Many people find themselves in retirement with less money than they expected, or a cost of living that’s way more than they imagined. They’ve worked hard for decades and paid off the mortgage, or very nearly, but for all sorts of reasons their retirement savings are a bit light. Their superannuation barely covers the basic necessities and, like many retired New Zealanders, they’re either constantly worried about money or simply unable to live the way they planned.

Apart from toughing it out, the only option seems to be to sell up and downsize or move to a more affordable part of the country. But they didn’t work all those years to end up struggling every day, plus they love their home and enjoy being close to friends and family.

Stay in your home and use it to fund a better retirement

If this sounds something like your situation, there may be a better way. There’s a type of mortgage that lets you borrow against some of the value in your home, without having to sell or even make repayments until you’re ready to move into full-time care or you pass away.

Known as reverse mortgages, they’ve become increasingly popular with seniors in New Zealand, who are using them for all sorts of reasons. For some, it simply means they can stay in their home and enjoy a modest but worry-free lifestyle. Others have used a reverse mortgage to buy a reliable new car, pay off other debt, complete home renovations, help out family, travel or even knock off their top bucket-list dream while they still can.

This guide is designed to help you understand more about the basics of reverse mortgages. It explains how they work and lists the main advantages and disadvantages. It also provides more detailed examples of how some people use them to fund a better retirement.

But a reverse mortgage is a big financial step and definitely not for everyone. If you think it might be just what you need, be sure to seek independent advice from your accountant or solicitor before signing up for anything. Most lenders require you to receive independent legal advice before taking out a reverse mortgage.

How does a reverse mortgage work?

No repayments, but what you owe steadily grows

Reverse mortgages have a variable interest rate

A reverse mortgage is repaid when you sell

You need to be mortgage-free or close to it

You must keep your home well maintained

The older you are the more you can borrow

The amount you can borrow with a reverse mortgage depends on the age of the youngest borrower, if there’s more than one. It’s always a percentage of your home’s value at the time you take out the mortgage; typically, it ranges from 20% for a 60 year old to 50% for a 90 year old. This is because the loan will grow over time, with the compounding interest charges, and the lender needs to be sure they can recover the amount owing when your home is eventually sold.

Most lenders also have a minimum loan amount. The minimum is typically around $5,000.

Standard mortgage vs reverse mortgage

| Standard mortgage | Reverse mortgage | |

|---|---|---|

| Eligibility depends on | Whether you’re able to repay the loan. | Whether you’re at least 60 years old and own a residential property in an acceptable location (typically in a city or town). |

| Initial loan is based on | Your income and the property‘s value. | Your age and the property’s value. |

| Balance owing | Reduces as you make regular principal and interest payments. | Increases as monthly interest payments are added to the loan and compound. |

| Mortgage ends | When you repay it in full. | If you choose to repay the current balance at any time, or if you sell, move out or pass away, then the final balance is repaid from the sale and the remainder, (less any fees and charges) is paid to you or your estate. |

A reverse mortgage example

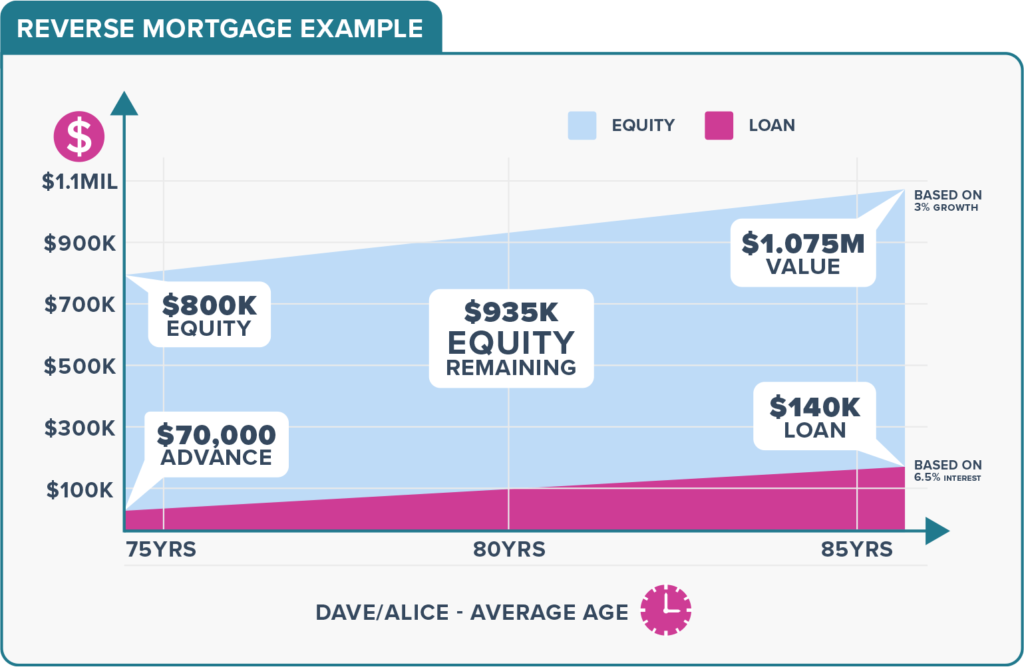

Here’s a fictional example of how a couple might use a reverse mortgage. The calculations are accurate, based on the assumptions made. However, given the future is impossible to predict and reverse mortgages have a variable interest rate, it can only be an approximate example of how a reverse mortgage might work.

Dave and Alice moved to the seaside town of Tairua about 10 years ago, when they stopped working full-time. They bought a modest house without needing a mortgage and it’s now valued at $800,000. Dave is now 77 and Alice is 75. They still love their home, but it needs a new roof and they want to get some renovations done to make things easier when their children and grandchildren come to stay. They’d also like a newer, more reliable car for road trips.

Dave and Alice looked into a reverse mortgage and, based on the home’s value and Alice’s age, found they could borrow up to $240,000. They decided that $70,000 would be enough. Although the reverse mortgage variable interest rate was 5.95% at the time, they ran the calculations on a steady 6.5% to allow for potential increases in the future. They also kept the property value growth to a conservative 3% per year.

Looking ahead, Dave and Alice feel they may need to sell and move into a retirement village in about 10 years’ time, when Alice is 85. If that’s the case, their reverse mortgage will have grown to just under $140,000, due to the compounding interest. Ignoring the value added by the renovations, their home would be worth about $1,075,000. That would leave them around $935,000, less any selling costs, to fund the next stage of their retirement.

Advantages and disadvantages of a reverse mortgage

Advantages

- You keep your home – a reverse mortgage lets you access some of the money tied up in your home, without having to sell up and leave town or move to a smaller property.

- Benefit from house price growth – as you continue to own your home you will benefit from any house price increase.

- No regular payments – unlike normal mortgages, a reverse mortgage has no regular payments. The monthly interest charges are simply added to your loan.

- No early repayment penalty – you’re free to repay some or all of a reverse mortgage whenever it suits, without paying a penalty.

- Use the loan as you wish – the money you borrow with a reverse mortgage can be used for pretty much anything and you can borrow more in the future up to the agreed limit (lender may have restrictions on certain purposes such as gifting or investment).

- Never owe more than your home is worth – most lenders provide a no negative equity guarantee. So, even if house prices fall dramatically and interest rates rocket up, you’ll never have to repay more than your house eventually sells for.

- Multiple drawdown options – you can borrow money upfront in the initial lump sum, via a regular monthly advance or have some set aside for future needs in a line of credit.

- Choose how much you have at the end – some lenders offer an equity protection option. This lets you set a minimum amount you want to have paid out when your home is eventually sold. Of course, the higher it is, the less you can borrow, but it can give you extra peace of mind.

Disadvantages

- Higher interest rate – a reverse mortgage typically has a higher interest rate than normal mortgages. It’s also a variable interest rate, which can increase or decrease with market rates.

- Your loan grows at an increasing rate – the monthly interest charges are added to your loan, increasing the balance and, therefore the interest charged the following month, with a compounding effect. If you keep the mortgage for 10 or 20 years the total interest charged can be quite substantial.

- There’s a limit to how much you can borrow – you can only borrow some of your home’s value at the time and the limit depends on your age. At 65 you can typically borrow up to 25% of your home’s value; this increases steadily to 50% at age 90.

Frequently asked questions about reverse mortgages

The lender will normally ask a registered valuer to visit your home to report on its value and condition. You will be charged for this, but most lenders will give you a choice of paying when you apply or adding the cost to the final charges when you eventually sell and repay your loan.

Usually, there are no regular repayments required with a reverse mortgage. The amount owing – including accumulated interest, fees and charges – doesn’t have to be repaid until you permanently leave your home. This would normally be when you downsize, move into long-term care or the sole remaining borrower passes away. The proceeds from selling your home are used to repay the balance owing, plus any final fees or charges. The remainder is then paid to you or your estate.

Reverse mortgages are designed to provide long-term finance for seniors who are no longer able to make the regular repayments of a normal mortgage. However, you still have the option to make lump sum repayments or repay the full amount owing whenever you choose, without an early repayment penalty.

This is unlikely, but it will depend on your circumstances. Before getting a reverse mortgage you should always consult your lawyer. This includes discussing the possible impacts on government payments you may receive. You can also check with Work and Income; to find out more visit workandincome.govt.nz