Our quarterly Property Pulse Report reveals how confident Kiwi buyers and homeowners are in the property market, their main concerns as well as their intentions for the future.

Together with Trade Me, we surveyed over 5,000 homeowners and 900 buyers across New Zealand.

Here are the key insights for Q3:

- Most homeowners and buyers think house prices will continue to decrease in the next 12 months.

- The biggest concern for homeowners looking to sell is that they won’t get the best price for their property. However, 14% of homeowners still plan to sell in the next 6 months.

- Despite growth in nationwide property supply compared to the same period last year, supply has dropped compared to the previous quarter, with both homeowners and buyers concerned about the lack of suitable properties on the market.

“House prices are set to continue falling throughout the rest of 2022 and into 2023, as the massive gains from 2020 and 2021 are partially reversed. Rapidly rising interest rates have been a key driver of lowering the temperature of the housing market recently, with 1-year fixed rates increasing from 2.2% in mid-2021 to 5.2% in September 2022. Borrowing rates are limiting the amount of money that buyers can access, forcing prices to moderate to allow a transaction to be secured. Over the next few months, interest rates will continue to head higher and will keep house prices under downward pressure.”

– Brad Olsen, Principal Economist and Director at Infometrics

Monthly Property Update

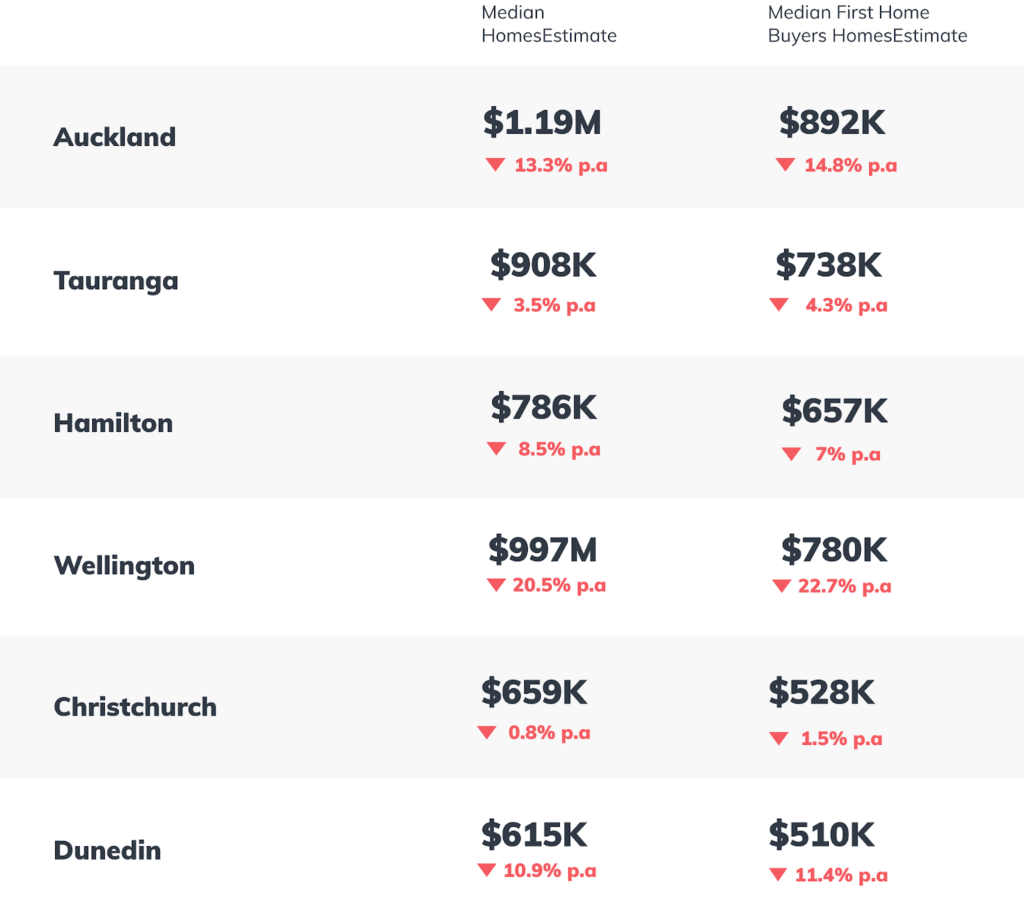

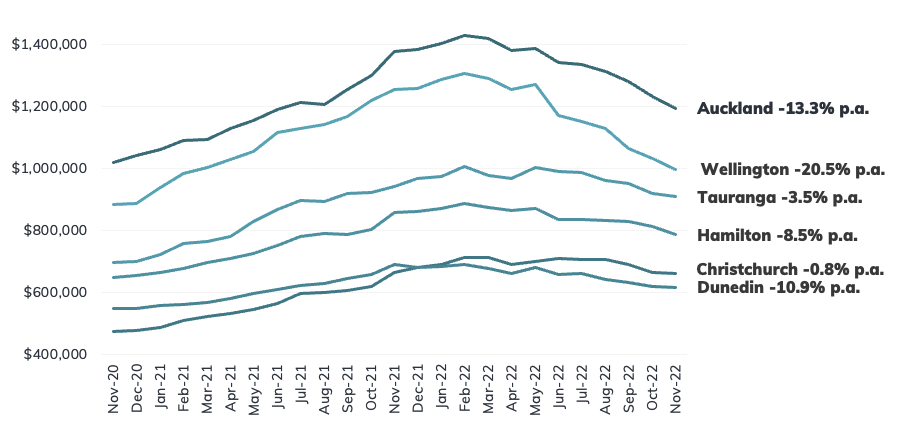

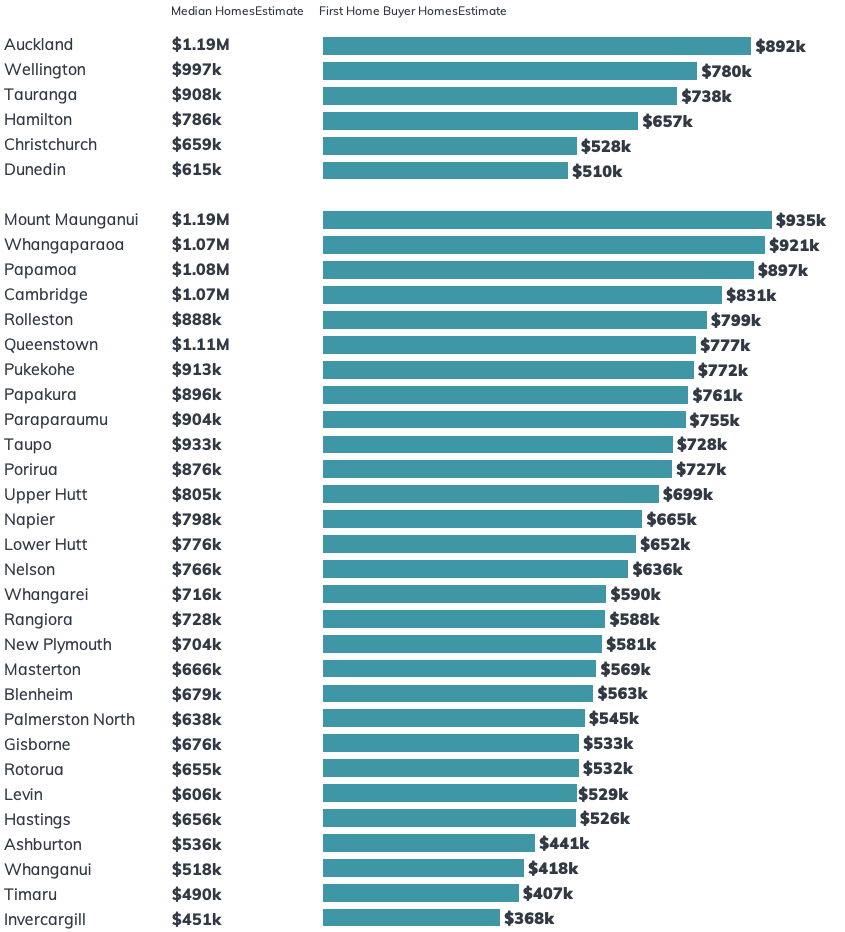

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s November 2022 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

NZ’s First Home Buyer HomesEstimate

Monthly Property Report

Content supplied courtesy of The homes.co.nz Data Team. The homes.co.nz website is built on the promise of free property information for every region in New Zealand. Visit today to understand estimated prices, find properties to buy, and do essential research before going to an auction or making an offer.