During the Covid-19 pandemic, we saw the Reserve Bank lower the OCR to help alleviate some of the inevitable pain felt by homeowners and businesses struggling to service their debt.

During this time, we saw interest rates plunge to record lows of around 2% – and this had a knock on effect that saw more people entering the property market. We saw both demand and house prices soaring in 2021. Alongside this, inflation also began to jump, reaching 7.2% in mid 2022.

The Reserve Bank’s target inflation rate is between 1%-3% so they had to take action to slow the rate of inflation. The Monetary Policy Committee review the OCR 7 times a year, and in 2022 we saw it steadily rise from 1.0% to 4.5%

What does 2023 have in store?

While there was some hope that inflation might decline at the end of 2022, it remained stubbornly high and the Reserve Bank is anticipating that it will remain so, perhaps going as high as 7.5% in the next quarterly Consumer Price Index due in April.

In late February, we saw the Reserve Bank increase the OCR again, by 0.5pts, not the 0.75pts earlier predicted, taking the current rate to 4.75%. Governor Adrian Orr decided to ease off slightly but made it clear that more interest rate rises should be expected in the coming months barring any extraordinary factors.

The central bank’s end plan is that the OCR will be sitting at 5.5% by around July, says CoreLogic chief property economist, Kelvin Davidson.

At the same time house prices are expected to continue to fall this year. Independent economist Cameron Bagrie doesn’t think the bottom of the market will hit until the investors return and Kelvin doesn’t think that will happen til the end of the year.

Investors are facing increasing costs of running a property, for instance insurance and rates so the numbers don’t stack up for them at the moment, says Cameron.

What does this mean for homeowners?

While there are more OCR rises to come, mortgage holders don’t necessarily have to fear these because the markets and banks have already factored these increases into their planning, says Kelvin. So just as mortgage holders didn’t see mortgage rates go up in the February 2023 OCR rise, they shouldn’t see them go up with the subsequent OCR rises expected until July, he says.

Banks, explains Loan Market’s Bruce Patten, are taking “a bit of the hurt” from OCR rises from customers which is what the Reserve Bank asked for.

Banks like to write business and they’re not writing a lot of business at the moment, says Cameron. BNZ has recently dropped 1 year rates to 4.99% for a period to chase for more market share which was good news for new home buyers.

Some might expect OCR rates to come down after the 5.5% peak is reached but Cameron says this is unlikely, so mortgage holders shouldn’t have that expectation when they’re deciding what term to refix at.

According to Kelvin, in the next year half of all mortgages will refix, for homeowners at various stages of their loan terms. For people on a 1 year term they may have already refixed from 2% to 4.5% last year, and will now go up to 6.5% but they have started their adjustments and they’ve still got their jobs, he notes.

Homeowners are typically taking fixed mortgage terms of 12 to 18 months in the current market paying an average of 5.99% interest, says Bruce. For some who bought in the last couple of years, their mortgage payments will be doubling. For instance, an Aucklander with a $1 million mortgage is going to see their payments go from $750 to $1300 weekly if they’re coming out of a 2.49% mortgage rate to a 6% one, and that’s just the interest.

Meanwhile for those who have owned a home for 5 plus years, around half have kept their mortgage payments at the 5% to 6% rate that they paid when they first bought so their total mortgage term may have shrunk for a few years, but is now expanding again. Still, they have made some good progress and saved themselves some money thanks to the low interest environment of the past few years.

And for those hoping to buy in 2023, the good news is there’s more certainty for borrowers and first home buyers, in greater numbers, are coming to the mortgage advisers with the intention to buy a home.

“First home buyers are taking action as prices start to come back,” says Bruce. They think now is a good time to buy because they’re not competing with investors or developers. And they’d be right.

This information is not intended as a complete guide, as it doesn’t consider your individual needs or financial situation. Homes.co.nz accepts no responsibility or liability for any inaccuracies or omissions in the content. Always obtain independent legal advice before buying or selling property.

Monthly Property Update

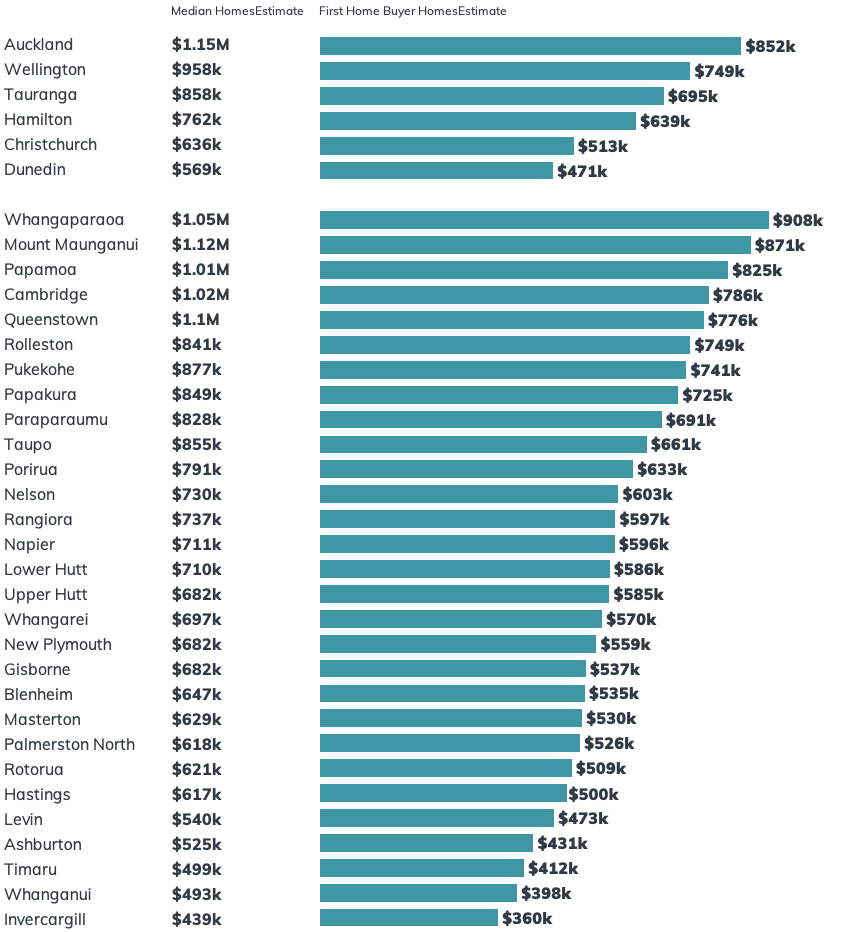

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s March 2023 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

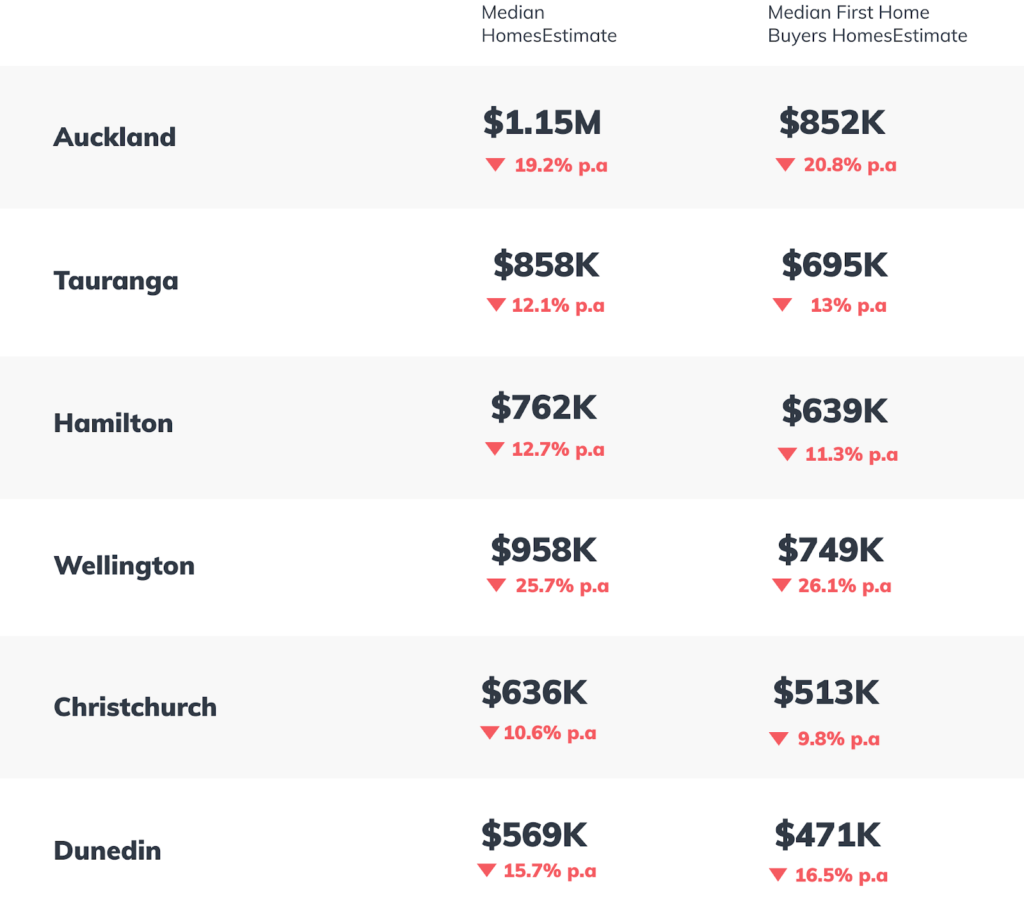

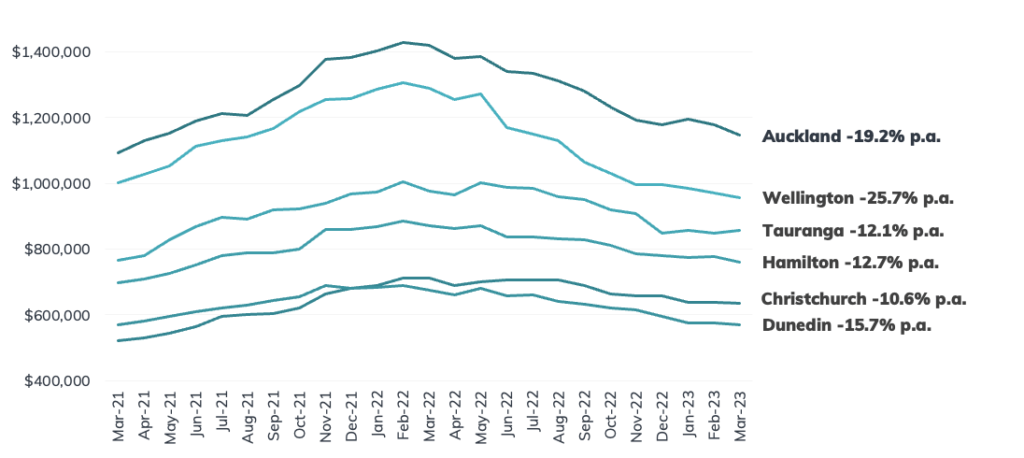

Trends in our Main Cities

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

NZ’s First Home Buyer HomesEstimate

Monthly Property Report

Content supplied courtesy of The homes.co.nz Data Team. The homes.co.nz website is built on the promise of free property information for every region in New Zealand. Visit today to understand estimated prices, find properties to buy, and do essential research before going to an auction or making an offer.