Turning of the tide

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey, undertaken last week, attracted 68 responses.

The main themes to come through from the statistical and anecdotal responses include these.

- Advisers report that first home buyers are returning to the market.

- Investors are still existing, but at the slowest pace since July last year.

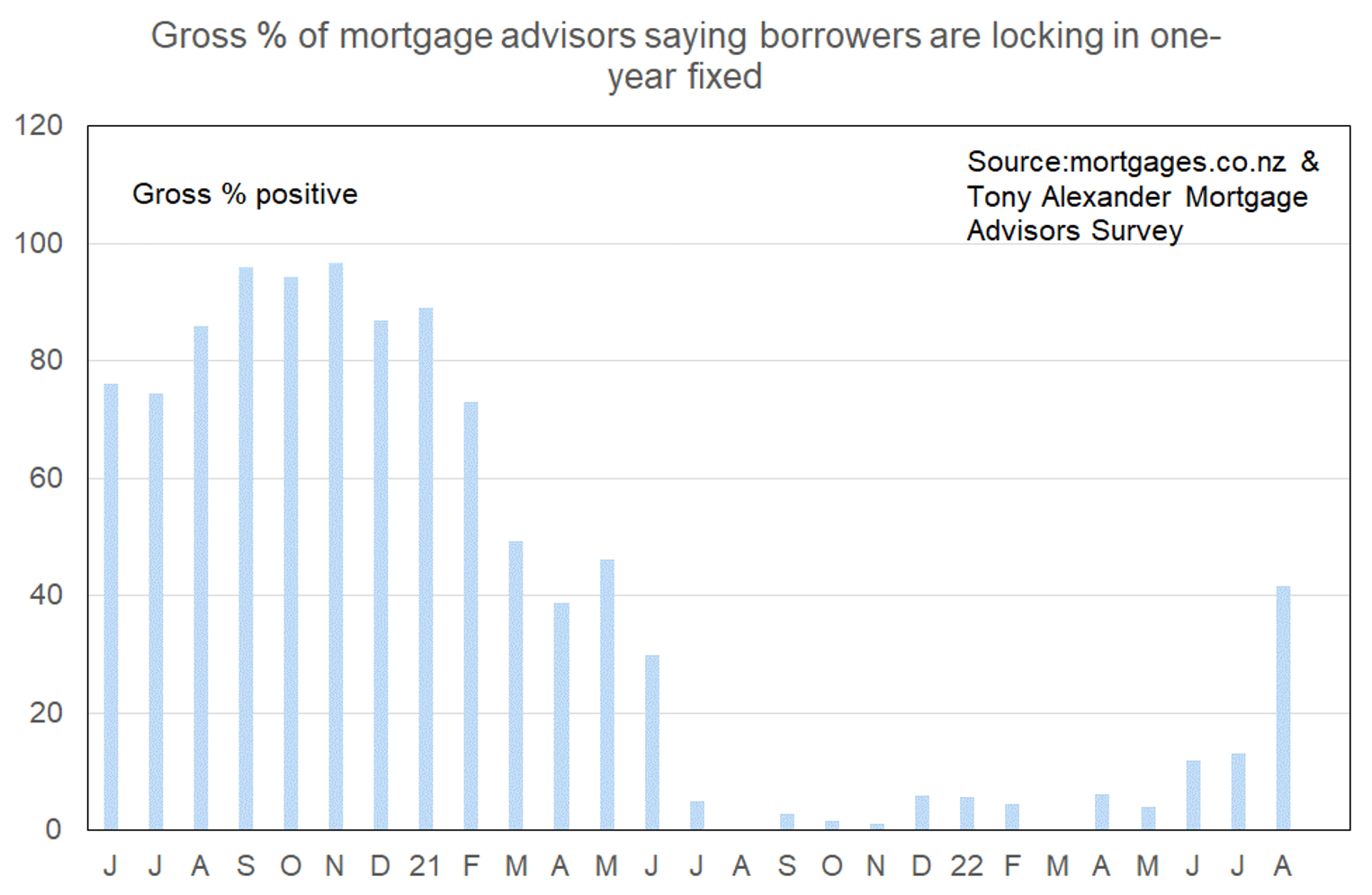

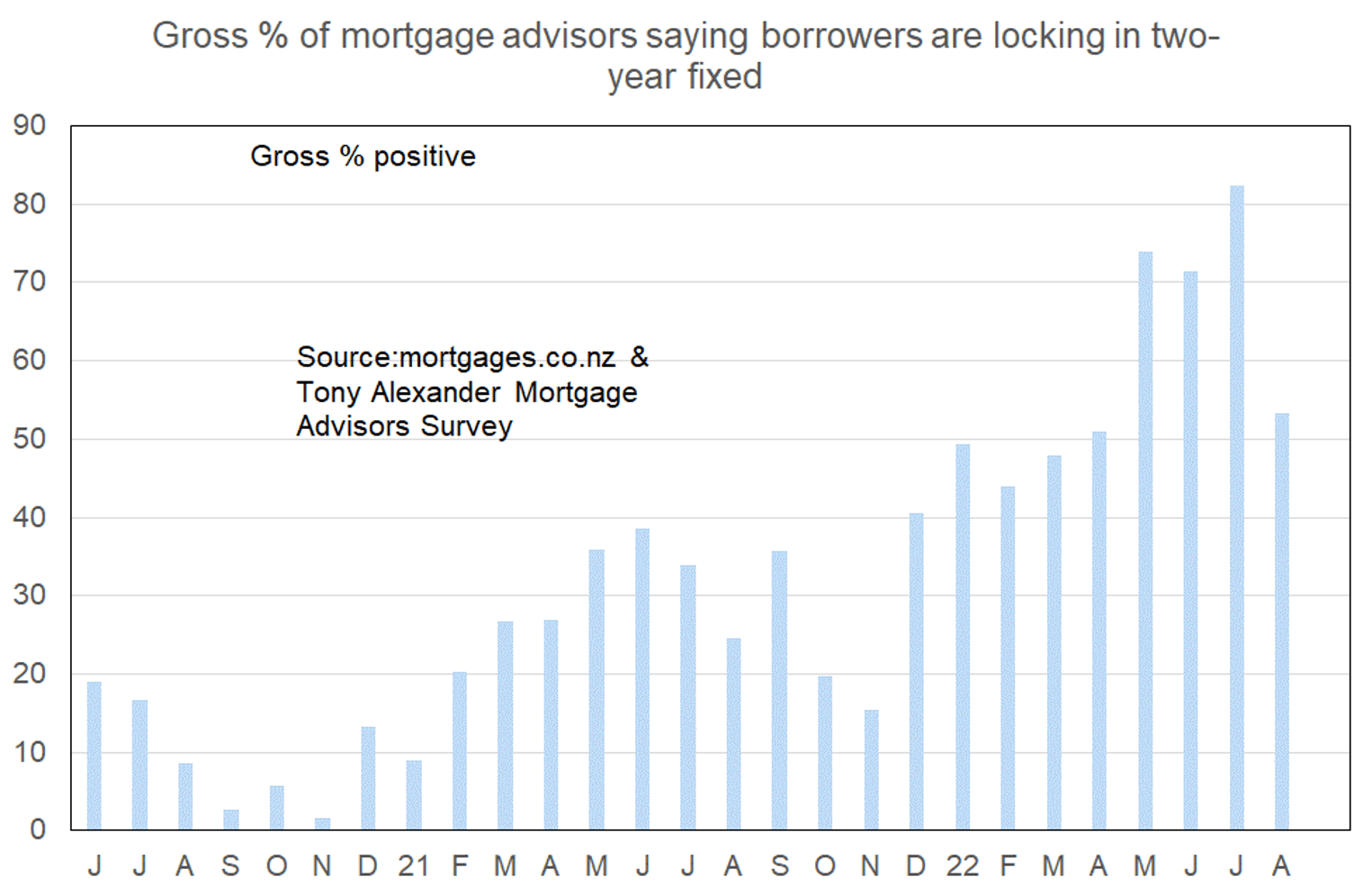

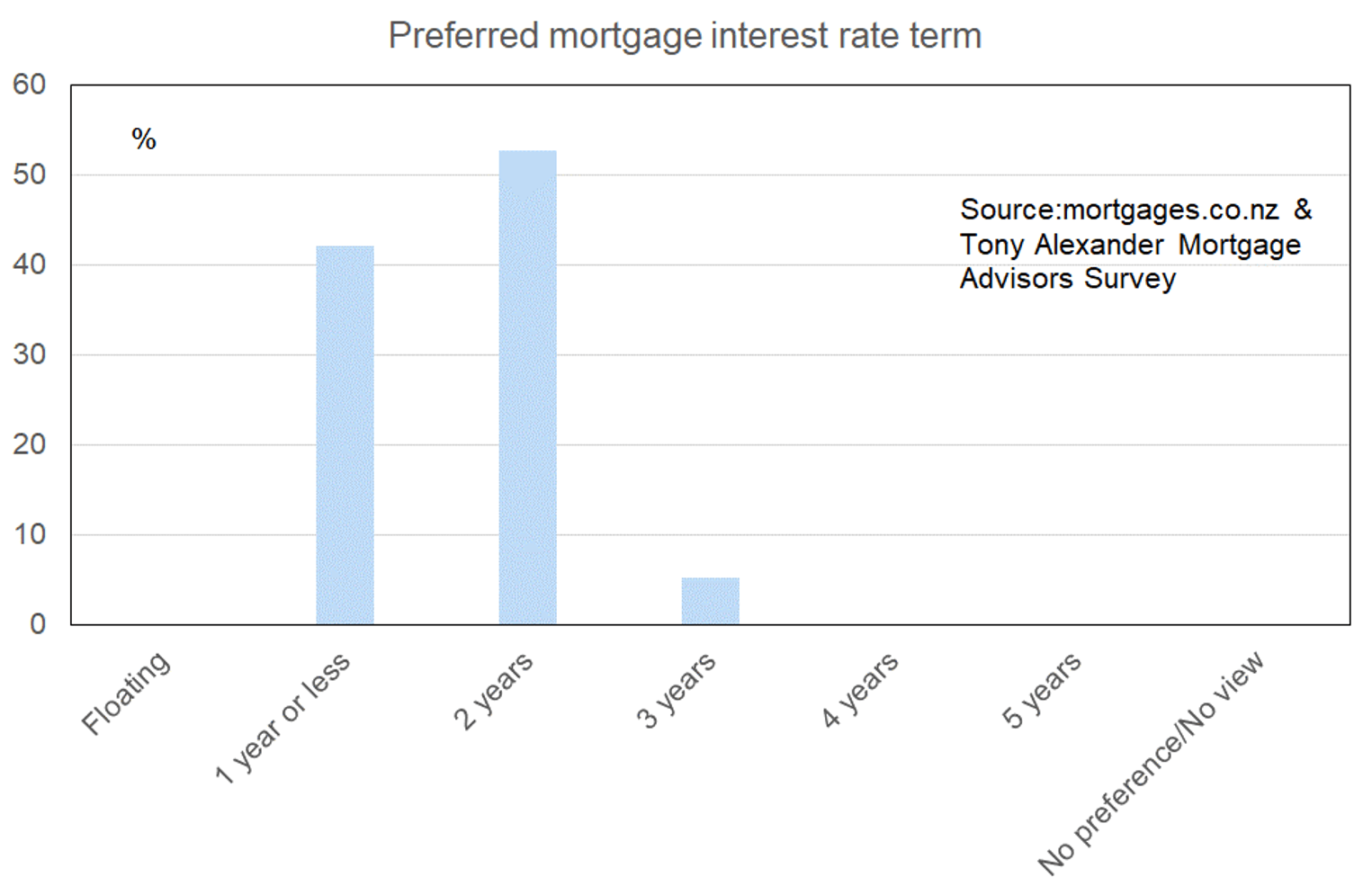

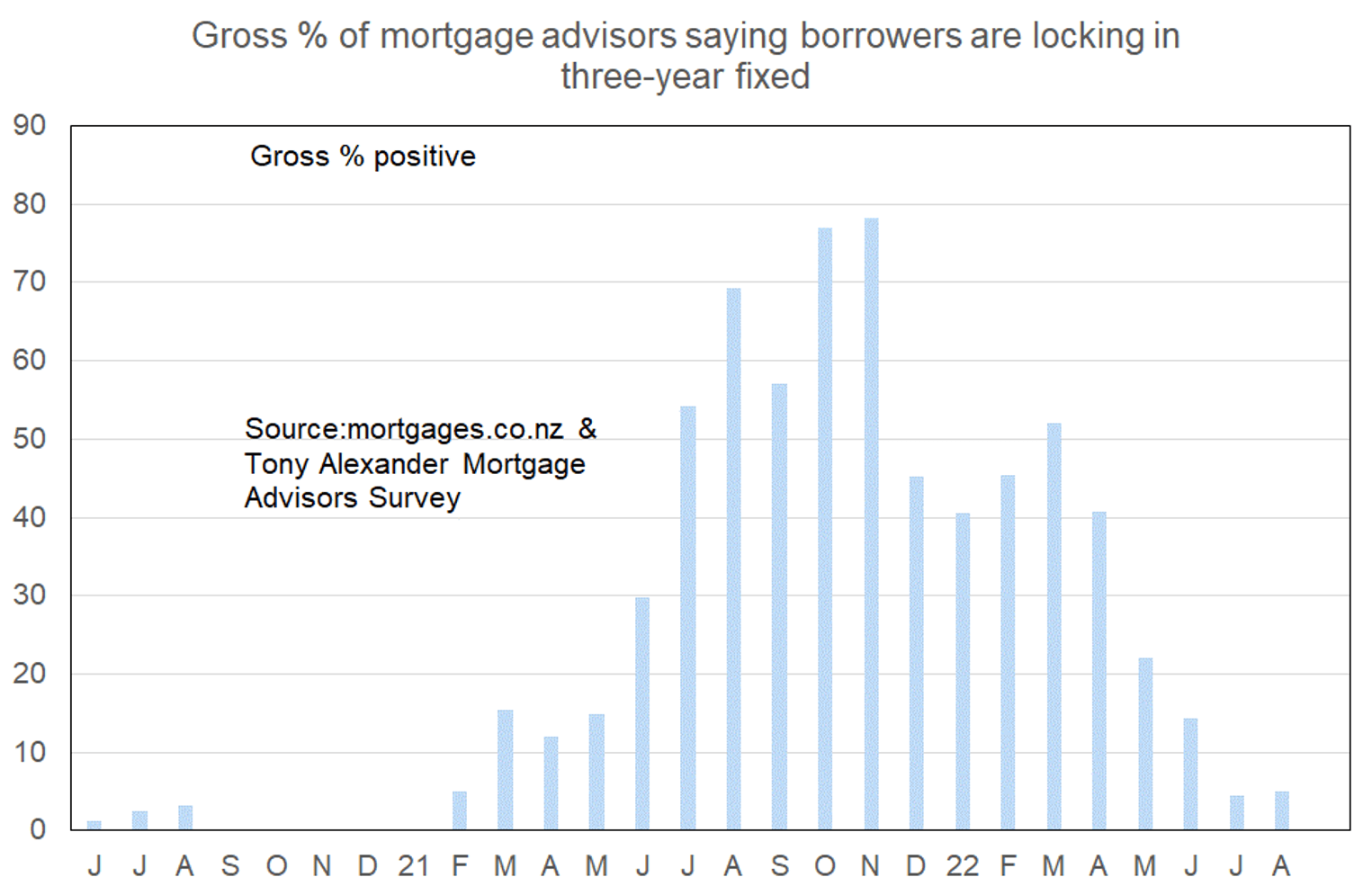

- The fixed rate term preference is near evenly balanced now between one and two years.

- A firm net 25% of advisers report that banks have become more willing to advance funds.

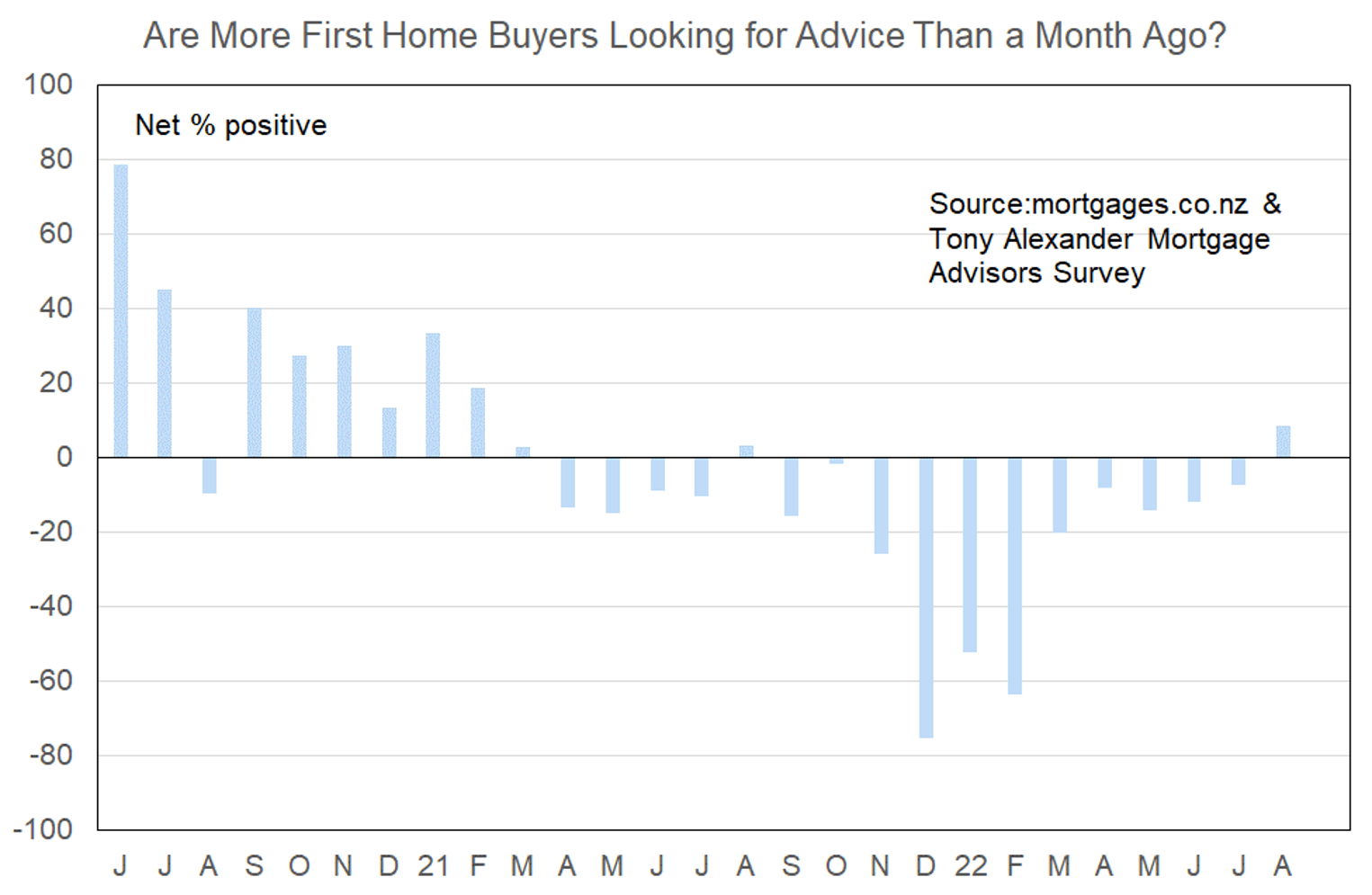

More or fewer first home buyers looking for mortgage advice

The result is the first solid statistical evidence to back up anecdotal reports recently appearing in printed media regarding a few more first home buyers choosing to re-enter the market.

While the monthly survey I run of real estate agents shows that buyers are concerned about high interest rates, access to finance, and prices falling after buying, it appears first home buyers may be focussing on the thing most important to them. That is securing a house to live in and raise a family rather than trying to get the last 5% or so of price declines in the housing market.

Comments on lending to first home buyers submitted by advisers include the following.

- We are mostly needing to do Kainga Ora First Home Loans as a lot of the banks aren’t doing over 80% LVR lending and if they are, the required surplus is not possible for 80% of clients.

- Assessors are trying to help, appears the seriousness of the CCCFA rules a year ago has now diminished to a more normal way of assessing, and time frames have dropped to 1-3 days maximum.

- A trickle of sub-20% lending available. Banks cherry picking the highest income earners.

- 20% deposit, clean credit history and servicing is now becoming a big issue as the stress test rate is now about 8%. Some pre-approvals that are having to be rolled over after 90 days have had the pre-approval amount reduced.

More or fewer investors looking for mortgage advice?

It is likely that some investors are starting to think about the implications of National winning next year’s general election and restoring the ability of investors to deduct interest expenses from gross income. Borrowing costs have also eased slightly and prices have fallen 10% – 15% in many parts of the country.

Comments made by advisers regarding bank lending to investors include the following.

- Heavy shading is applied to rental income with many also including the property rates and insurances as expenses. Although xxx reduced this shading by 3% this week (to 27% from 30% for properties built before 27th March 2020).

- Strictly max 60% LVR, assessing all lending on high test rates based on P&I. Rental income is scaled more than it used to be, plus banks are including extra rates and insurance cost in expenses. Does not make it easy to meet affordability criteria.

- Difference between banks and they way they scale income. Some include rates and insurance as part scaling some don’t – but all scale at similar rates.

- Investors with several investment homes are just out of the mortgage market. The Banks used to calculate the remaining term on Interest only, once this went to P&I and over the terms remaining for the clients’ loans, this just took them away from the mortgage market and the ability to purchase anything further.

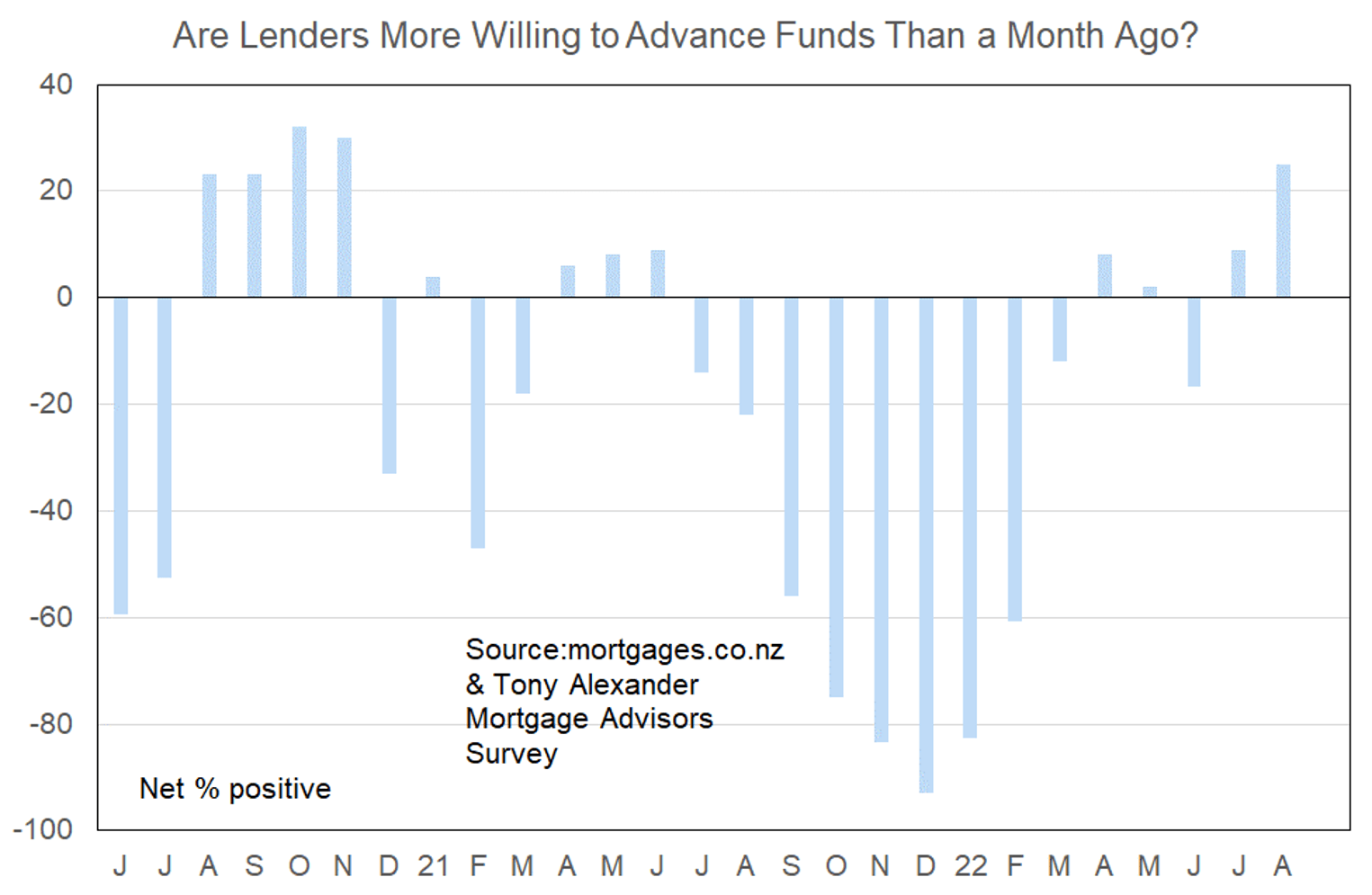

More or less lenders willing to advance funds?

Over the past two months there has been a strong lift in the net proportion of mortgage advisers reporting that banks are becoming more willing to advance funds. Back in June a net 17% reported banks becoming less willing to lend. Now, a net 25% report that lending willingness has risen. This is the strongest result since November 2020 – but does not mean that credit availability is what it was back then.

What time period are most people looking at fixing their interest rate?