The credit crunch continues

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey undertaken last week shows weak results again across all our measures.

All results from this month’s survey show a continuing dearth of credit flowing from lenders due to the tightening of LVR and CCCFA regulations late last year.

The strong preference of borrowers remains for the two and three year fixed rate terms.

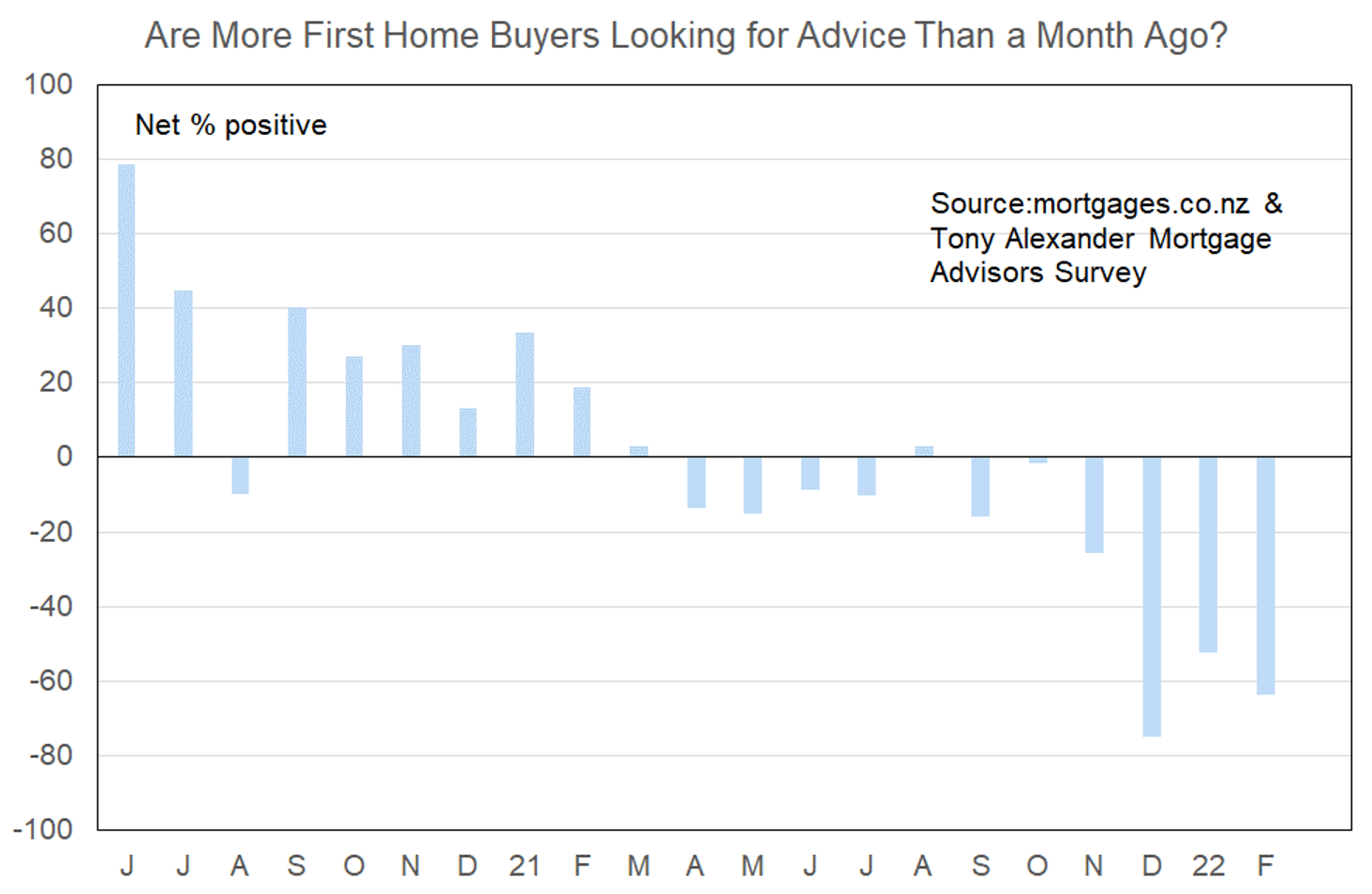

More or fewer first home buyers looking for mortgage advice

As was the case last month in particular, advisers note the role being played by the Credit Contracts and Consumer Finance Act changes effective from December 1 making banks turn down far more applications than before. Advisers note that many first home buyers have seen the many media stories and are no longer bothering to start discussions with advisers because of an expectation that their applications will be declined.

Some of the comments made by advisers with specific regard to first home buyers include the following.

- Dumb questions = Dumb answers. We had a bank ask if a bungy jump on a client’s statement on the second of January in Queenstown (client lives in Auckland) was an ongoing expense or not. Then had to get the client to email confirming that this was in fact a one off expense. Feels like any common sense has been removed from the system and trust in borrowers has hit an all time low.

- No funds available for over 80% deals on existing properties.

- Very strict affordability calculations around expenses.

- Essentially there is no funding for low deposit borrowers which is the causing the biggest hurdle to help them. Very little change, 1 bank has today opened up a small amount of capacity for selected clients.

- More in-depth look at discretionary spending. that said, we have had NO declines. We mitigate things well and the banks have been really good with this. I think it is how you tell the story – be open and upfront, admit what has happened and then show that it won’t take much reduction in coffee or craft beers to make the wheel turn.

- Need a deposit at 20% and good monthly surplus after all expenses.

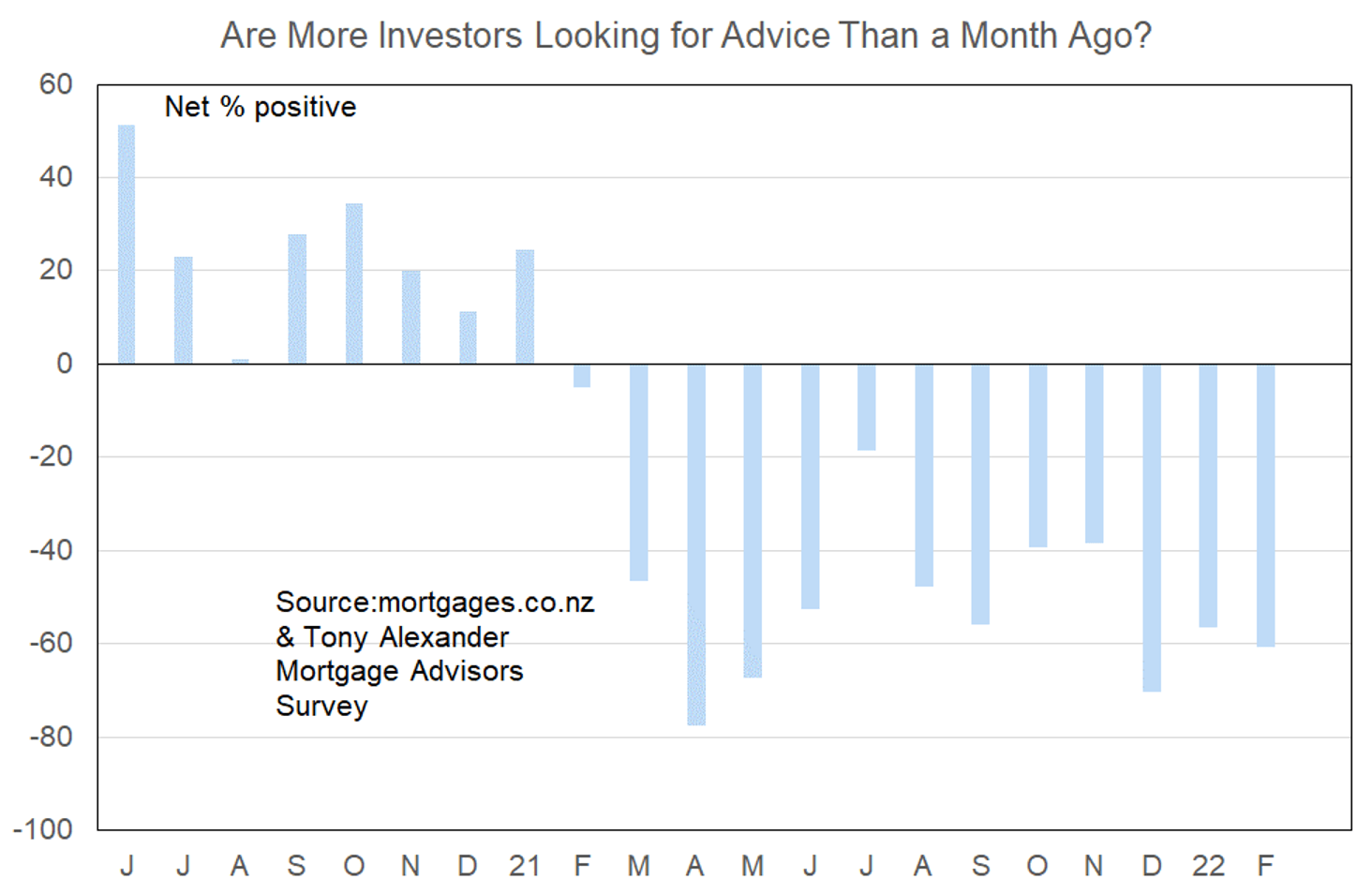

More or fewer investors looking for mortgage advice?

A net 61% of advisers this month have reported seeing fewer investors looking for finance. As is the case above for first home buyers this is consistent with the stepping back of investor loan enquiries over the previous two surveys. Again, no improving trend is yet apparent.

The interesting difference with first home buyers is that investors started stepping back from the market after the March 23 2021 announcement of tax changes. Unlike first home buyers they have not freshly withdrawn because of LVR and CCCFA tightening.

Having said that, logic would suggest that most of those no longer engaging with the market would have already disappeared by now and the net proportion of advisers reporting extra weakness would have gravitated back towards zero.

Therefore, it seems reasonable to conclude that the credit crunch is having an impact on investors as well as young buyers.

Comments made by advisers include the following.

- DTI is biggest killer for the banks using it.

- Not seeing many investors unless it is new builds. In which case the banks are a bit wary of developments especially if they have a long time to complete. Justified too as many clients reporting developers cancelling projects or asking for more money to complete.

- More scrutiny of personal and investment expenses but this is now standard.

- Including more expenses like rates & insurance on rentals when historically the scaling of rental income accounted for those expenses.

- Investment lending is tougher than it was compared to last year as most banks are adding in more expenses and scaling the rent more than in the past.

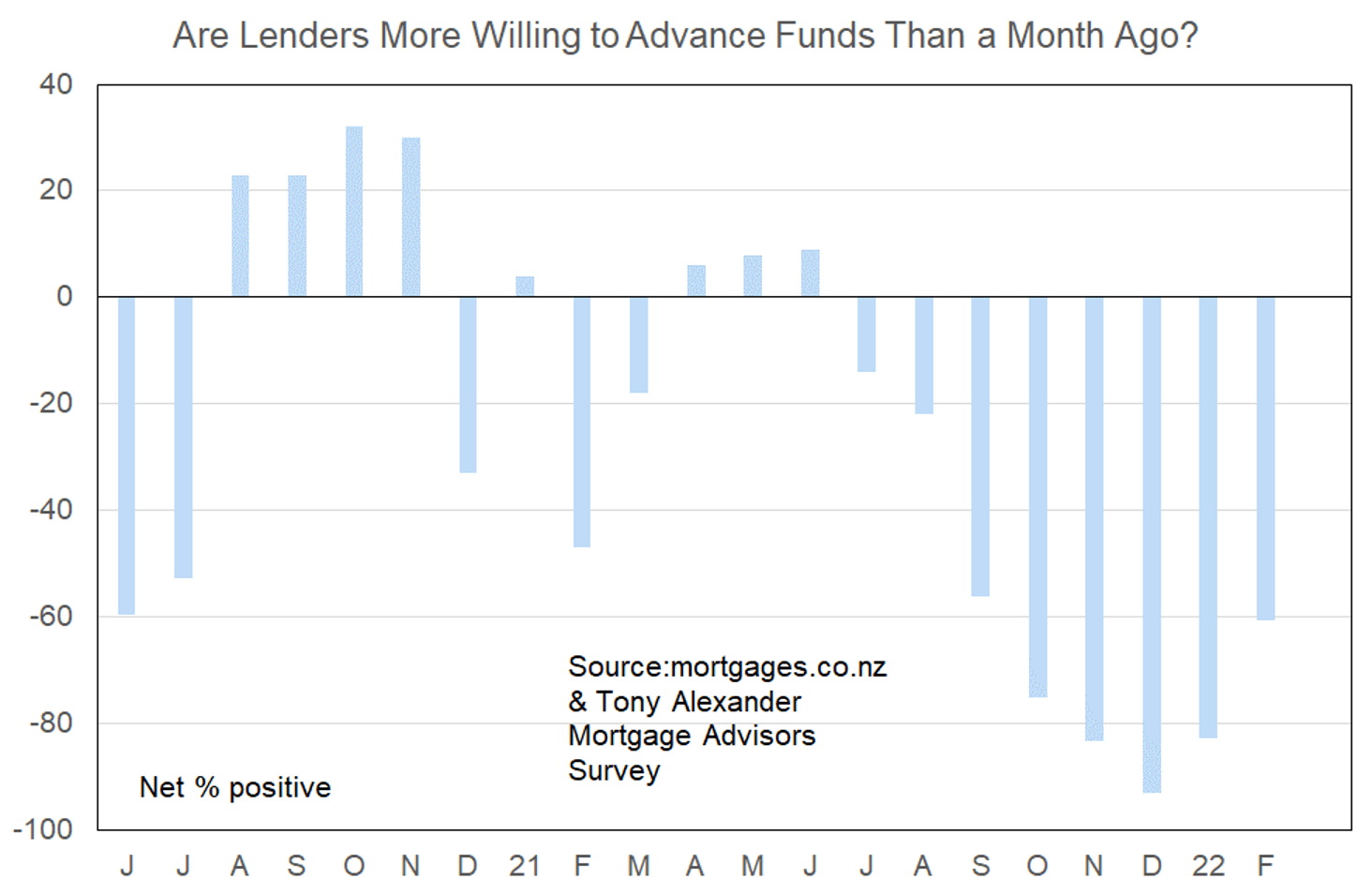

More or less lenders willing to advance funds?

A net 61% of advisers have reported that banks have become less willing to advance funds. The graph below clearly shows the sharp reduction in credit availability from lenders which started in July, deepened tremendously in September, and reached peak withdrawal in December.

There is a small improving trend underway, perhaps helped by banks and advisers figuring out how to better apply the new CCCFA criteria. But overall, the result here shows the credit crunch remains underway.

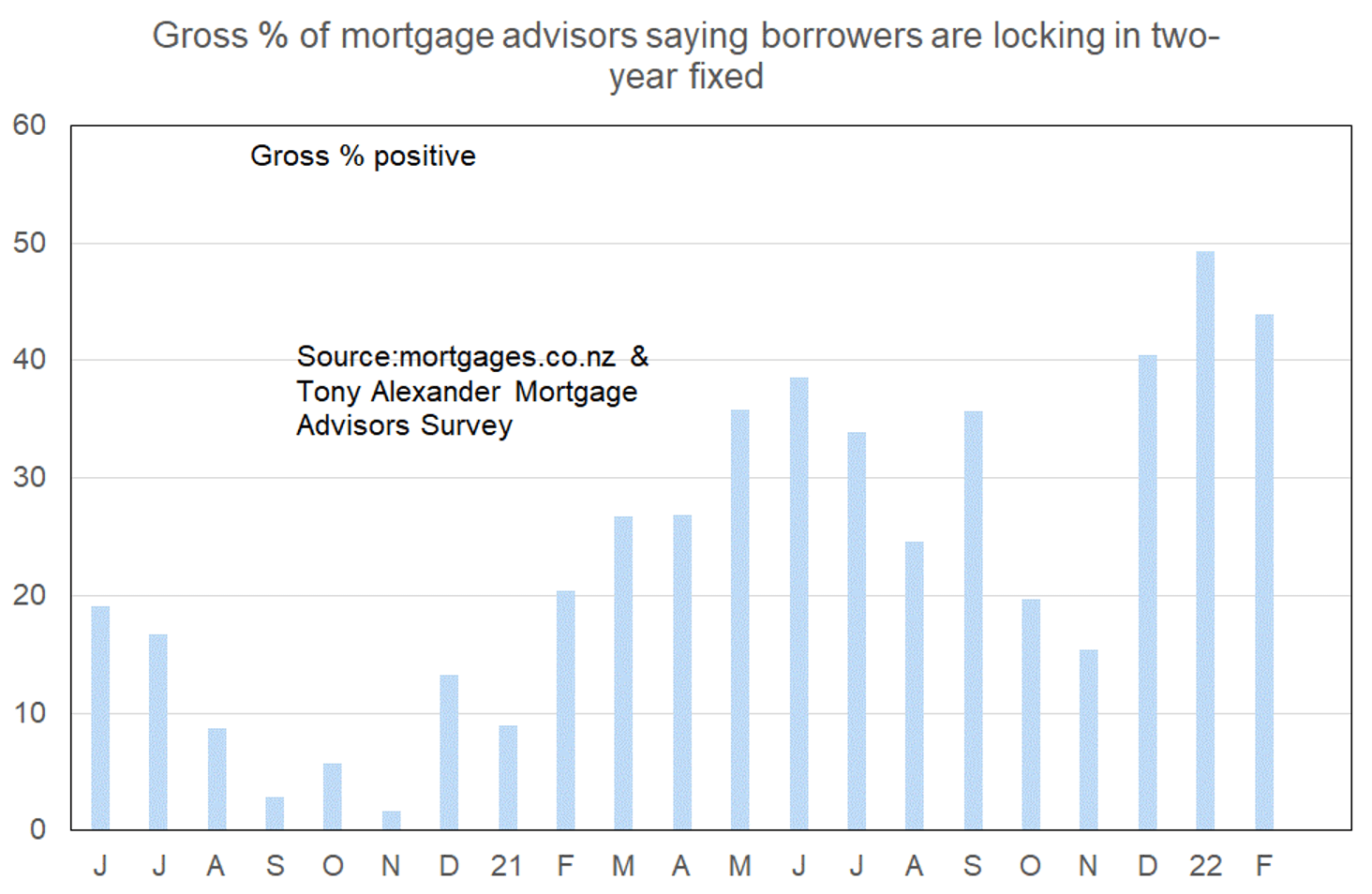

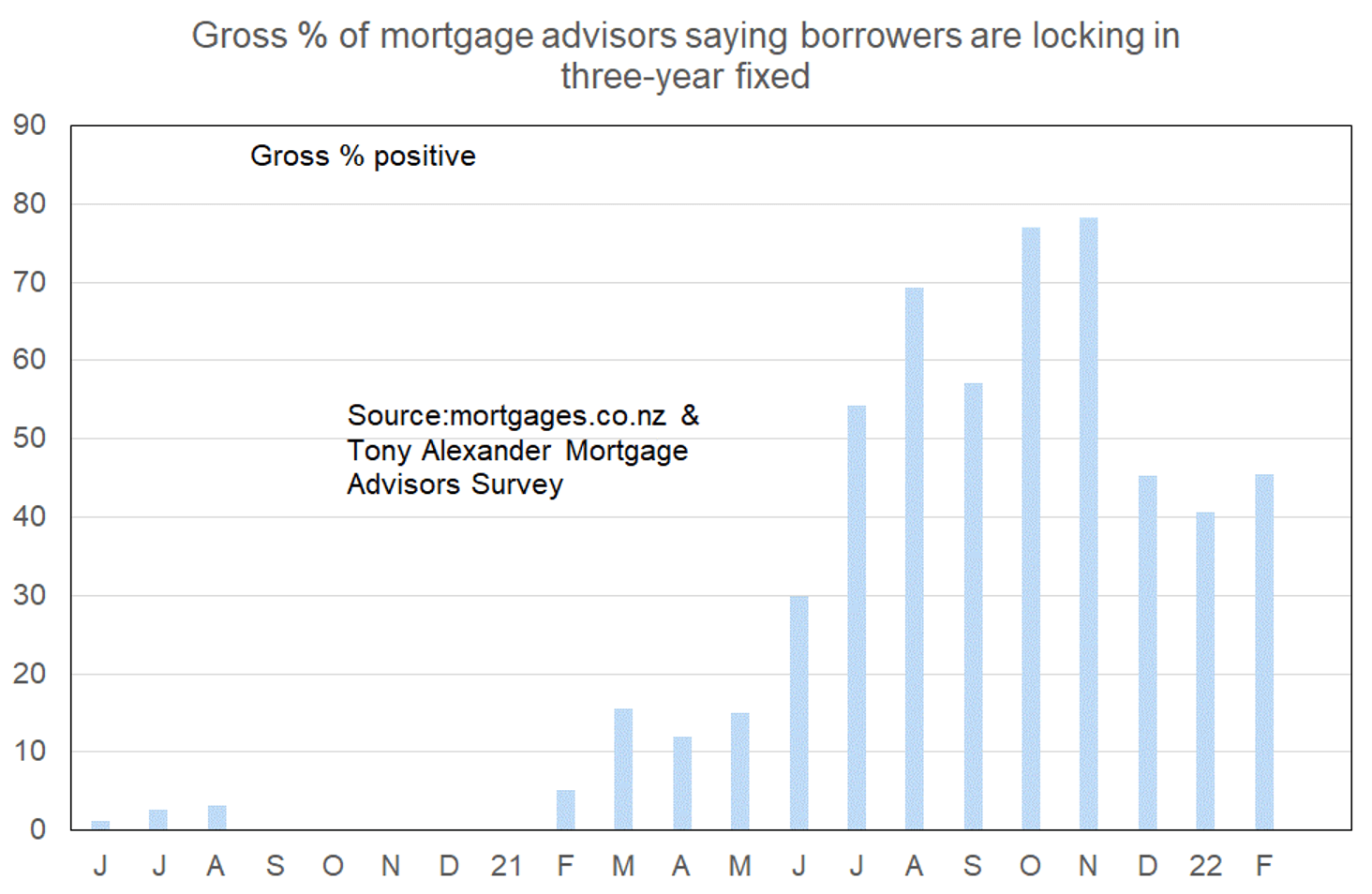

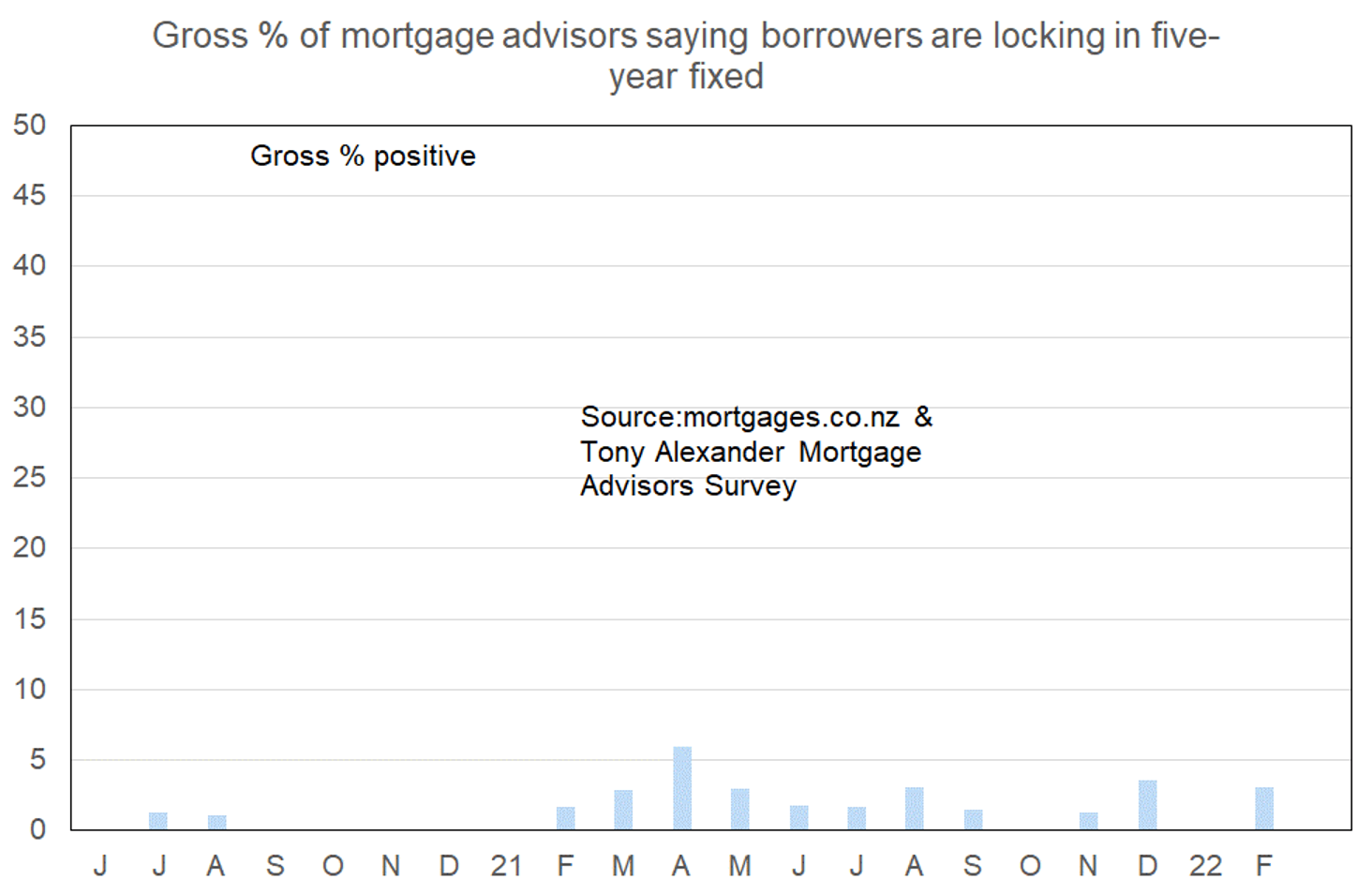

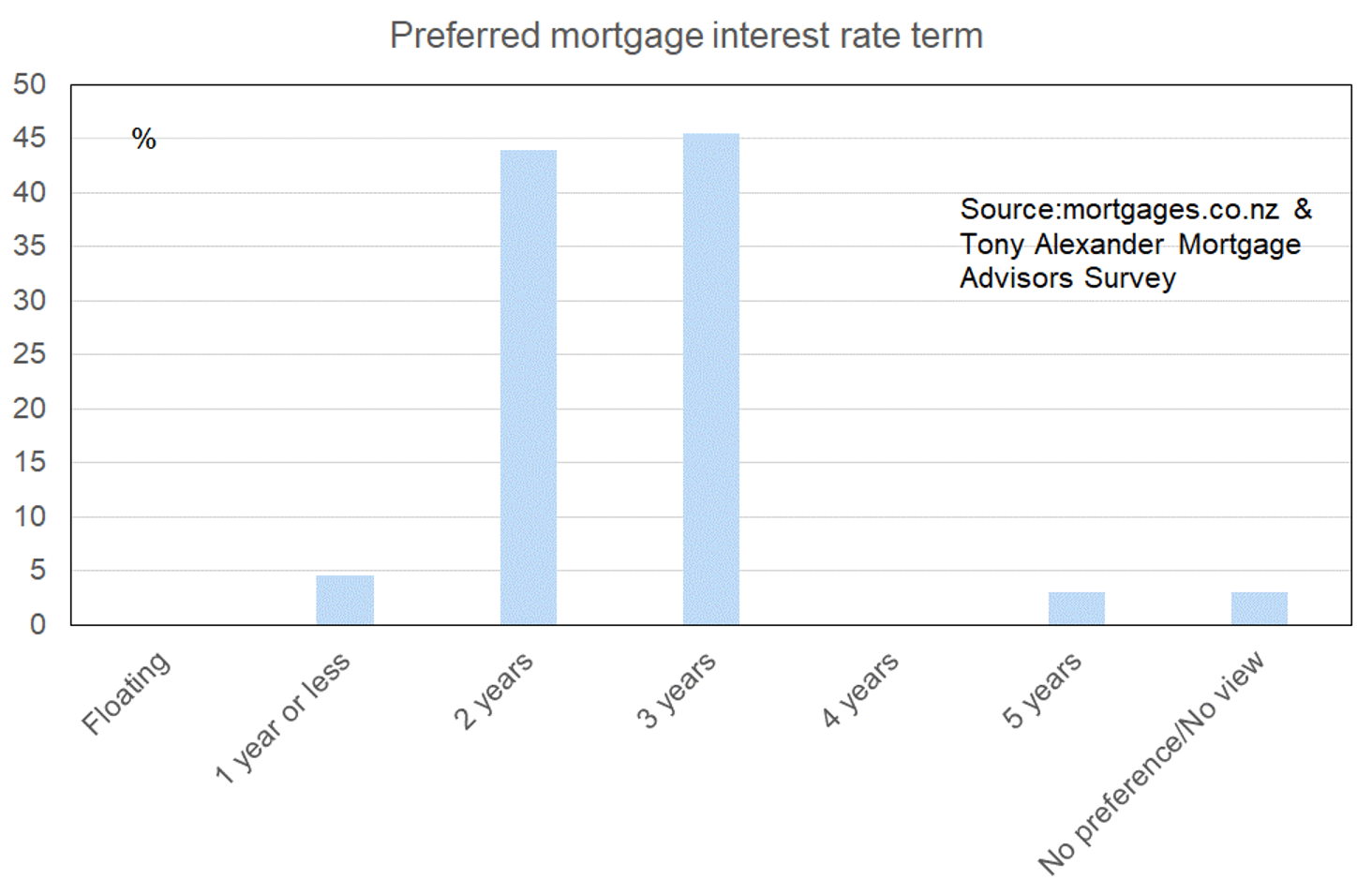

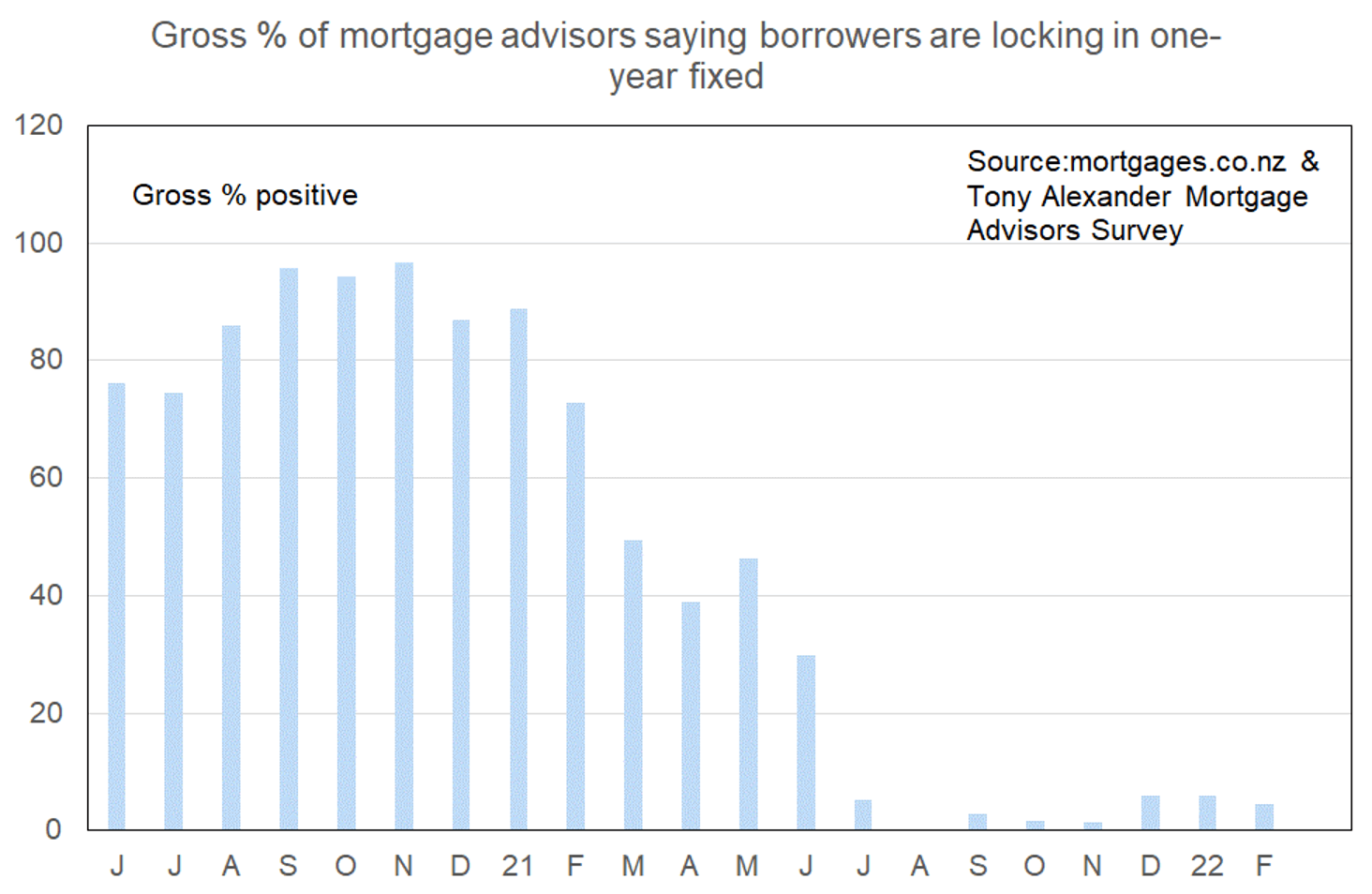

What time period are most people looking at fixing their interest rate?

The strong preference for the term at which to fix one’s interest rate remains in the 2-3 year area, almost to the complete exclusion of all other terms.

Over the past three months the preference for fixing two years has become increasingly popular relative to an earlier preference for fixing three years. The two terms are now level pegging in popularity.