Strong first home buyer interest

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 75 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- First home buyers remain strongly interested in purchasing a property.

- Investor enquiries are at their highest levels since late-2020.

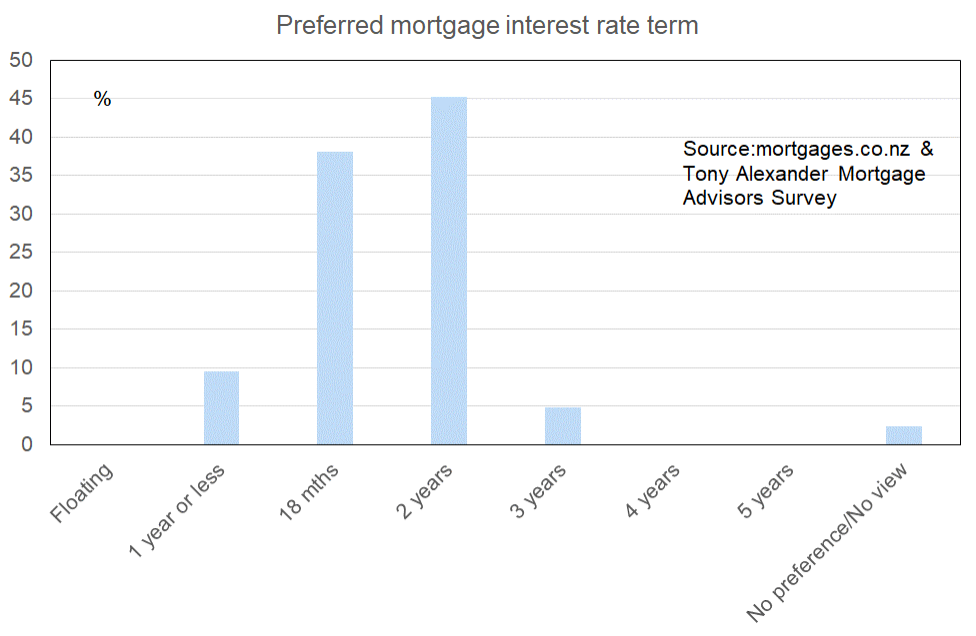

- Borrowers strongly prefer the 18 and 24 months terms for fixing their interest rate.

- Seasonal patterns of activity for now have been disturbed by the general election.

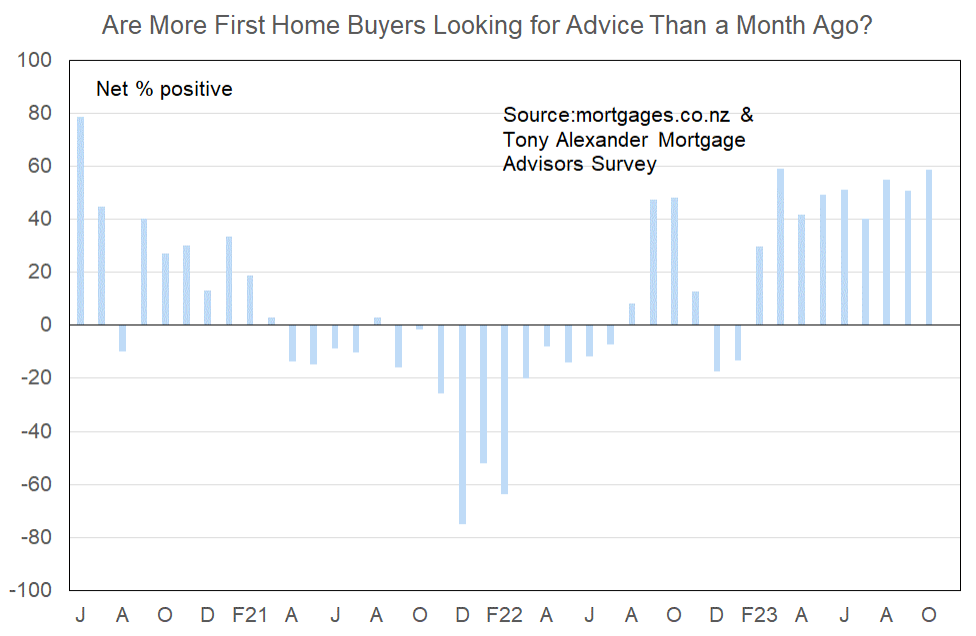

More or fewer first home buyers looking for mortgage advice

In this month’s survey a net 59% of our 75 respondents have said that they are receiving more enquiries from first home buyers. This tells us that the extent to which young buyers are driving the upturn in the housing market is not easing and if anything may be strengthening.

Only our first survey in June 2020 showed a higher net proportion of mortgage brokers saying that more first home buyers were seeking financing advice.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Still can’t get preapprovals for high LVR > 80% without a live deal which is disappointing as you can’t send them out ‘house shopping’ with confidence

- Interest rates and margins are impacting serviceability.

- One bank has dropped their monthly surplus requirements for over 80% lending, another is incentivizing higher cash contribution for FHB

- Banks starting to look at different ways to help clients – each bank has their own interpretations of compliance within CCCFA.

- Partners scheme running out of funds has been a bit of block for some clients.

- Loan servicing surplus criteria continues to slowly loosen but still a tough ask with the test interest rates hovering around 9%

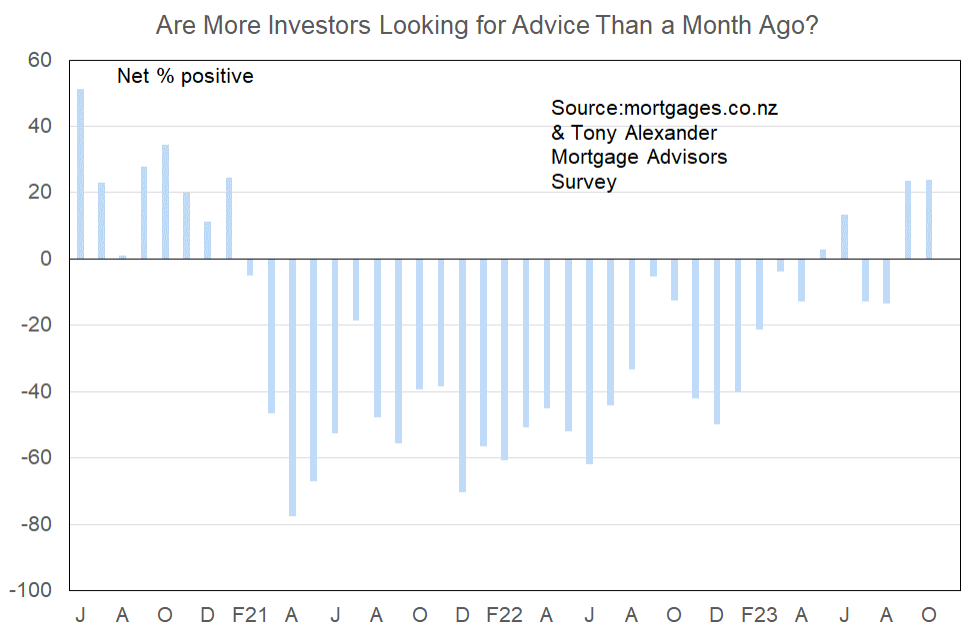

More or fewer investors looking for mortgage advice?

A net 24% of mortgage brokers have reported that they are receiving more enquiries from investors. This is the same reading as last month and tells us the surge in investor enquiry in September was not a statistical blip. The situation is now markedly different from almost all other months since early-2021 when tax rules for investors changed.

Comments made by advisers regarding bank lending to investors include the following.

- Not much change in this area – everything seems to be hinging on the election

- Tweaks to the shading of the rental income has decreased, however, the actual rates and insurance expense, in most cases, exceed the shaded allowance when a percentage of the rent was considered.

- No changes. 65% LVR for existing investment properties, 80% LVR new builds, 80% overall LVR for owner occupied and Investment property.

- Enquiries are steady, however, once investors do the numbers as part of the application process and speak with their accountant, they no longer wish to proceed as they cannot make the numbers work or they are not willing to top-up the difference.

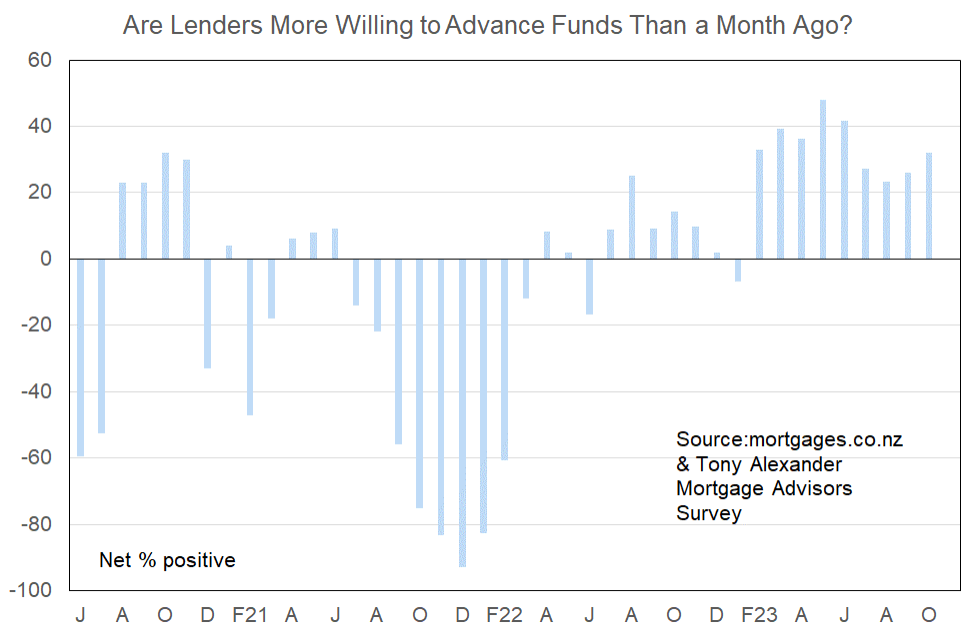

More or less lenders willing to advance funds?

The main change in perceptions of bank willingness to lend to home buyers happened earlier this year. Since that change in February things have not altered much with a net 32% of brokers this month saying that lenders are getting more willing to advance funds.

We have come a long way from the deep credit crunch days of late-2021 when at one stage a net 93% of mortgage advisors reported that lenders were pulling back on funds availability.

What time period are most people looking at fixing their interest rate?

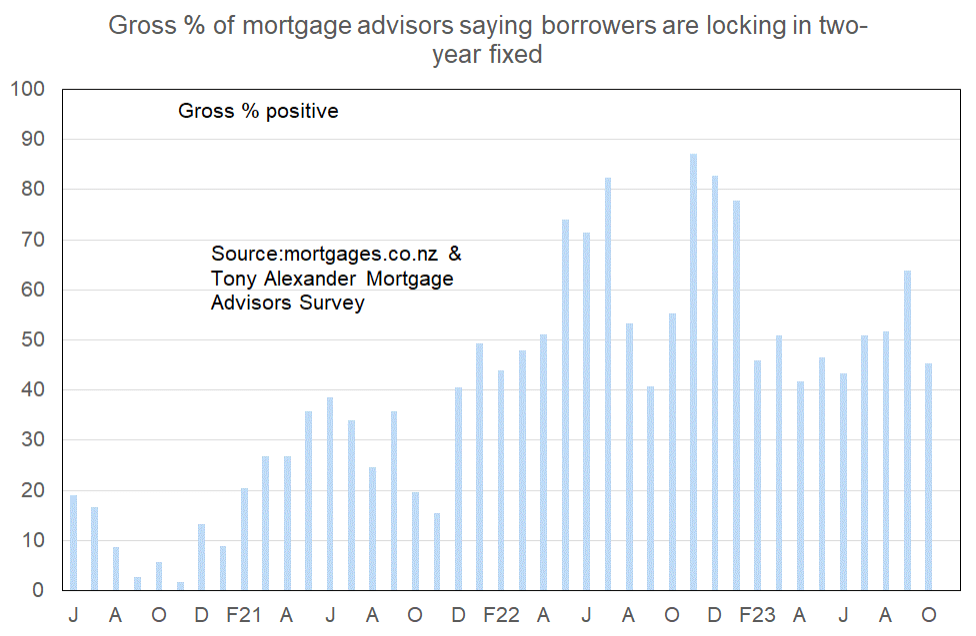

10% have chosen one year, down from 31% last month. 45% have said two years, down from 64%. In other words, doing some basic maths we can see equal numbers of brokers choosing one year as two years when the 18 month choice was not available. That makes sense.

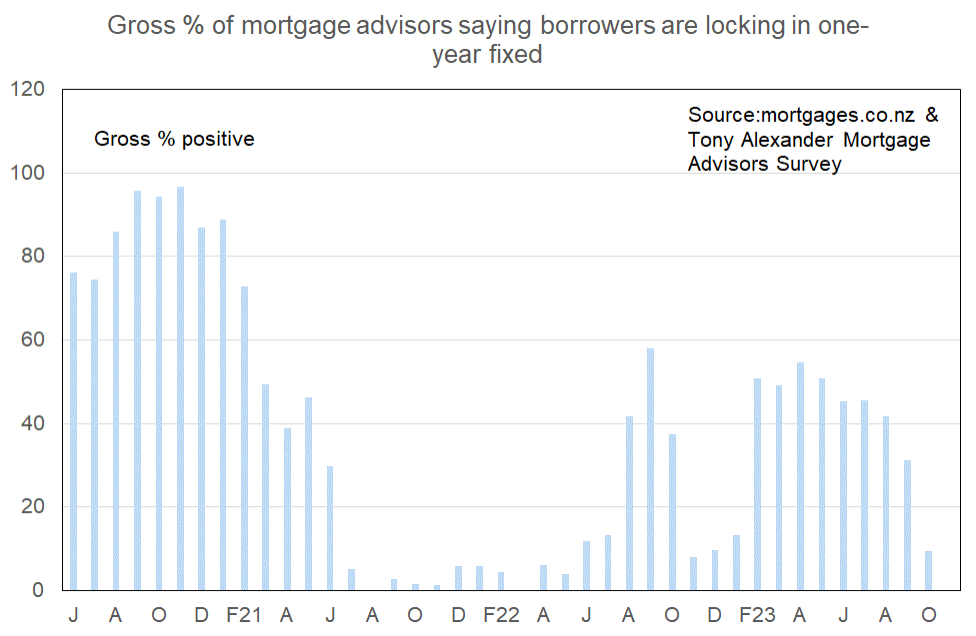

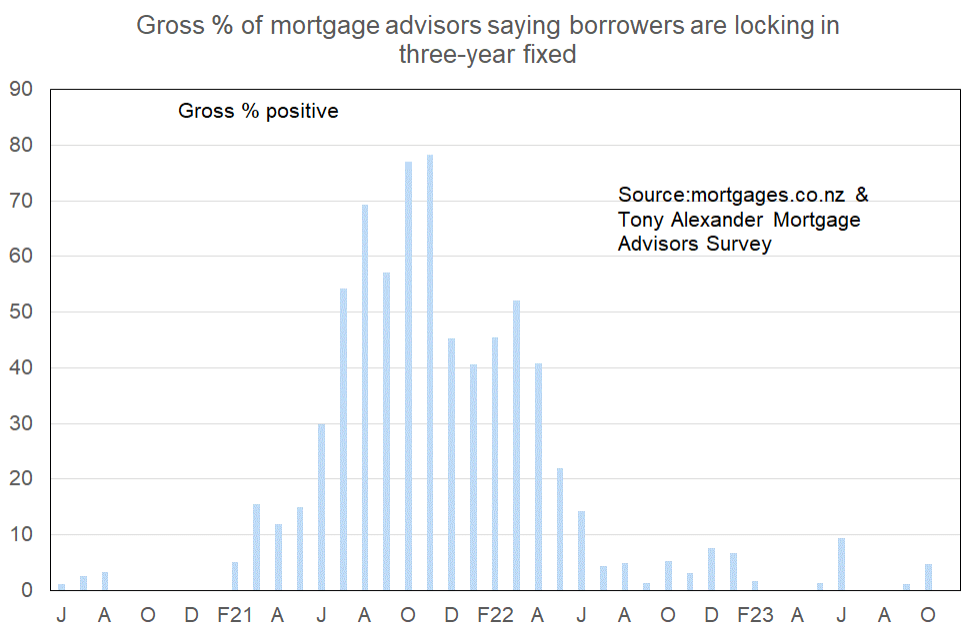

The following graphs show term preferences, but we can’t yet put a time series in place for the 28 month term. Plus, be aware of the step down in preference for one and two years from this month because of the survey change.

There is understandably no obvious impact on the three year preference from our survey change. Interest in that and longer terms remains near zero.

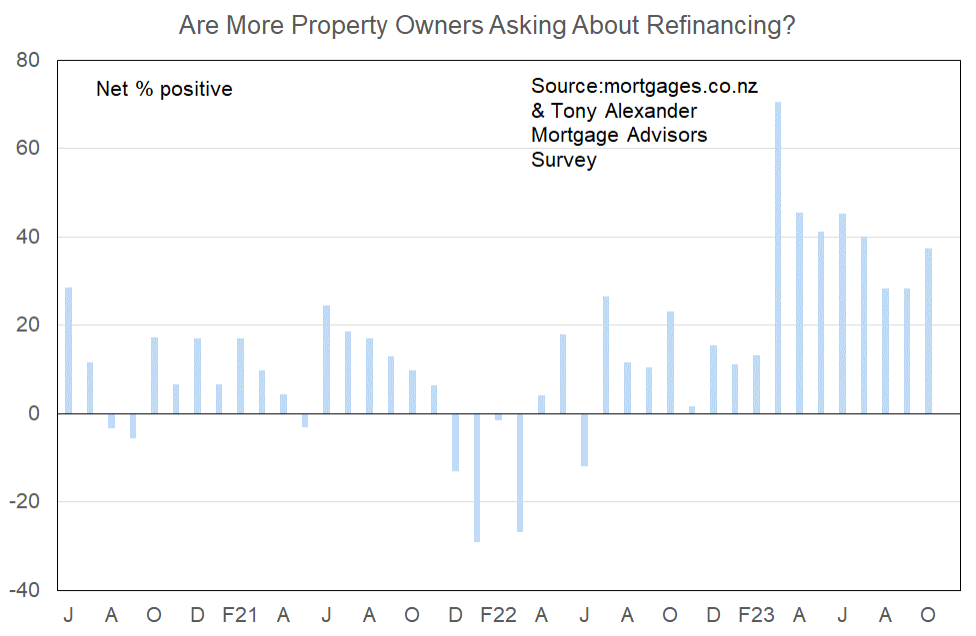

Are more property owners asking about refinancing?

A net 37% of brokers have this month reported that they are seeing more people making enquiries about refinancing. This continues a string of relatively high readings for this measure in place since March and likely reflects the extra hikes in mortgage rates in an environment where many people have been rolling off record low short-term fixed rates previously secured during the dying days of the pandemic.