Back in the mid-1980s, it was perfectly normal to pay around 20% interest for your home loan. Sure, houses were a lot cheaper back then, but the every-month reality of getting charged 20 cents for every dollar you borrowed was pretty hard to live with.

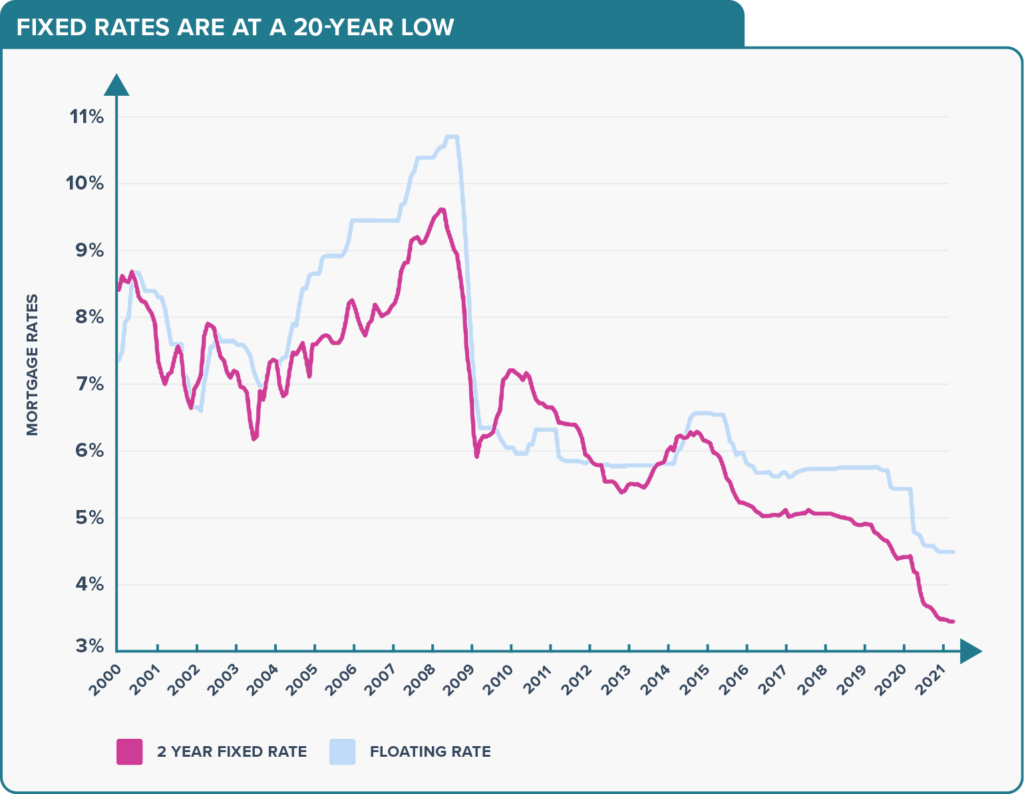

Since 2008, mortgage rates have been tracking ever-lower. We all got pretty excited when they got down to 5%; now that 1-year rates are firmly in the lower 2s, we’re ecstatic. But there’s plenty of evidence to suggest rates have now bottomed out.

At the end of May, the Reserve Bank’s outlook pointed to grey clouds on the horizon. They left the official cash rate (OCR) at 0.25%, as expected, but they also predicted that the OCR will start rising late next year and hit something like 1.75% by mid-2024.

However (and there’s always a ‘however’), they tied this prediction to the economic outlook unfolding as expected. In these pandemic times, we know that ‘expected’ can be hard to achieve.

The only concrete evidence of mortgage rates beginning to track up can be seen on our mortgages rates page. Check out the 5-year rates and they’re all in the mid 3s – a whole percentage point higher than the 1-year rate. Yet a time-traveller from the 1980s would be rolling their eyes; locking a 3.19% in for five years would be like ‘money for nothing and your chicks for free’, to quote Dire Straits from 1985.

Why are mortgage rates still so low?

Mortgage rates zoomed down from the 4s to the 2s last year, as central banks conjured money from thin air to pump stimulus into their economies and soften the economic damage of Covid-19. Without money creation, economies around the world would have crashed and burned. Keeping interest rates low is part of the strategy, because it encourages borrowing – and borrowing is crucial for oiling the money-go-round that keeps economies ticking.

But as the pandemic gets sorted, one vaccination at a time, many economists are picking interest rates to rise in the short to medium term. Talking to Radio New Zealand, Tony Alexander said:

“The central banks around the world have been at pains in the past three to four weeks to emphasise they don’t plan raising their overnight monetary policy interest rates for up to three years or so, but before then, the medium-long term interest rates – government bond yields, fixed interest rates – they’re likely to rise, but again it’s not going to be a rapid thing.”

Talking to Stuff, Kiwibank chief economy Jarrod Kerr concurs. He says that Reserve Bank projections suggest we’ll eventually see the end of ultra-low mortgage rates.

“Obviously if a war breaks out tomorrow or Covid savages us, then that is a different story, but based on the Reserve Bank’s outlook it is definitely the bottom in rates.”

What would an OCR of 1.75% mean for you?

In March 2019, the OCR was 1.75% and 2-year fixed rates were hovering at 5%. The floating rate was around 6%. So you can see where rates could be heading. In 2015, the OCR was 2.75 and 2-year fixed rates were above 6%. That’s just a few years ago.

To imagine our super-low interest rates will continue would be head-in-the-sand dreaming. Maybe it’s time to look harder at those 5-year rates?

Nick Goodall, Head of research at CoreLogic, told Stuff that locking in longer-term rates is a behaviour that soon follows a forecast of higher OCR rates.

“As soon as there is expectation that longer term interest rates will start to lift, people will start to go ‘well, today’s rates are pretty good’, and they will start to lock in at those rates as well.”

Making hay while the sun shines

While the bulk of the fixed rate crop is trending up, there are still ripe apples to be plucked from the mortgage tree. ASB and Heartland are offering rates in the 1s, with special conditions attached, but they’re not likely to last long. Better get picking!