example:

- For some years now, rental property expenses can only be used to offset income from the property itself (its rent) and not the investor’s other income. This was known as ‘ring-fencing’.

- For investment properties bought on or after 27 March 2021, mortgage interest paid from 1 October onwards can’t be treated as an expense for tax purposes.

- For existing (not new-build) investment properties bought before 27 March 2021, the percentage of mortgage interest that’s allowed to be counted as an expense for tax purposes reduced to 75% from 1 October 2021 and is dropping a further 25% each year from 1 April 2023, becoming zero from 1 April 2025 onwards.

- However, for a new-build property you can claim mortgage interest as an expense for the first 20 years from the date it receives a code of compliance certificate. This continues, but does not reset, if the property is sold to another investor during the first 20 years.

- Since 1 October 2021, the interest on any loan taken out on or after 27 March 2021 for property maintenance or improvements can’t be claimed as an expense for tax purposes.

As with any investment or business venture, it’s important to get experienced independent advice to ensure you understand potential risks and how you could manage them. For starters, here are some examples of property investment risks. Most can be reduced by repaying what you owe as quickly as possible.

- Your rental property is empty for a long time and you can’t keep up the mortgage payments, so you have to sell in a hurry or at a time when values are low

- The property requires unexpected major repairs that you can’t afford to fix and you can’t borrow more money to pay for them

- Interest rates increase and you can’t get more rental income to compensate

- Your mortgage is with the same bank as the one for your home and they choose to sell both properties because you couldn’t make the regular payments for one of the mortgages

Teaming up with a friend can get you onto the property investment ladder much sooner than otherwise possible. But no matter how well you get on with your buddy, it pays to treat it as a purely business arrangement. Be sure to get advice from experienced experts before diving in.

Here are some examples of things to consider:

- What happens to your share if you die? If you buy the property under a tenants in common arrangement, your share is passed on according to your Will. With a joint tenants arrangement, your share goes to the other surviving person (your investment partner).

- What if one person wants to sell up? Before you buy the property, a lawyer can draw up an agreement that sets out a process you both agree to follow.

If one person can’t keep up their contribution to the regular mortgage payments that aren’t covered by rental income, the other will have to pay it for them. That’s because both people are individually and collectively responsible for the entire mortgage. - Your credit ratings become linked, so one person’s financial problems will affect the other.

- Who will be responsible for the various landlord jobs, from finding tenants and chasing up late rent to paying the bills and getting maintenance done?

- If you choose to buy another house on your own, lenders will consider the entire mortgage for the joint property as your liability, but only your share of the property as an asset.

Although it has been suggested as a way to help improve home ownership rates, at the moment a KiwiSaver first home withdrawal can’t be used to buy a rental or investment property. To use KiwiSaver, you have to live in the home.