CCCFA changes crush borrower hopes

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey undertaken last week shows weak results again across all our measures.

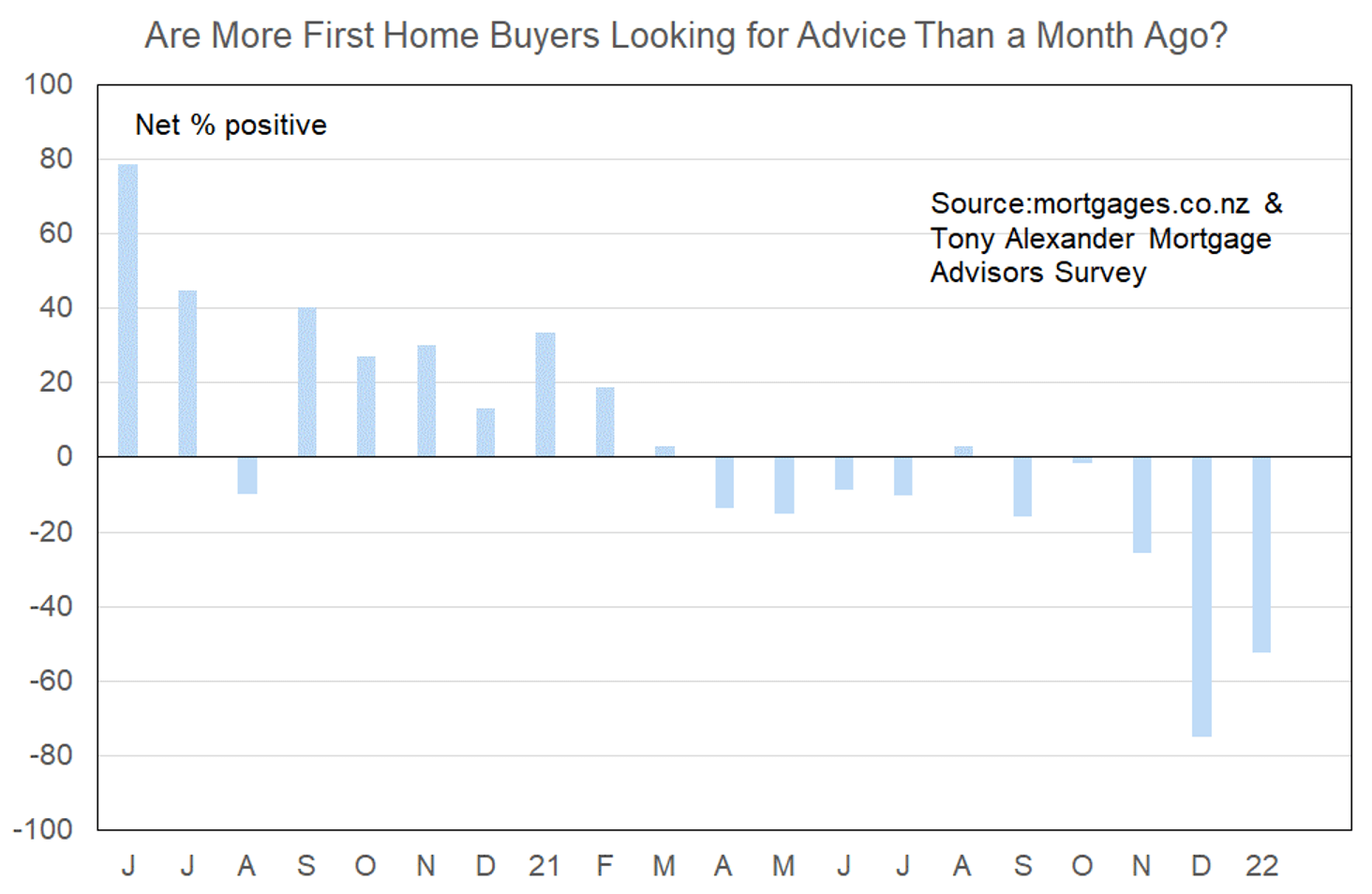

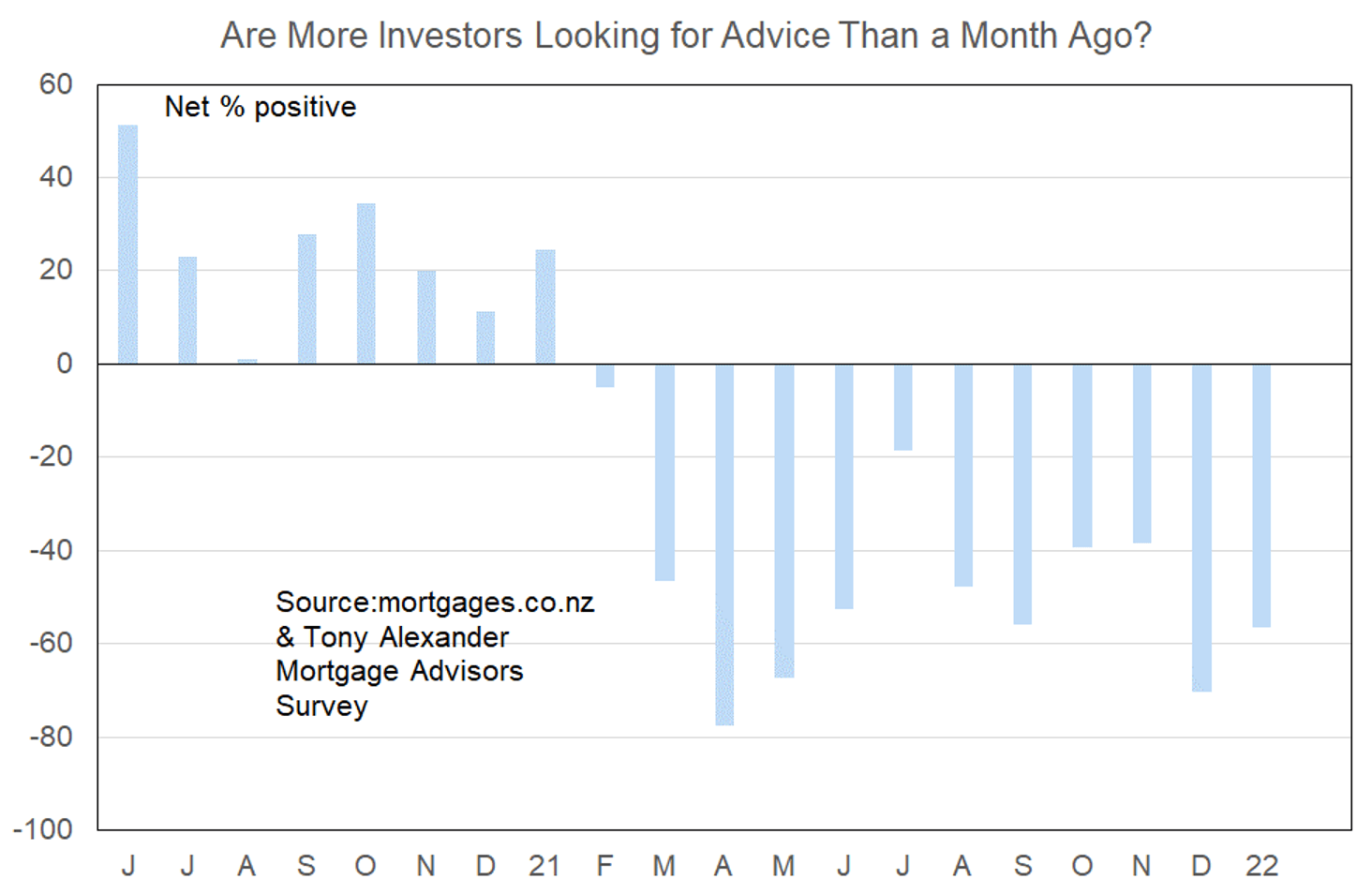

A net 52% of the 69 mortgage advisors responding said that they are seeing fewer first home buyers coming forward for finance. A net 57% are seeing fewer investors, and a net 83% report that banks have reduced their willingness to lend.

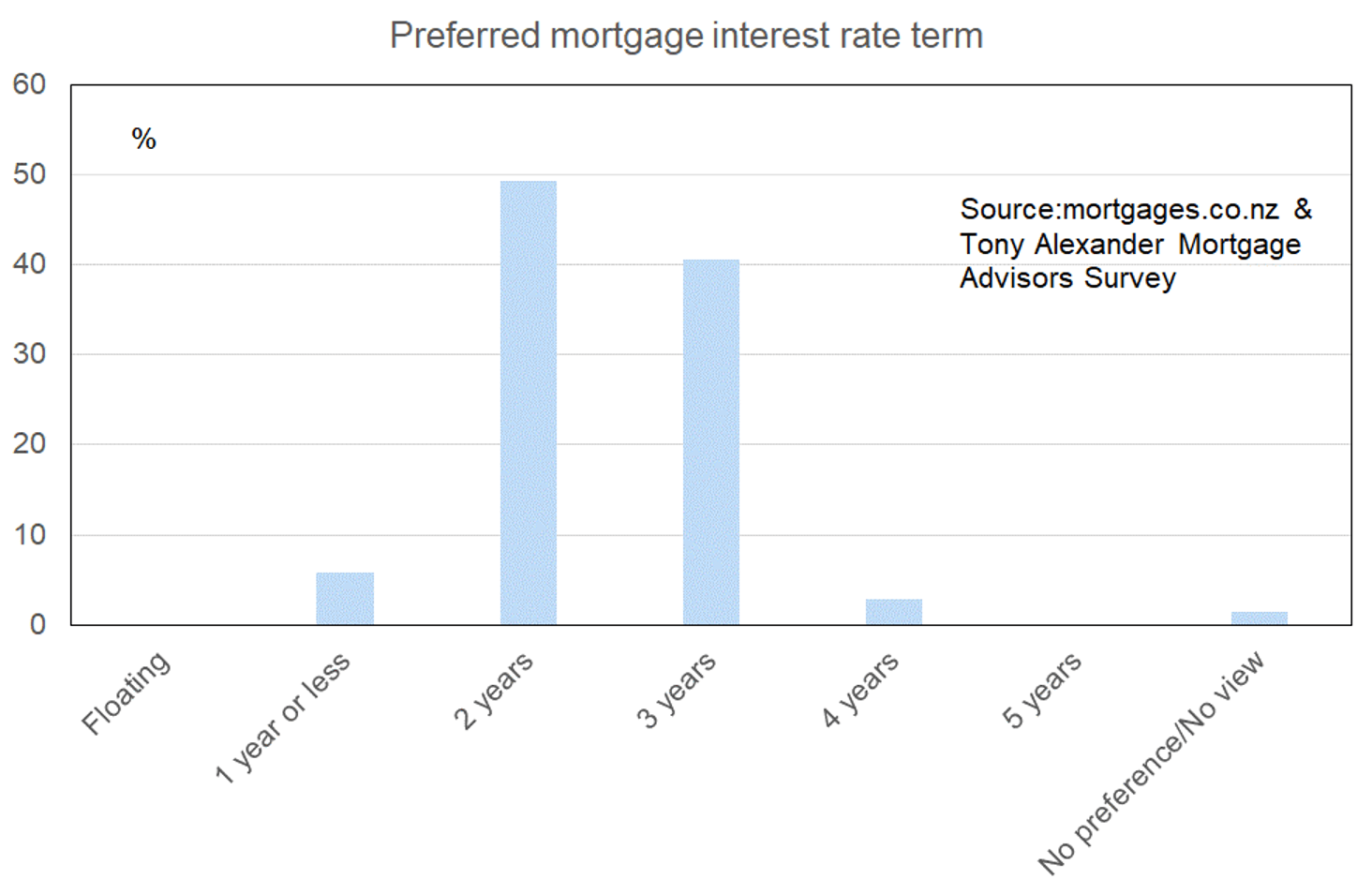

The strong preference of borrowers remains for the two and three year fixed rate terms.

More or less first home buyers looking for mortgage advice

A net 52% of mortgage advisors responding in our first survey for 2022 have reported that they are seeing fewer first home buyers coming forward for a mortgage. This is an improvement from a net 75% seeing fewer in December but continues to indicate extra backing away by first time buyers.

Advisors strongly noted the impact of changes to the Credit Contracts and Consumer Finance Act effective from December 1 as making mortgage acquisition extremely difficult for first home buyers. The reduction in the proportion of bank lending able to be undertaken where the borrower has less than a 20% deposit was also frequently cited.

Some of their comments include the following.

- The recent changes to the CCCFA are having the biggest impact compared with LVR restrictions, interest deductibility removal etc. Banks are now taking a forensic look at client’s expenses; trust has been eroded between the bank and client around how they should live their lives.

- No over 80% lending. Must have 20% deposit at the moment and cautious spending habits.

- First home buyers with less than 20% deposit are virtually cut out, unless they have a live deal and that’s quite scary for them.

- Things are pretty tough right now and I’ll say 9 out of 10 FHB’s are directly impacted with the new CCCFA changes.

- Most banks are not lending at all to people with less than a 20% deposit.

- Employment terms – must be no less than 6 months with one employer as long as the occupation is the same or 12 months with one employer if new occupation. Must have employer letter, payslips and 12 month IRD earnings for income verification.

More or less investors looking for mortgage advice?

As is the case for first home buyers, there has been a small reduction this month in the net proportion of agents reporting that fewer investors are stepping forward for a mortgage. A net 57% are seeing fewer investors compared with a net 70% in December.

Comments made by advisers include the following.

- No over 60% LVR lending.

- Significant reduction in rental income allowed for servicing.

- Using less of the rent to service debt, including more expenses for the rental property.

- All have brought their sensitivity on rental income back to about 60-65% of gross income. If an investor operates through a company, they are looking at historic financials 31 3 2021 instead of current rental streams. To get them to use current rental they want YTD financials and 12 months projections.

- Changes being applied on average 65% of rental income as opposed to 75% before.

- Extensive review of actual expenditure over three months.

- Stronger requirements for reviewing expenses/excessive scaling of rental incomes plus the capturing of expenses for rental property so being hit with double whammy.

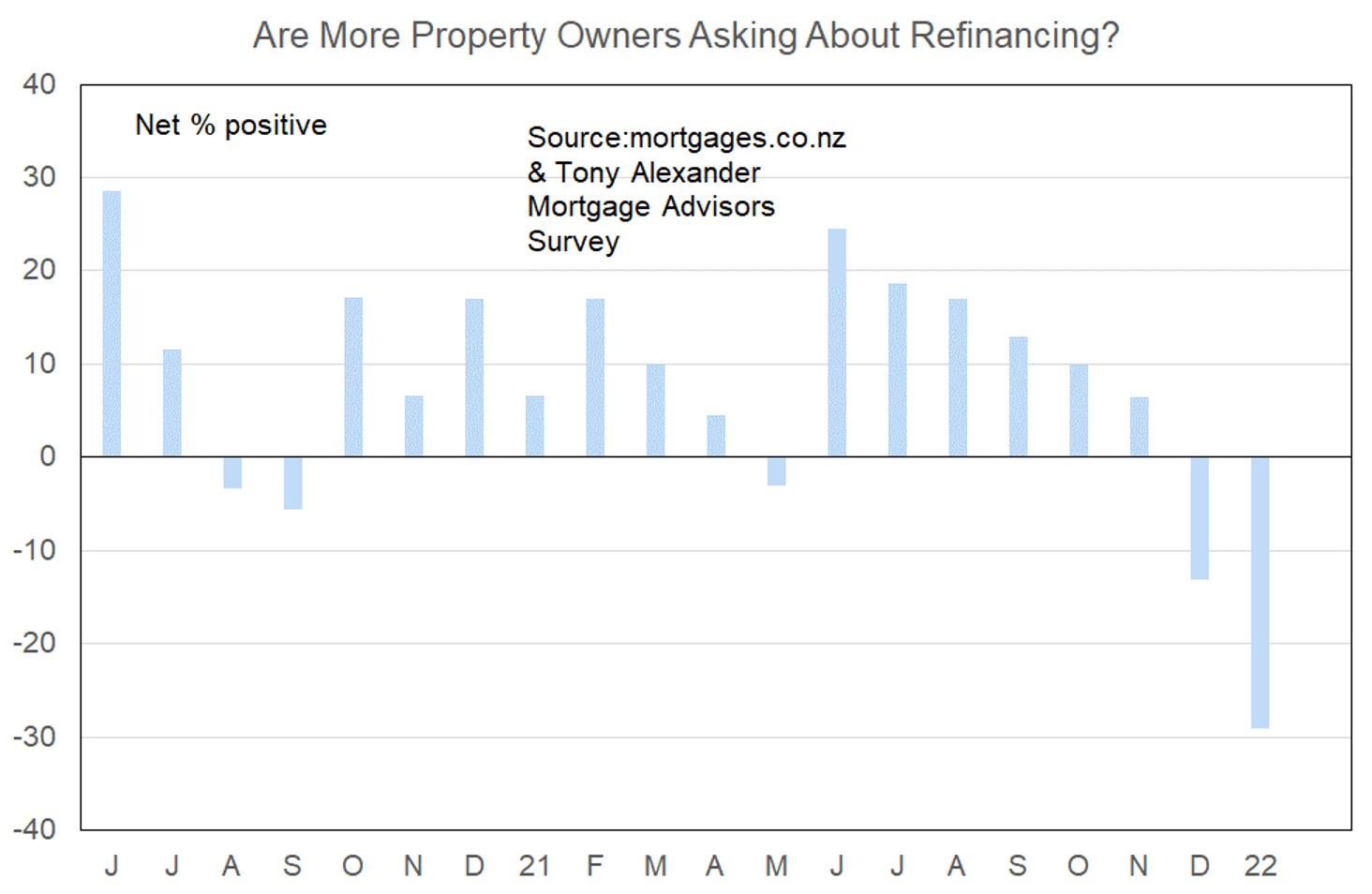

More or less property owners looking for refinancing?

The biggest change recorded in our survey this month is a substantial decline in the net proportion of advisors receiving requests for refinancing advice. This has deteriorated to a net 29% down from 13% at the end of 2021.

As the graph shows this situation is quite different from all other periods in our survey from June 2020.

Despite the seeming logic of interest rate worries potentially accelerating people’s decisions to rearrange their interest rate exposure, this measure looks more and more like a gauge of the confidence investors have regarding getting mortgage changes made.

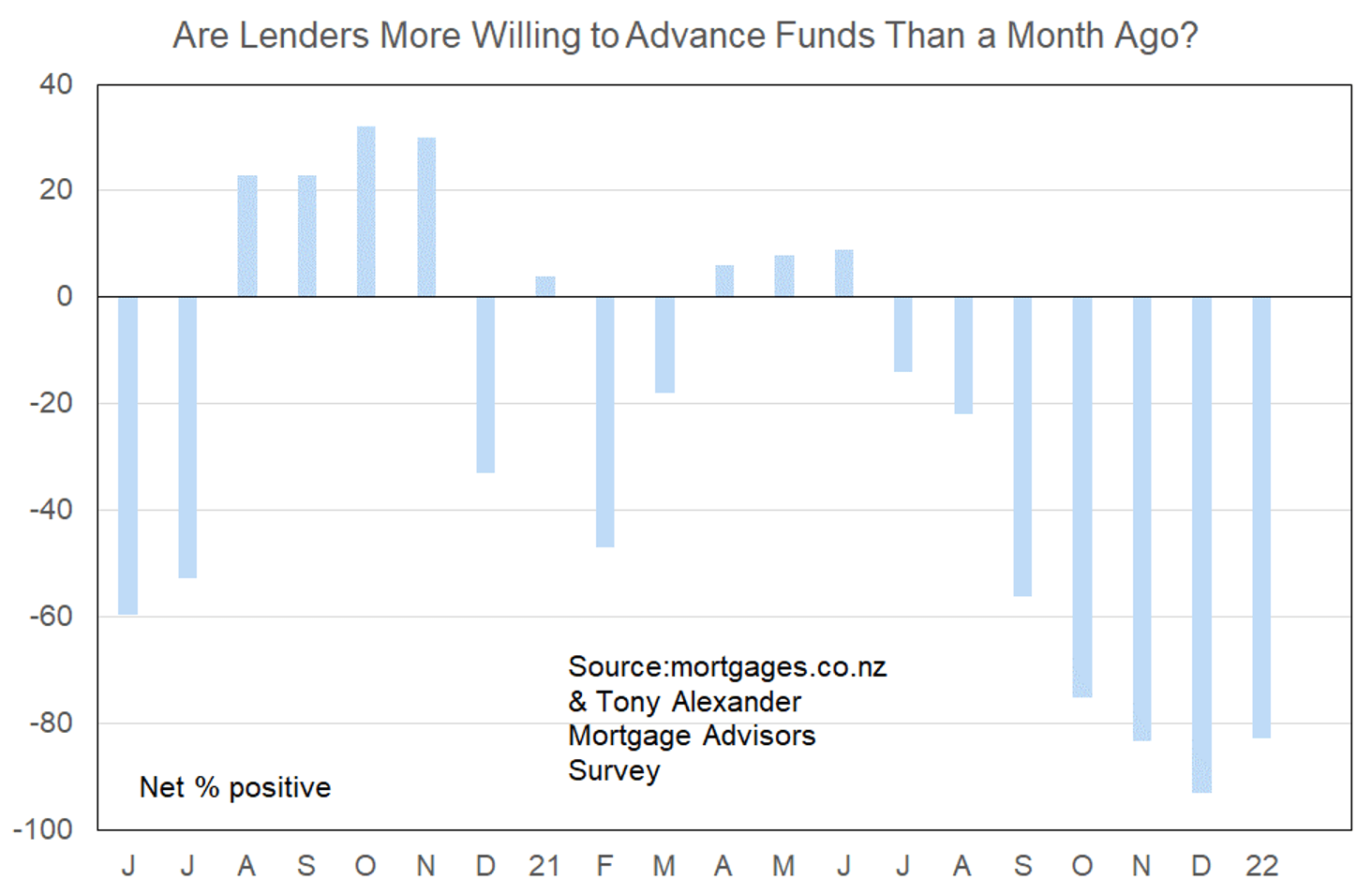

More or less lenders willing to advance funds?

As has already been reported from many other sources, perceptions of bank willingness to lend have substantially deteriorated in recent months. Our survey gave the first statistical indication of bank willingness to lend changing back in July, well before implementation date changes for LVR rules and CCCFA requirements.

This month a net 83% of advisors say that banks have become less willing to lend to borrowers. This is the same proportion as in November and little changed statistically from the record net 93% of December.

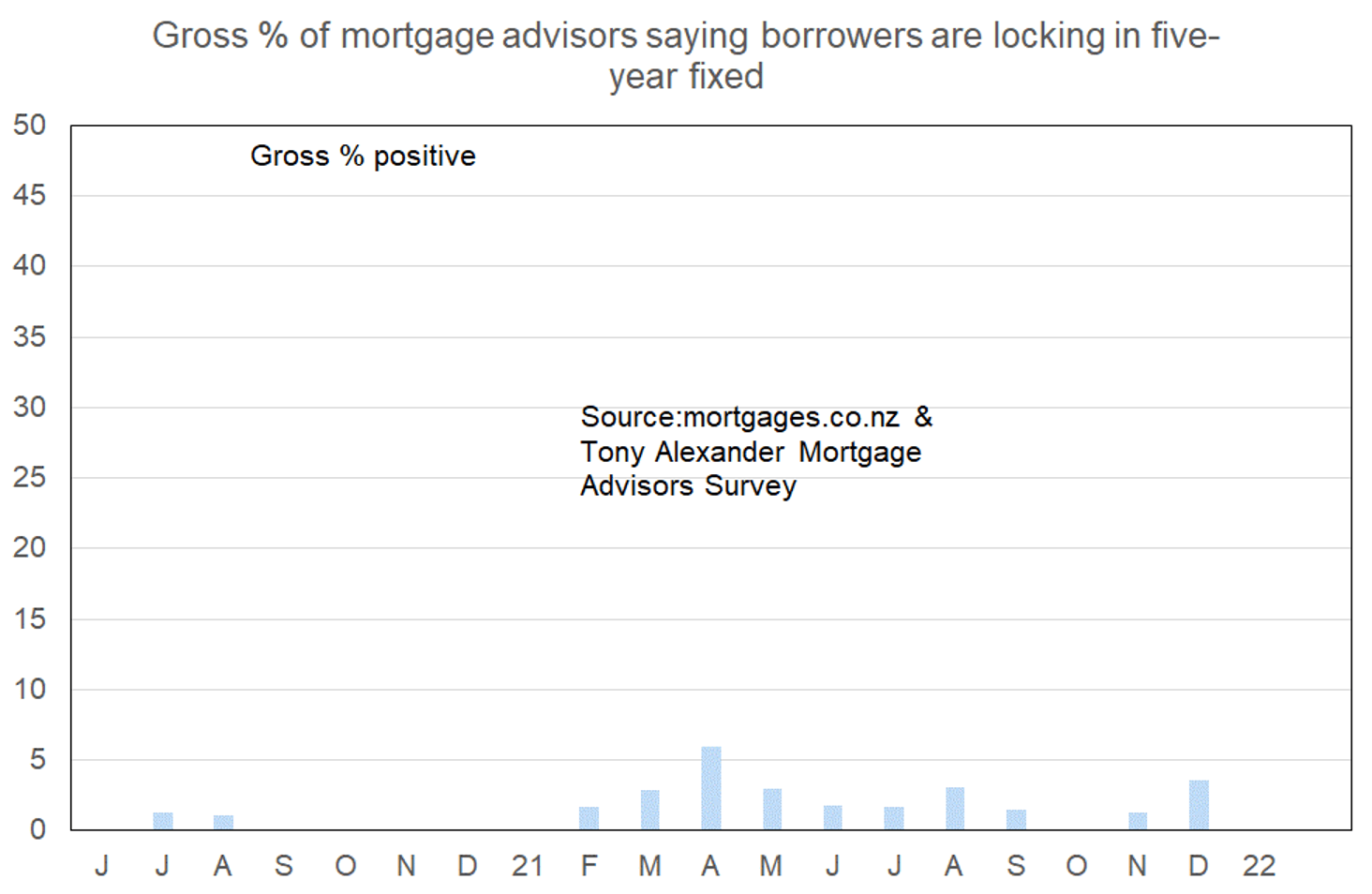

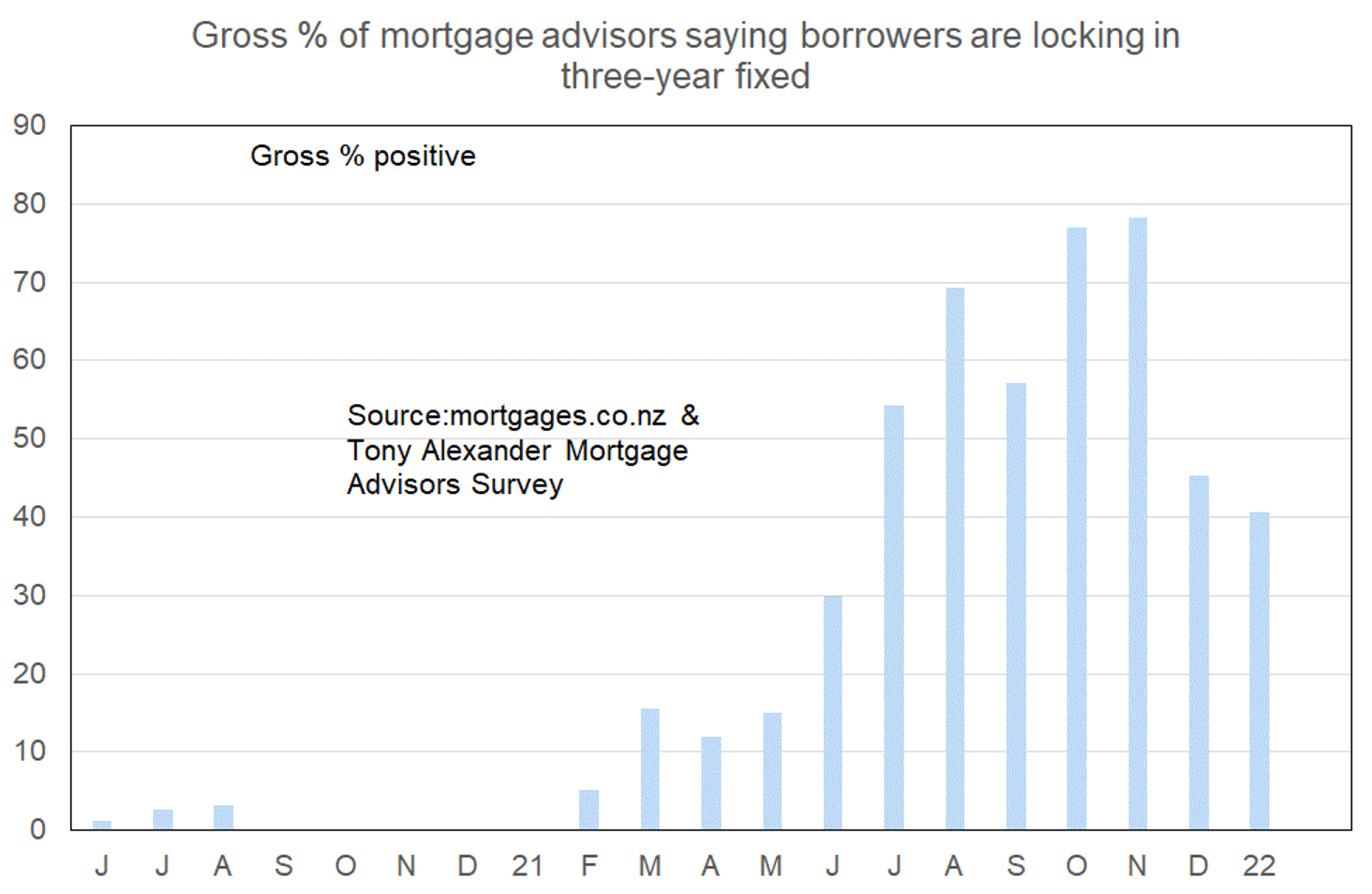

What time period are most people looking at fixing their interest rate?

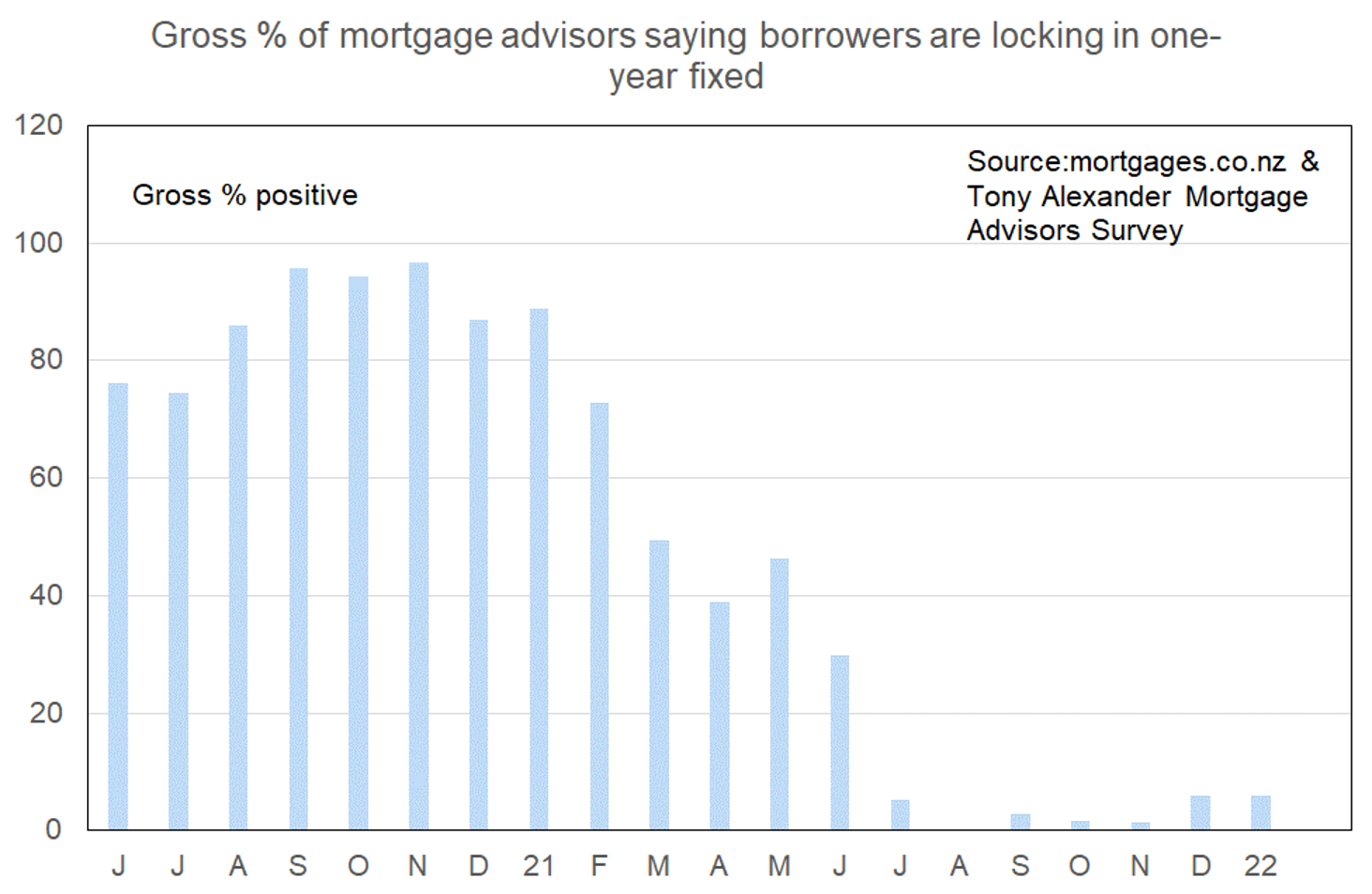

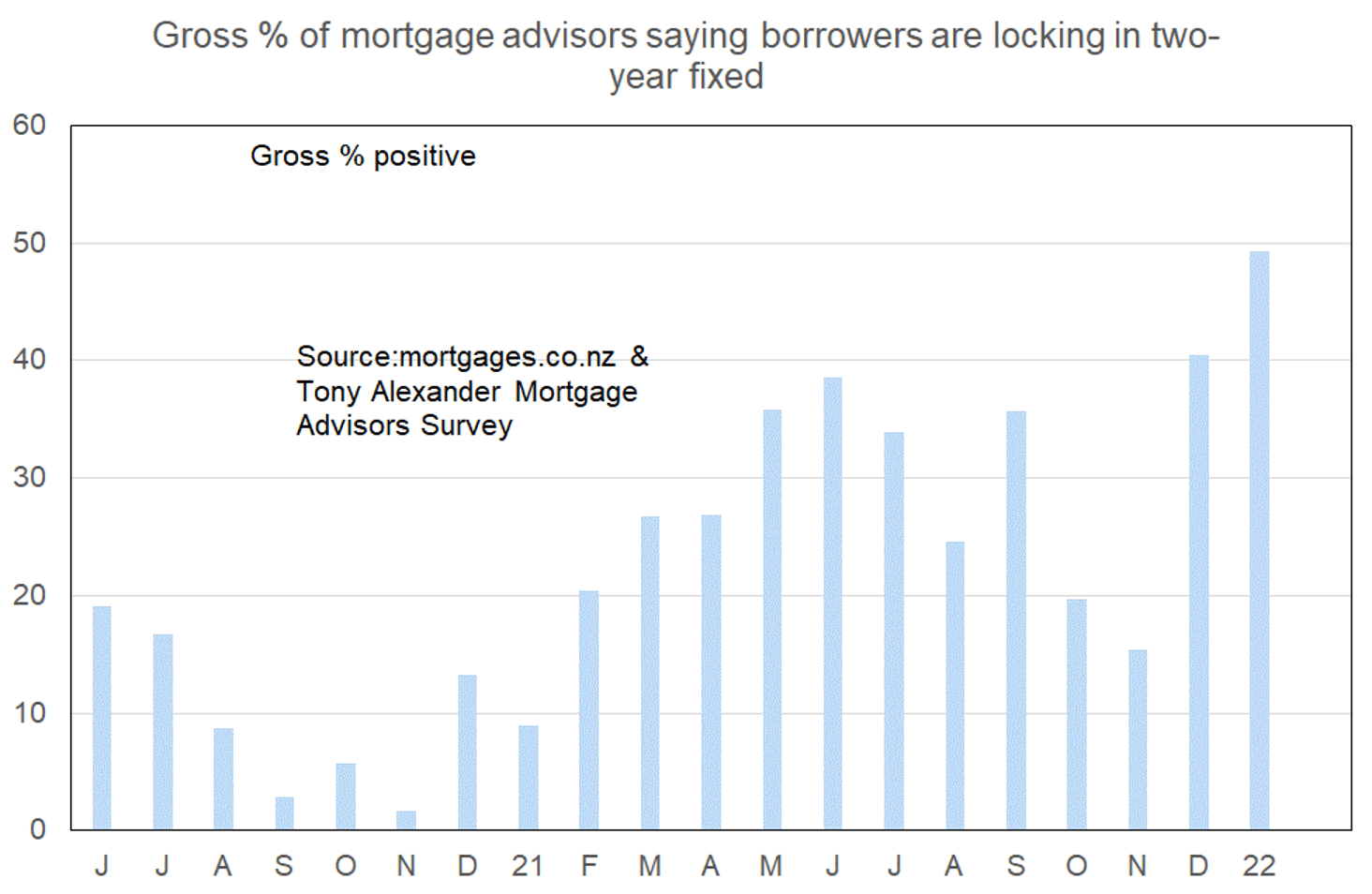

The one-year fixed rate was very popular until the middle of last year when the commencement of rate rises and deepening concern about inflation and tightening monetary policy made people increasingly consider longer terms.

As ever, very few borrowers favour fixing five years, especially now that the rate commonly charged by banks is about 2% higher than in the middle of 2021.