Signs of a bottoming out

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 74 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- More first home buyers are appearing.

- There are increasing signs that buyers feel we are at or almost at the bottom for prices.

- Some investors are returning but the interest level is still very low.

- Bank willingness to lend has increased further, assisted by CCCFA rule changes – plus anticipation of LVR changes from June 1.

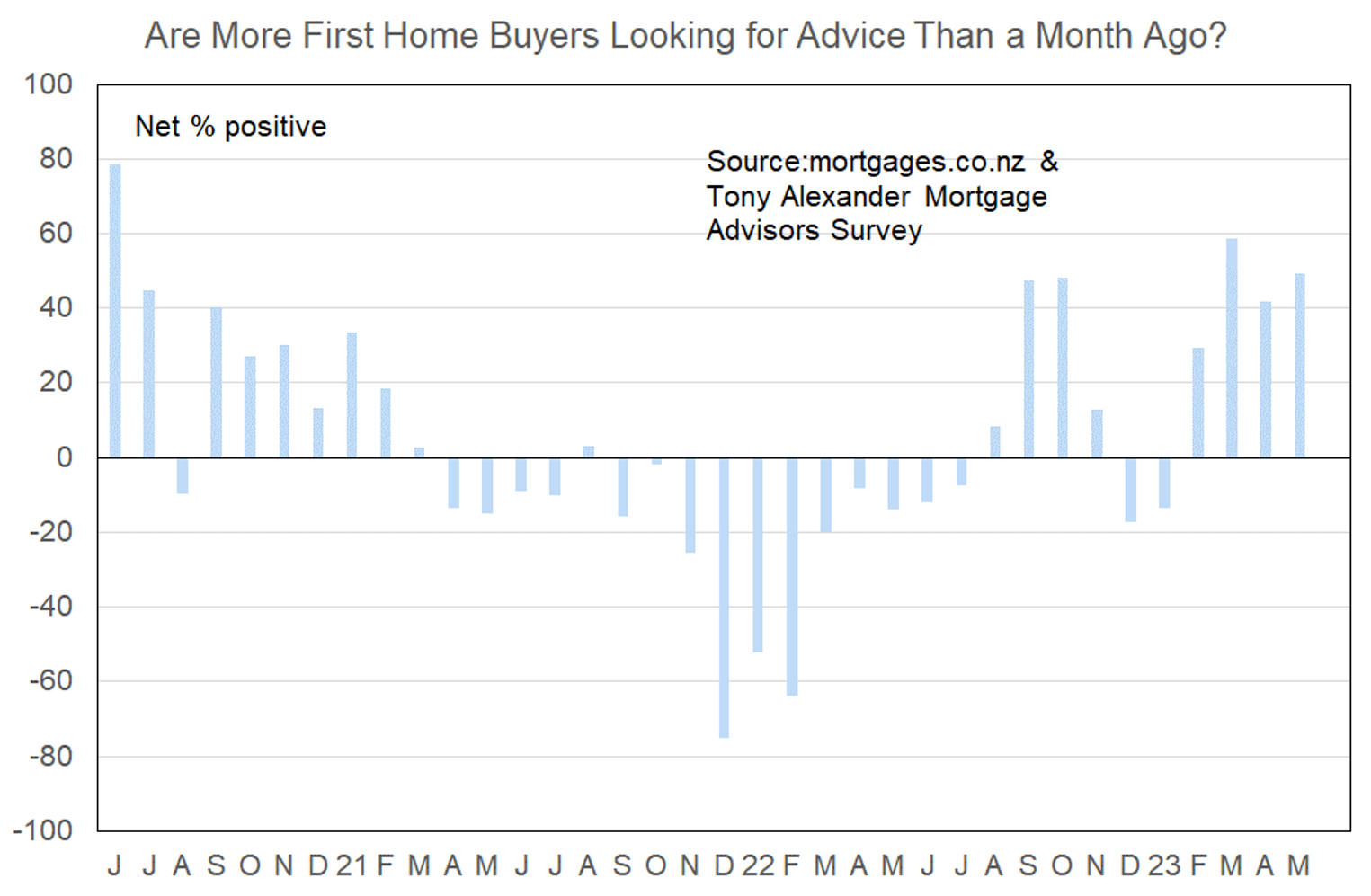

More or fewer first home buyers looking for mortgage advice

In this month’s survey a net 49% of responding mortgage advisers have said that they are seeing more first home buyers seeking advice. This is a result broadly consistent with 42% last month and 59% in March and consolidates the shift in first buyer presence seen from early this year.

Young buyers have seen house prices fall a long way. Their incomes have risen, rents are rising, and credit is slowly starting to become more available. High stress test interest rates remain a challenge for many, however.

Comments on bank lending to first home buyers submitted by advisers include the following.

- One bank has opened up lending to people with less than 20% deposit for both existing and new to bank customers. Before, the only option was only if you’re an existing customer with the bank that they can access those funds. Competition is heating back up.

- More willingness to support first home buyers by less stringent review of discretionary spending. CCCFA was amended last week. This will allow borrowers to increase their borrowing capacity as banks are no longer taking a deep dive into bank statements and including discretionary expenditure…about time logic prevailed.

- Banks starting to open up ahead of 1 Jun changes to RBNZ speed limits

- Easing up a bit on LVR. Also, great to see the Kainga Ora LIM is being reduced from 1% to .5 from 01 June.

- Construction loans – cost overruns were previously 15%, now cut back to 10% unless it’s not a fixed contract, in which case it’ll be 20%

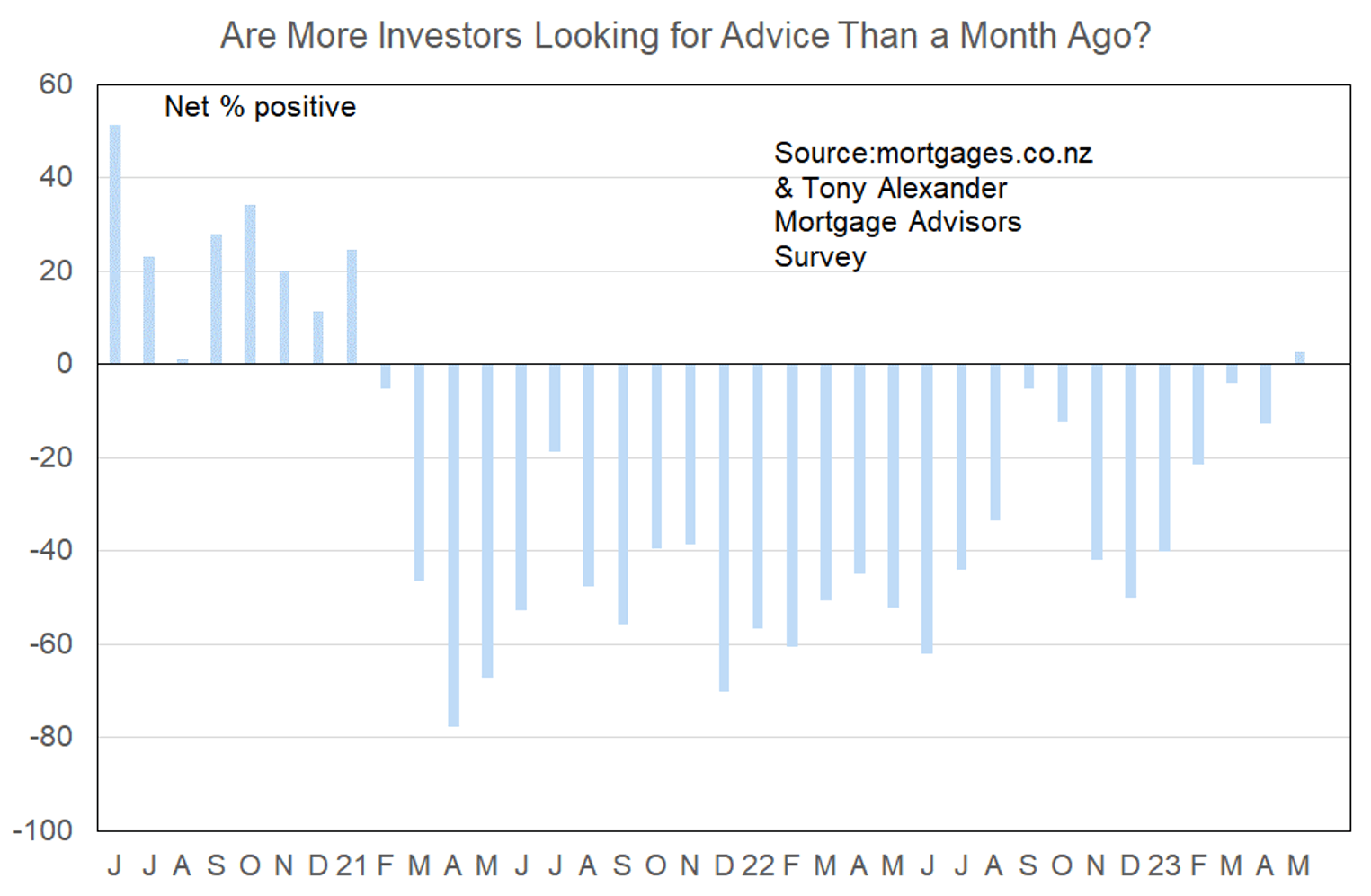

More or fewer investors looking for mortgage advice?

For the first time in over two years there are more mortgage brokers saying they are seeing more investors seeking advice than the number saying they are seeing fewer. This is the standout result in this month’s survey but not entirely unexpected. The graph here shows that this measure has been getting less dire since the start of this year and was almost in net positive territory in September last year just before the extra high inflation number of 7.2% was revealed.

A net 3% of brokers say they are seeing more investors. This is not a radical shift from a result of -13% in April and -4% in March and the comments about bank lending to investors and investor demand submitted by brokers in this month’s survey show this.

My interpretation of this result is not that investors are back in the market, but rather than the flow out has stopped.

Comments made by advisers regarding bank lending to investors include the following.

- Test rates on existing lending hampering many, especially with rental scaling and full expenses assessment.

- Investor lending still tough but banks seem to be easing policy slightly.

- No change – waiting for 1st June for the LVR changes to come in.

- There is practically no new lending to investors apart from exempt loans to new apartments.

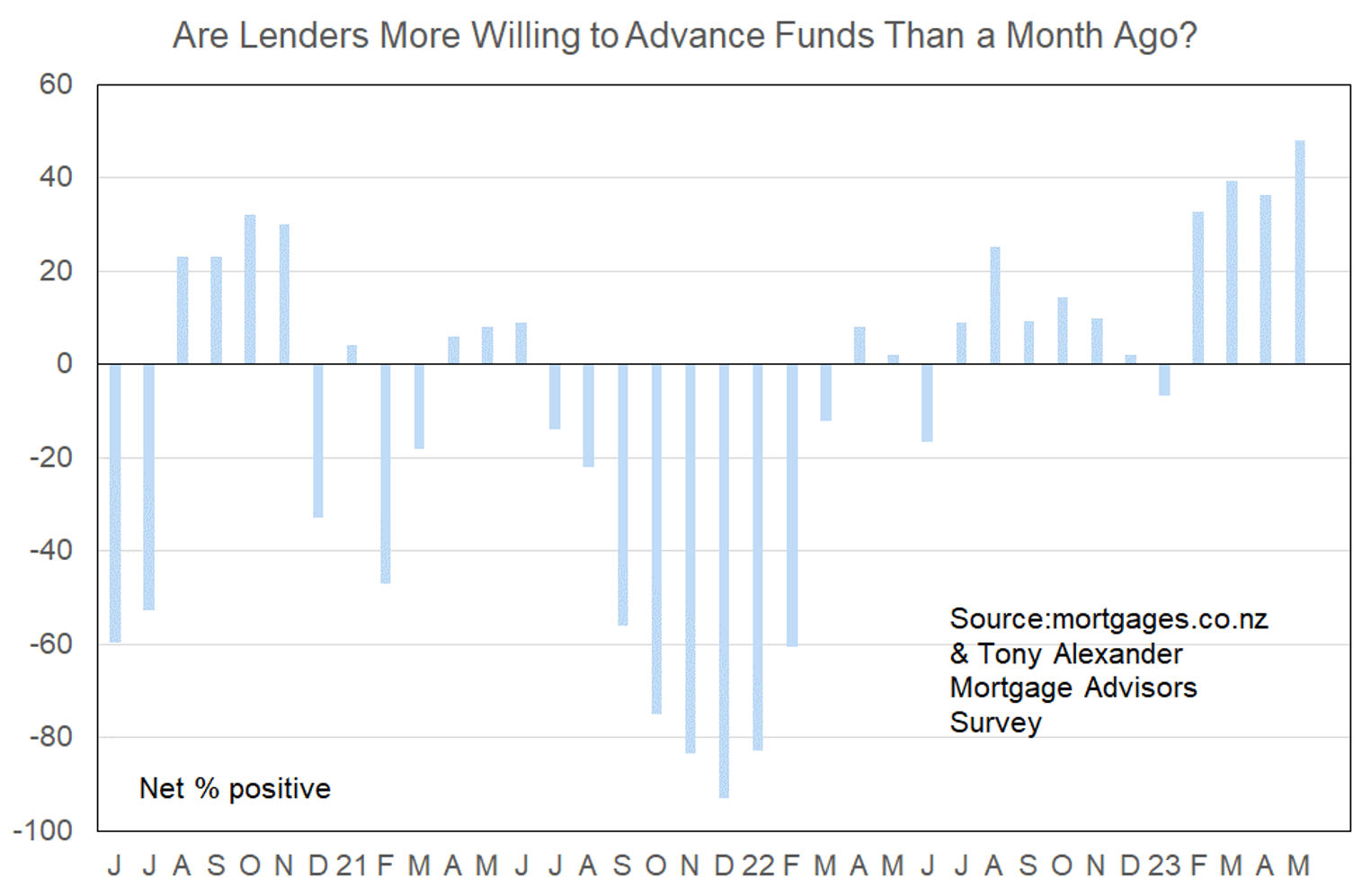

More or less lenders willing to advance funds?

This month a record net 48% of brokers have said that they are seeing banks more willing to lend funds to borrowers. This continues a string of positive results since February and a number of factors are likely to be behind this shift.

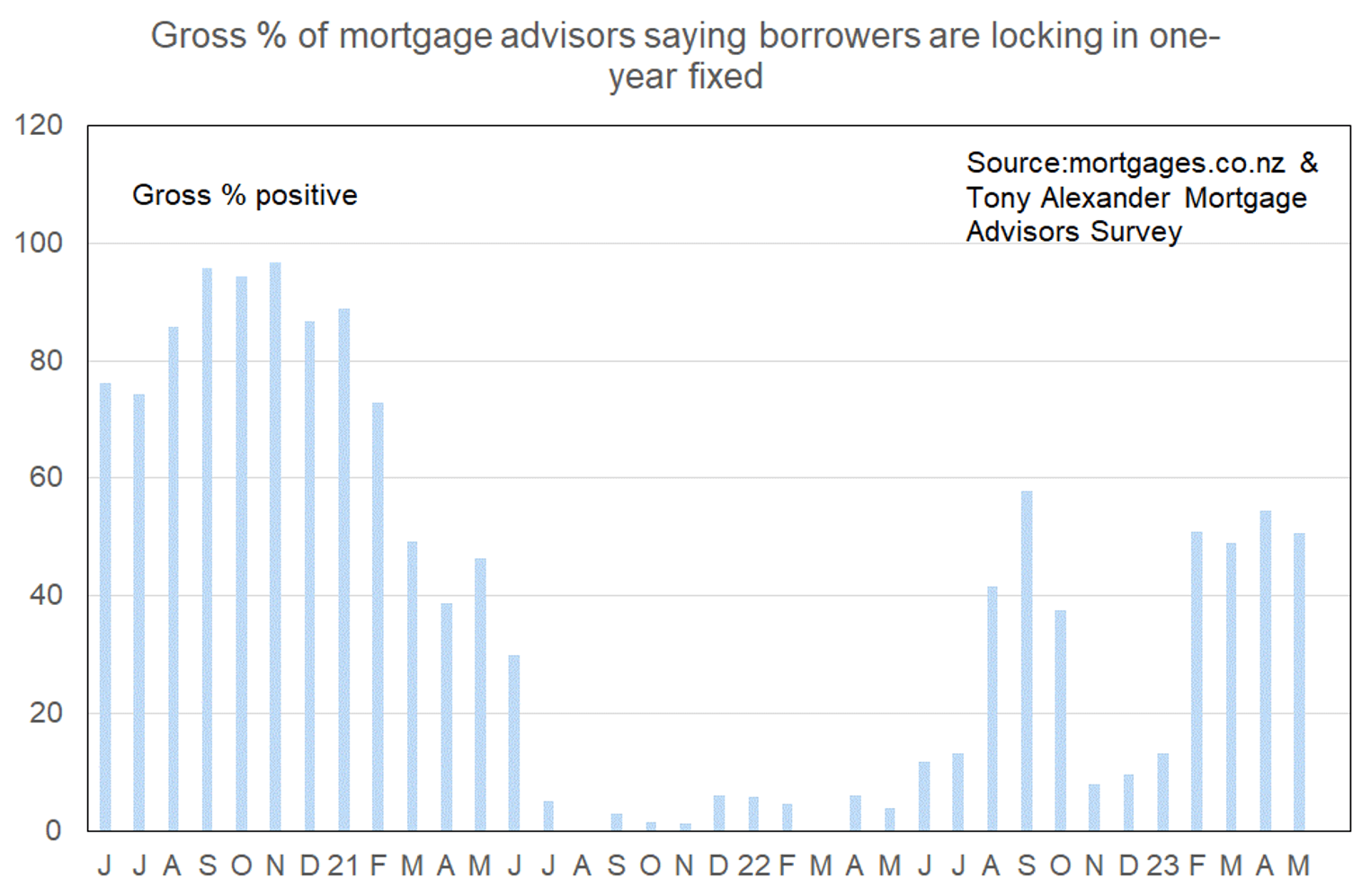

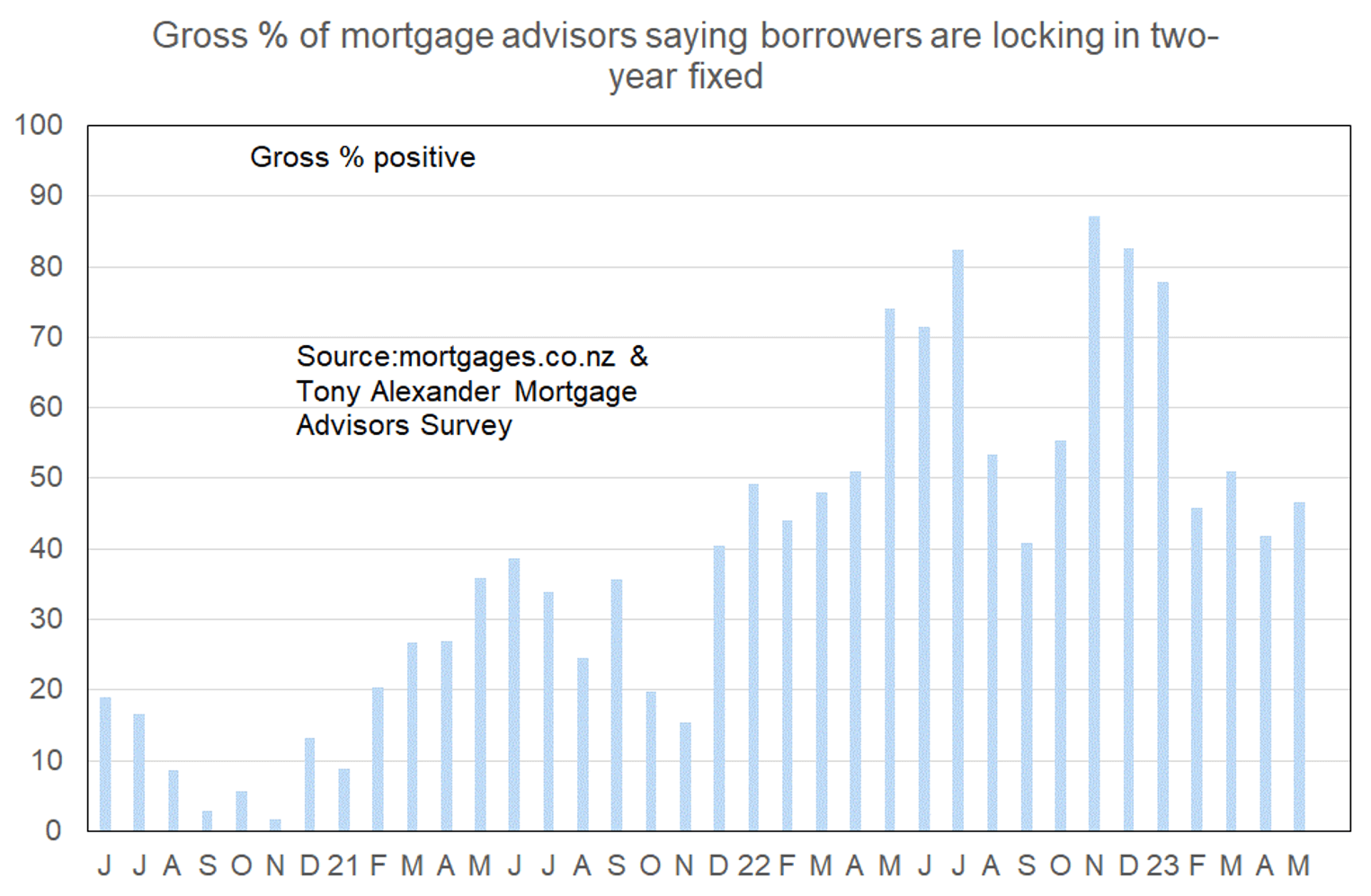

Banks are failing to meet mortgage sales targets and that is leading to greater willingness to act more assertively to acquire business. The tactic of offering extra low special 1-2 year rates about three months ago has not been repeated and that is probably because the Reserve Bank called the bankers up to tell them to not do it.

The response from banks appears to be greater targeting of market share through easing lending criteria rather than making very visible rate reductions.

Changes to application of CCCFA rules are helping willingness to lend and the ability of borrowers to qualify for a loan with further to come from June 1 when LVR rules are set to be eased slightly.

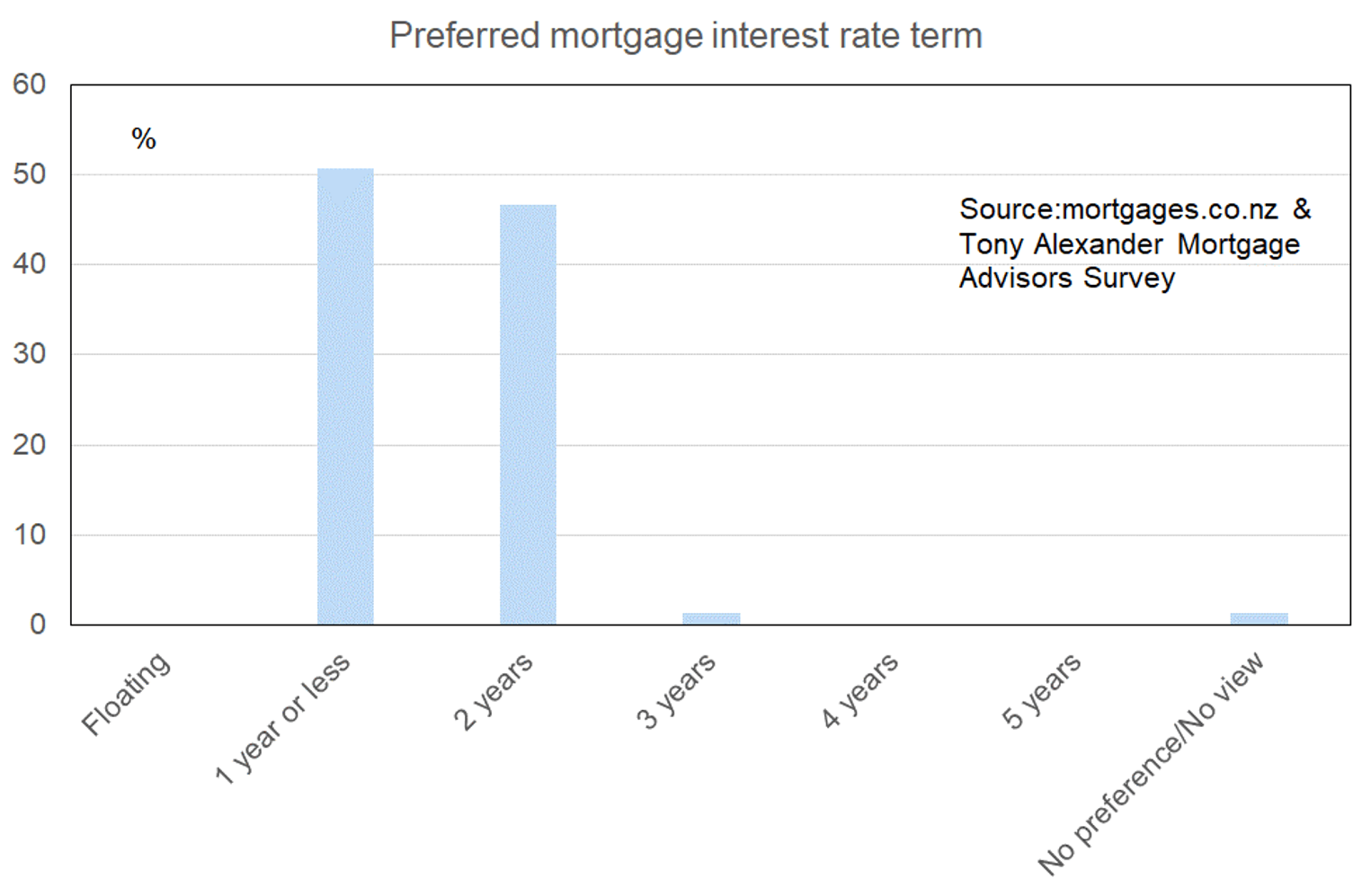

What time period are most people looking at fixing their interest rate?

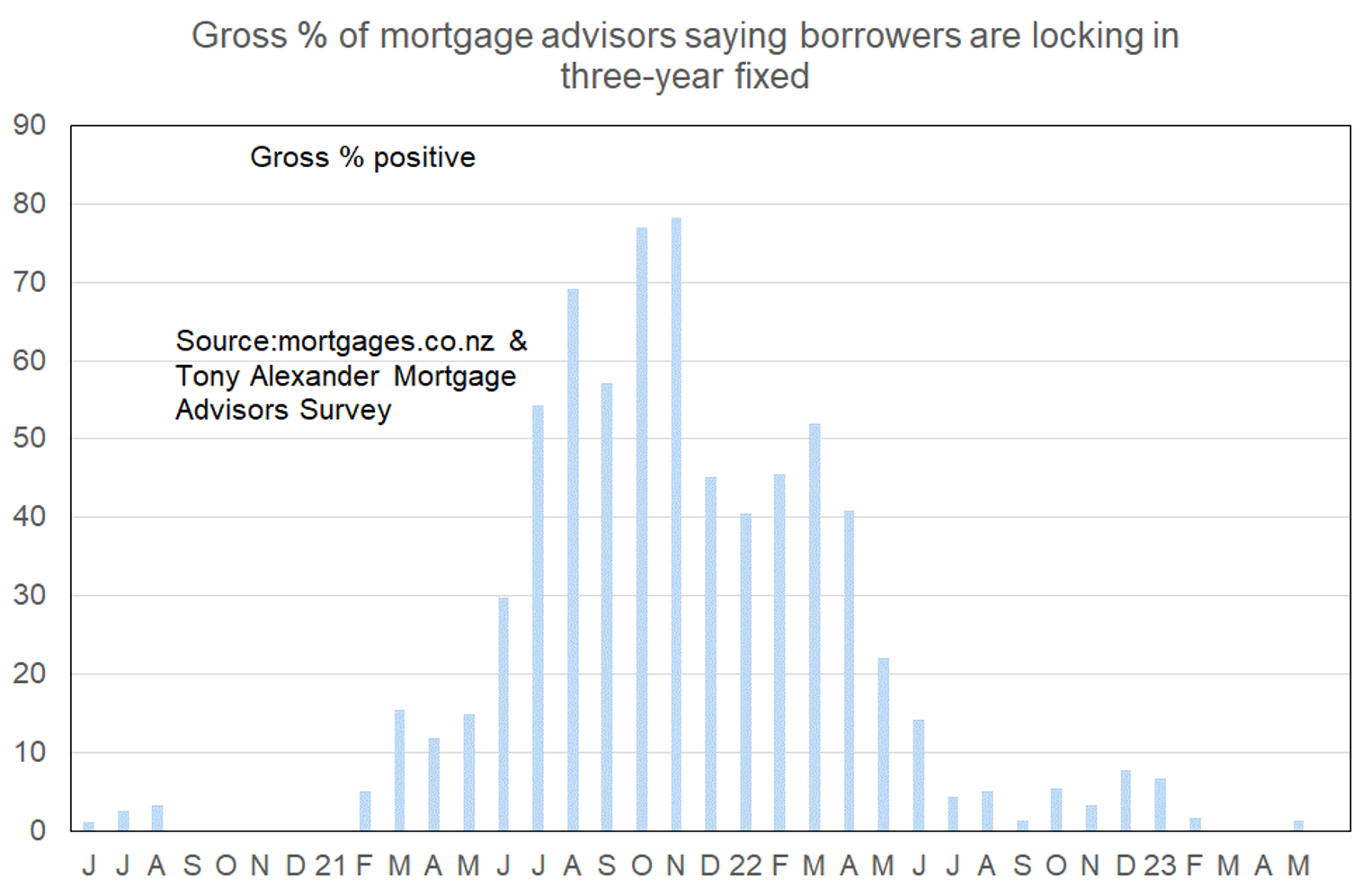

People overwhelmingly favour fixing one year (51%) or two years (47%) although if the tick box of 18 months were offered quite a few would likely indicate that term as being most attractive to borrowers.