Cashflow strain from higher house prices

House prices across the Auckland region, for example, have skyrocketed since the last round of valuations were completed in 2017, with Rodney, Papakura and Franklin all up over 50%, Manukau up 47.7%, Waitakere +45.2%, North Shore +38.4%, while Auckland City was up ‘just’ 31.6%.

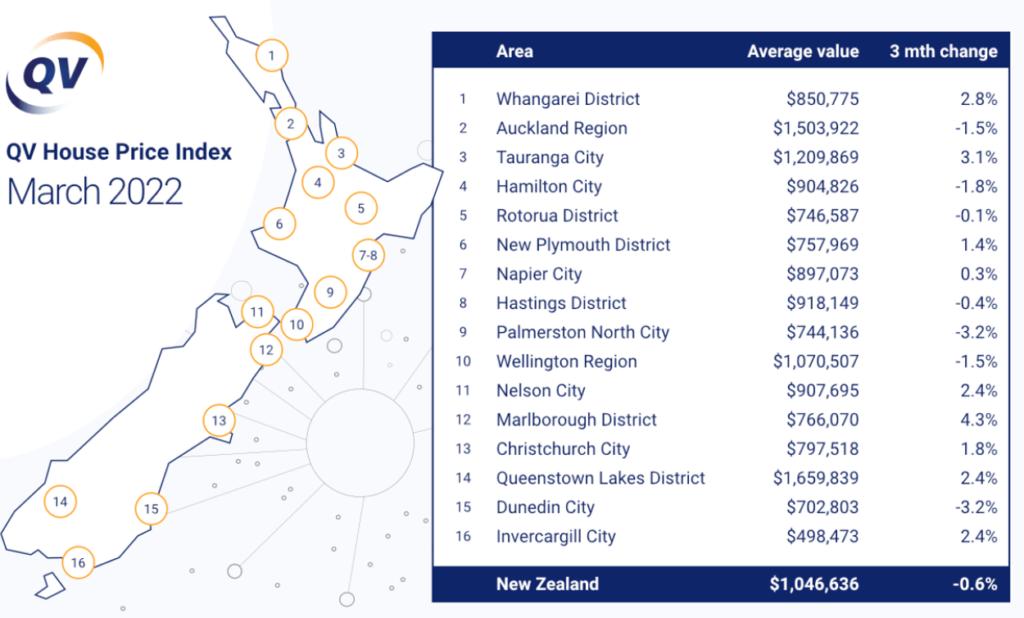

The most recent Auckland valuations are as at 1 June 2021. With house price growth having stalled and some regions even in decline (refer to the QV House Price Index below), this may end up being the peak of the property market. Regardless, local councils use these values to calculate rates, which are spent on local services like libraries, pools, parks and recreation, roads and footpaths, along with council operating costs. Most councils also have targeted levies or separate charges for things like rubbish, water and even climate change.

The increase in rates is not directly proportionate to the increase in property value, but it does have a relative impact.

QV house price index - March 2022

Council rates going higher

Almost all council rates are going up, though the impact will vary across different regions. Cities like Tauranga, for example, may see a 13.7% increase in rates, whereas Christchurch will see a 4.9% increase. Auckland rates are increasing by 3.5%, however when combined with the Climate Action Targeted Rate the increase is closer to 6%. The changes are not uniform, with some suburbs facing a double digit increase in rates.

When combined with surging inflation, which is expected to exceed 7%, the higher rates will put a strain on many Kiwi household budgets, particularly for those on lower incomes.

Tough on retirees

One group who is particularly affected is retirees who are living off New Zealand Super alone. A retiree living alone receives $925.88 fortnightly (after tax) from NZ Super, while a couple receives $1,424.44 in total fortnightly. Even before the increase in council rates and rampant inflation, budgets were under pressure with data from the November 2021 New Zealand Retirement Expenditure Guidelines estimating a couple living in a major city would need $1,729.88 per fortnight for a ‘no frills’ lifestyle, or $2,940.52 per fortnight for a comfortable lifestyle with more luxuries.

There is a solution

The good news for home-owning retirees is that they have options. They are likely to have built up significant equity and can access this by downsizing or through a reverse mortgage. A reverse mortgage enables over 60-year-old homeowners access to money tied up in their home, without having to sell it or make regular repayments. The product’s thorough application process ensures customers make an informed decision, and offers considerable protection including a lifetime occupancy guarantee and a no negative equity guarantee to provide extra peace of mind.

With options available, aging homeowners should take the time to seek advice on what will best meet their needs. The last thing anyone wants to be doing in retirement is worrying about how to make ends meet.

Heartland Bank Limited’s responsible lending criteria, terms, fees and conditions apply. Data in this article is sourced from Quotable Value (QV), the Auckland, Tauranga and Christchurch council website, the Work and Income website, and the New Zealand Retirement Expenditure Guidelines 2021.

Andrew Ford

Andrew is General Manager – Retail and Reverse Mortgages at Heartland Bank. The teams he leads support Heartland’s market leading products by providing customers with exceptional service. Heartland is the leading reverse mortgage provider in New Zealand and Australia.

Read more »