Credit crunch shuts out first home buyers

Each month we invite mortgage advisers around the country to give insights into developments in the residential real estate market from their unique perspective. Our latest survey undertaken last week shows the weakest results for almost all our measures since the first survey was undertaken in June 2020.

First home buyers are finding it almost impossible to buy with less than a 20% deposit now. Because over 40% of their borrowing previously did involve a small deposit this change in bank policy is shutting almost half of FHBs out of the market, especially when the new assessment regimes for expenses and income stability are applied to meet CCCFA requirements.

Investors are having rental incomes shaded, expense calculations lifted, and debt to income ratios of 6 are being applied by some lenders. The impact is less severe than for first home buyers with the bigger impact on activity levels being the March 23 tax announcement.

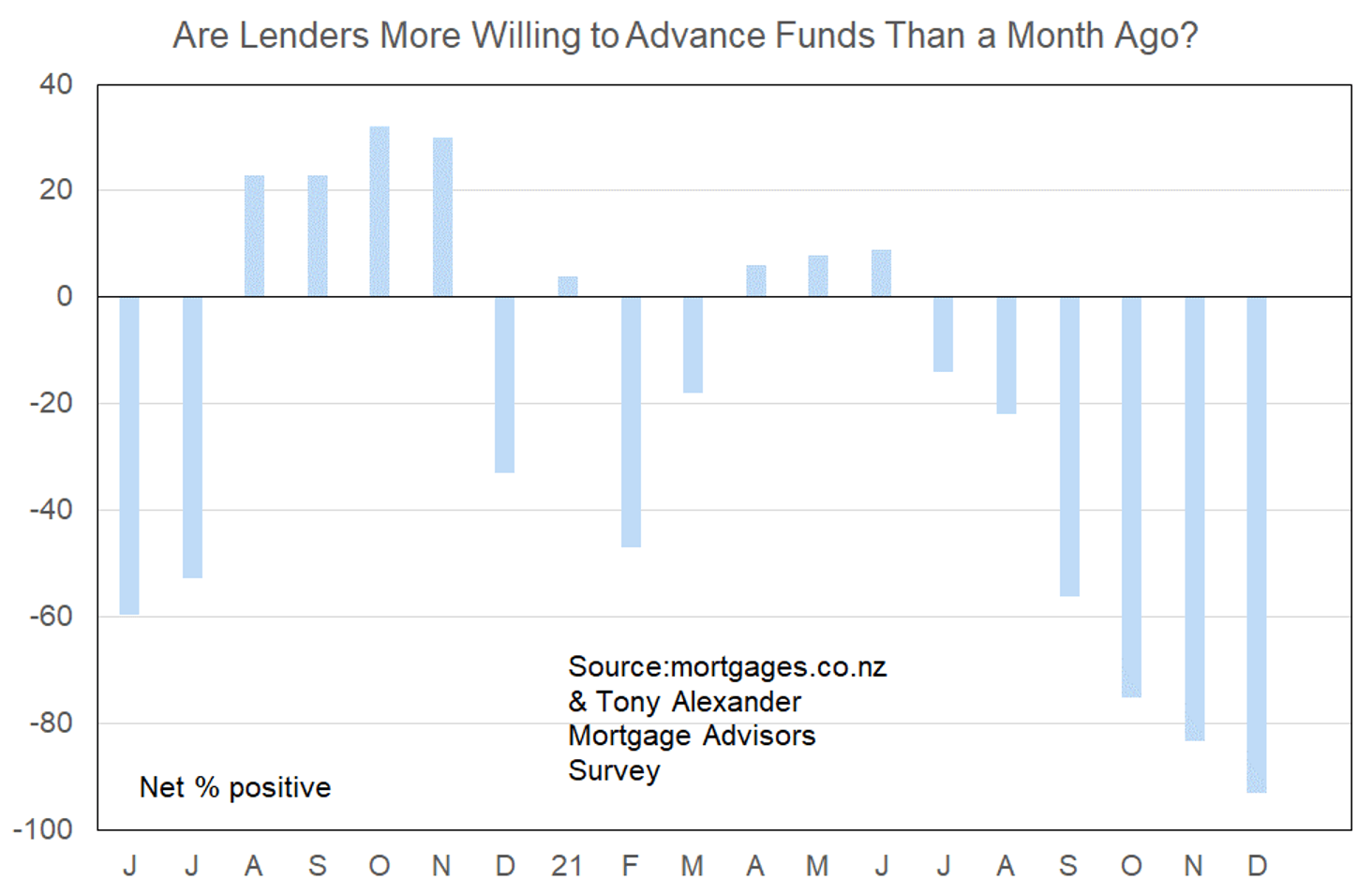

93% of our 86 respondents this month have reported that lenders have become less willing to advance funds. None reported that things have become easier and just 6 felt lending willingness was the same as last month. This 93% figure provides justification for describing the current state of home lending affairs as a credit crunch.

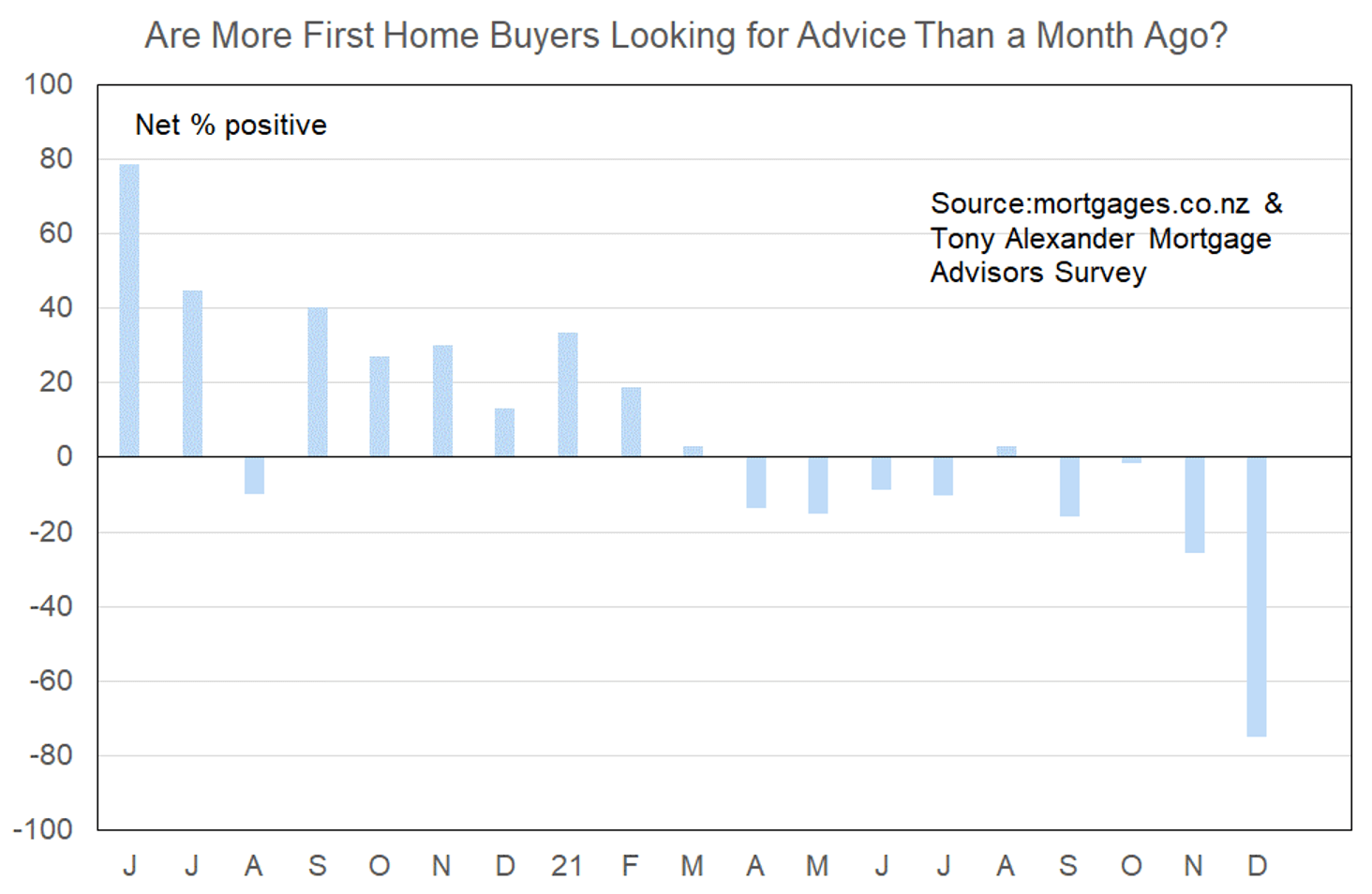

More or less first home buyers looking for mortgage advice

A net 75% of our responding mortgage advisers report that they are seeing fewer first home buyers looking for mortgage advice. This is a complete reversal of the net 79% in June 2020 who were reporting more enquiry.

Back then mortgage rates had just been cut to record lows, house prices had fallen 3% on average, loan to value ratio requirements had been removed, and expectations were high of plentiful listings and little competition from investors.

Now, mortgage rates have just undergone their most rapid increases since shortly after being introduced in the early-1990s. More significantly, the combined effects of changes to LVR rules, the requirements of the Credit Contracts and Consumer Finance Act, and banks experimenting with Debt to Income ratios (DTIs), have led to many potential house buyers no longer qualifying for a loan

The comments made by mortgage advisers regarding lending policies towards first home buyers were numerous and include the following.

- Major focus on living expenses and use of DTI is causing chaos.

- 80% maximum lending, no long term preapprovals for over 80% lending, more valuation requests at the customer’s expense even for under 80% deals.

- If you have regular savings of $100 per week – this suddenly becomes an expense even though clients have stated this will cease and be applied to the mortgage once the purchase is complete.

- Closer than ever scrutiny. Removing pre-approvals in place, which is despicable especially when someone is halfway through a purchase.

- If you don’t have 20% deposit don’t bother applying at this stage. Hopefully it will settle down in a few months once the banks get back to the right weighting on their total housing lending.

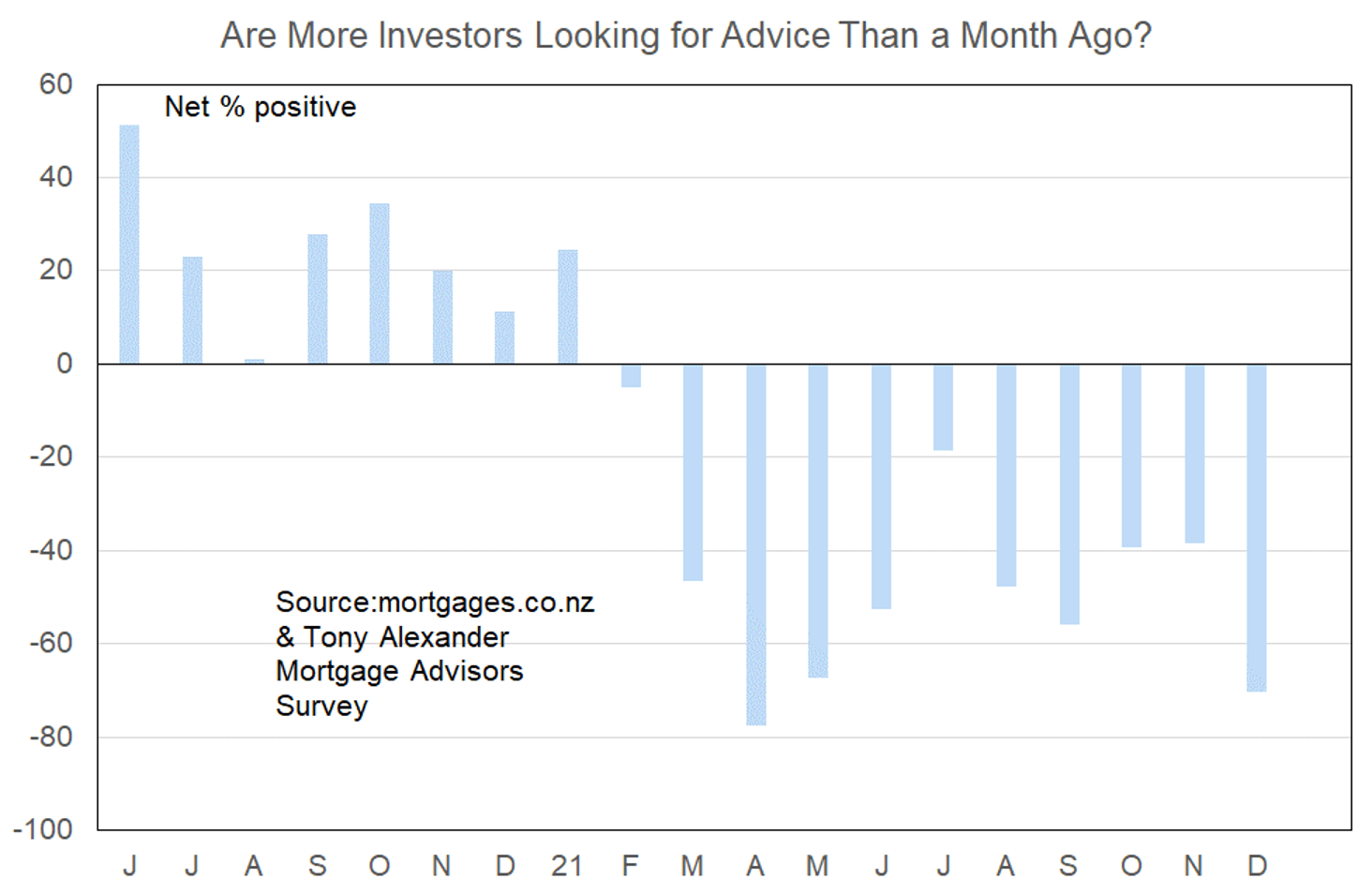

More or less investors looking for mortgage advice?

A net 70% of mortgage advisers have reported that they are receiving fewer enquiries from investors. This is a deterioration from November when a net 38% reported fewer investor enquiries but not as negative as the net 78% of April. That result came after the government had changed tax and brightline regulations affecting property investors and every month since then advisers have reported reduced investor enquiry.

Comments made by mortgage advisers regarding bank lending to investors include the following.

- More aggressive discounting of rental income, higher test interest rate being used, and adding rates expense on top which is making numbers less workable.

- I have had one lender advise that all properties providing rental income for an investor must be held as security by them.

- Focus on exit strategy if investor is going to be over 70 when loan paid off – previously could ask for 30 year loan term, now need to justify with an actual exit strategy.

- Servicing requirements for all insurances, maintenance are now required rather than just scaled rental income.

- Wanting good cashflow and looking harder at the buildings and types of tenancies.

- Tougher criteria. Only using 60% of rental income and CCCFA is causing strong clients to be declined.

- Anecdotally, lenders are going to have to push Professional Investors into Commercial where RBNZ rules don’t apply.

- Most deals for existing Investors with multiple properties that are already highly leveraged are failing servicing; so no new money for them.

- Much more difficult now cccfa is in place. More stringent bank statement reviews. Now adding rates, insurance, other property investment costs, and only taking 60-70% of the gross rental income. Making investor lending almost impossible unless you have a very strong income elsewhere from salary or business.

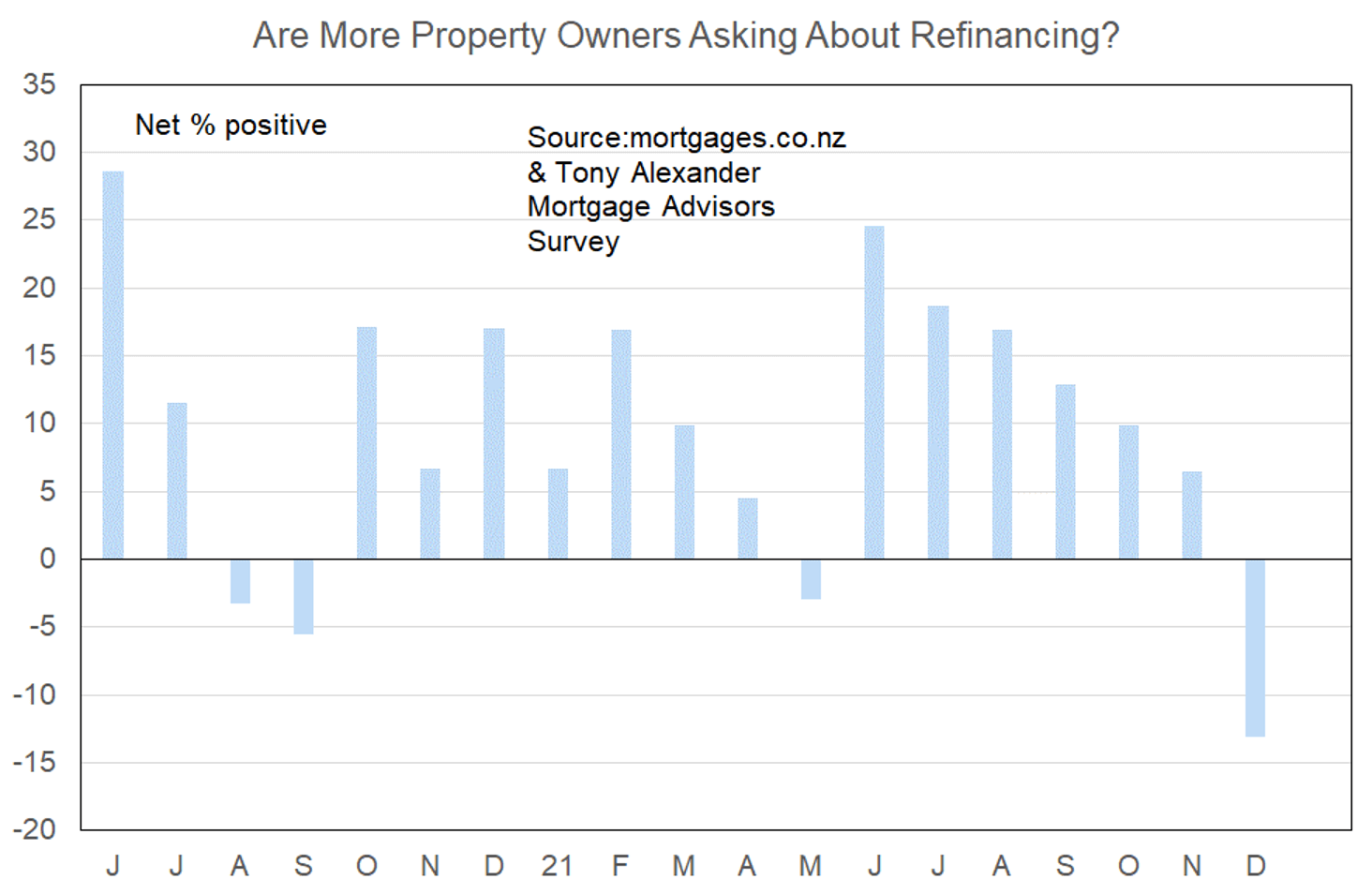

More or less property owners looking for refinancing?

There has been a sharp decline in the net proportion of advisers reporting that more people are seeking to refinance their loans.

More or less lenders willing to advance funds?

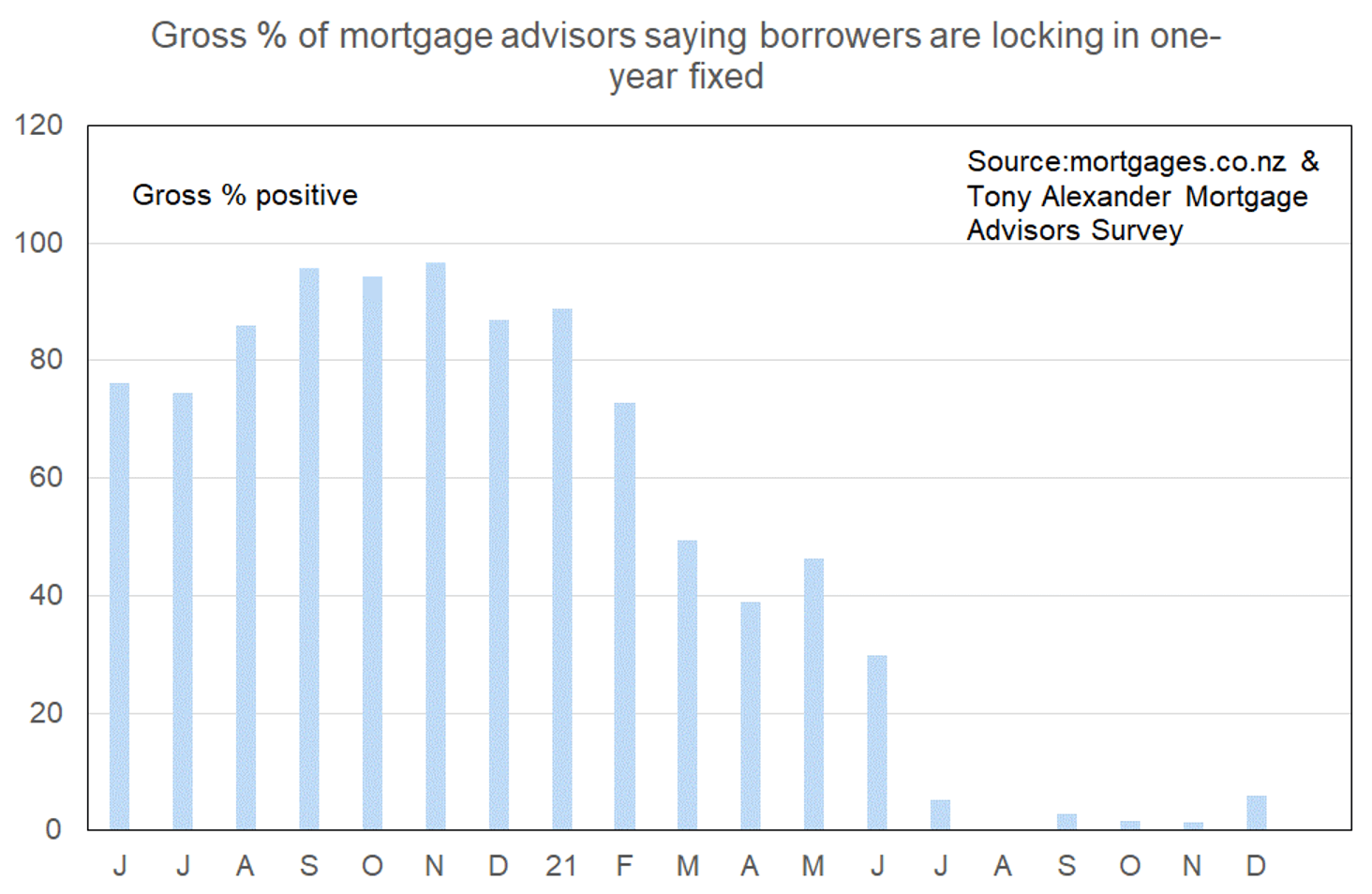

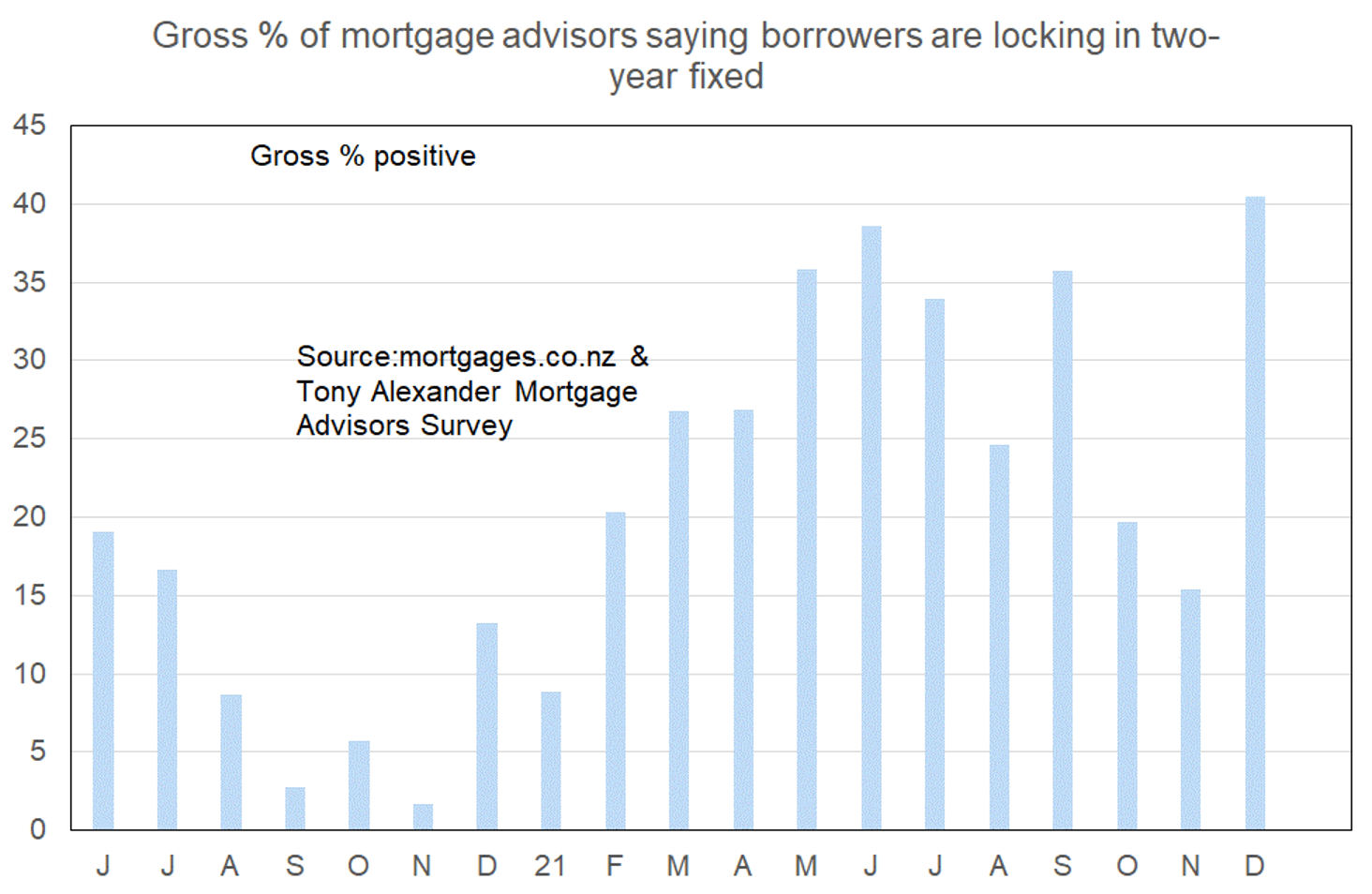

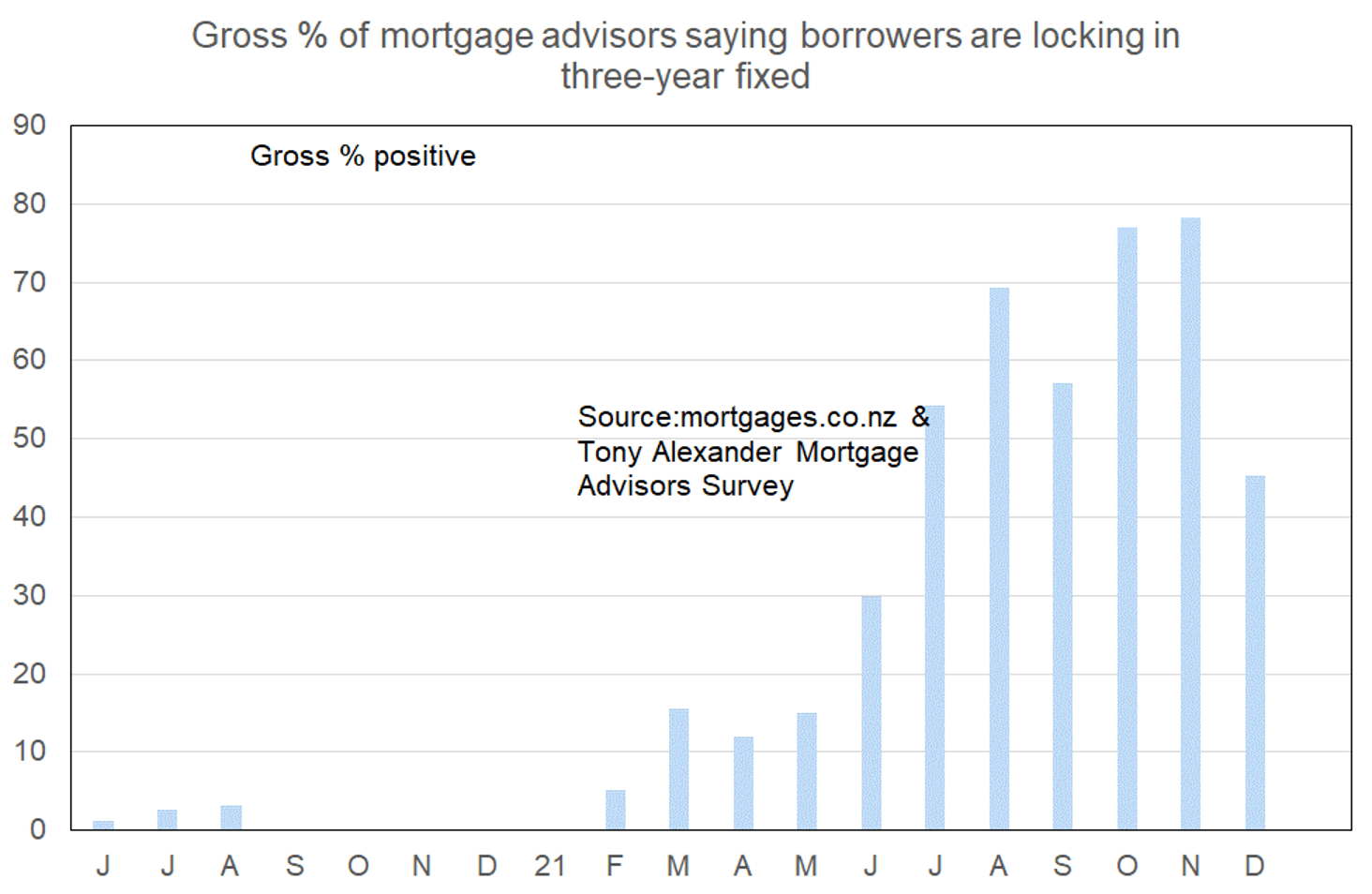

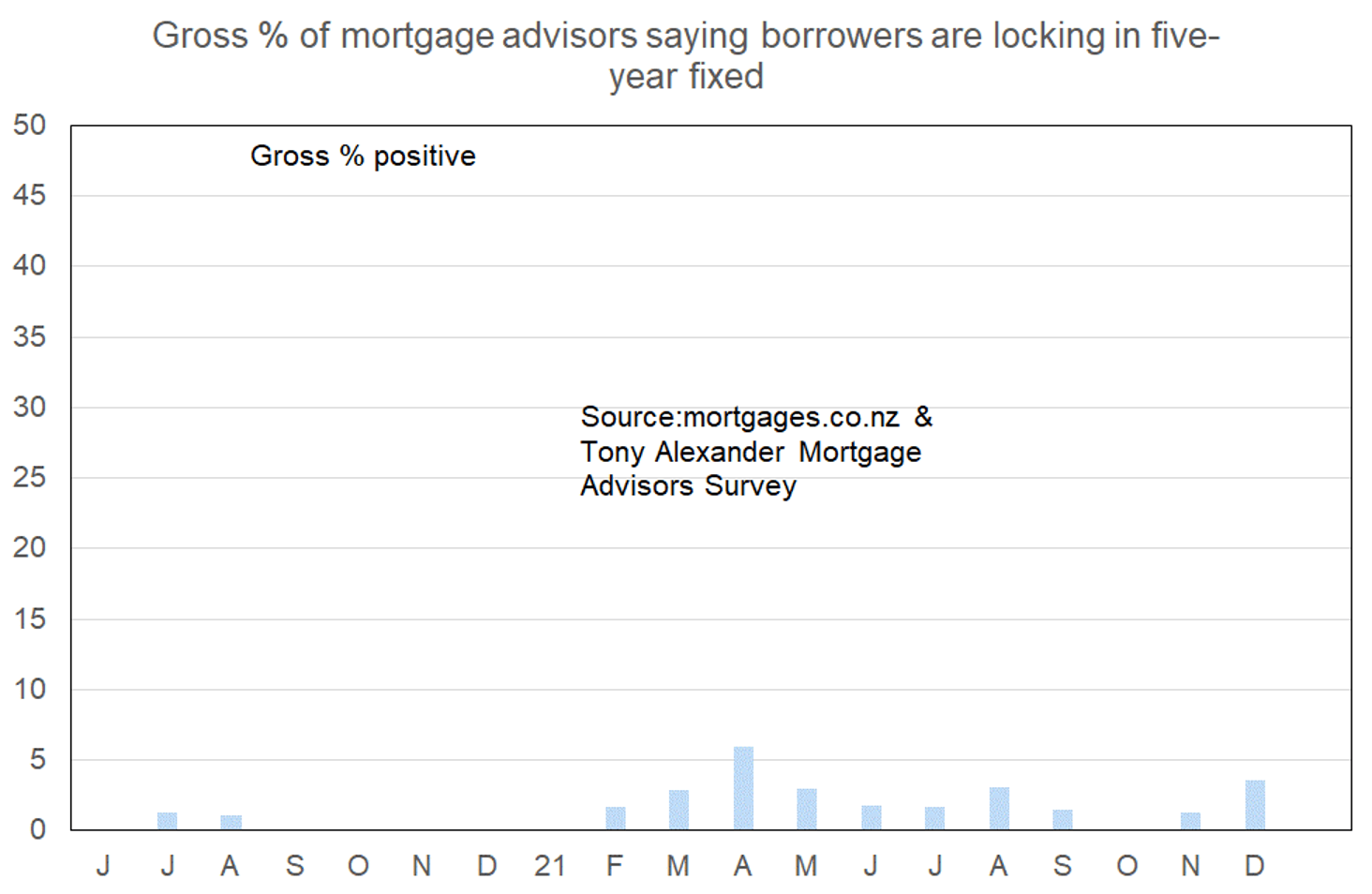

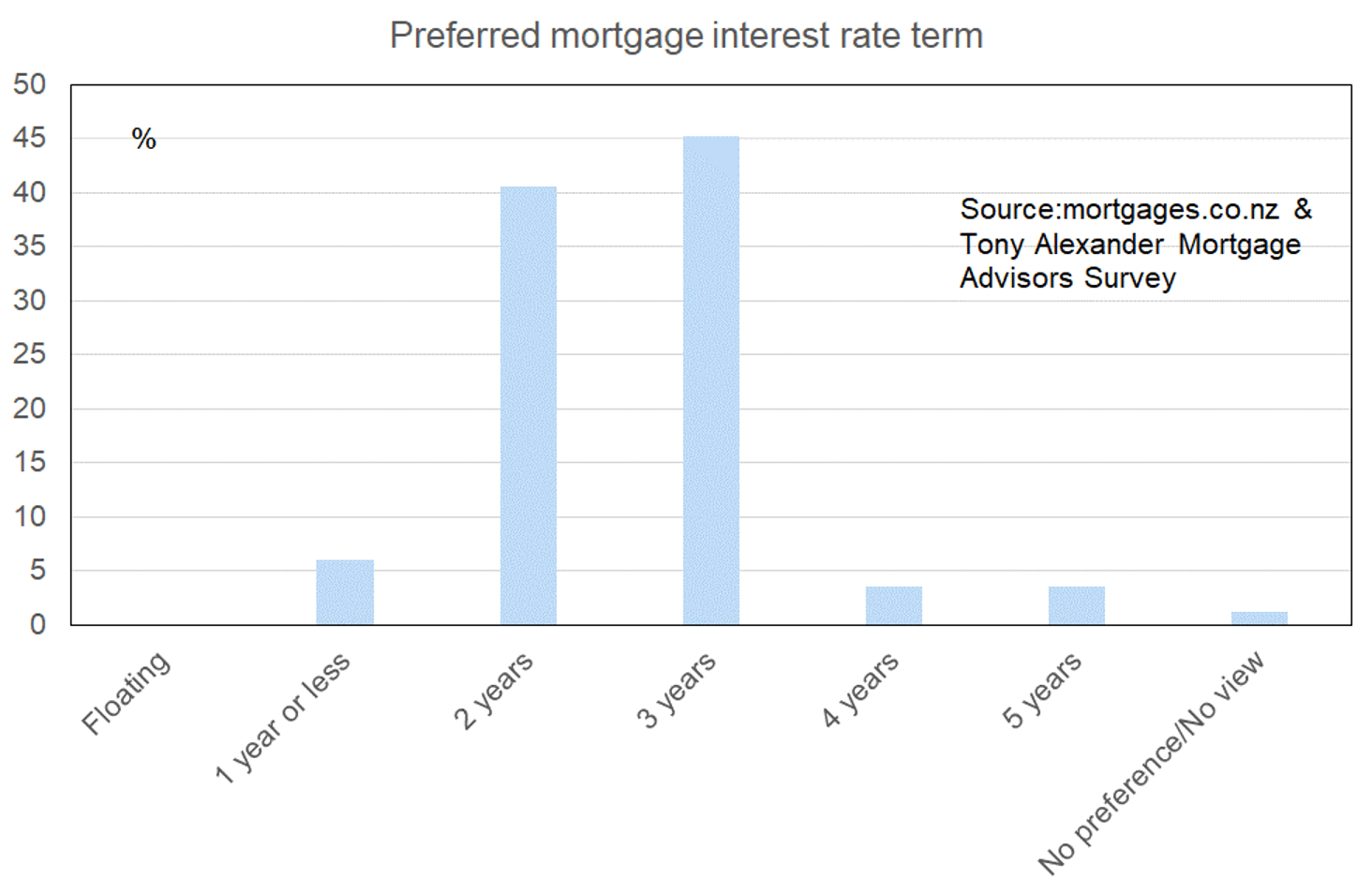

What time period are most people looking at fixing their interest rate?

In contrast, 40% this month say borrowers prefer fixing for two years as compared with 15% last month. The result overall is that almost all borrowers are opting for the two and/or three year terms for fixing their mortgage rates.