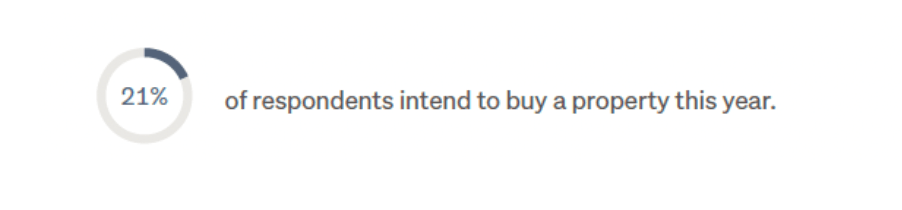

1. People still want to buy

Source: Trade Me State of the Nation Report 2023

Source: Trade Me State of the Nation Report 2023

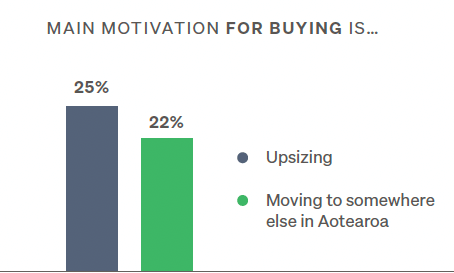

There are two main reasons why they’re motivated to buy:

- Trade Me found that 25% were upsizing: people are watching the prices coming down and seeing it as a good time to upsize and get a bargain.

- Trade Me found that 22% were moving somewhere else in Aotearoa: with the recent cost-of-living squeeze, people are finding life in the city too expensive and opting for a cheaper lifestyle in the regions. This is, of course, made easier in a world where workplace flexibility is much more commonplace, allowing people to take their jobs with them.

2. People think now is a good time to buy

Source: Trade Me State of the Nation Report 2023

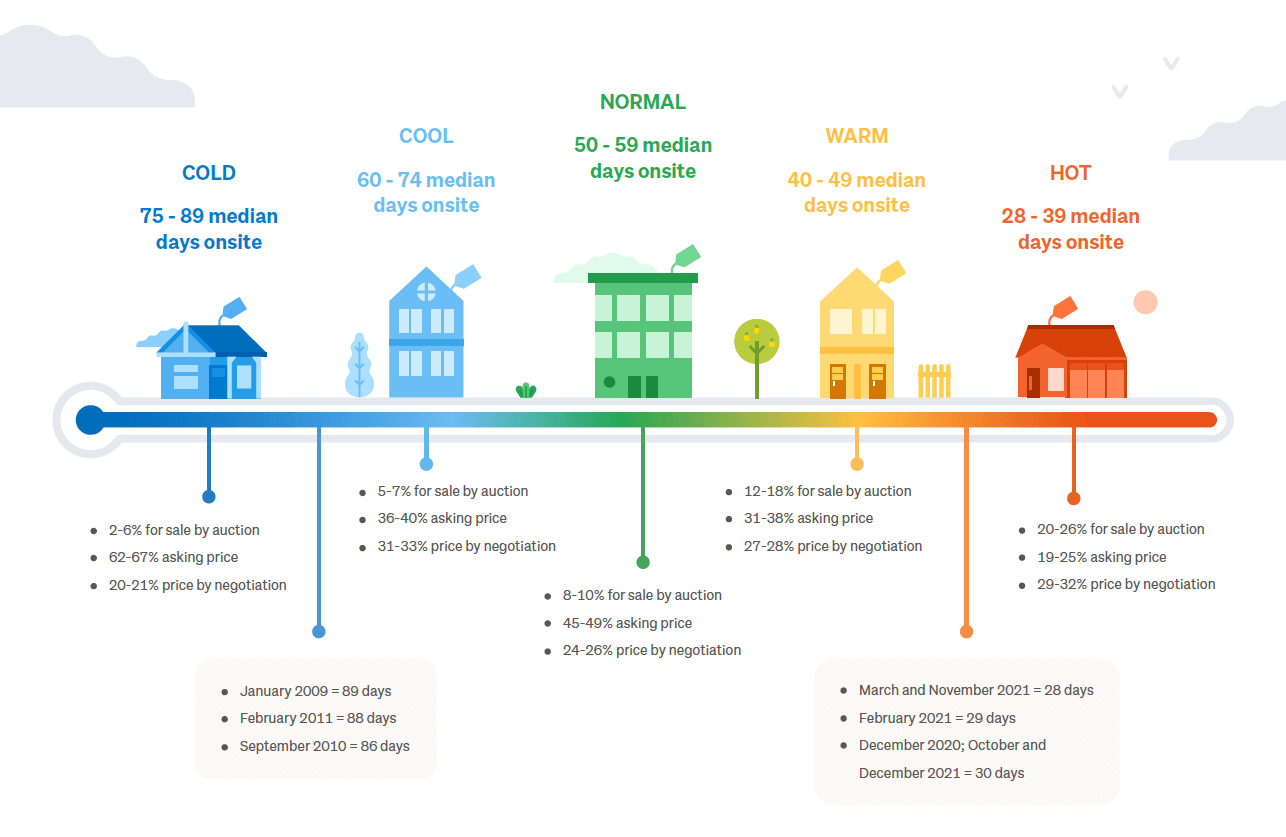

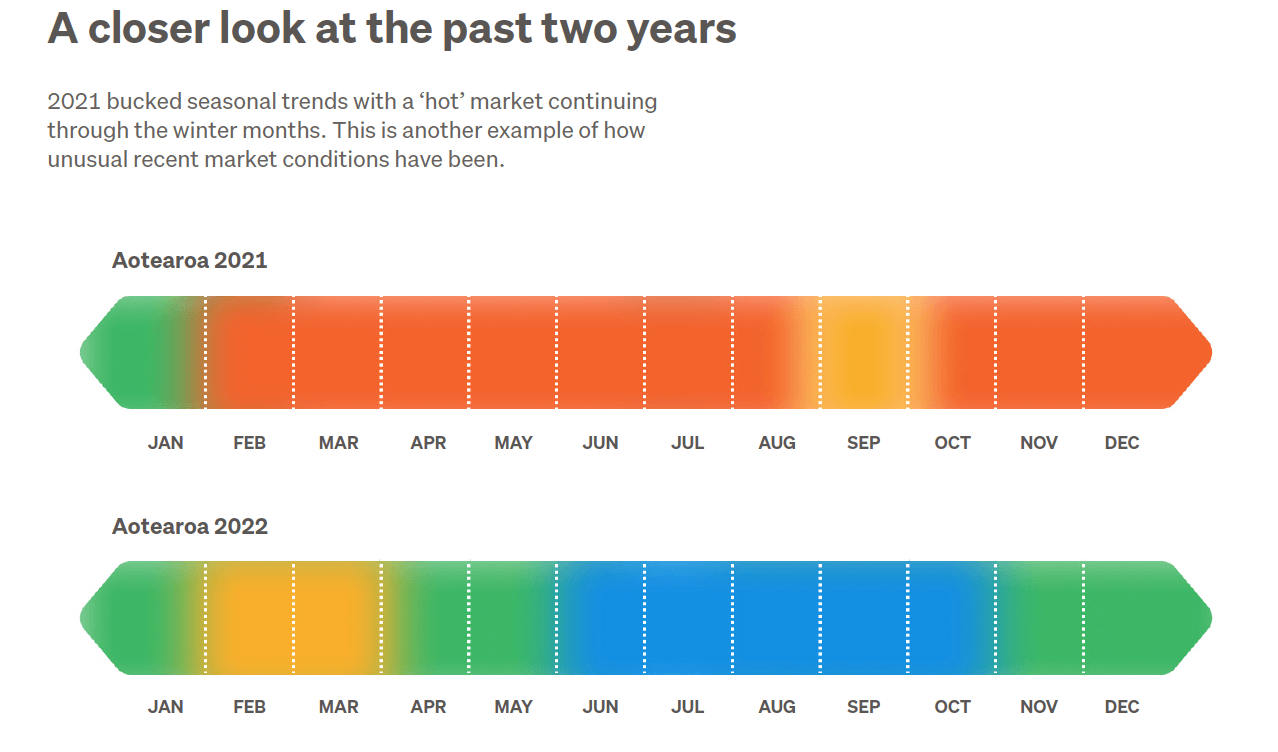

3. The 2021 market wasn’t ‘normal’

Source: Trade Me State of the Nation Report 2023

Source: Trade Me State of the Nation Report 2023

It’s true that this year has been off to a slow start in the property market – but 20 years of Trade Me ‘days on site’ data helps bring some perspective to this. In 2021, we experienced the hottest property market on record with the median number of days on site (before selling) dropping to just 28 days in March and November. This was an abnormal year, with houses flying out the door, while 2022 was more ‘normal’ sitting on an average of 58 days on site.

Monthly Property Update

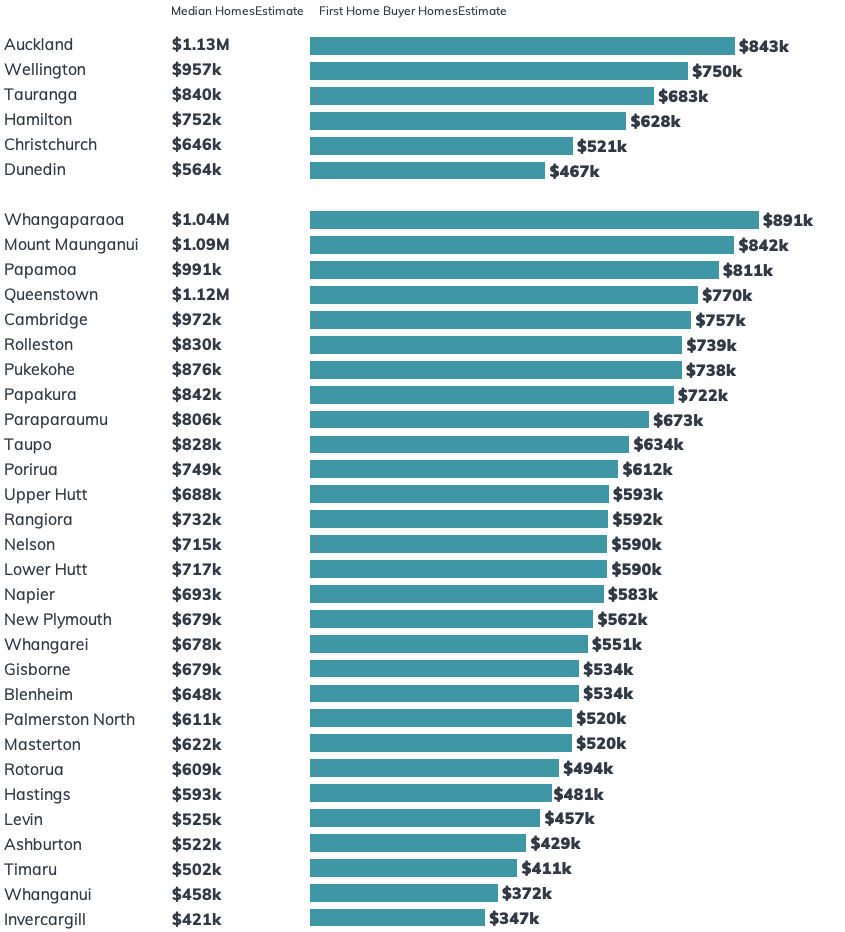

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s April 2023 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

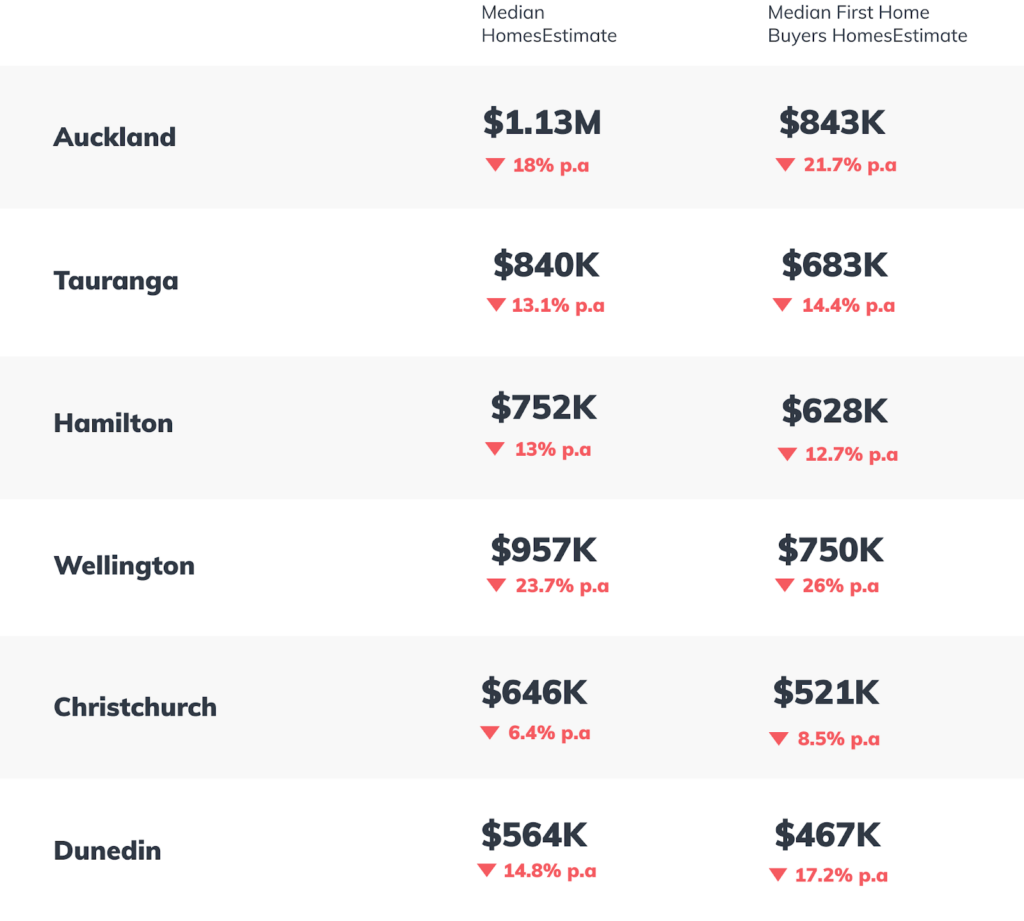

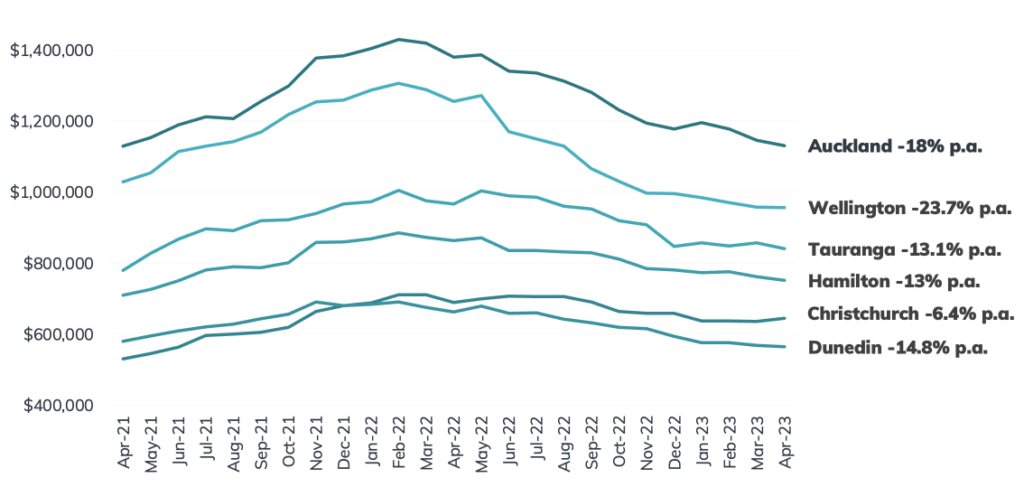

Trends in our Main Cities

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

NZ’s First Home Buyer HomesEstimate

Monthly Property Report

Content supplied courtesy of The homes.co.nz Data Team. The homes.co.nz website is built on the promise of free property information for every region in New Zealand. Visit today to understand estimated prices, find properties to buy, and do essential research before going to an auction or making an offer.