Investor withdrawal slowing

Each month since June last year we have surveyed mortgage advisors throughout New Zealand asking them what they are seeing. The responses which these advisors can provide give us early insight into changes that are happening in buyer behaviour in particular, well before such changes show up in any of the official datasets.

We also gain unique insight into changes in bank lending practices which are not available from any other outlet.

This month, the extent of pullback from investors has eased again and there has been a noticeable shift in the fixed rate terms preferred by borrowers.

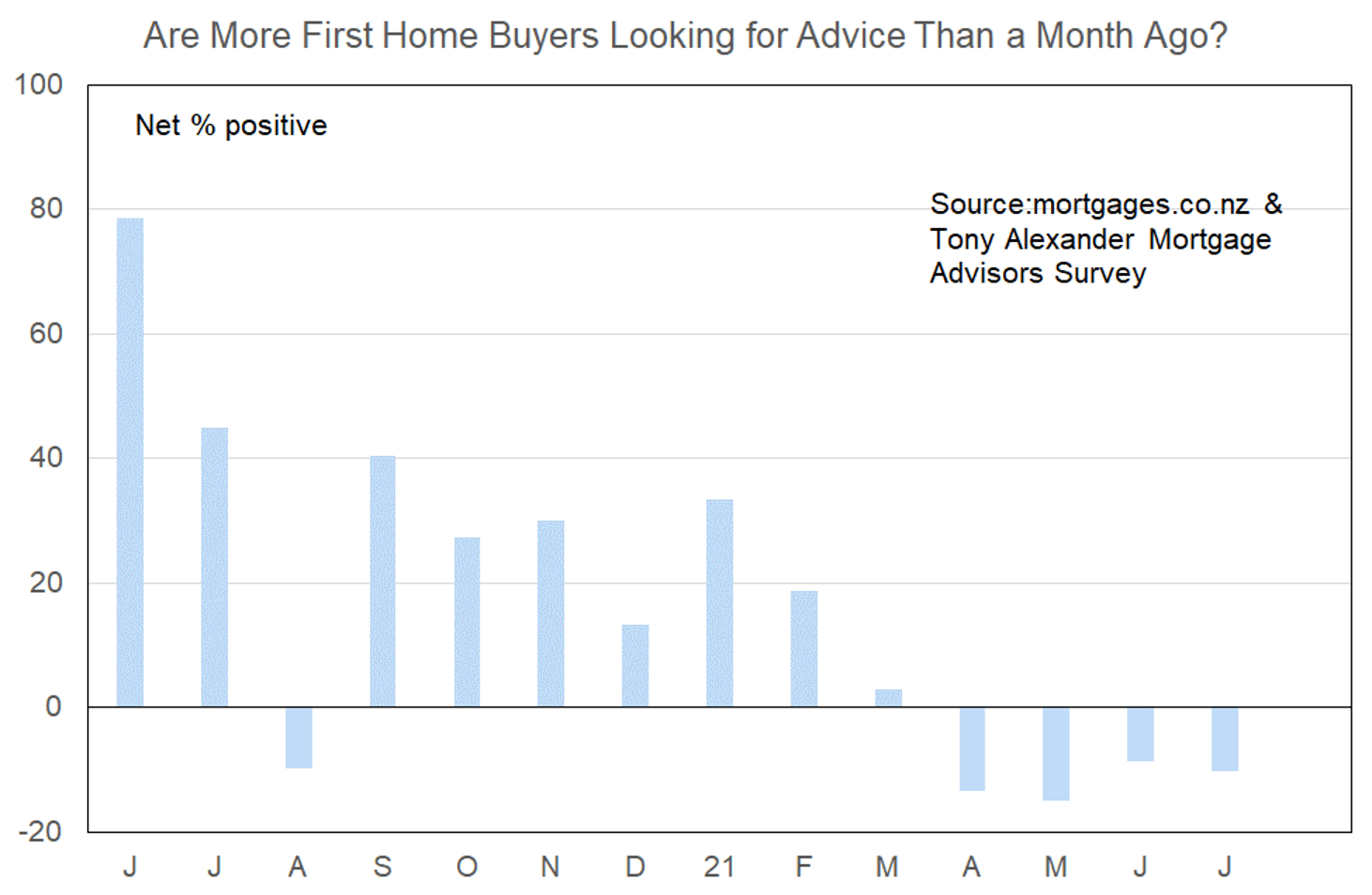

More or less first home buyers looking for mortgage advice

For the fourth month in a row following the March 23 tax announcement, more mortgage advisors have reported that they are seeing fewer first home buyers looking for advice than are seeing more.

A net 10% of our 59 respondents from around the country have reported fewer first home buyer enquiries. This is statistically the same as the net 9% seeing fewer in our June survey and only marginally better than the net 15% of May.

We can see from the graph that there has been a downward trend in enquiries from first home buyers to mortgage advisors for all of the past year, but that the extent of the decline has in fact plateaued in the past few months.

This still means young people are holding back from the market, but not in greater numbers. This then is a point of contrast with investors.

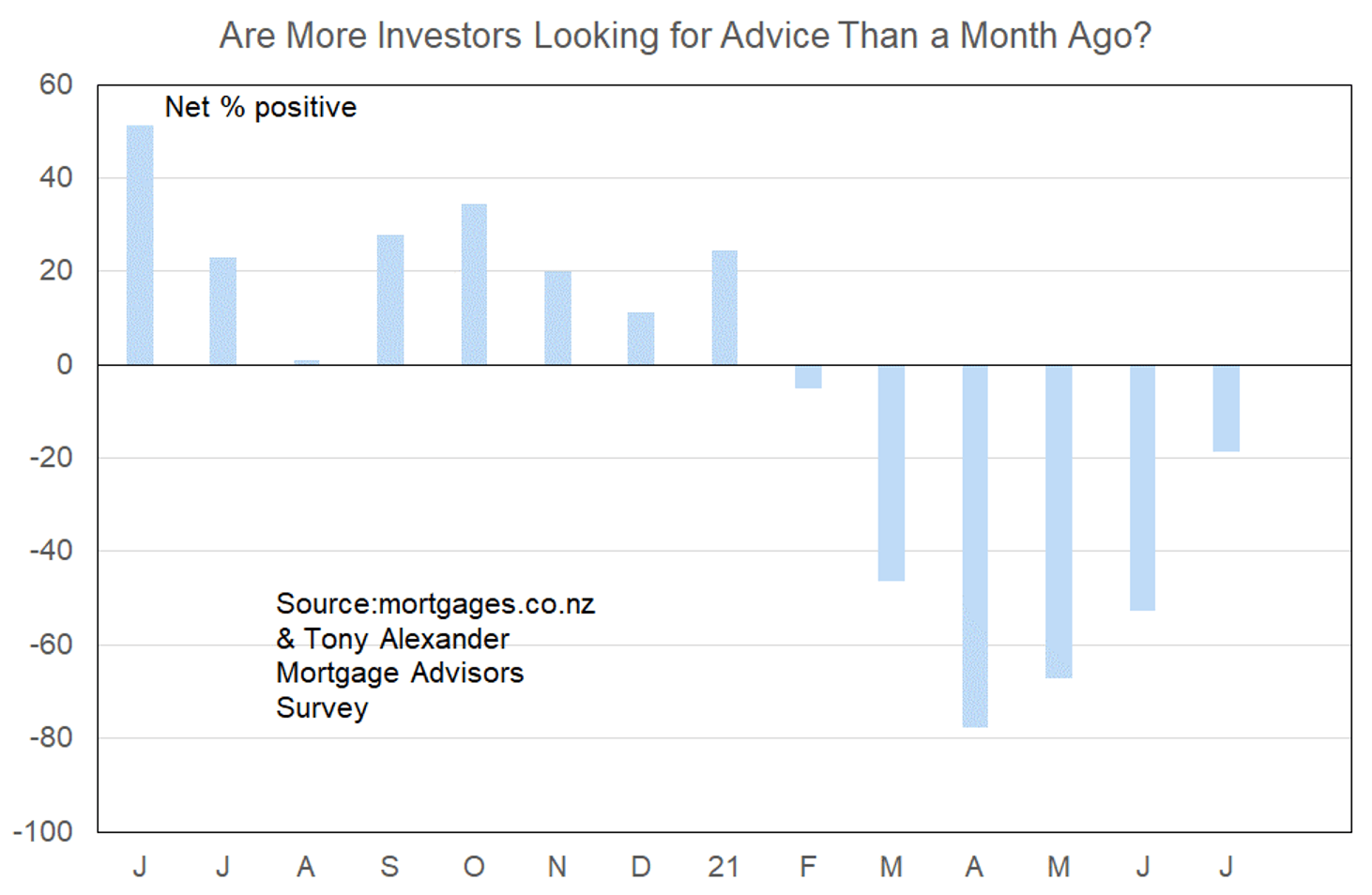

More or less investors looking for mortgage advice?

A net 19% of mortgage advisors this month have reported that they are seeing fewer investors coming forward. This negative result is commensurate with overall caution in the country’s residential real estate market. However, this net 19% negative result is the least weak outcome recorded for investors in five months, as seen clearly in the graph.

This tells us that the shock effects of the Loan to Value Ratio rules returning in February and the tax changes announced on March 23 are passing. Perhaps most noteworthy is that our survey fully encompasses a period when mortgage rates have been increased by lenders and when further rises are being commonly discussed and expected over the coming one to two years.

From this we can broadly conclude that expectations of borrowing cost increases are not having a noticeably negative impact on the willingness of investors to make a property purchase. This is the first indication from all of our surveys as to how rate rises may impact the property market and it will be interesting to slot this preliminary result alongside the others to come in the next few weeks.

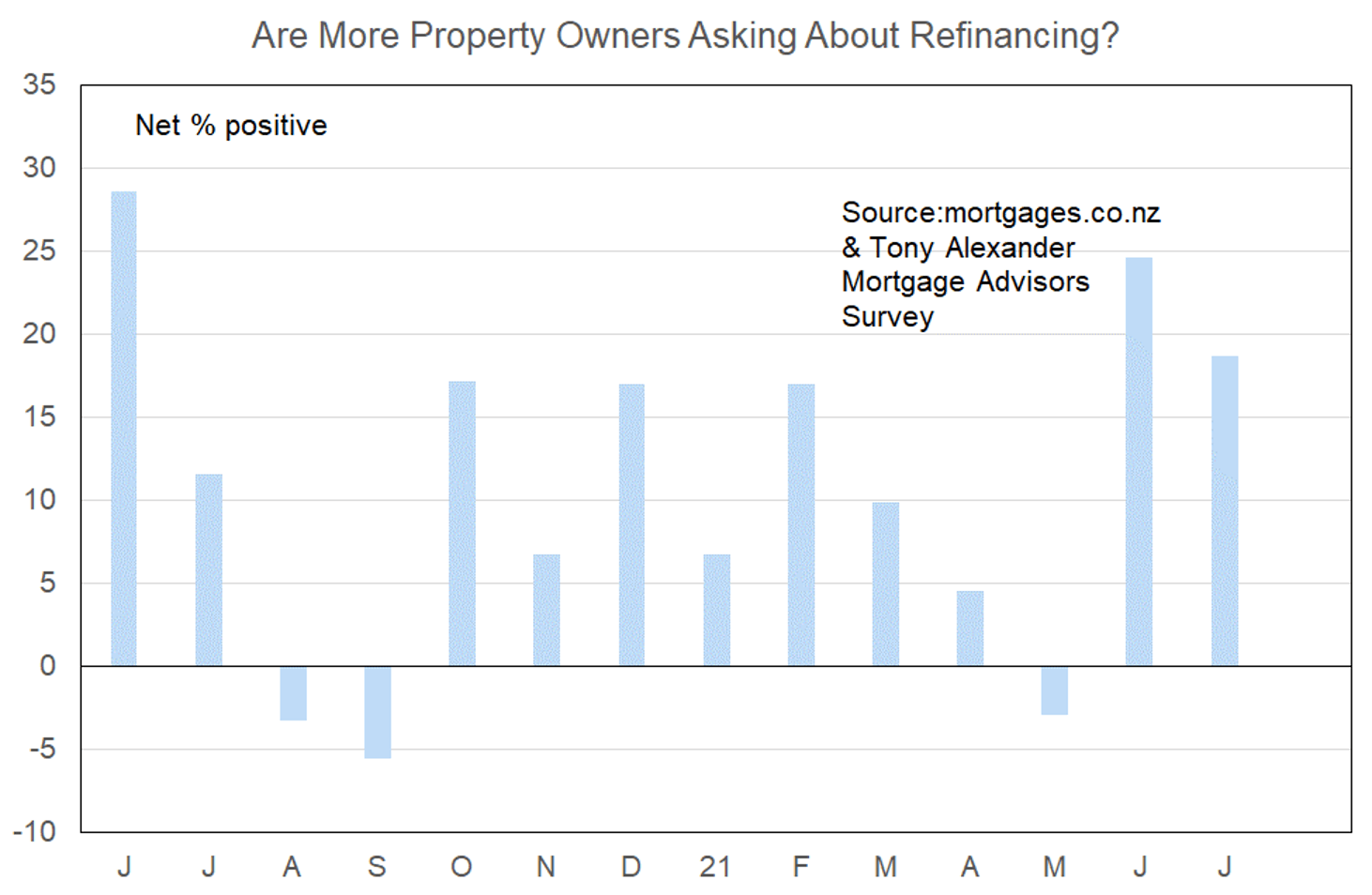

More or less property owners looking for refinancing?

Last month we reported on a sizeable jump in the net proportion of mortgage advisors seeing more people stepping forward with enquiries about refinancing. This jump has been validated this month with only a small reduction in this measure to a net 19% from a net 25% last month.

Some of the lift in mortgage refinancing enquiries will reflect a desire to spend from higher paper wealth resulting from the sharp jump in house prices over the past year. Some will reflect shifting around of debt in response to tax changes.

Some will reflect anticipation of higher mortgage rates encouraging people to think about their mortgage structures. Had this measure not jumped to 25% in June we would have attributed this month’s 19% result almost entirely to discussions about interest rates going up following the higher-than-expected inflation rate for the June quarter.

But this inflation and interest rates effect may not be all that large and that reinforces the result from the previous question showing fewer investors backing away from the property market.

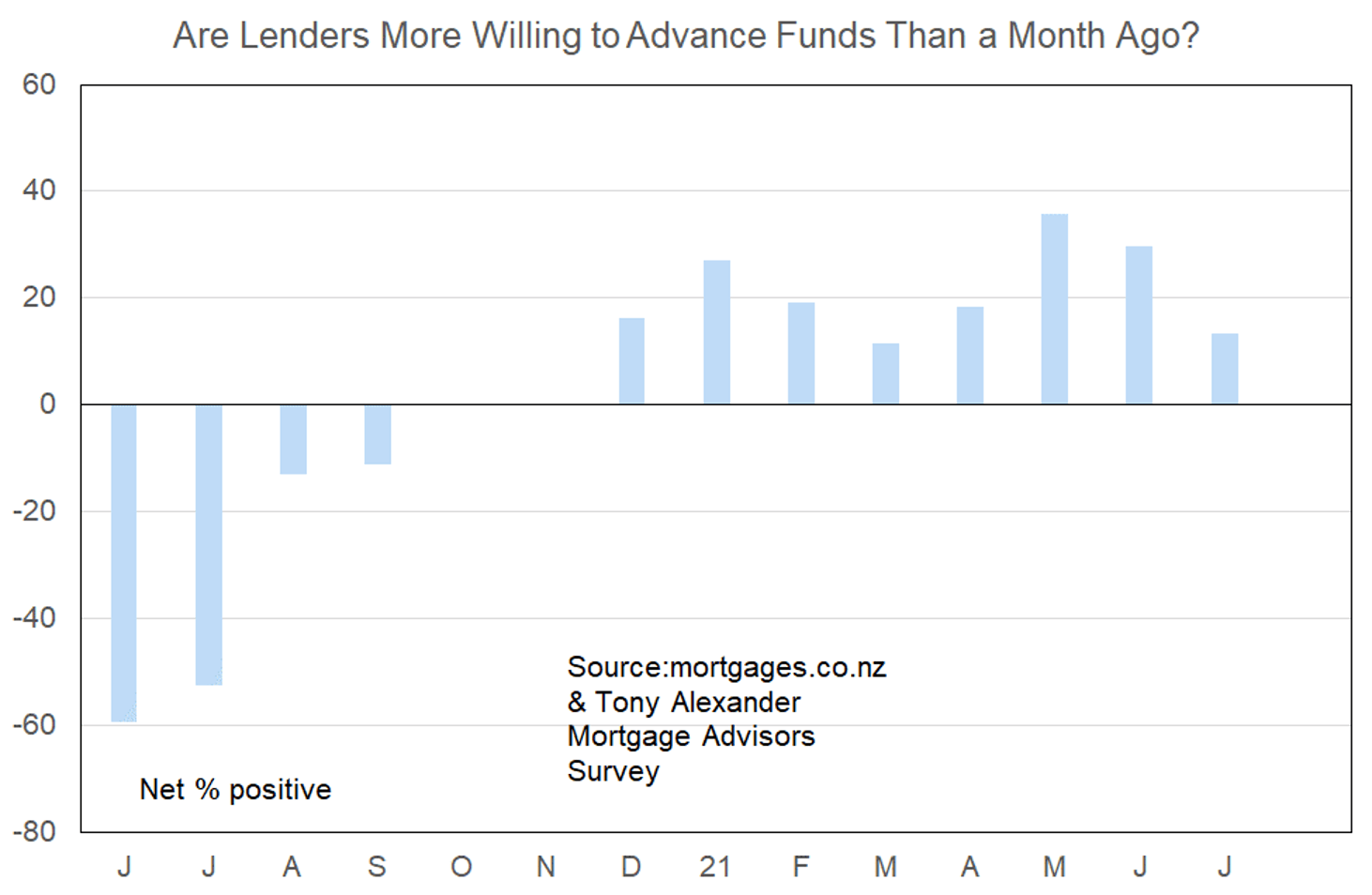

More or less lenders willing to advance funds?

The improving state of the NZ economy is likely accounting for the positive reading overall which is given to the direction of change in bank willingness to lend that advisors are noting. But perhaps the extra emphasis on debt servicing associated with rising mortgage rates and increasing discussion and application by some banks of DTIs (debt to income ratios) is becoming more important.

What time period are most people looking at fixing their interest rate?

Two weeks ago the June quarter inflation outcome was revealed to be 0.5% higher than market expectations. Bank wholesale borrowing costs spiked higher as expectations for when the Reserve Bank would tighten monetary policy shifted from late this year to as early as next month.

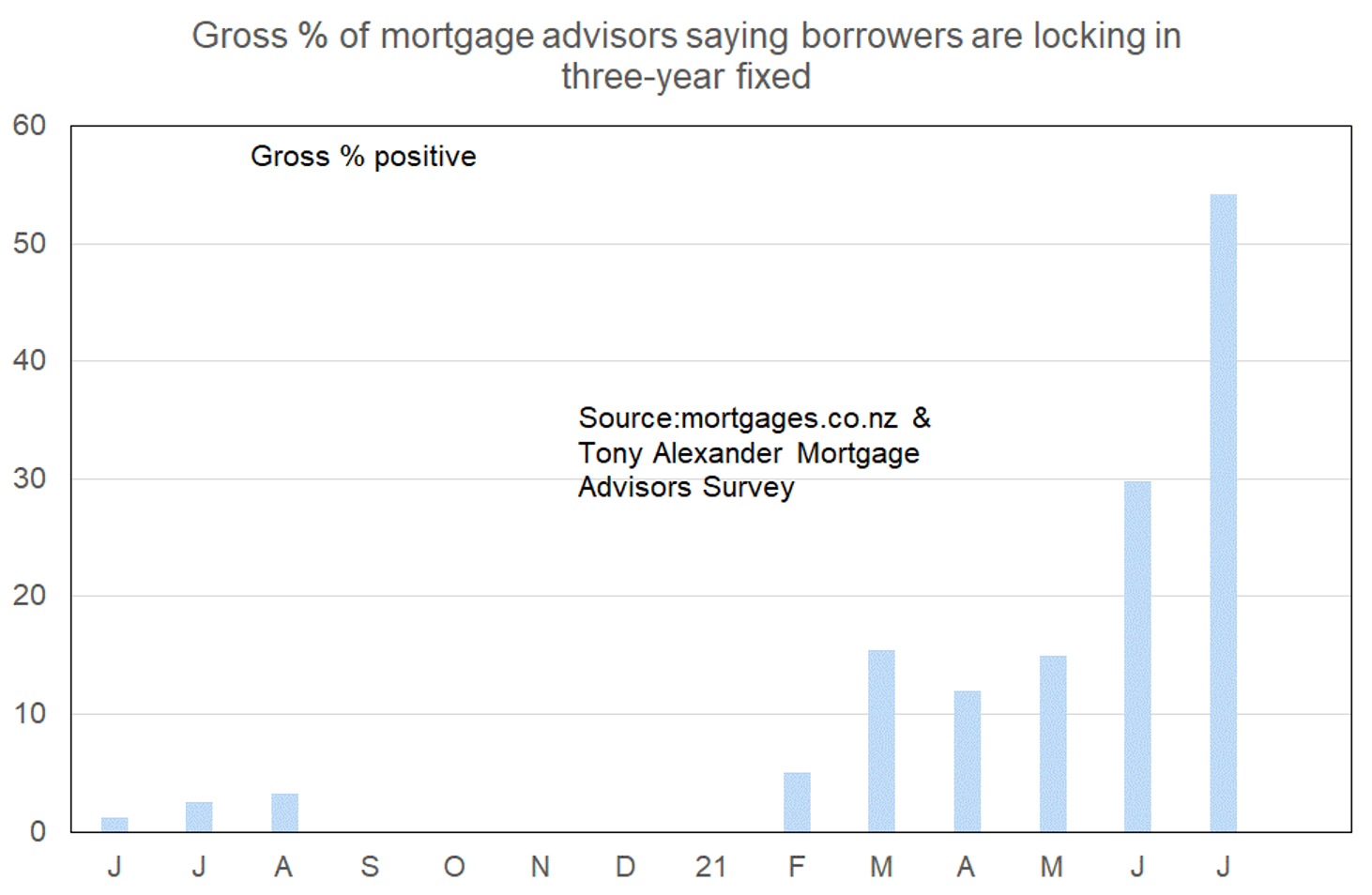

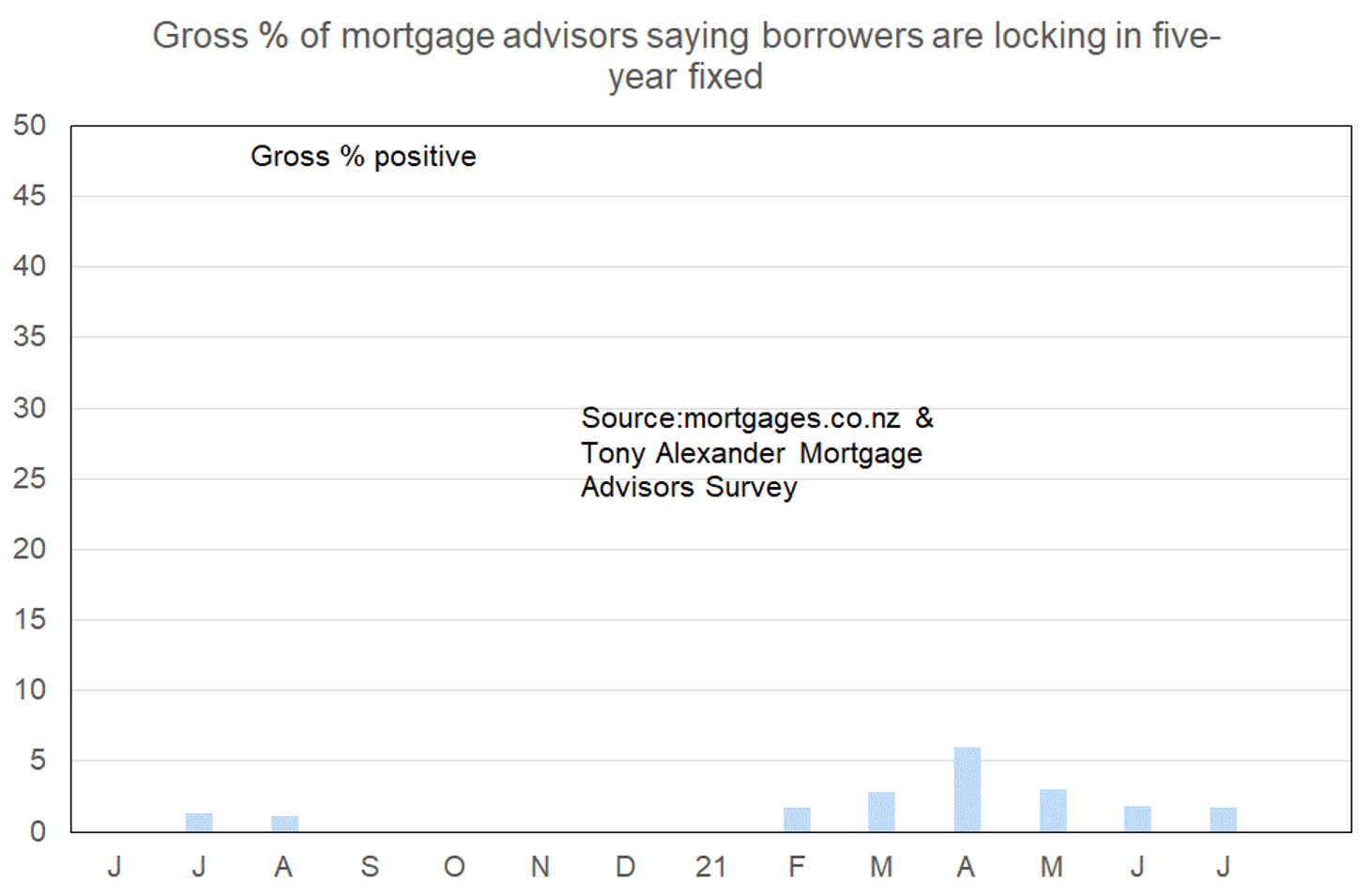

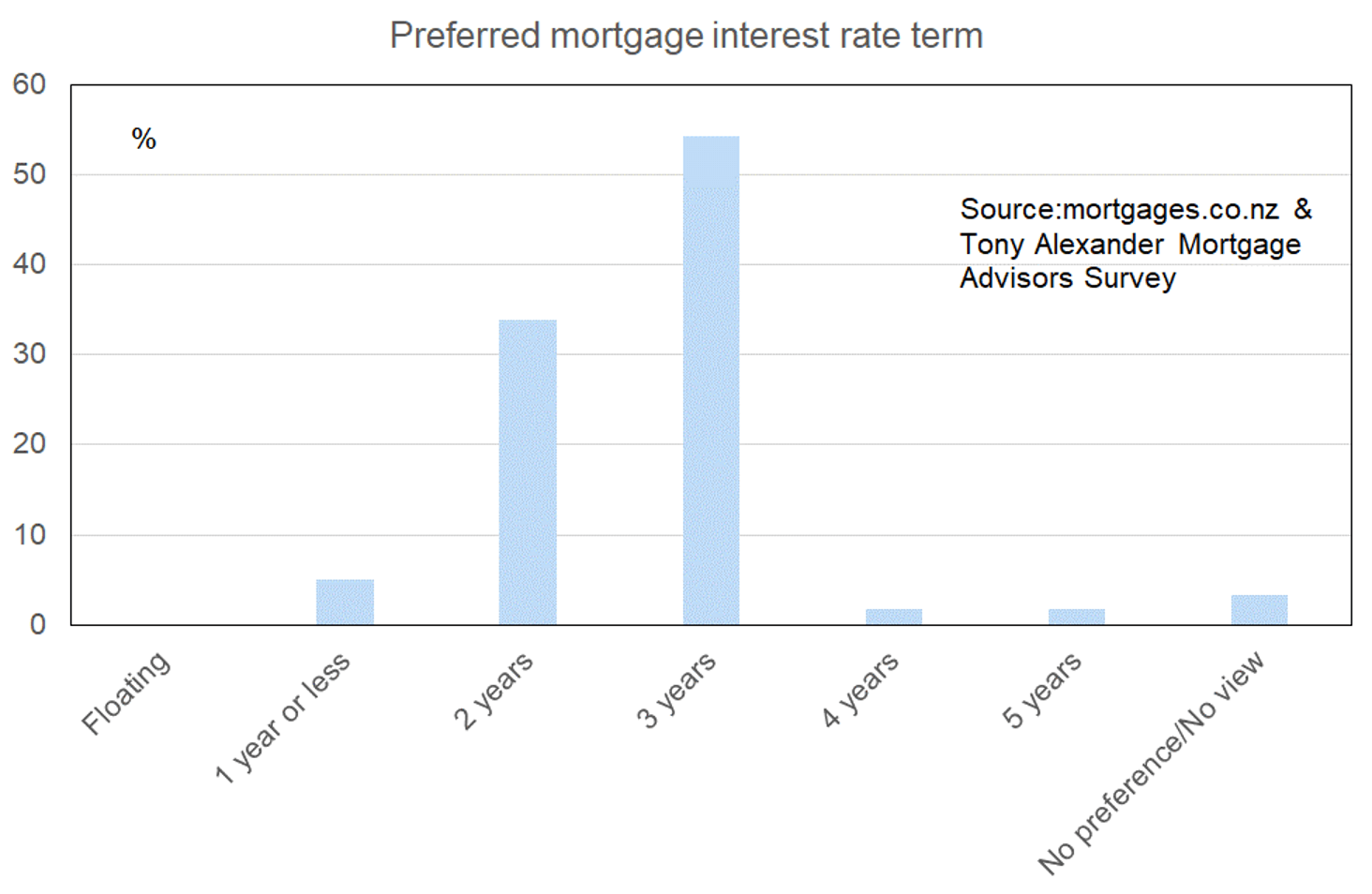

A round of increases in fixed mortgage interest rates has occurred and we have seen a clear shift in people’s term preference as they consider forecasts of rates going upward.

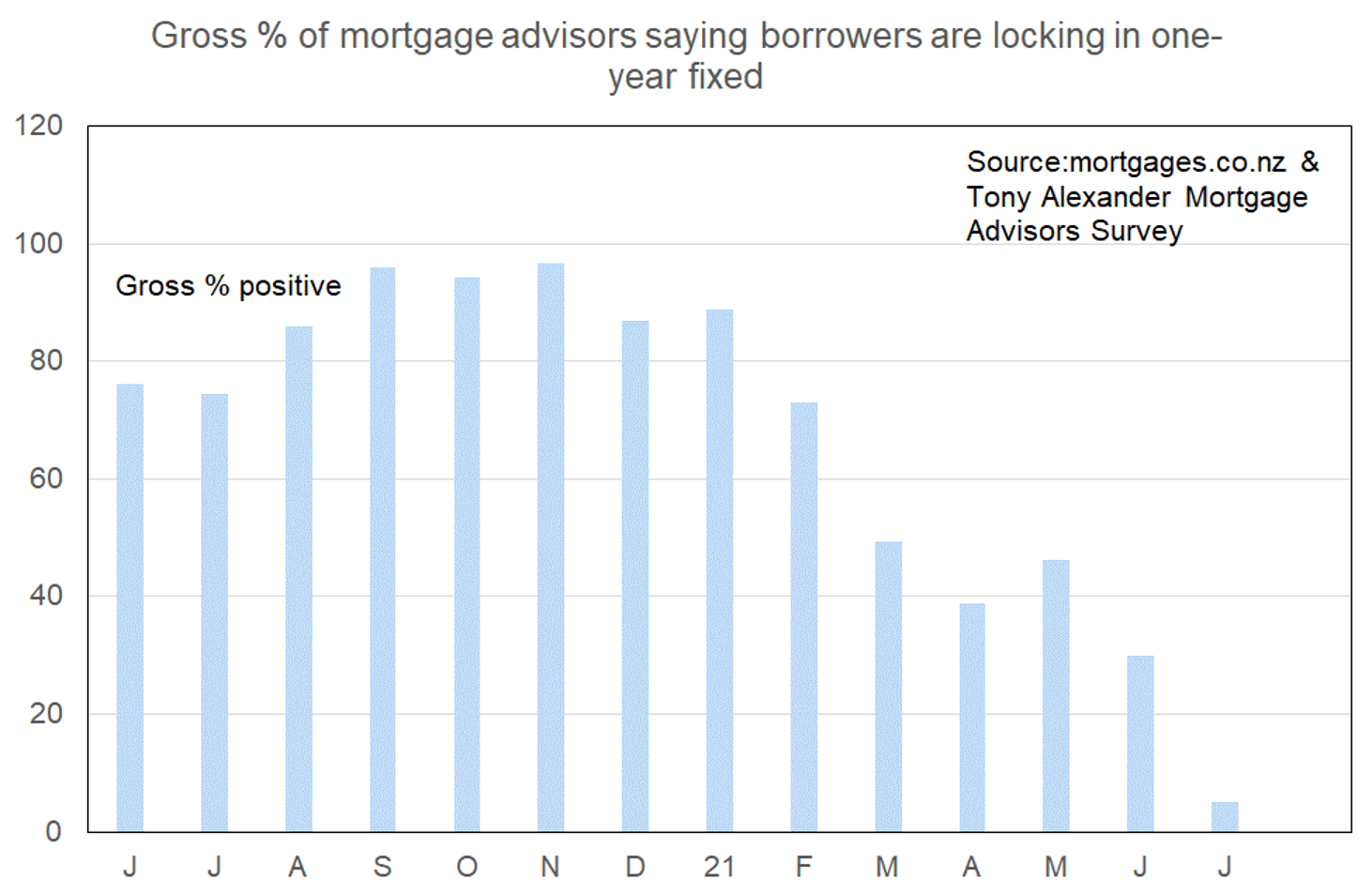

In February 73% of mortgage advisors said that buyers preferred the one-year rate. Come April that proportion fell to 39%, last month it was 30%, and this month only 5% of agents rated the one-year term as most preferred.

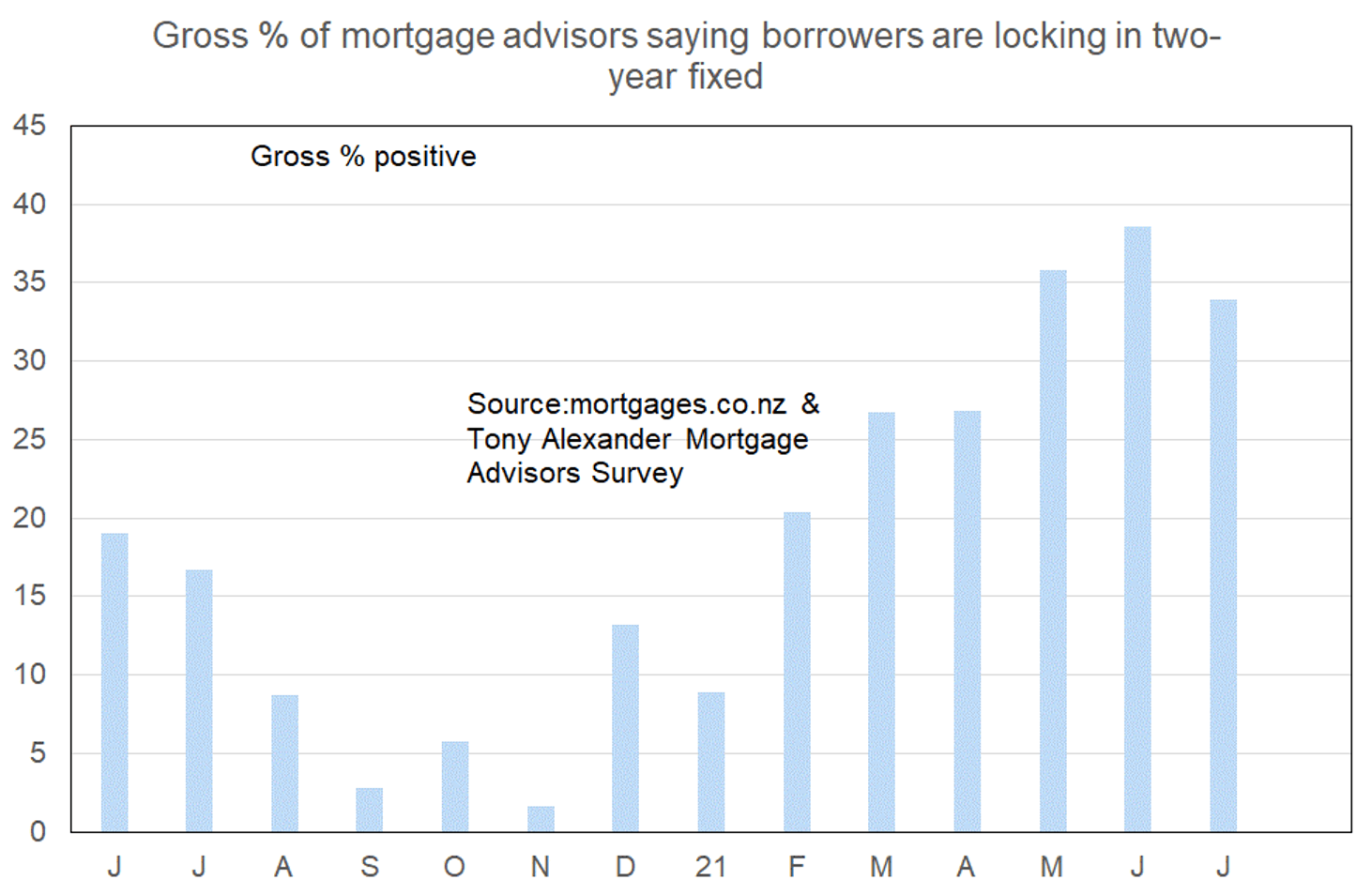

In recent months as people have moved away from fixing one-year there has been a firm shift towards the two-year term. But this month that preference has declined slightly.