You may have noticed your HomesEstimate starting to decrease. The reason for this is the headwinds facing the property market are starting to be seen in homes.co.nz’s sales data and are now starting to impact homes.co.nz’s estimated values across the country. The headwinds include:

- Increasing interest rates resulting in higher mortgage servicing costs

- Tightened lending criteria resulting from changes to the Credit

- Contracts and Consumer Finance Act (CCCFA) making it harder to secure a new loan

- Tax rule changes for investors (removing interest deductibility and an increased bright line test)

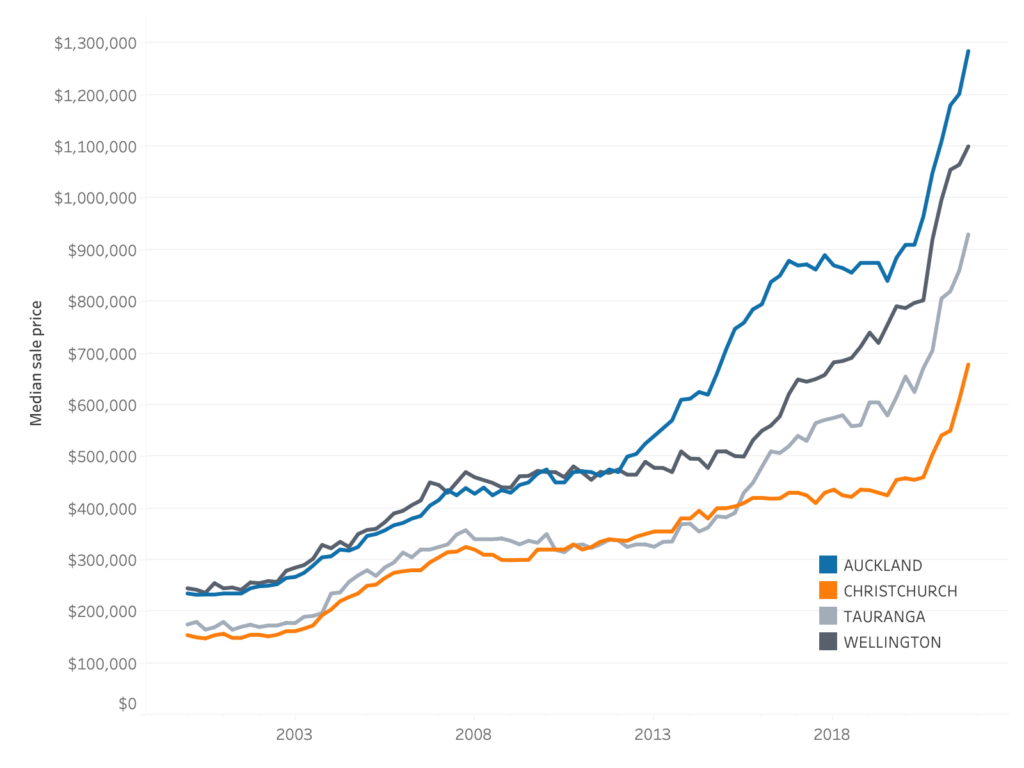

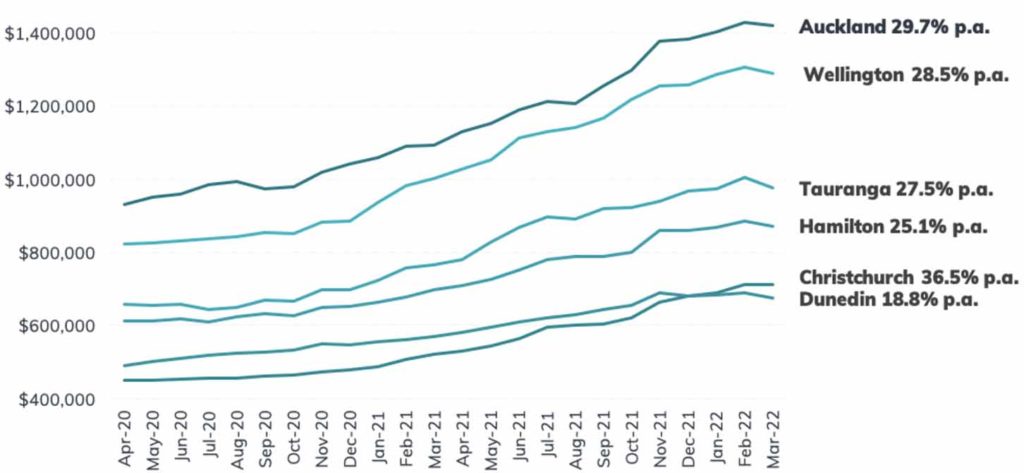

Although the trajectory above appears to still be heading up, we are seeing signs that we are transitioning into a plateau phase. From the sales available on homes.co.nz, we are seeing median sale prices in January decrease in most of our main centres. This market change has seen more auctions passing in and properties failing to sell. It is becoming evident that sellers are expecting prices to grow in a similar way to 2021, but buyers are not willing, and some unable to match these expectations.

Just as buyers and sellers are adapting to the market’s changes, so too is our automated valuation model (AVM) which is used to calculate homes.co.nz’s HomesEstimates.

We rely on new sales data as one of many inputs to our model, but this data can often take 2-3 months from the date of sale until we display it on homes.co.nz. This means we’re only just starting to see evidence of the phase change now, while our model is still expecting the price growth of 2021 to continue. However, as I noted at the beginning of this article, we’re starting to see the impact of recent data bringing our estimates into line with new market expectations.

Monthly Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s March 2022 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

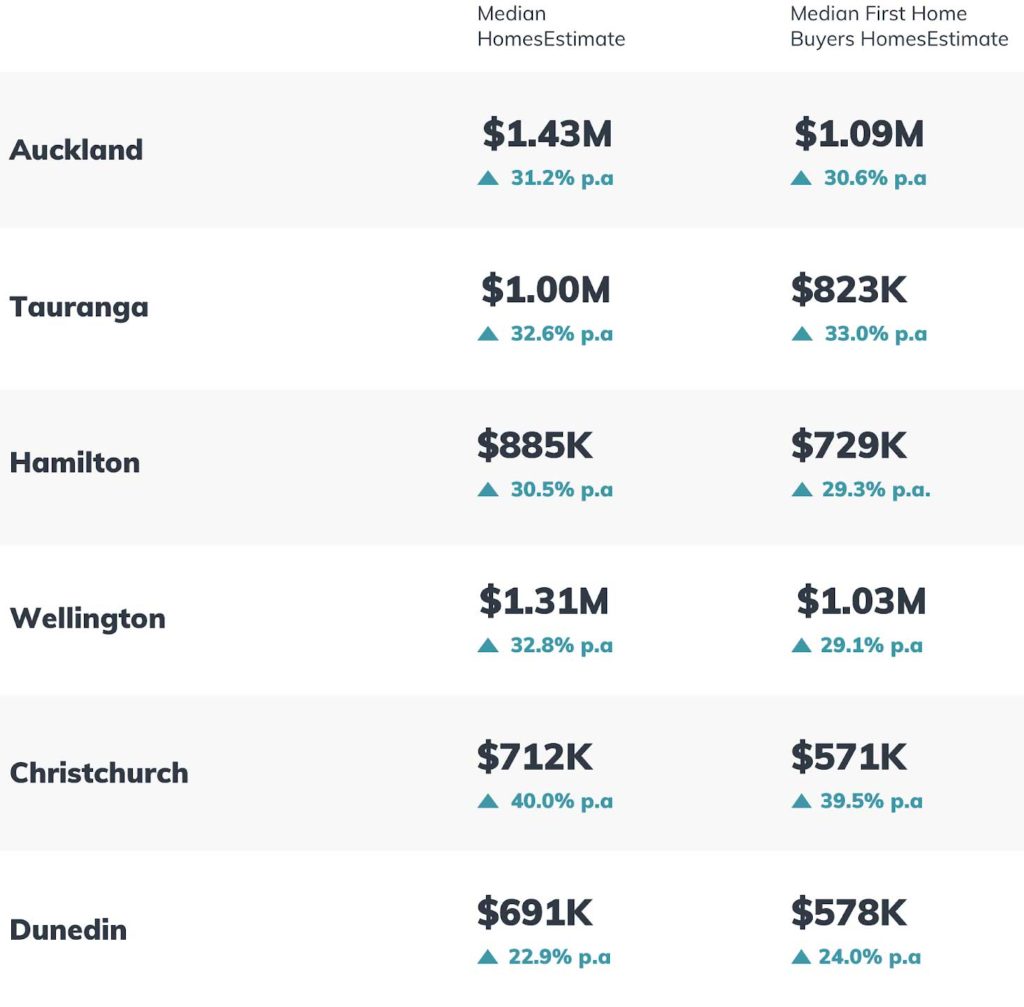

Trends in our Main Cities

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

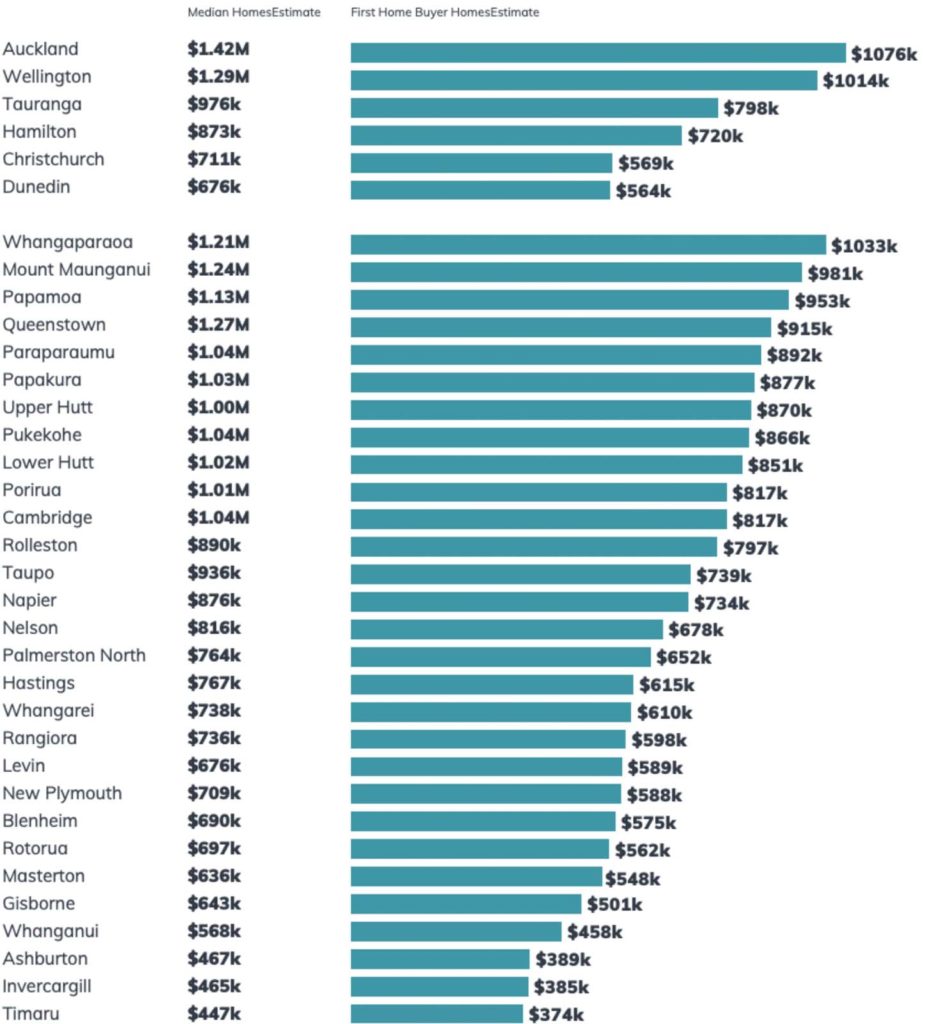

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

Monthly Property Report

Content supplied courtesy of The Data Team - homes.co.nz (Tom Lintern - Chief Data Scientist). The homes.co.nz website is built on the promise of free property information for every region in New Zealand. Visit today to understand estimated prices, find properties to buy, and do essential research before going to an auction or making an offer.