Capital Values, Rateable Values, CVs, RVs are all terms for the three-yearly (usually) assessment of a property’s value and are used by local councils to help apportion the rates in their area. These are especially relevant right now, with new CVs being released by Auckland Council last month, the first time since 2017.

There are a few things to remember:

- CVs are an estimate of the “most likely selling price” at a point time only and can quickly become out of date. Their primary purpose is to apportion rates, not provide an indication of market value.

- Take note of the reassessment date. For Auckland, the reassessment date was June 2021 and the CV reflects the market value at that date, not the date when they were made publicly available.

- Relax – A 30% increase in your CV does not mean your annual rates will increase by 30%. What’s more important is how much your CV increased relative to other properties in the area.

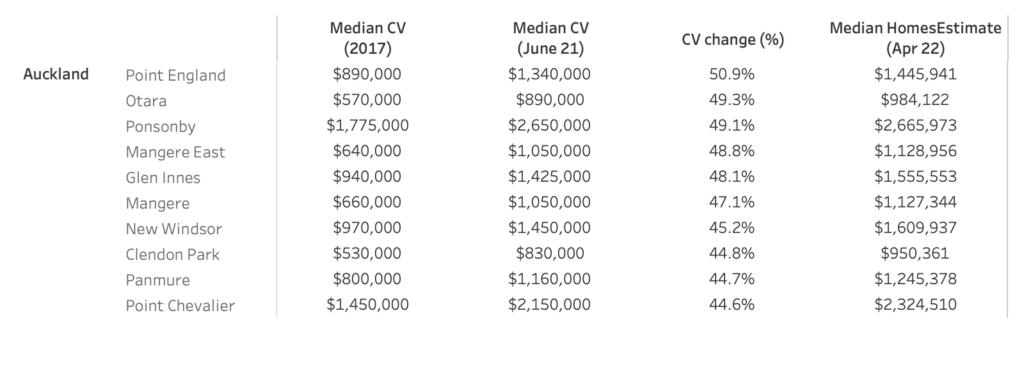

The suburb with the highest CV increase was Point England where the median CV increased by 50.9%. It’s interesting to see the CVs in Ponsonby also increasing by 49%. Being one of the city’s most expensive suburbs means that the absolute increase in CVs (in $ terms) was also one of the highest; from $1.78M to $2.65M.

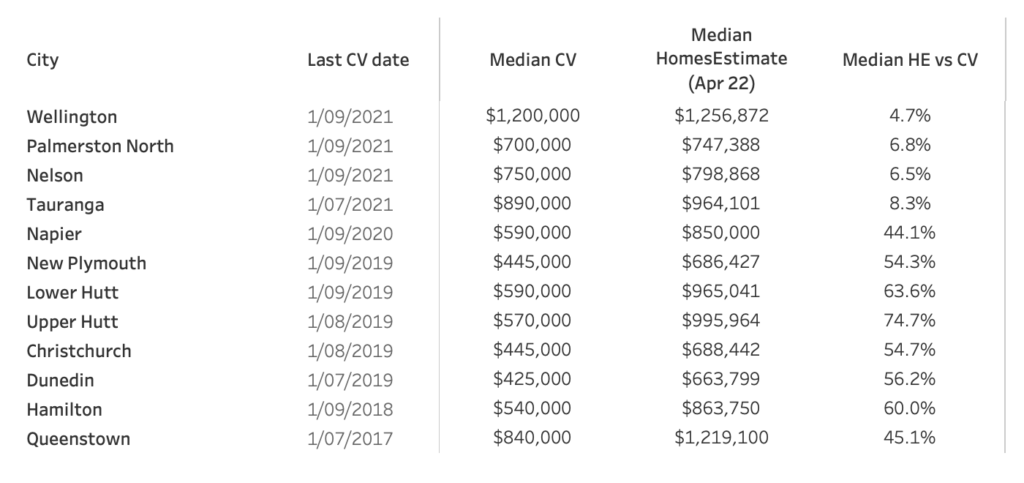

Another question is how relevant are the CVs in other parts of the country? The table below shows the median CV at the last reassessment date and illustrates how far the market has moved since then. You can see the difference between the current market values and the last CVs increasing as they become further and further out of date. For those in Queenstown, you’re next and should expect a public notice of your new revaluations this month.

So how much weight do we point on the CVs? They’re great at the date of the reassessment but for a more accurate and up-to-date estimate of a property’s value, we suggest using homes.co.nz’s HomesEstimates. These are calculated each fortnight using up-to-date sales information and track trends in your area.

Monthly Property Update

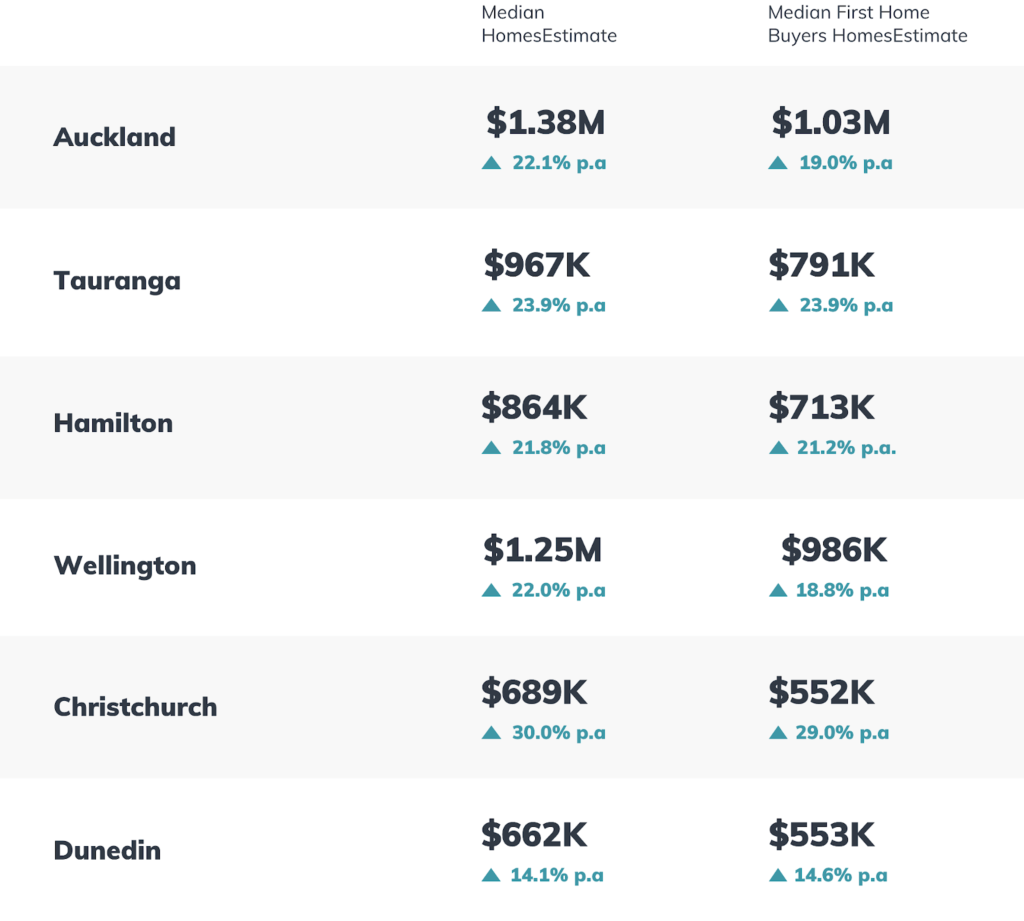

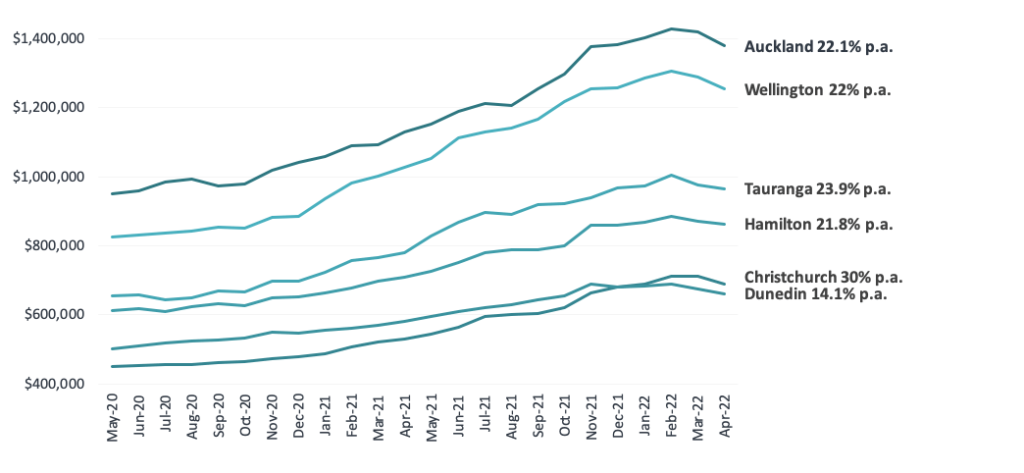

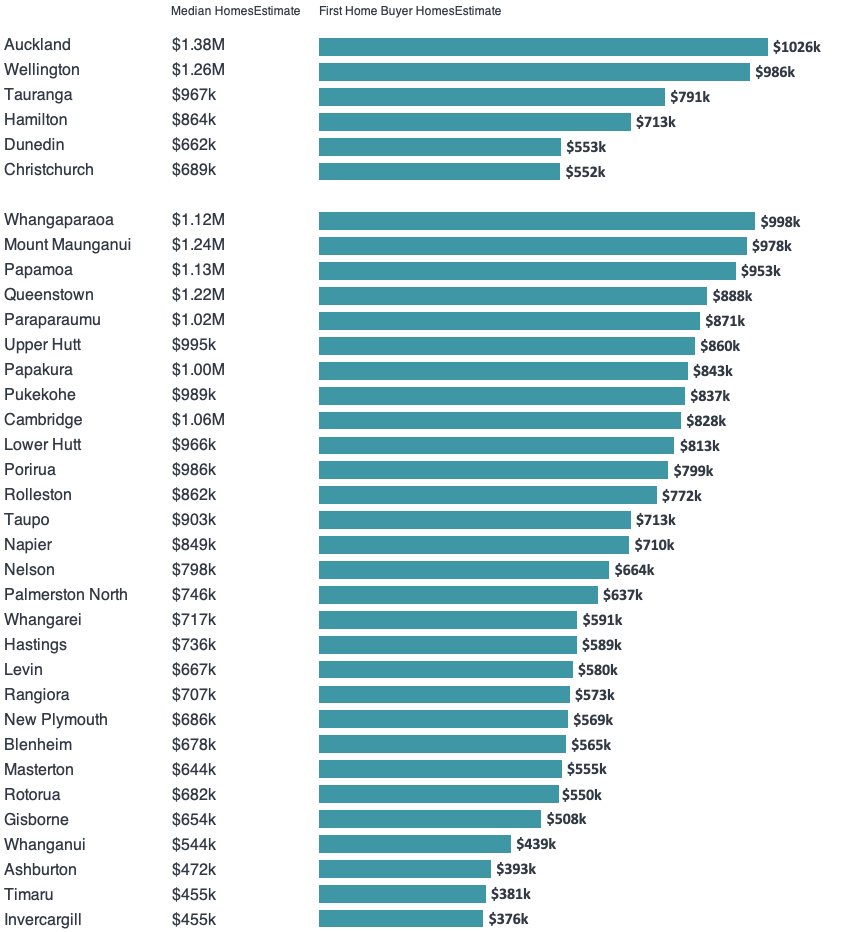

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s April 2022 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

Monthly Property Report

Content supplied courtesy of The Data Team - homes.co.nz (Tom Lintern - Chief Data Scientist). The homes.co.nz website is built on the promise of free property information for every region in New Zealand. Visit today to understand estimated prices, find properties to buy, and do essential research before going to an auction or making an offer.