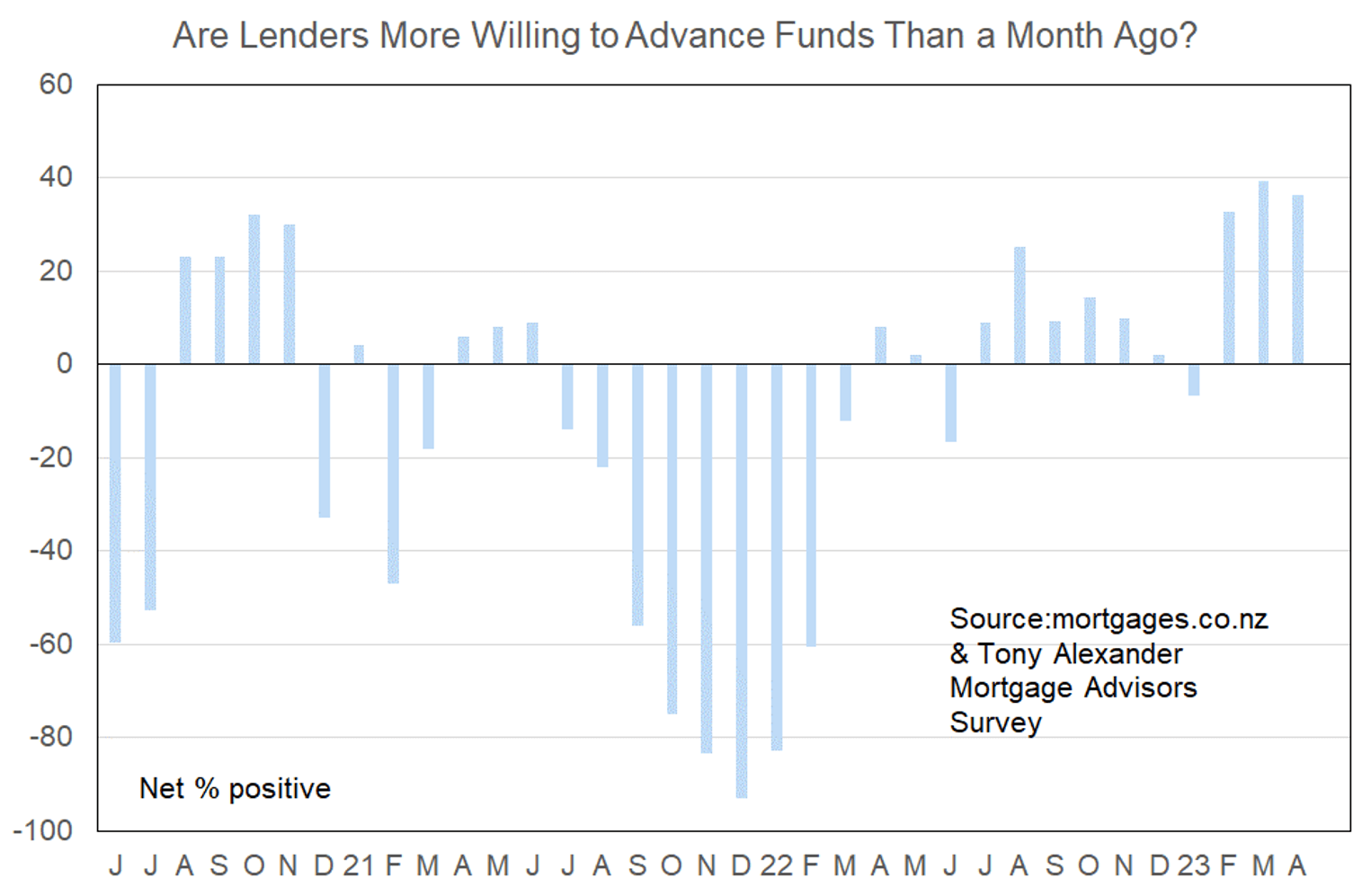

Banks more willing to lend

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 55 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- First home buyers remain active, but investors continue to stand back.

- Bank willingness to lend is improving and some criteria are being eased.

- There are a few more signs of vendors getting more realistic on prices while buyers who put off purchasing last year are increasingly stepping forward.

- Interest in new builds is low.

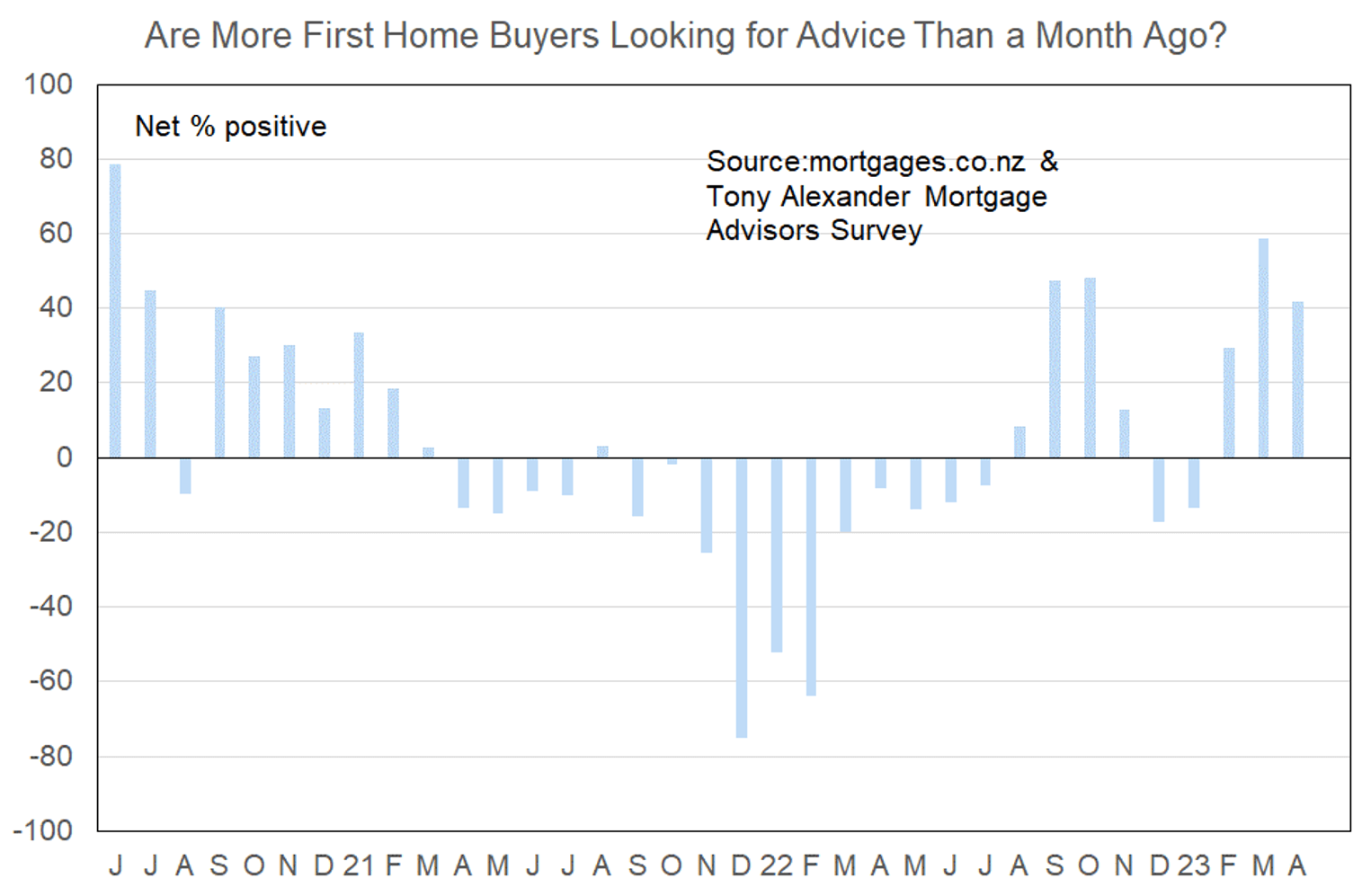

More or fewer first home buyers looking for mortgage advice

For three months now mortgage advisers have noted in our survey that they are seeing more first home buyers in the market. The latest result is a net 42% seeing more young buyers from 59% last month and 3% in February.

This is consistent with what real estate agents are also seeing and likely reflects a number of factors rather than one overwhelming influence. Job security remains good, wages are rising, deposits have grown, house prices are much lower, rents however continue to rise, and banks have become more willing to lend.

Will this upsurge in first home buyer interest disappear as quickly as that which happened over September and October last year? Probably not unless we get another unusually high inflation outcome and extra tightening of monetary policy by the Reserve Bank.

Comments on bank lending to first home buyers submitted by advisers include the following.

- Banks are trying to be creative around CCCFA rules, to loosen up some income servicing criteria so customers can offset high service test rates at present.

- No material change – although policies are loosening slightly around the likes of boarder income amounts that can be used (as an example).

- Less “nit-picking” over small expenses evident

- Banks more open to First Home Buyers and are already removing the discretionary spending barriers in preparation for the changes to CCCFA in May.

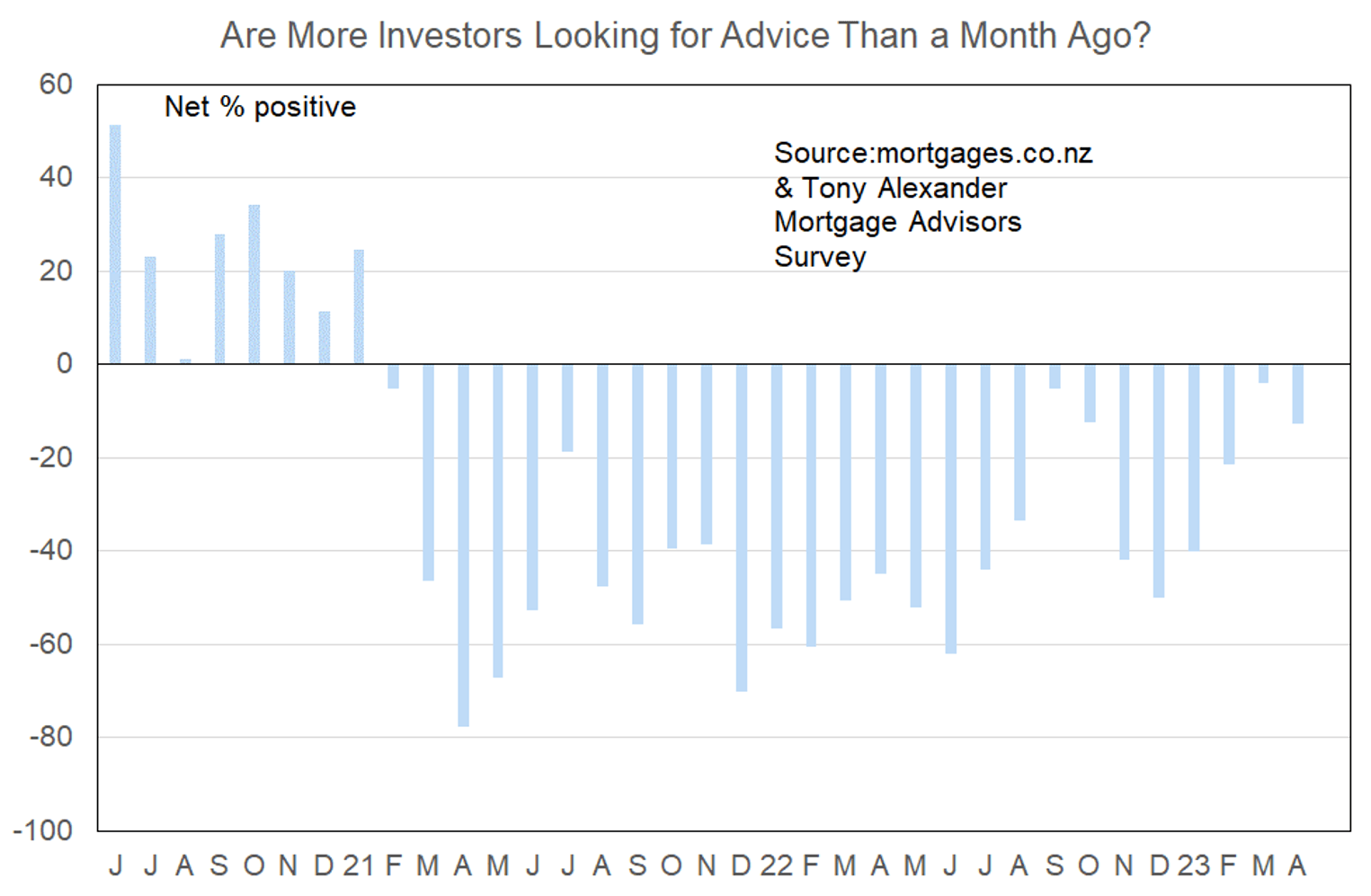

More or fewer investors looking for mortgage advice?

A net 13% of brokers responding in our survey have said that they are seeing fewer investors in the mortgage market. This is broadly consistent with the small 4% of March and better than the period from December to February when monetary policy concerns were strong and talk of recession rife.

But unlike first home buyers investors still remain out of the market. Few are willing to stretch themselves to pay current high mortgage rates when ability to deduct that expense against rental income is declining courtesy of the tax changes announced in March 2021.

Comments made by advisers regarding bank lending to investors include the following.

- One main bank removed double counting of rental expenses.

- Flexible to 60%, nonbank for over.

- Continue to discount the rental income and then (in most banks cases) further deduct fixed costs. New tax year, so new calculators sent by banks representing the change in interest claimability (IRD).

- Slight change in the rental income % used. Only a small change but positive.

More or less lenders willing to advance funds?

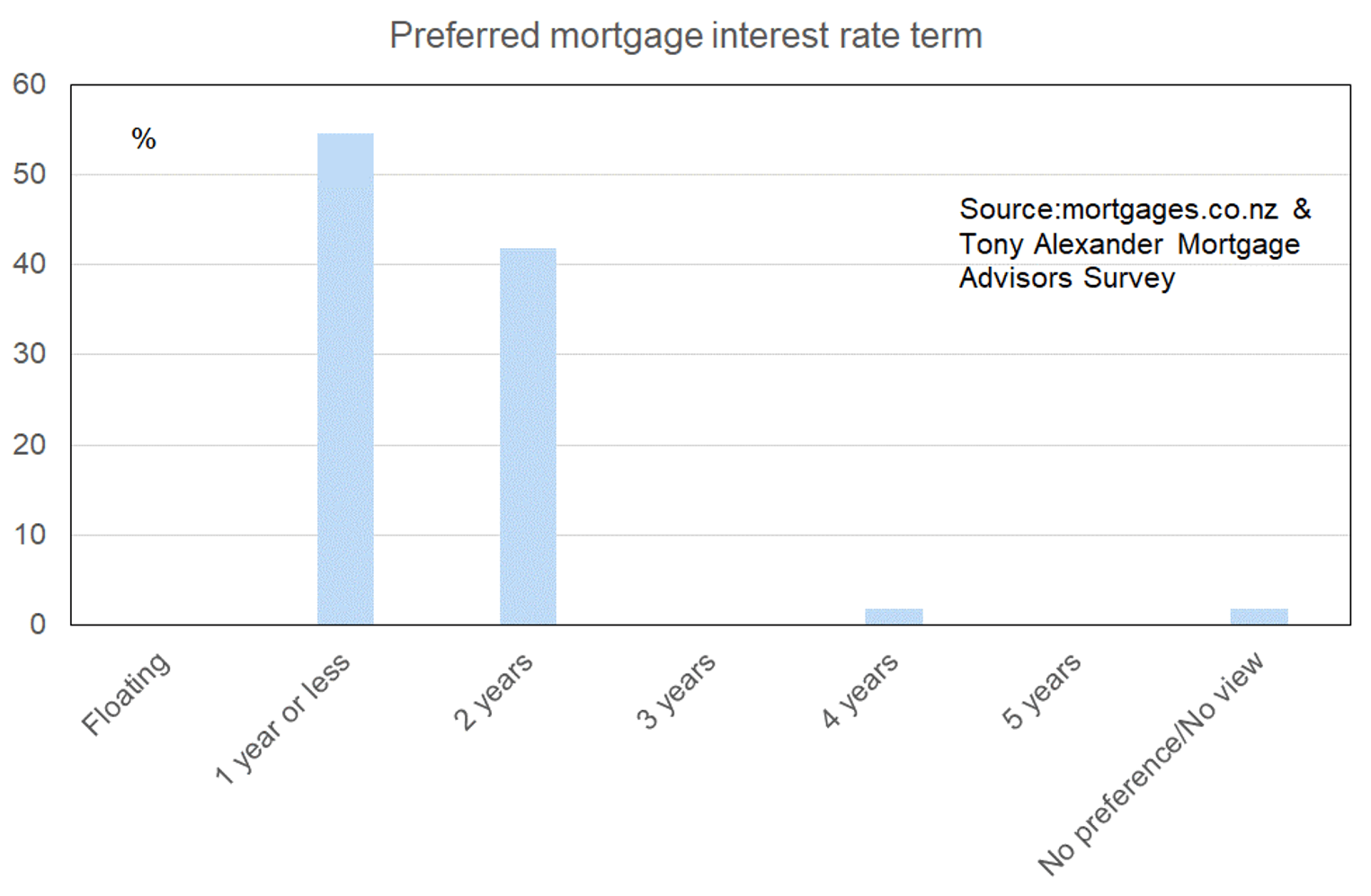

What time period are most people looking at fixing their interest rate?

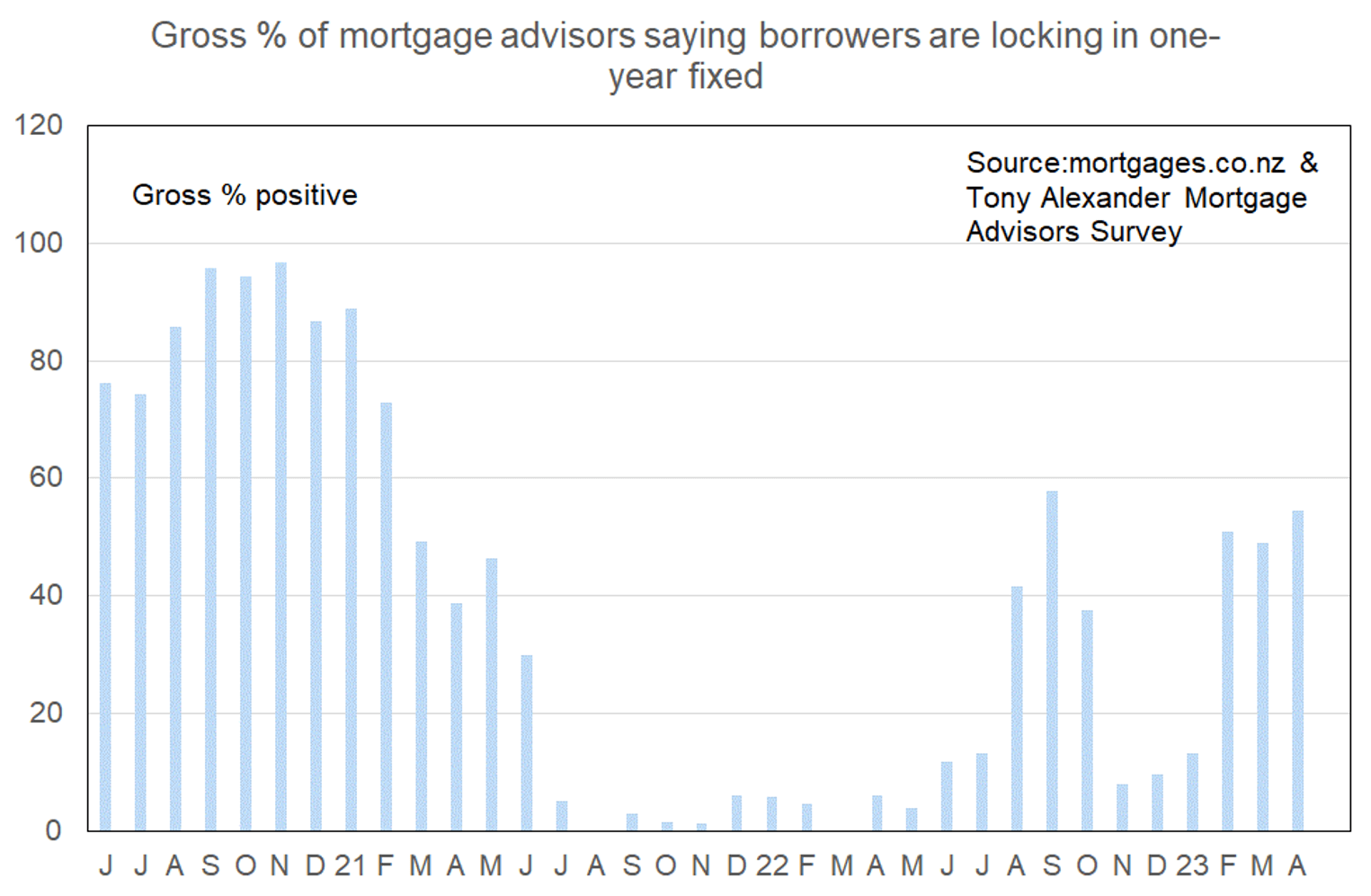

The one year term preference is not as strong as it was during the pandemic buying frenzy of mid-2020 to mid-2021.

Is it likely that the large gap which is this week starting to open up between the newly higher one year fixed mortgage rate and longer terms will encourage people to fix for 3-5 years? Maybe for some people for whom immediate interest costs will determine whether they can remain in their house or not. But the bulk of people are likely to overwhelmingly continue favouring the 1-2 year periods.