First home buyers back

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken this week, attracted 53 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- While first home buyers are active others and particularly investors remain cautious.

- Banks are slowly easing their lending criteria still but not overly competing for business in general.

- Some buyers are awaiting much greater clarity on how the debt to income (DTI) regime will work and where interest rates are headed. New confusion has appeared in this space.

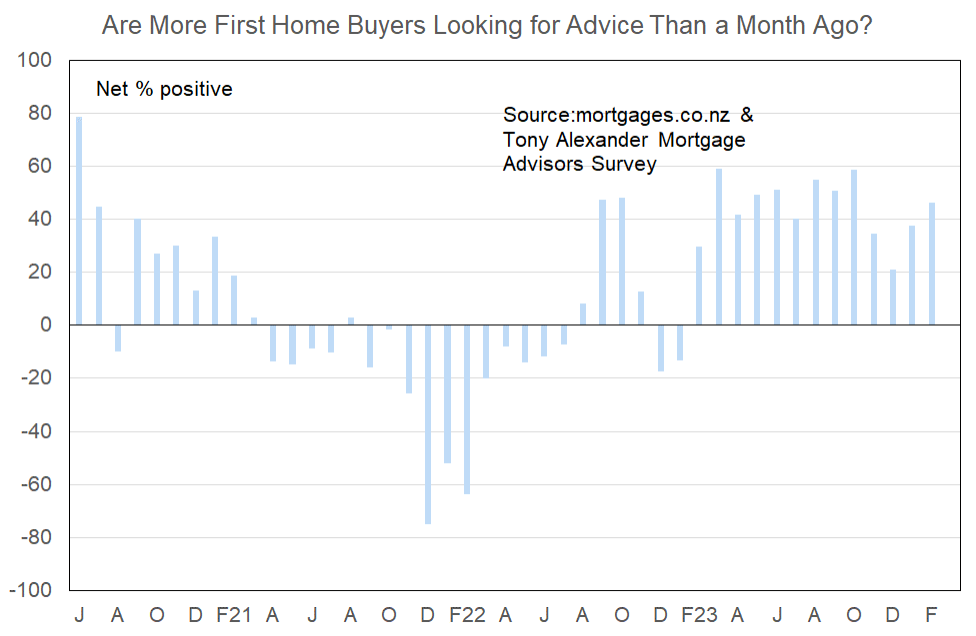

More or fewer first home buyers looking for mortgage advice

First home buyers continue to have a strong presence in the housing market as we start to advance through 2024 in an uncertain interest rates environment. A net 46% of our survey respondents have reported that they are seeing more first home buyers looking for advice.

This is up from a net 38% in January but consistent with almost all other results since this time a year ago.

Comments on bank lending to first home buyers submitted by advisers include the following.

- More supportive in assisting first home buyers however we are still limited in obtaining pre approvals for clients with less than 20% deposit.

- General market has taken a wait and see approach.

- No changes here. Some banks have started offering more cash back and sharp rates for first home buyers even if high LVR.

- Kainga Ora tightening up their criteria so a little more difficult to get First Home Loans approved through the banks that do them.

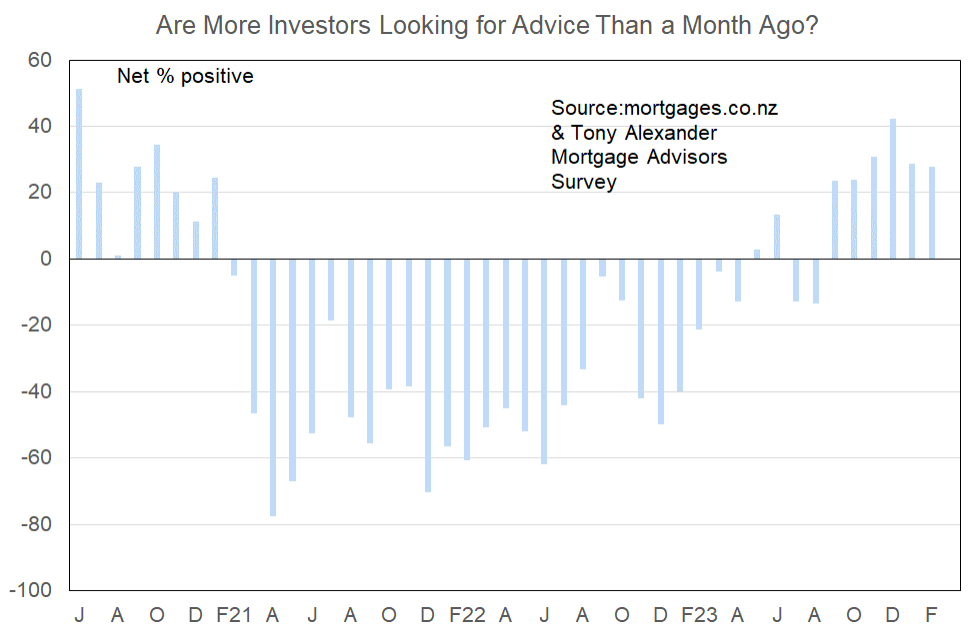

More or fewer investors looking for mortgage advice?

Our survey shows that investors began moving into the housing market in the latter part of 2023, perhaps encouraged by what the polls were suggesting would be the outcome for the general election.

A net 28% of survey respondents this month have said that they are seeing more investors, virtually the same as January’s net 29% and consistent with other months since September.

Comments made by advisers regarding bank lending to investors include the following.

- LVR rules are tough for preexisting property, Some banks are shading rental income plus adding second dwelling expenses i.e. rates insurance etc.

- Investors slowly coming back but its very slow and they are weary.

- I’d say banks are cautious and wanting evidence of ongoing costs like rates and insurance to be verified.

- Waiting for the government to change the rules for LVR.

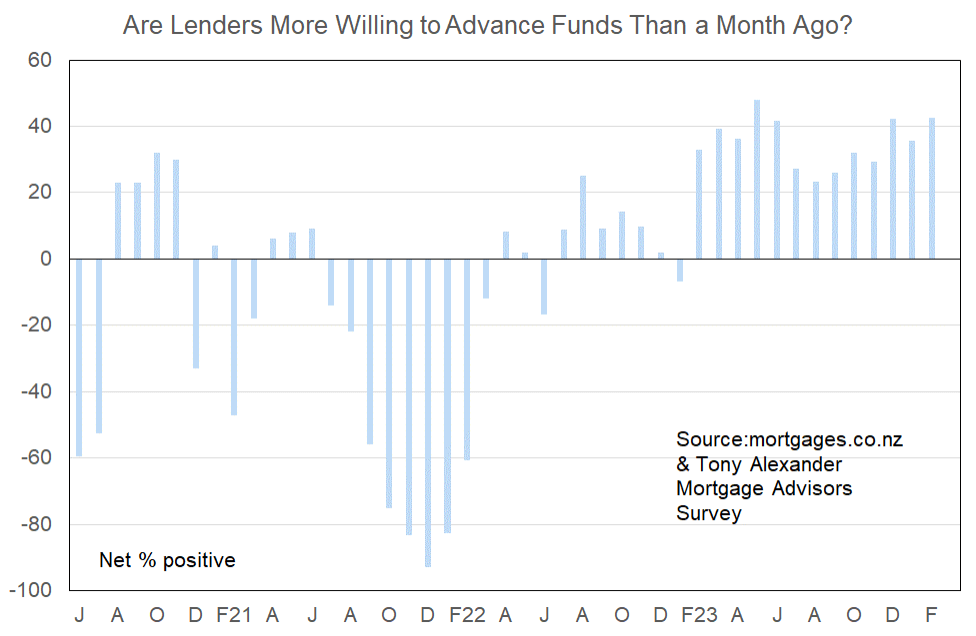

More or less lenders willing to advance funds?

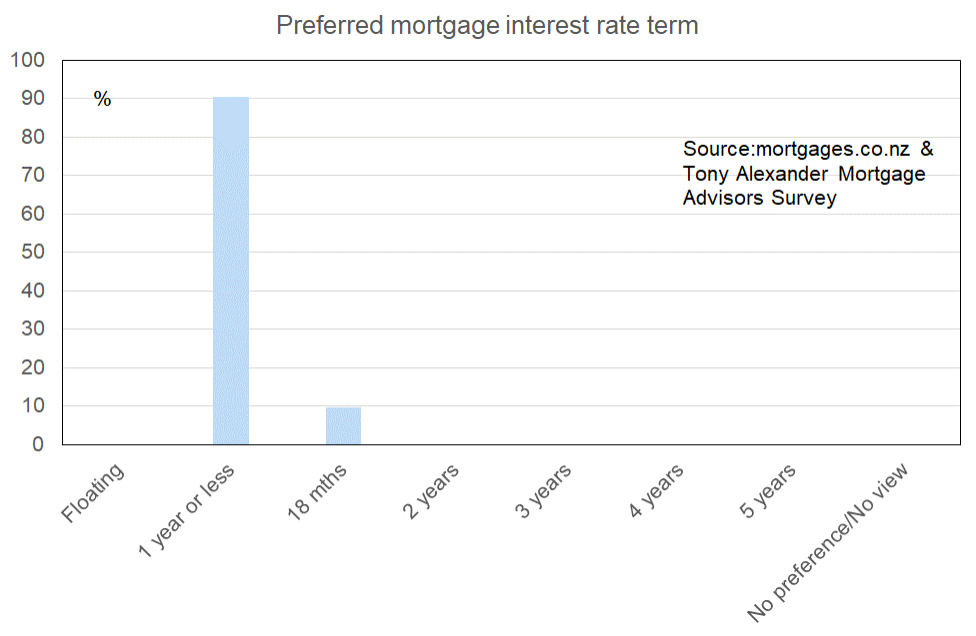

What time period are most people looking at fixing their interest rate?

For the second month in a row brokers have overwhelmingly reported that their clients wish to fix for a period of one year or less. Six months apparently is especially popular.

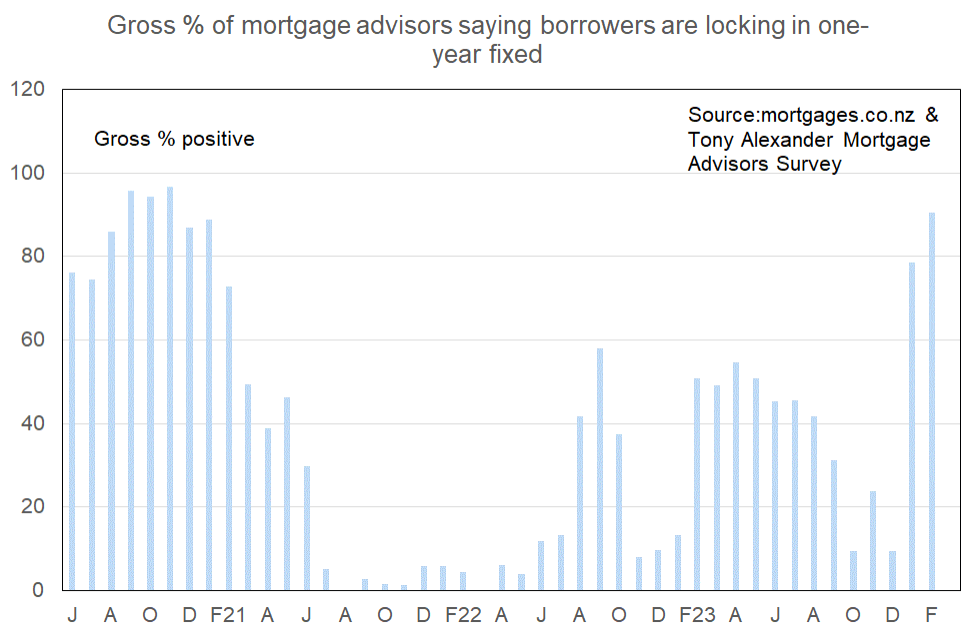

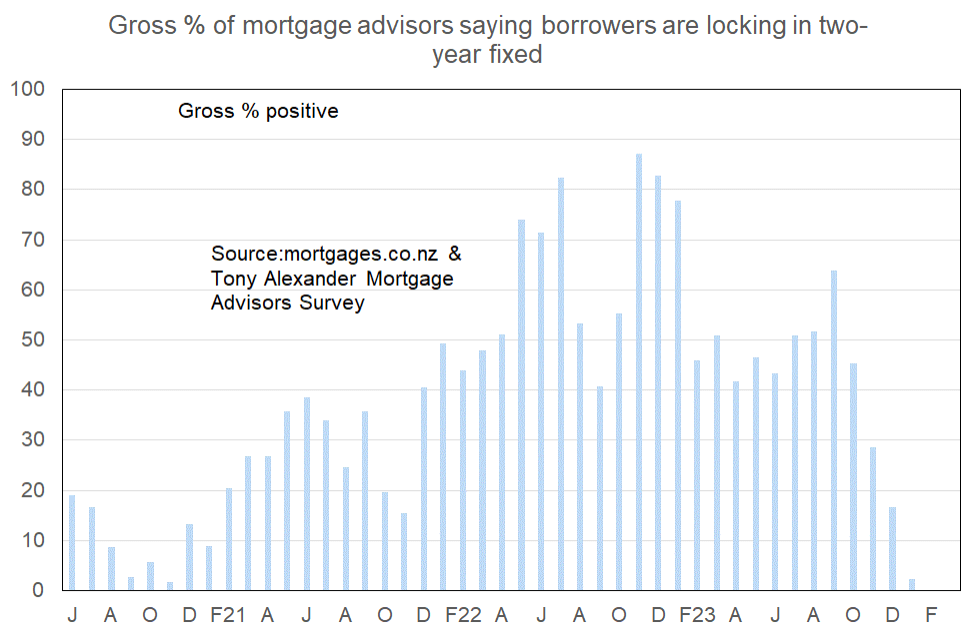

This month 90% of brokers reported a one year or less preference from 79% last month and just 10% in December. No-one has interest in fixing long and this reflects the widespread expectation amongst borrowers that the next change in interest rates will be a decrease – though when that will happen is impossible to accurately predict.

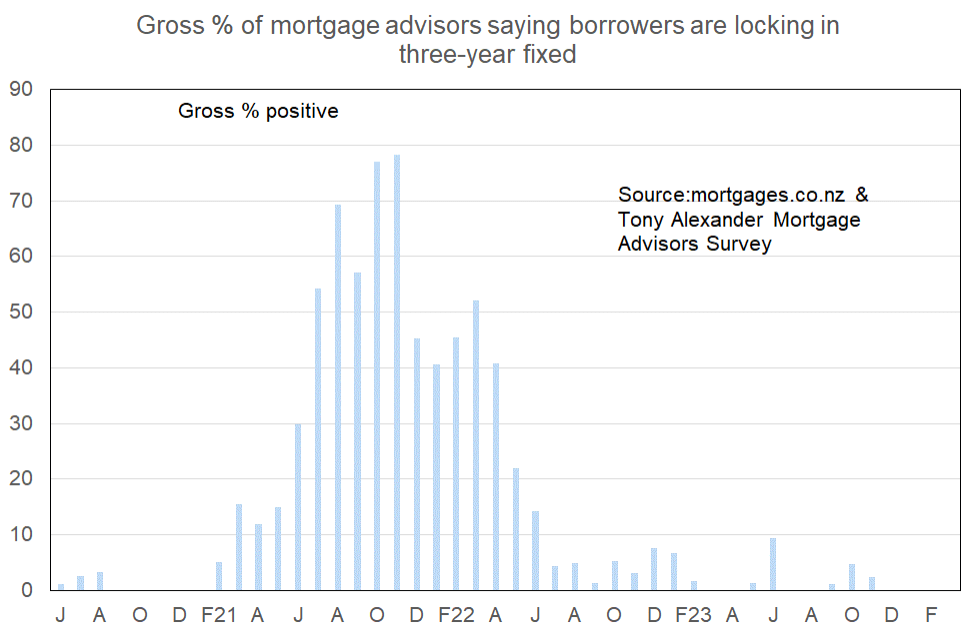

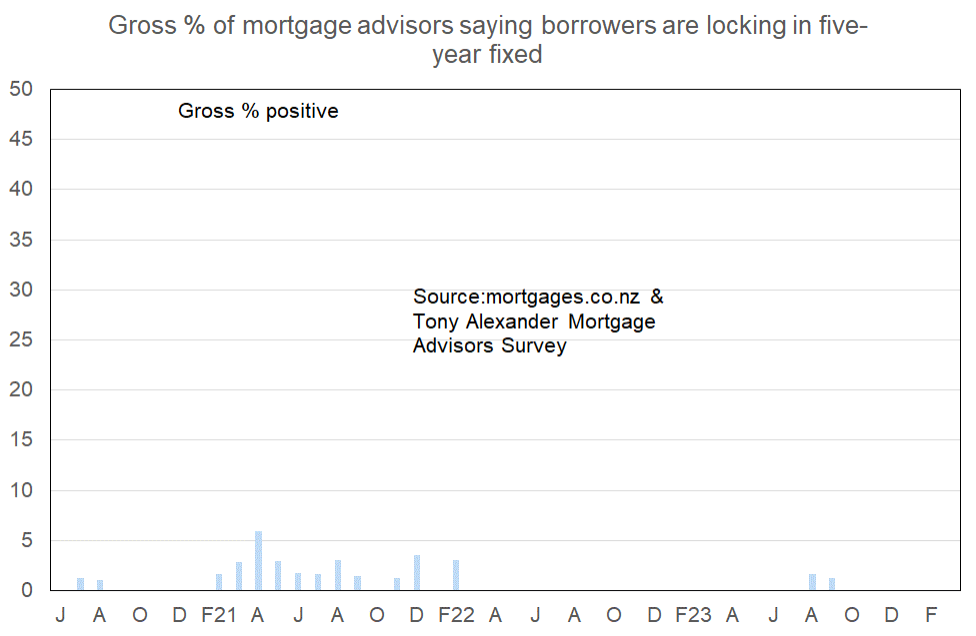

Fixing three years was only popular through 2021 into early-2022.

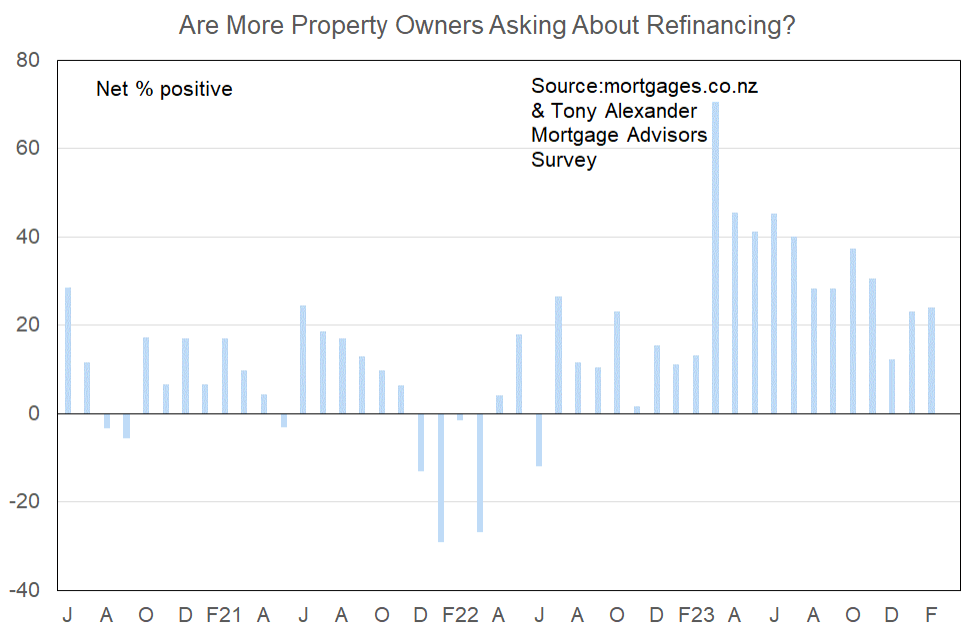

Are more property owners asking about refinancing?