Spring bounce in demand

Each month we invite mortgage advisors around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey has attracted 75 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- Brokers have become very frustrated about a blowout in bank application processing times. Some blame this on the Commerce Commission recommending brokers get three quotes for clients.

- Further strength has appeared in buying interest from both investors and first home purchasers.

- Anticipation of easing monetary policy has boosted interest in floating mortgage rates.

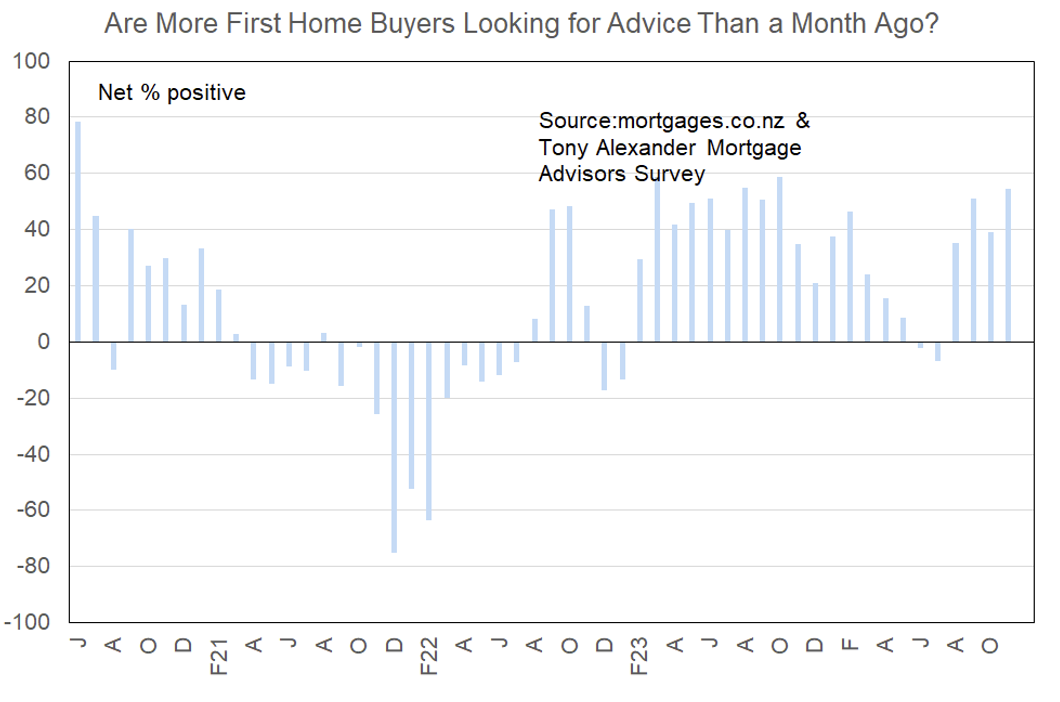

More or fewer first home buyers looking for mortgage advice?

A net 55% of brokers responding in this month’s survey have said that they are seeing more first home buyers in the financing market. This is up from 39% last month and the strongest result since October last year.

Last year’s surge in young buyer demand fizzled out as worries surfaced about interest rates going higher and as a large number of vendors entered the market causing a decline in FOMO. This time around brokers note that falling interest rates are causing people to expect stronger housing activity going forward with more buyers appearing.

Comments on bank lending to first home buyers submitted by advisors include the following.

- Banks are tightening up on receiving applications from FHBs that do not have 20%. They only want live deals – i.e. auctions or signed sale and purchase agreements. No new to bank lending over 80%.

- Minimal changes to criteria given LVR restrictions but competition gearing up with some lenders now offering cash-backs.

- The banks are still quite restrictive with their policies and the time taken from the application to approval is quite lengthy for a First Home Buyer. Most of the lenders are at a minimum of 10 working days as their turnaround times.

- Lowering test rates are helping FHB

- Preference to existing customers for first home buyers with LVR above 80%, preapprovals to new to bank customers no longer welcome, live applications are not necessarily getting preferred with turnaround times blowing out with all the banks, feedback is one of the banks is giving a 24 hour turnaround to customers who approach the bank directly.

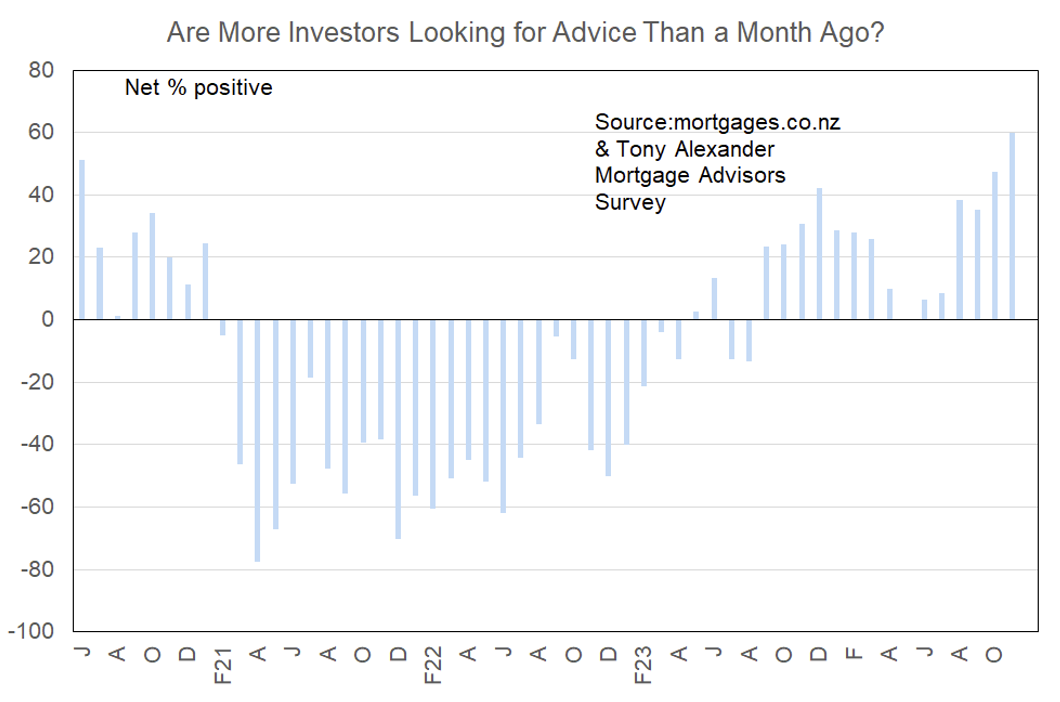

More or fewer investors looking for mortgage advice?

A record net 60% of brokers around New Zealand have said that they are seeing more investors in the market. This reading is up from 47% in October and just 9% four months ago.

The turnaround in investor demand has been quite strong and this looks to be due to falling interest rates offsetting the depressing effect on rents of rising unemployment and migration losses.

Comments made by advisors regarding bank lending to investors include the following.

- DTI becoming more of an issue as test rates drop.

- Closely looking at DTIs for self employed.

- Has become slightly easier with not so much focus on rates and insurances for the rental properties and with test rates coming down, it does become a little easier for them to buy. Rental income shading has come down to 20% more or less.

- Investors seem to be coming back in force. Banks are lending, interest rates falling, good deals to be made. Never a better time than right now for investors to be back in the market.

- Slow turnaround, but bank test rates are reducing, which allows more lending.

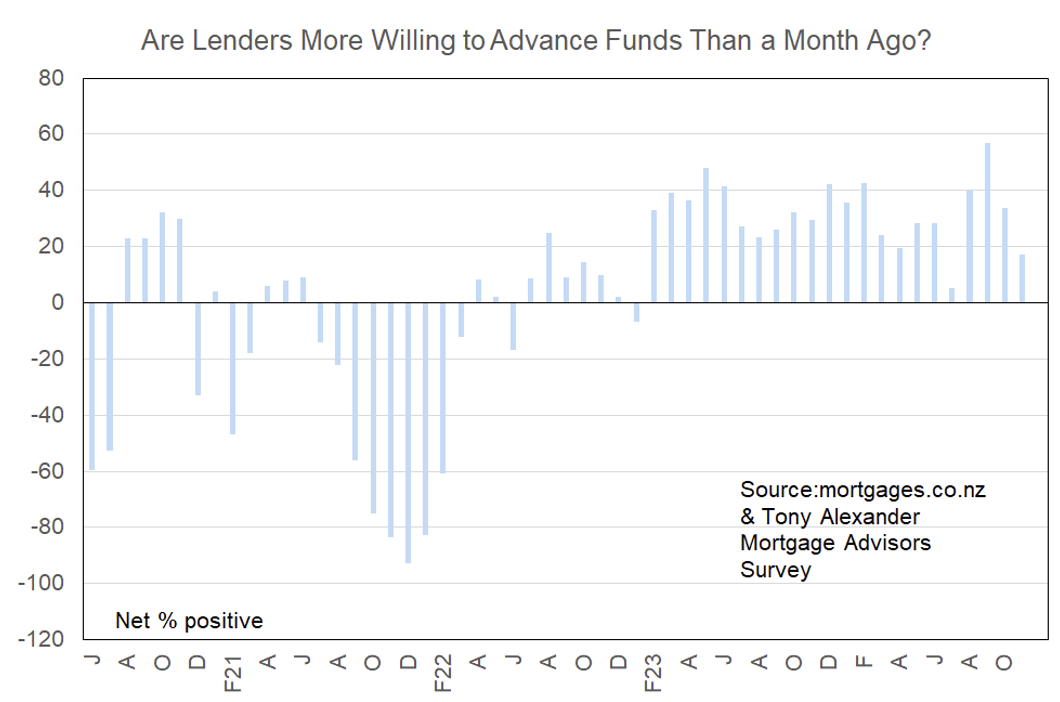

More or less lenders willing to advance funds?

A net 17% of mortgage advisors have reported that banks are becoming more willing to advance funds to home buyers. This is down from a net 34% last month and 57% in September with one cause potentially being the blowout in loan application processing times.

Comments from brokers indicate deep frustration at long processing times and this is offsetting some easing of lending criteria – admittedly in limited ways.

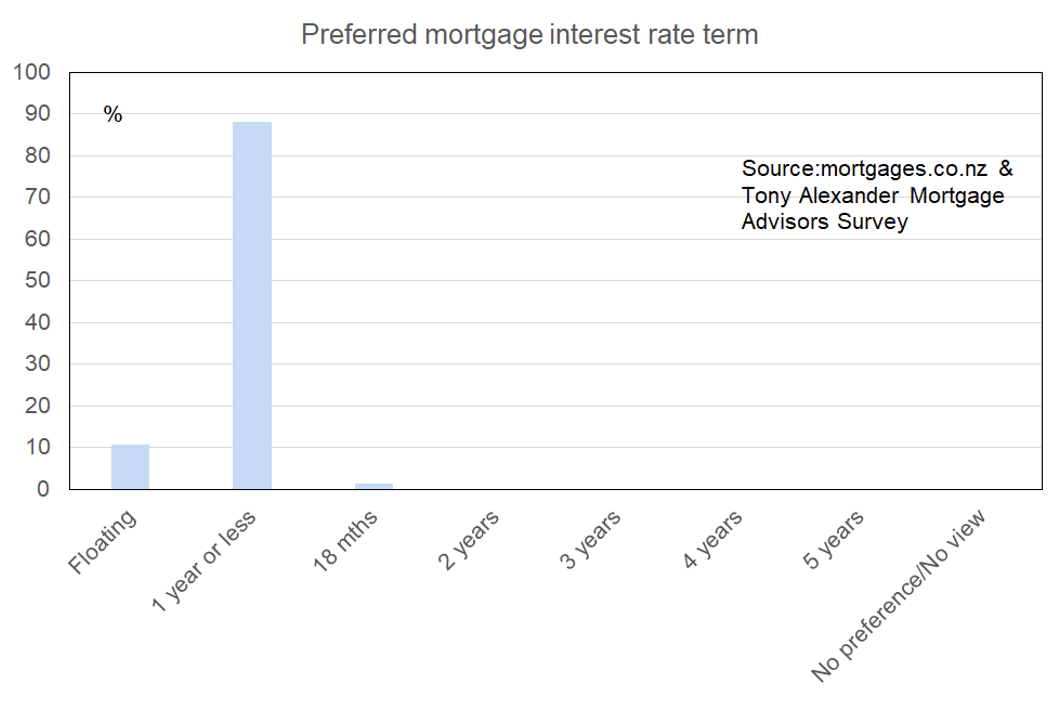

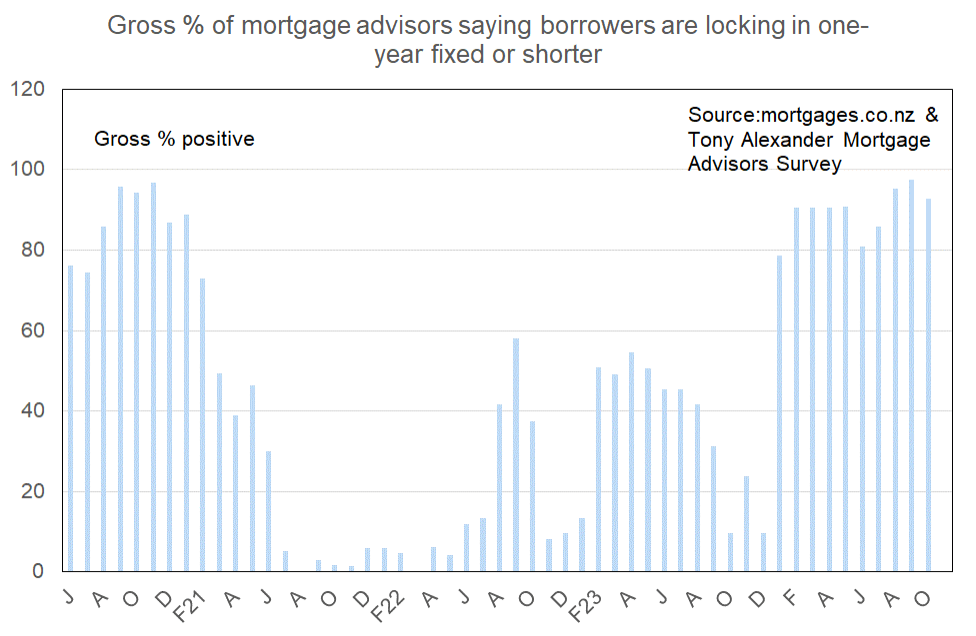

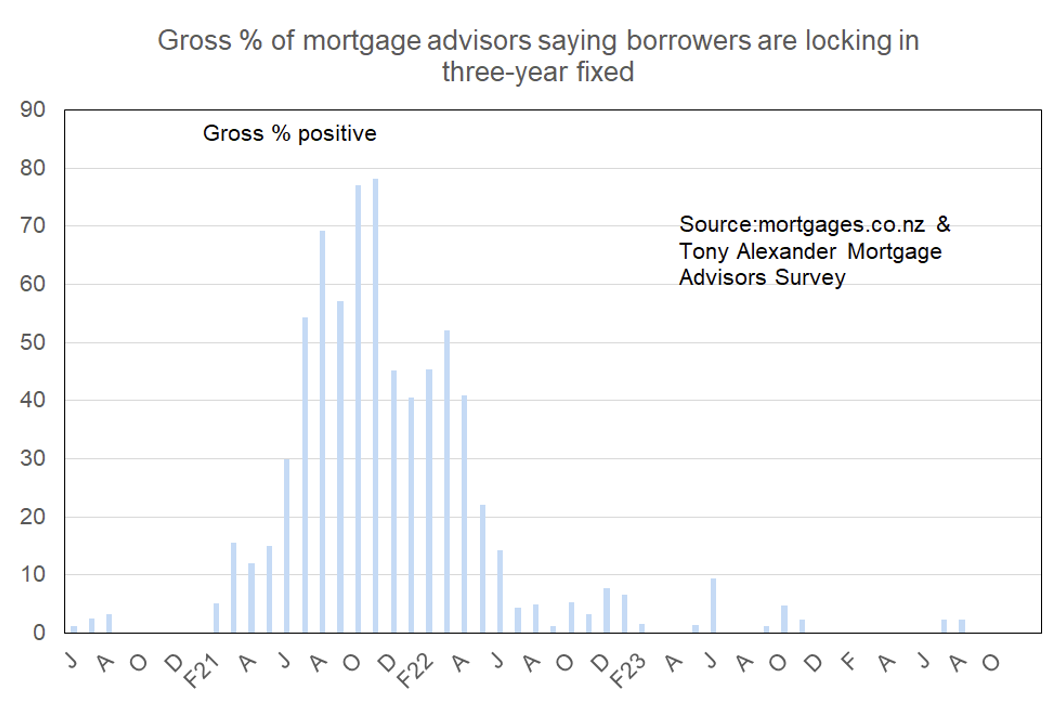

What time period are most people looking at fixing their interest rate?

A notable feature of this month’s survey has been a jump to 11% of brokers saying that people are opting for a floating mortgage rate. This appears to be driven by a desire to see what happens at the next official cash rate review on November 27 with widespread expectations of another 0.5% rate decline.

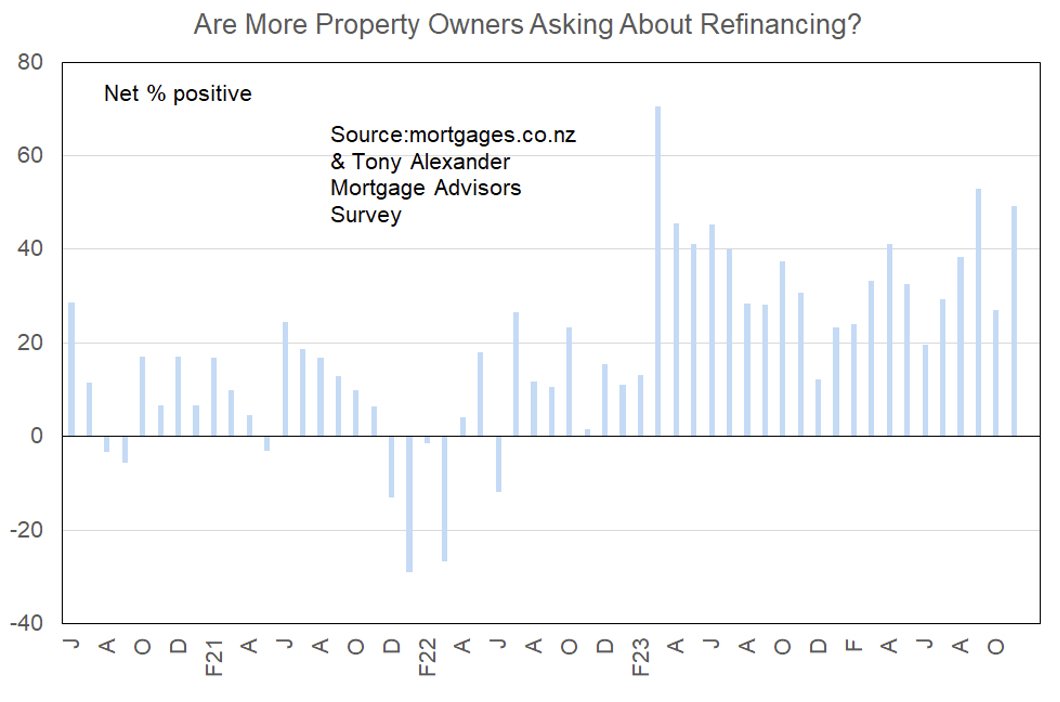

Are more property owners asking about refinancing?

A net 49% of brokers report that they are receiving more enquiries from people regarding refinancing. This high reading likely reflects the impact of interest rate declines to date with further falls widely expected.