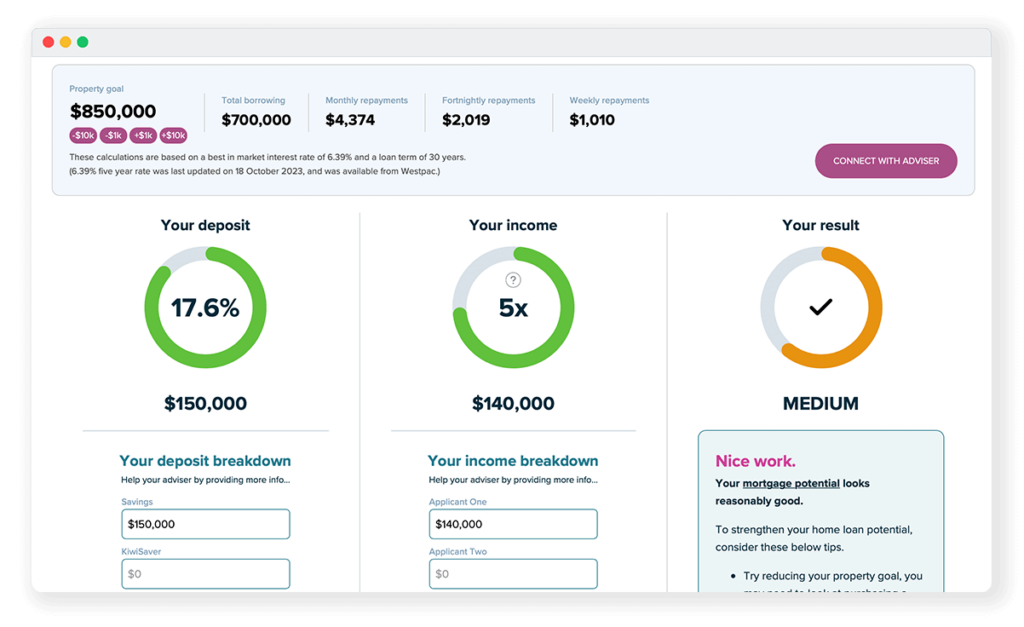

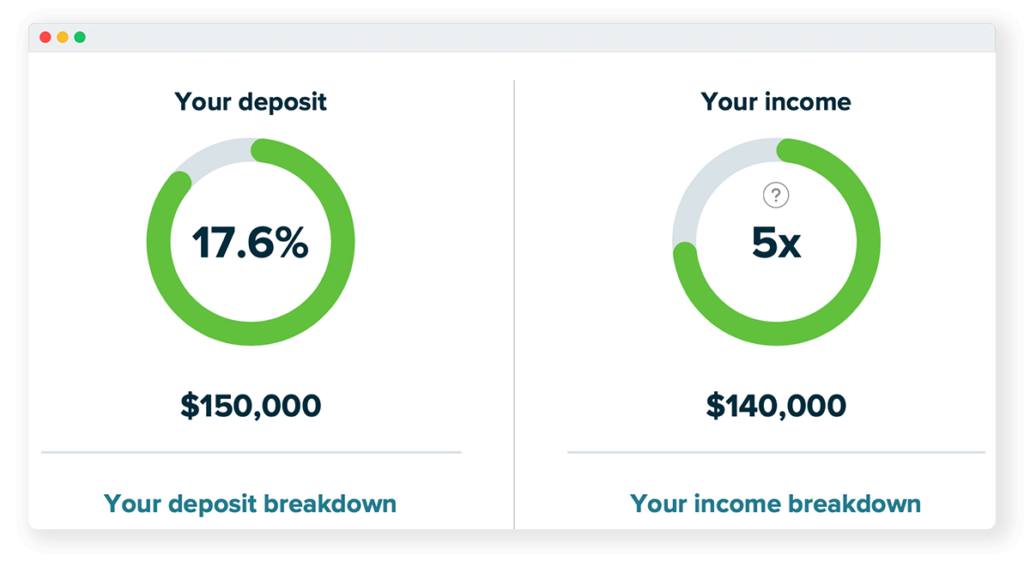

Loan Check shows you how you look to a lender

We understand how the lenders crunch your numbers. Our unique algorithm uses up-to-date market rates and figures to give you the insights you need. Can I get a mortgage? Find out quickly using Loan Check without contacting your bank or a mortgage broker.

Adjust your position if you can

need advice on the best available rate for you?

Get a financial adviser on your side.

It’s easier to navigate the New Zealand home loan landscape when you have a financial adviser helping you. Through us you can get connected to a qualified mortgage adviser.

Our financial advisers work with a wide range of lenders and often have access to lower-than-advertised rates. And if your situation is complicated, by something like overseas assets or a low deposit, you definitely want to be working with one of our mortgage advisers.

Why should I use an adviser?

- Advisers are paid by lenders, so their service to you is free

- All the home loan research is done for you

- You could get a better deal than what the banks are advertising

- Loan pre-approval is easier with an adviser to help

- Advice about loan structuring helps you to pay less interest

- You’ll get assistance with all the paperwork and admin

What does a mortgage broker do?

Getting a mortgage is a big deal. Where do you go to find the best lender for your circumstances? What criteria will you have to

Who pays a mortgage broker?

When it comes to choosing a mortgage broker or mortgage adviser, there are quite a few things to check out and carefully consider. This article

Is a mortgage broker really on your side?

You’ve probably heard there’s usually no charge to use a mortgage broker (mortgage adviser). That’s because they’re paid a commission by the lender you end

Frequently asked questions.

Loan Check uses an algorithm to assess your chances of getting a loan, based on current loan criteria for major home lenders. It’s the only tool of its kind in New Zealand and it costs nothing to use.

If you get the ‘not quite ready’ result from Loan Check, which suggests you won’t currently be approved for the loan you need, you can explore your inputs to find a solution. For example, you could adjust to a cheaper property, a bigger deposit or a higher income.

A positive Loan Check result doesn’t guarantee lender approval. Our tool is designed only to provide a quick indication for you and your mortgage adviser. These calculations have been formulated through market research and in consultation with our adviser panel, based on data from recent home loan pre-approvals.

The Loan Check formula is constantly monitored. We make changes to adjust for OCR announcements, bank serviceability increases and differing market conditions, via the latest adviser feedback.

Yes! When you’re getting into the New Zealand property market for the first time, using Loan Check to understand your chances of getting a home loan can give you confidence to move forward. And if the result isn’t as good as you hoped, you’ll know what action you can take to improve your position.

LoanMatch uses an algorithm to assess your chances of getting a loan, based on current loan criteria for major home lenders. It’s the only tool of its kind in New Zealand and it costs nothing to use.

If you get the ‘not quite ready’ result from LoanMatch, which suggests you won’t currently be approved for the loan you need, you can explore your inputs to find a solution. For example, you could adjust to a cheaper property, a bigger deposit or a higher income.

A good mortgage broker should know all the lenders, interest rates and fine print. They can help you to identify which mortgage deals will be the most appropriate for you and your circumstances.

An offset mortgage lets you use money in another account (savings or everyday) to reduce the balance of your mortgage when it comes to calculating the interest charged. The money stays in its own account and is available as usual.

An interest-only mortgage means your regular weekly, fortnightly or monthly payments only include the interest charged. So you don’t repay any of the money you borrowed (known as the principal) until the end.

Change is constant, so every now and then you should review your mortgage arrangements to see if there’s a better deal going. It might mean changing lenders or restructuring your loan with your existing lender.

A revolving credit mortgage is like an all-in-one bank account with a big overdraft facility. You can draw down a loan, put money in and take it out whenever you like, provided you don’t exceed your limit.

No. We provide you with information about mortgages and your potential ability to afford one. We do not arrange your loan or provide you with financial advice about what lender to use, how to structure a loan to meet your specific needs or the risks of borrowing the amount you want to. However, we can link you to a professional mortgage adviser who can help with those things.

A good mortgage broker should know all the lenders, interest rates and fine print. They can help you to identify which mortgage deals will be the most appropriate for you and your circumstances.

Change is constant, so every now and then you should review your mortgage arrangements to see if there’s a better deal going. It might mean changing lenders or restructuring your loan with your existing lender.

A revolving credit mortgage is like an all-in-one bank account with a big overdraft facility. You can draw down a loan, put money in and take it out whenever you like, provided you don’t exceed your limit.

An offset mortgage lets you use money in another account (savings or everyday) to reduce the balance of your mortgage when it comes to calculating the interest charged. The money stays in its own account and is available as usual.

An interest-only mortgage means your regular weekly, fortnightly or monthly payments only include the interest charged. So you don’t repay any of the money you borrowed (known as the principal) until the end.

Check out the latest mortgage rates.

Are you on the best mortgage rate? See a daily snapshot of the advertised rate from many of New Zealand’s top lenders. The rates have been grouped into different lender types. You can also sort the entire list of options by rate.

Calculators to get you there.

Whether you need a mortgage calculator to work out your borrowing power, mortgage repayments or some help budgeting to work out what you can afford, you’ll find them here. Start with the budget planner, then assess your borrowing power and finally work out what your mortgage repayments would be.

Get an estimate of what your repayments could be, based on your mortgage amount, term and interest rate.