After a well-earned summer break, most Kiwi’s are getting back into the swing of the year, and the property market is no different. The volume of properties for sale is picking up as we move into one of the year’s peak selling periods and we thought it was time for a refresher on the different ways people are buying and selling property.

If you’re looking to buy (or sell), there are 3 main methods of sale:

- By Negotiation – There are a bunch of variations of this method (Advertised Price, Buyer Enquiry Over, Deadline Sale), but essentially this method provides the most flexibility for buyers and sellers to negotiate a purchase price.

- Tender – In this method, prospective buyers make a written offer before an advertised deadline and all offers are typically evaluated by the seller together when the tender closes. There are usually multiple offers, so remember to put your best foot forward.

- Auction – This method of sale is favoured in some locations and by some real estate brands. Property auctions are a public event where the property is sold to the highest bidder. Unlike the 2 other methods above, any auction bid is unconditional and successful bidders are obligated to complete the transaction.

It’s important for buyers and sellers to understand how a property is being sold, so make sure you get in touch with a local real estate agent for an explanation. You can also visit websites such as settled.govt.nz for more in-depth, independent guidance about buying and selling property.

Does 1 method of sale seem more familiar than others? If so, this is because different sale types are more common in different areas. For example, auctions are currently very common in the Gisborne and Tauranga markets, with 49% and 34% of current listings on homes.co.nz being listed to sell by auction. This contrasts with “Tender Town” Wellington, where less than 1% of properties are planned to go under the hammer.

Paige Smith, Director at Collab Realty in MountMaunganui, explains “Auctions are used widely here in the Bay of Plenty because of the results achieved through taking away the price and giving cash buyers the opportunity to compete and purchase all at the same time”.

Paige explains how auctions work particularly well for their vendors. “Going to auction allows the vendors to control the sale and have the terms and conditions that best suit them. Auctions allows vendors to know they have sold and move on rather than have to wait in anticipation for an unconditional date.”

In contrast, Tom and Harriet Culy from Lowe and Co Realty think that tenders are better suited to the more conservative Wellington population and locals are very familiar with this method of sale. Tom and Harriet believe that tenders are more inclusive with buyers able to include conditional offers which supports First Home Buyers better than some other selling methods. Tom and Harriet also encourage buyers to consider putting a letter about themselves and their family in with their Tender, “People often want to know their home will be in good hands and it’s a great way to let the owner know a bit more about who the new owners might be”

And in this market buyers may need any help they can get!

Monthly Property Update

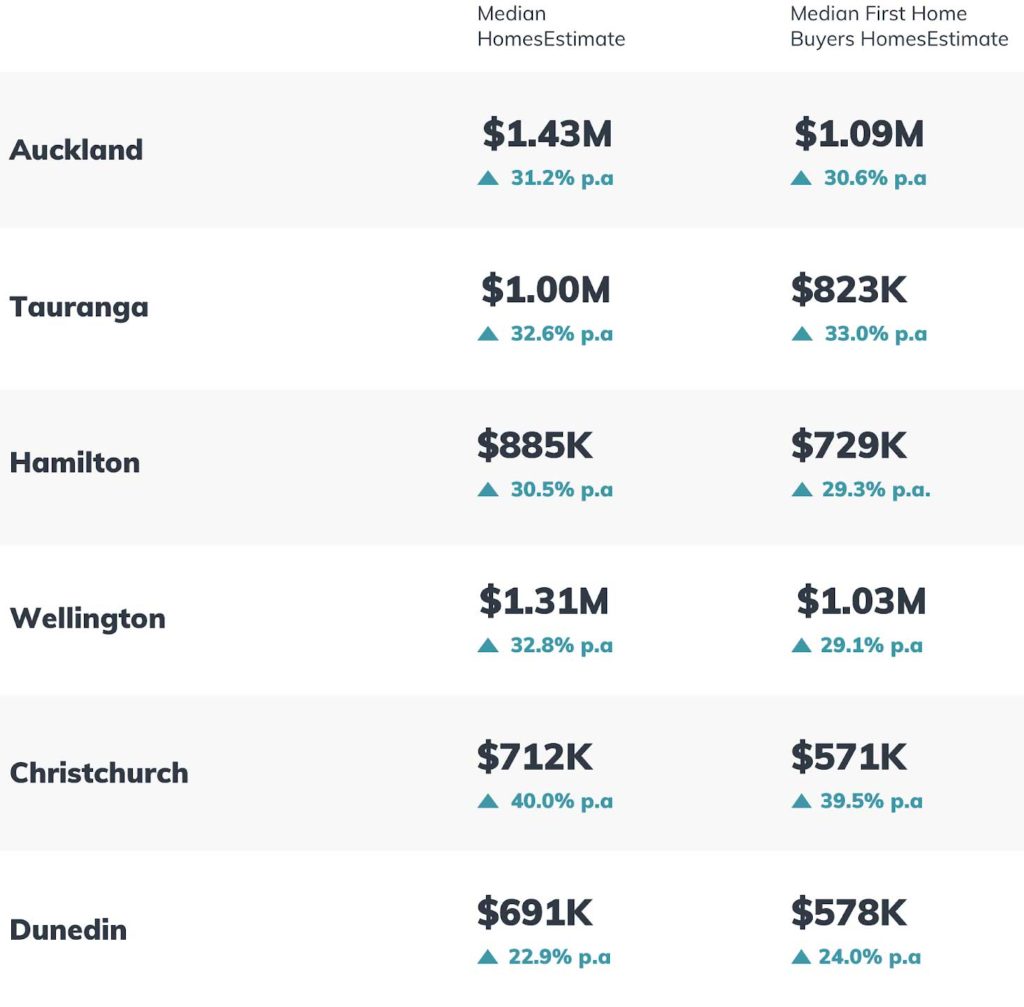

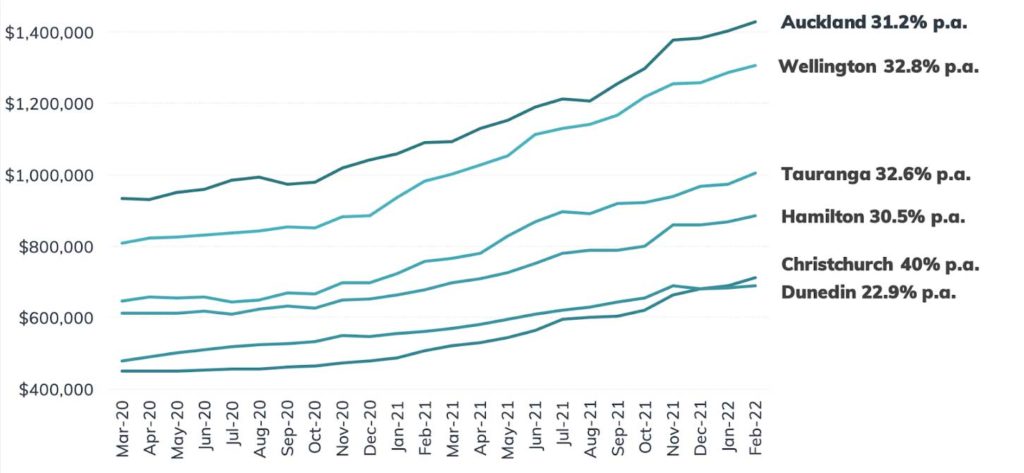

Tauranga is the latest $1M city, with the median HomesEstimate exceeding $1M for the first time. The median HomesEstimate in Tauranga is now $1M,up 32.6% from 12 months ago and joins both Auckland and Wellington who have median HomesEstimates of $1.43M (up 31.2%) and $1.31M (up 32.8%), respectively.

Trends in our Main Cities

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

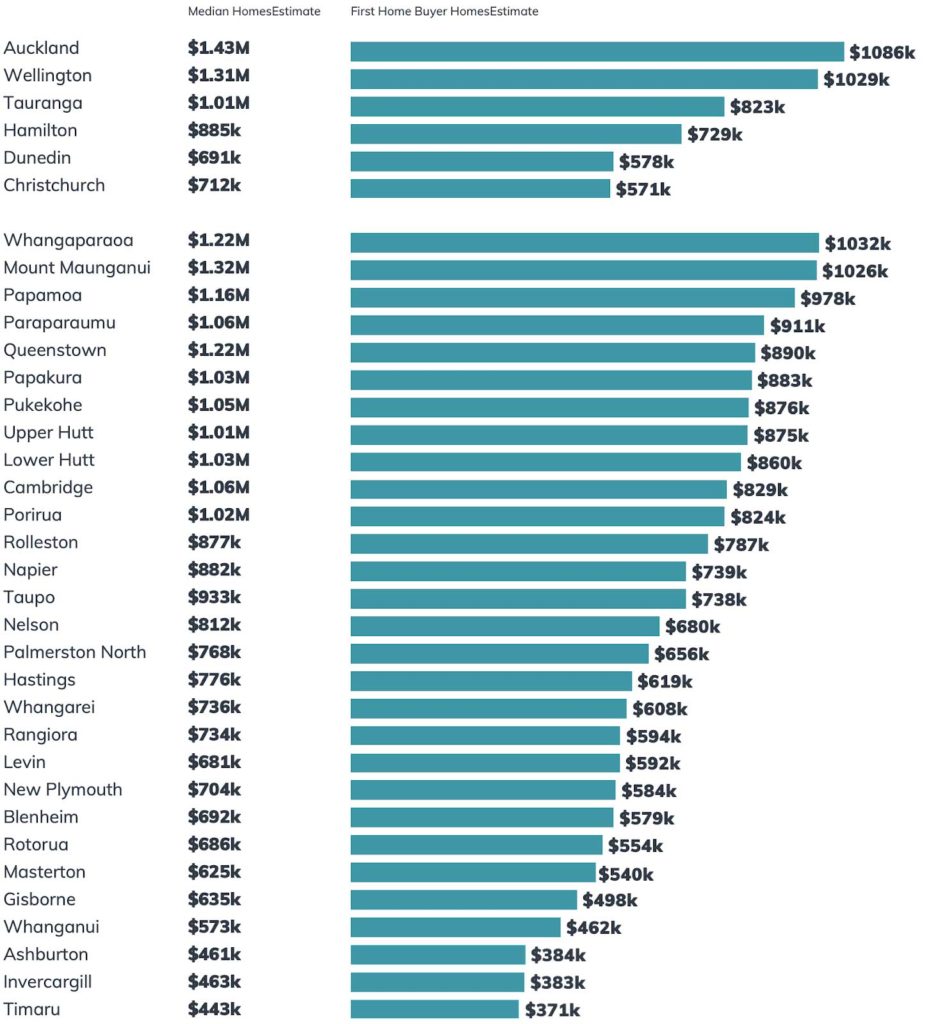

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

Monthly Property Report

Content supplied courtesy of The Data Team - homes.co.nz (Tom Lintern - Chief Data Scientist). The homes.co.nz website is built on the promise of free property information for every region in New Zealand. Visit today to understand estimated prices, find properties to buy, and do essential research before going to an auction or making an offer.