Strengthening signs grow

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 53 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- First home buyers are solidly in the market, assisted by some easing in credit rules.

- Investors are still rare but starting to express some mild interest.

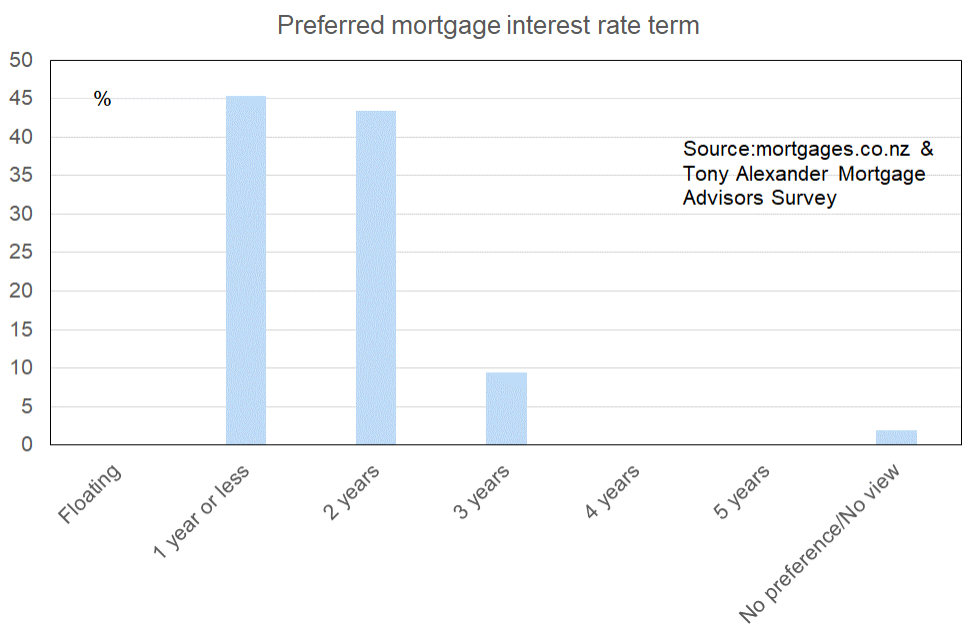

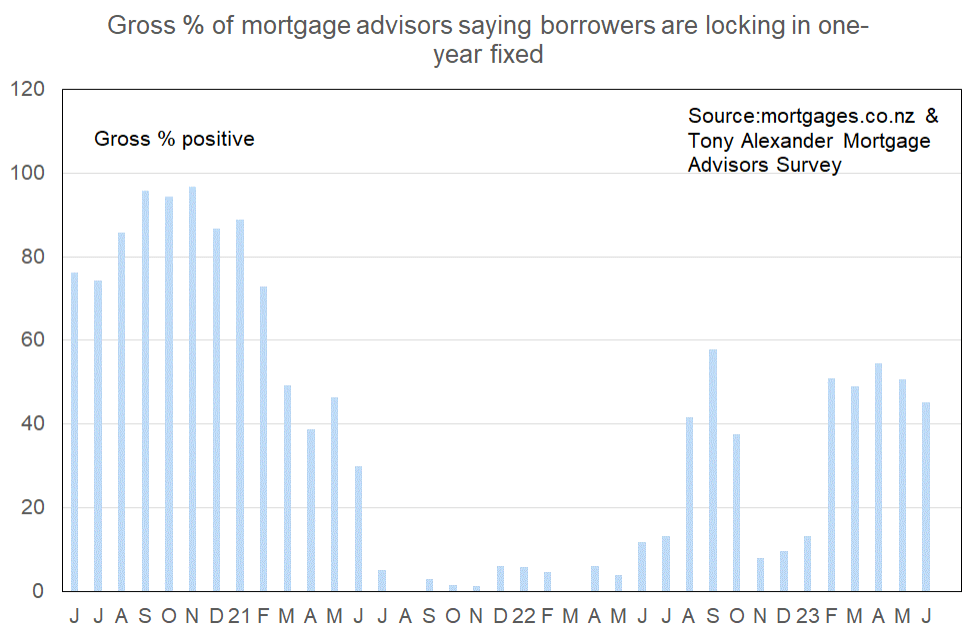

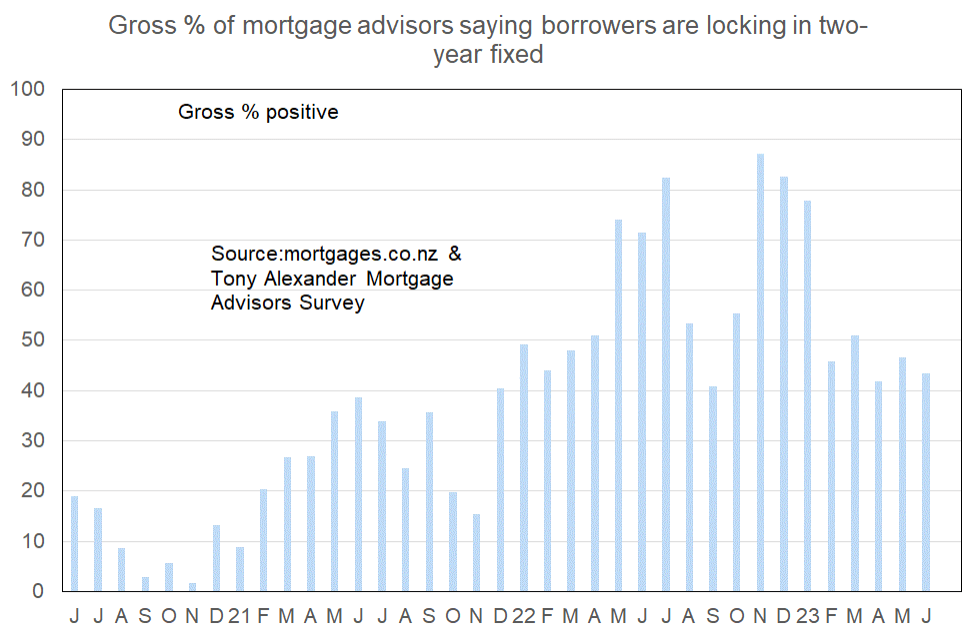

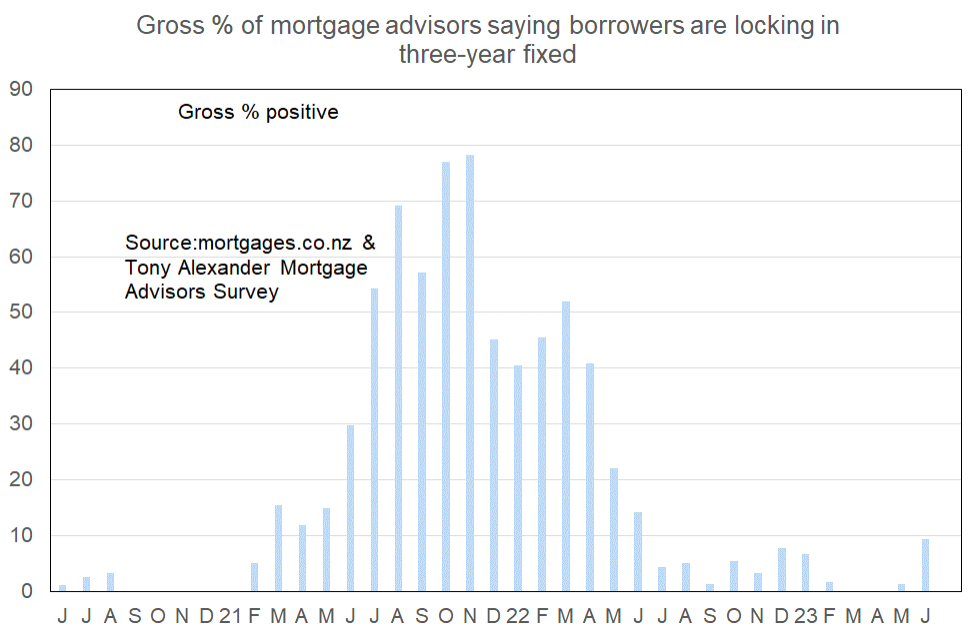

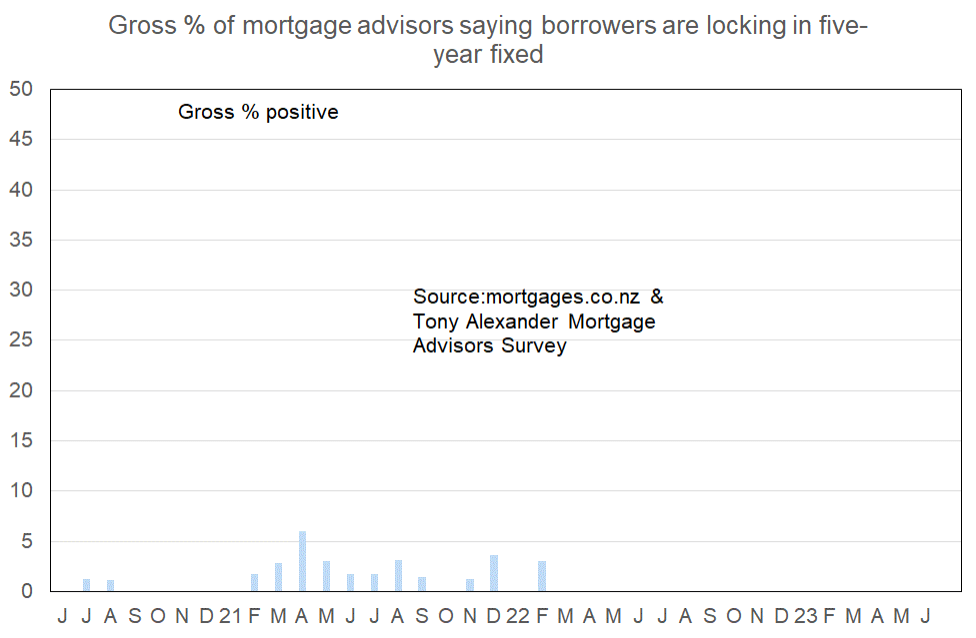

- The one year, 18-month, and two year terms are most favoured for fixing one’s mortgage interest rate.

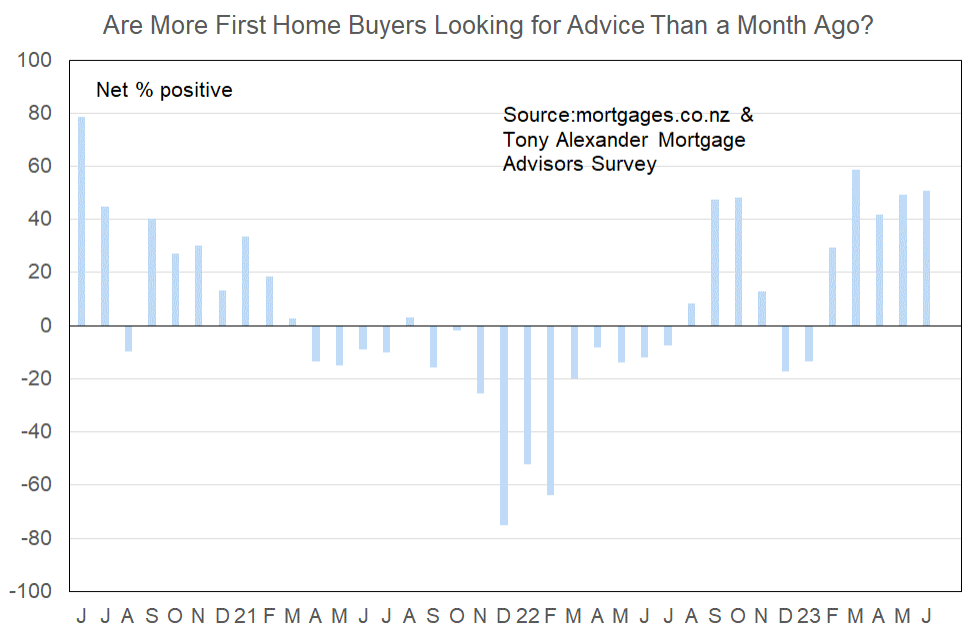

More or fewer first home buyers looking for mortgage advice

For the fifth month in a row a strongly positive net proportion of mortgage advisers have reported that they are seeing more first home buyers in the market looking for advice. Last month the reading was a net 49%, this month it is 51%.

There is increasing discussion about house prices bottoming out and many buyers have been waiting up to two years for market conditions to be more favourable to buyers. Initially they may in 2021 have held off buying because of a lack of choice, lack of ability to attach conditions to offers, and high cost of repeatedly undertaking work required to make a bid then failing to secure a property.

Comments on bank lending to first home buyers submitted by advisers include the following.

- A little more low deposit lending opened up 1st June. CCCFA relaxed at same time making things a little easier.

- More relaxed with expenses, provided bank statements are in order.

- V slight softening in acceptance of over 80% lending. Kainga Ora loans still the main way to purchase with a small deposit, needing a live deal elsewhere. Further softening in the cccfa is positive.

- Loosened LVR requirements with RBNZ changes. Reduced UMI surpluses required for debt servicing.

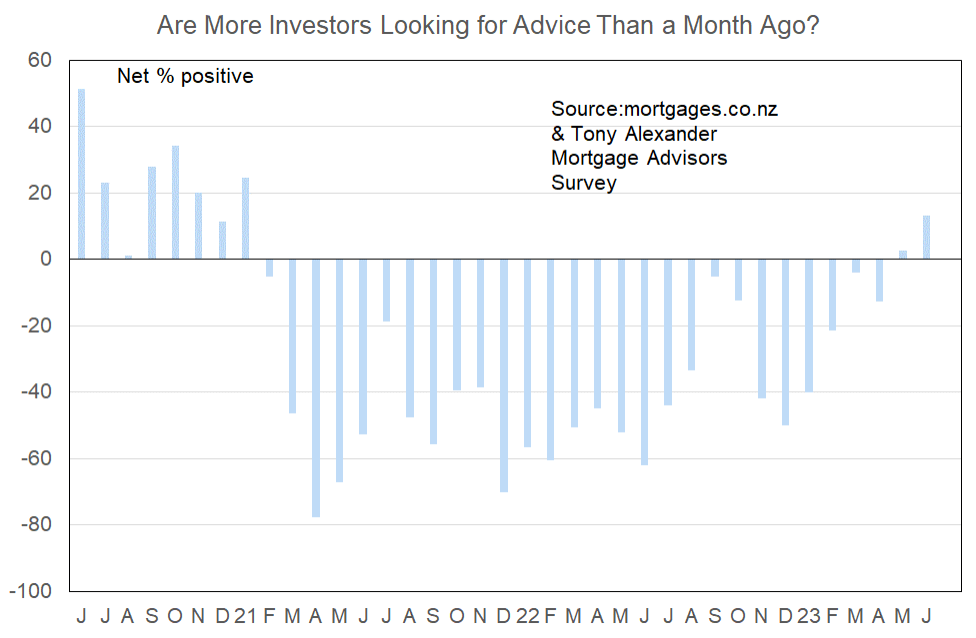

More or fewer investors looking for mortgage advice?

Comments submitted by mortgage brokers indicate that the overall level of interest from investors is still very low. But the discussion of the market bottoming out and interest rates peaking appears to be eliciting some selected interest.

Comments made by advisers regarding bank lending to investors include the following.

- Haven’t noticed much difference yet with LVR increasing from 60-65%.

- Deposit requirements have reduced to 35% but again test rates have gone up, with interest rates so high, investors are not keen to take on debt at the moment. Interest deductibility is what everyone is waiting for – waiting for election results to see if there is a change of government.

- Less of a deposit required now.

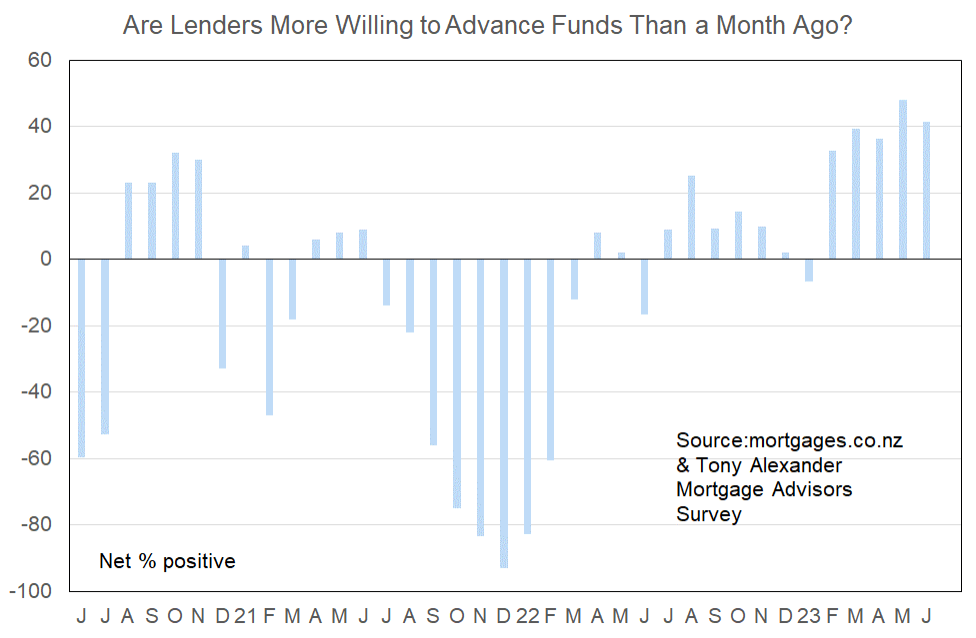

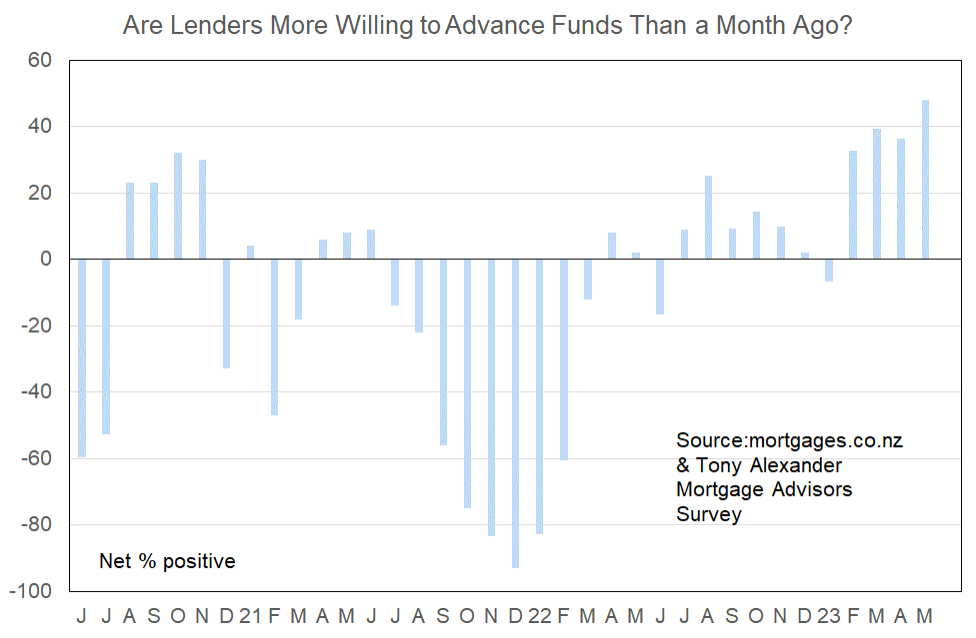

More or less lenders willing to advance funds?

In an environment of low sales and with the Reserve Bank perhaps still sensitive to any signs that mortgage rates are being discounted, banks are relying on easier lending rules in order to at least protect market share.

The easing of lending toughness has been assisted by the June 1 change in Loan to Value Ratio rules allowing banks to undertake extra lending at less than 20% deposit, and cutting the minimum investor deposit from 40% to 35% of property valuation.

What time period are most people looking at fixing their interest rate?